The lifespan of people has increased due to financial development, medical advancement, health consciousness. The average lifespan is now 75-80 years according to the latest survey report. So, you need to make proper financial planning to lead a happy retirement life without financial woes and tension. In order to make financial planning, you need to plan all the aspects which are vital not only now but also in the future. In this context, we will guide you on how to make financial planning and points to consider to stay on track for financial freedom by making use of proper financial planning.

What is Financial planning

Financial planning is a comprehensive evaluation of an individual’s current and future financial state by using currently known variables to predict future expenditure on different heads i.e. Insurance Planning, Retirement Planning, Tax Planning, maintaining and enhancing cash flow through debt and Lifestyle Management.

Manage your Money

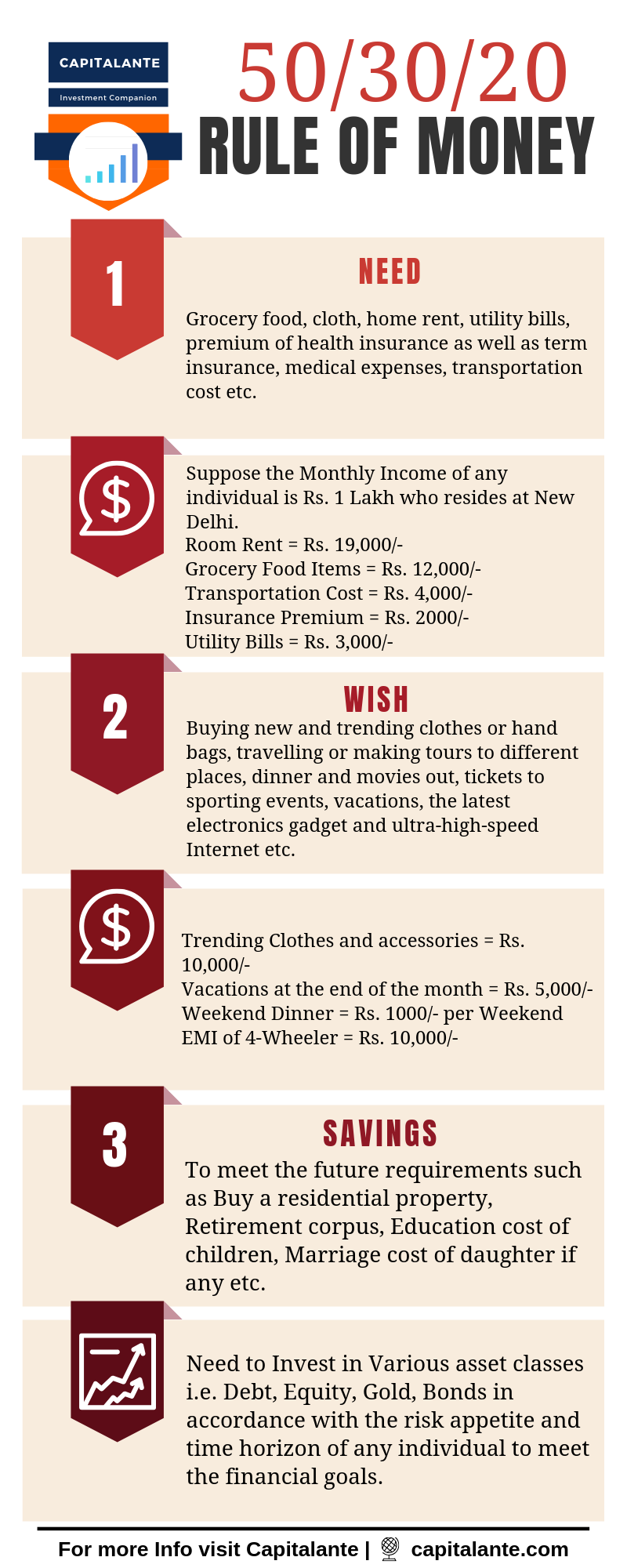

After earning money how you utilize it is very important. You should have the management of your money. The first thing is to fix money for your various expenditures. Then try to save some money from your earning. You should save as much as you think about you can. Don’t spend lavishly and don’t buy the things that you don’t need. Just try to save 20% of your income.

You can save your money by some small sacrifices. Everyone has a desire to buy a vehicle or car or build a house, but where the money will come becomes a problem. Here your savings and small sacrifices will fulfill the desires. Business concerns and famous e-commerce companies give a 40-50% discount or buy one get one free offer on various items on various occasions. This is their business policy. You should think about whether you really need the item. Don’t get tempted to these kinds of offers and spend your money unnecessarily.

