The mutual fund is a safe and good option for investment if you don’t have any idea about direct equity. An individual can invest in the mutual fund in two ways. He/she can put a lump sum at once or the individual can invest in a monthly basis with a small amount of Rs. 500/- only. This kind of monthly investment is called systematic investment plan or SIP. Now, you should be careful about conditions or risk associated with a systematic investment plan. Here we are going to explain the common mistakes to avoid while investing in mutual funds that investors, particularly the novice investors make when they invest in mutual funds via SIPs.

Top 10 Common Mistakes to Avoid While Investing in Mutual Fund

Does not have any financial goal

First, you need to analyse your financial goal and then invest accordingly. You need to specify your goals either it is short term or long term because you have to set your investment portfolio in accordance with your goals. Let’s make it clear with an example. If you are of 25 years and planning for retirement at 60 then you have 35 years. In this case, you should invest in the equity asset class, because the equity asset class outperforms all the asset class over the long term. Since retirement planning is a long term goal, you need not worry about market volatility in the near term.

- Read also: Five mistakes mutual fund investors should avoid in this market

- Read also: 7 mistakes to avoid while investing in mutual funds – Business Today

But if you are planning for the purchase of a four-wheeler within the next few years then you need to invest your corpus in debt instruments, because in the short run stock market is quite volatile. Suppose, after you make the investment the market goes into sharp correction or remains volatile in the upcoming one year. So, you may suffer a huge loss. In order to avoid loss in the stock market, you need to analyse your financial goal and then invest accordingly which will help you to achieve your targets in life.

- If you are confused about how to do financial planning you may read our article Financial Planning in Easy Steps.

No Research

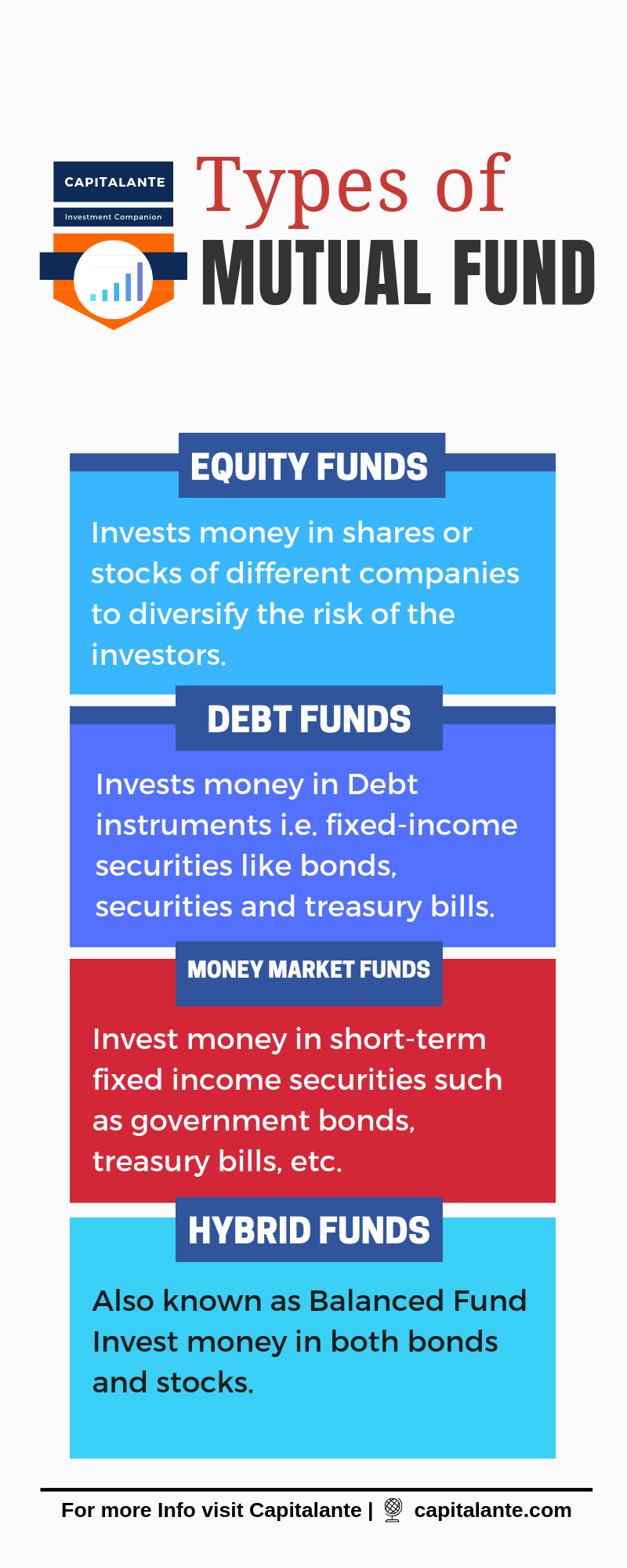

Many novice investors start investment without understanding the asset allocation, risk profile. They start investment in mutual funds because mutual funds have given better returns in last one year. But these investors do not check Fund type, Asset size, Exit load, Expense Ratio, and Fund Rating, etc. You need to analyse your time horizon, the performance of the fund during the past 10 years, portfolio allocation etc. before investing there.

- If you are confused about picking the best mutual fund you may read our article How to Pick the Best Mutual Fund.

Not Checking Risk and Asset Allocation

Lack of checking the risk appetite and an appropriate asset allocation always lead to bad investment decisions. You need to prepare an asset allocation strategy in accordance with your time horizon of goal and risk appetite. The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class which has some moderate risk than the other asset class like the bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you should subtract your age from 100 to determine the percentage of your investment to the equity asset class.