Regulate your expenses wisely

If you find that your money comes to an end until the end of a month, you need to regulate your expenses. Here you need to cut your expenses and live according to your own way. There may be some unplanned expenses like medical, function at home, celebrations of family or religious events, etc. You can have a budget for these things and a reserve fund for them. You should always see your present priorities on the basis of which you can have a budget. When you fulfill the necessary expenses, you can save or allot funds for entertainment or luxury.

Maintain a personal record

Always maintain a record of your every expenditure. Every day you should write down every expense you have done. Then sum all the expenses incurred in a month. Here you can see the total expenditure for a month. Then subtract the amount from your income. You will get the surplus money. This is your savings. By having a record of expenses you can have an exact idea of your expenditures so you can spend accordingly.

Get your risks covered

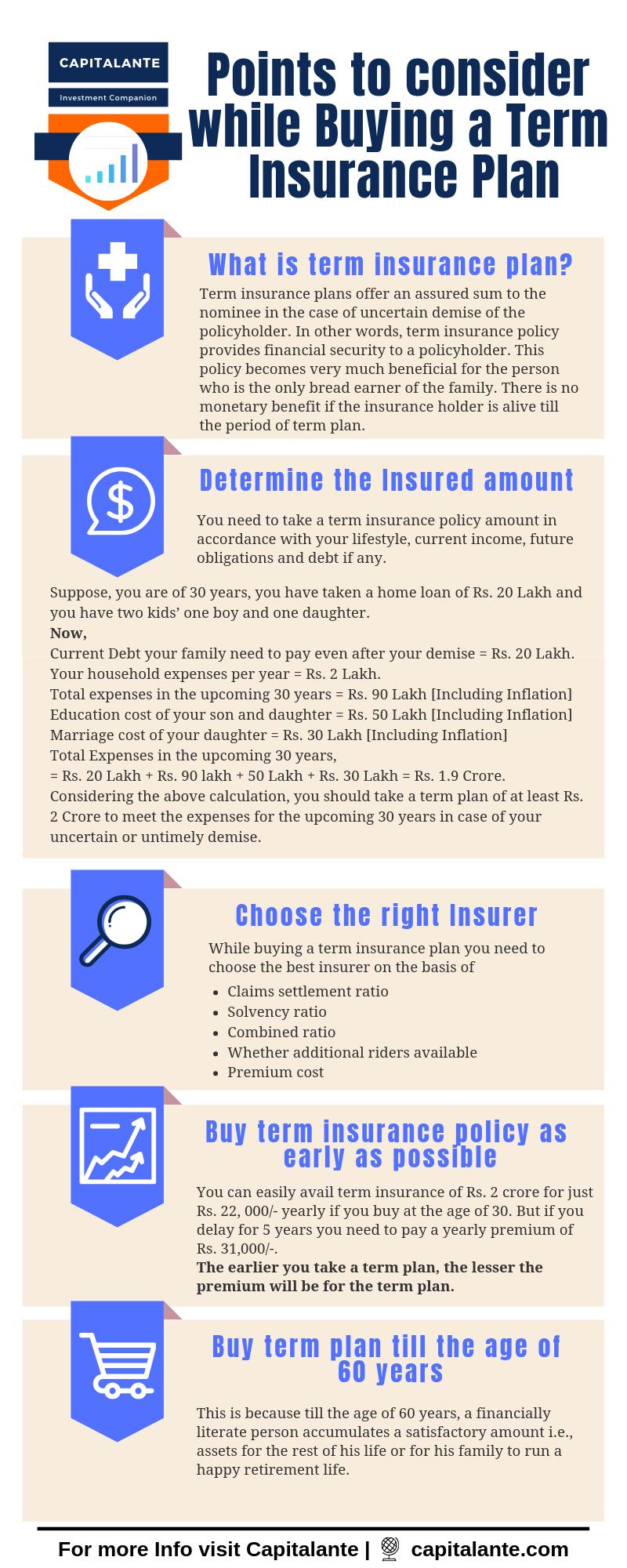

The most vulnerable thing is your health. So, you should first secure the health of you and your family members. To do this you must buy a term insurance plan for self. It is more important when you are the sole bread earner of your family. The term insurance plan provides policyholders higher risk coverage at reasonable price. You can buy a plan that can secure 10 times of your annual income. You also need health insurance for you and your family members. Health insurance can lessen the financial burden for medical treatment.

The most important thing is you should buy a term insurance plan at an early age. Whenever you start earning you should take a term plan. The earlier you take a term plan, the lesser the premium will be for the term plan and Family Floater Health Insurance for emergency medical expenditure.

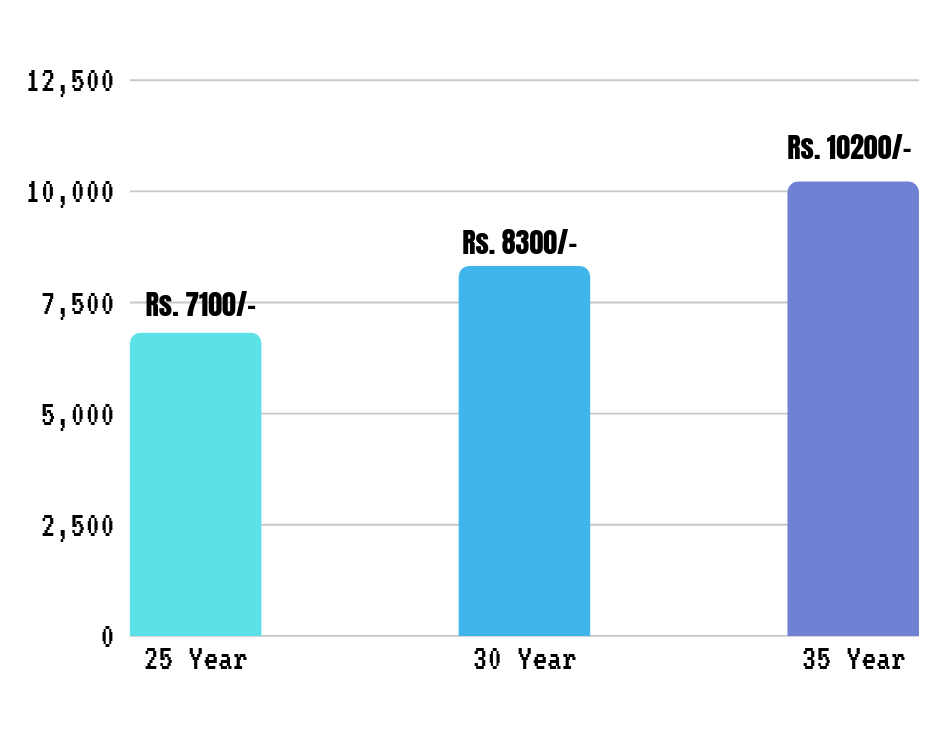

In the case of Term Insurance Plan

Suppose, you buy a term plan at the age of 25 and you want to continue this plan till the age of 60 years and a sum assured is Rs. 1 Crore. So, the duration of the term plan is 35 years. If you choose a Term Plan at the age of 25 then you have to pay Rs. 6800/- per year. If you choose a Term Plan at the age of 30 then you have to pay Rs. 8300/- per year instead of choosing a term plan at the age of 35 that costs Rs. 10,200/-. So, you have to pay a lesser premium at the age of 25 instead of at the age of 35.