- If you are confused about Asset Allocation Strategy you may read our article Asset Allocation Strategy in Easy Steps

Start with an amount which is not carried forward in the future

Before investing in a mutual fund you should check and think carefully what amount you can afford to invest. The mutual fund requires a long term to yield satisfactory return, at least 10 years or more. Once you start investment you need to continue the investment to make fruitful outcome just to say at least 10 or 15 years. Before this period if you withdraw the accumulated money or stop monthly contribution, you will definitely make a loss. Many people invest via SIPs a huge amount at starting, but they can’t continue the contribution in the near future and then stop the investment. So, as a smart investor, at first, calculate your earning and expenditure. Then you should start investment in the mutual fund for long term horizon.

Invest for a short term

It is a thumb rule that mutual funds yield a satisfactory or better return in the long run. When you keep investing for a longer period of a minimum of 15 years, you will yourself come to know the fruits of investment. Many people start investing in mutual funds with enthusiasm in the hope of making money. But later when they do not get expected result, these chicken heart investors become frustrated and sell their portfolios suffering a loss in a short span of 2 years or 3 years. To practically say there is no scope for hurry in the case of mutual funds. You cannot get a satisfactory return in short term. So, in order to gain satisfactory return stay invested for the long term of at least 10 years instead of short term.

Stopping investment suddenly

Many investors stop their investment suddenly owing to sharp market correction or volatility in the market. These investors do not have enough courage to retain their current units during this time. Influenced by several business news channels and market analysts they are in fear that the market may go more downward in the short term, so they sell their units suffering loss. For those chicken-hearted investors, I offer this

The intelligent investor should recognize that market panics can create great prices for good companies and good prices for great companies. —Benjamin Graham

Waiting for the ideal time to invest in the mutual fund

Whenever the share market touches high or inches toward a higher level, novice investors fear that the market may collapse or go into sharp correction leading to the loss for the investors. Again, when the stock market witnesses sharp correction or enters in the bear market, investors think that the market may continue its correction, so it is not the time for investment. They think that the share prices may further downside more.

Practically, it is needless to say that the bear market and the bull market are the two inseparable parts of the stock market. An investor who wants to invest in the stock market for a long-term horizon should not get bothered by these two inevitable situations. If you are confused about the best time to invest in the stock market, we offer you this,

Yesterday was the best day to start investment in the stock market. If you missed it then the next best day is today. The worst day to start an investment is tomorrow.

So, the best approach is that you can start an investment right now with a little amount, preferably via a mutual fund SIP.

- If you are confused about the right time to start investment you may read our article What the right time to invest in Stock Market is.

Don’t opt Step-up SIP

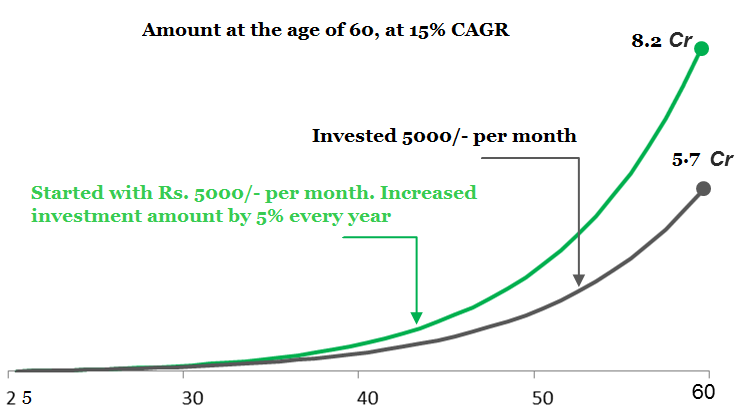

Step-up Sip is just like running a marathon where an individual will increase pace and distance gradually. So, in the case of mutual fund investment, it is assumed that one individual will increase one’s SIP in accordance with the rise in income. But many investors don’t increase the investment amount as per their increasing income. Before the discussion how retail investors suffer a loss if they don’t Step-up SIP lets discuss Step-up SIP.

Step-up Systematic Investment Plan can be defined as the gradual increase in the SIP amount automatically in a predefined rate and period. Let’s make it clear with the help of the following example,

Suppose you started investment in any equity oriented mutual fund with a monthly investment of Rs. 5000/- per month in January.

You opt a step-up SIP of 5% annually then in the next January your SIP will be increased to [Rs. 5000/- + 5% of Rs. 5000/- = Rs. 5000/- + Rs. 250/- = Rs. 5250/-].

Now let’s compare the amount between a Step-up SIPs & Conventional SIPs with the help of the following graph,

Invest lump sum money at once

Almost 95% of novice investors make this mistake. They invest all the savings in the mutual fund at once. Since you have invested all of your savings, you don’t have enough money to meet an emergency money requirement such as medical expenses. So, in order to meet the expenditure, you have to redeem your units which attracts exit load. Exit load is a kind of charge levied by mutual funds if any individual redeems units varying between 6 months to two years. So, at the beginning don’t invest all the money you have. You need to create an emergency fund. Try to accumulate enough money in this fund so that you can bear your all expenses i.e., foods, clothes, insurance bills, even your sip installments for at least 6 months.

Forgetting to monitor the investment

Many people invest in mutual fund either via lump sum or via SIP, but after investing they don’t monitor their investment. These people do not consider it vital to monitor their investment or portfolio. You may have invested in the best mutual fund, yet you should monitor your fund and portfolio once in a year.

Hope, by avoiding the above-mentioned mistakes you will be a successful investor. If you have any question make a comment so that we have a discussion. Finally, if you have found this post helpful feel free to share with your loved ones.