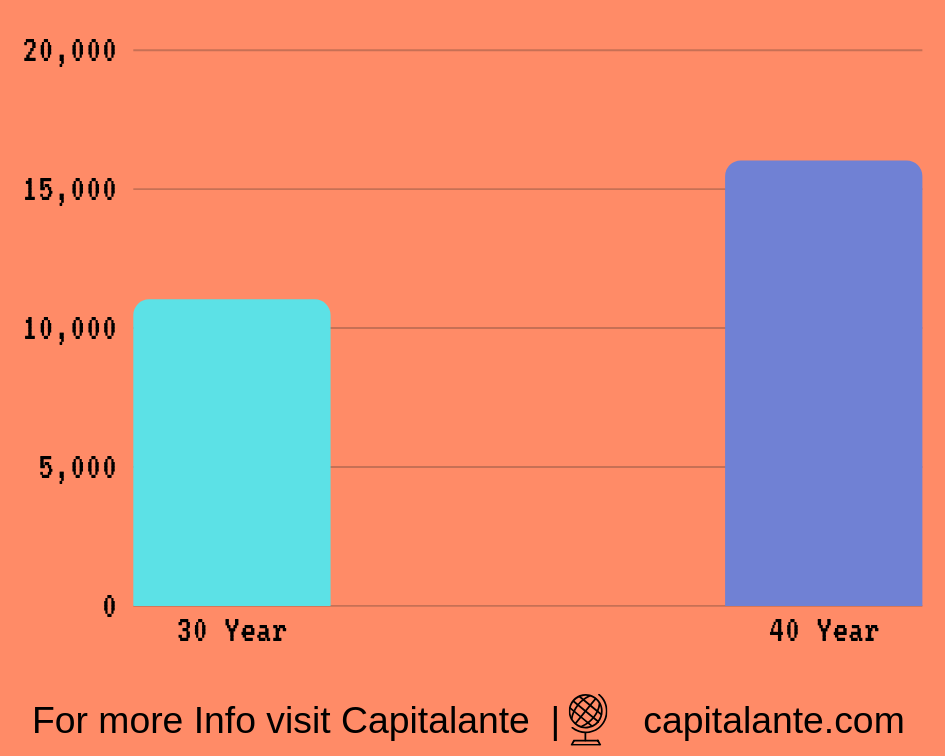

In the case of Health Insurance Plan

If you take a family floater plan at the age of 30 years of Rs. 5 lakh and the plan consists of self, your spouse and 2 dependent children, you have to pay Rs. 11,000/- on a yearly basis. But if you take the same plan at the age of 40, you have to pay Rs. 16,000/- on a yearly basis. So opt for a family floater plan as early as possible. It is better to take a family floater plan just after marriage and later you can include your children.

Dealing with surplus cash judiciously

Now what you do with your savings is a vital matter after taking a term insurance plan and fulfill. Your present management of investment will determine your future. You can put your savings in the stock market via mutual funds. As a smart investor, you can invest little amount per month via a Systematic Investment Plan (SIP) in a good mutual fund. You can have your start with a nominal amount. Then in the future about you may increase your investment. But why you should invest in the stock market either via mutual fund SIP or via direct equity,

- To beat the inflation

- Better Growth potential over a long-term horizon

- Passive income source

- To create a second source of income

- You can start an investment with a small amount of Rs. 500/-

- No lock-in period

- Power of compounding

Read also: 10 Reasons to Invest in the Stock Market

Set up a realistic corpus you need in the future

In order to make perfect financial planning, you must have a clear view and a good understanding of the expenses that will be required to live even after retirement. The current inflation rate is 7% per year. It means next year you will need Rs. 107/- to buy the same product you can buy now with Rs. 100/-. So if you can fulfill your requirements with Rs. 20000/- per month now, you will need Rs. 1, 20,000/- approximately per month after 30 years. Consider the case of inflation and do the needful.

Retirement Planning

Now let’s calculate the desired corpus you need to accumulate when you retire at the age of 60 years if you have started your professional career at the age of 25 years.

Suppose you have started earning at the age of 25 years and your earning is Rs. 25000/- monthly. So, you have got 35 years to achieve a sufficient amount in order to make a happy and prosperous retirement life.

Your yearly salary – Rs.3, 00,000/- assuming Rs. 25,000/- a month.

Your Yearly Household Expenses – Rs. 1, 80,000/- assuming Rs. 15,000/- a month.

Term insurance premium – Rs. 7,000/- assuming assured sum of Rs. 1 crore for a term of 30 years.

Health insurance premium – Rs. 8,000/- assuming a cover-up to Rs. 5 lakh/ year for a term of 30 years.

Expenses on festive season = Rs. 25,000/-

Total Expenditure

So, your expected expenses throughout a year is = Rs. 1, 80,000/- + Rs. 7,000/- + Rs. 8,000/- + Rs. 25,000/- = Rs. 2, 20,000/-.

Then, the expenses at the age of 60 years assuming a current inflation rate of 7% will be = Rs. 21 lakh. [excluded term insurance premium and health insurance premium since they are fixed at the time of buying].

So, you have to accumulate a corpus of [Rs. 21 Lakh × 20 years = Rs. 4.2 Crore] at the age 60 years assuming you will live at least 80 years.

Let’s assume you have two kids i.e. one daughter and one son. So, the Education cost of son & daughter as well as the daughter’s marriage after 20 years = Rs. 40 Lakh.

Total amount need = Rs. 4.2 Crore + Rs. 40 Lakh = Rs. 4.6 Crore.

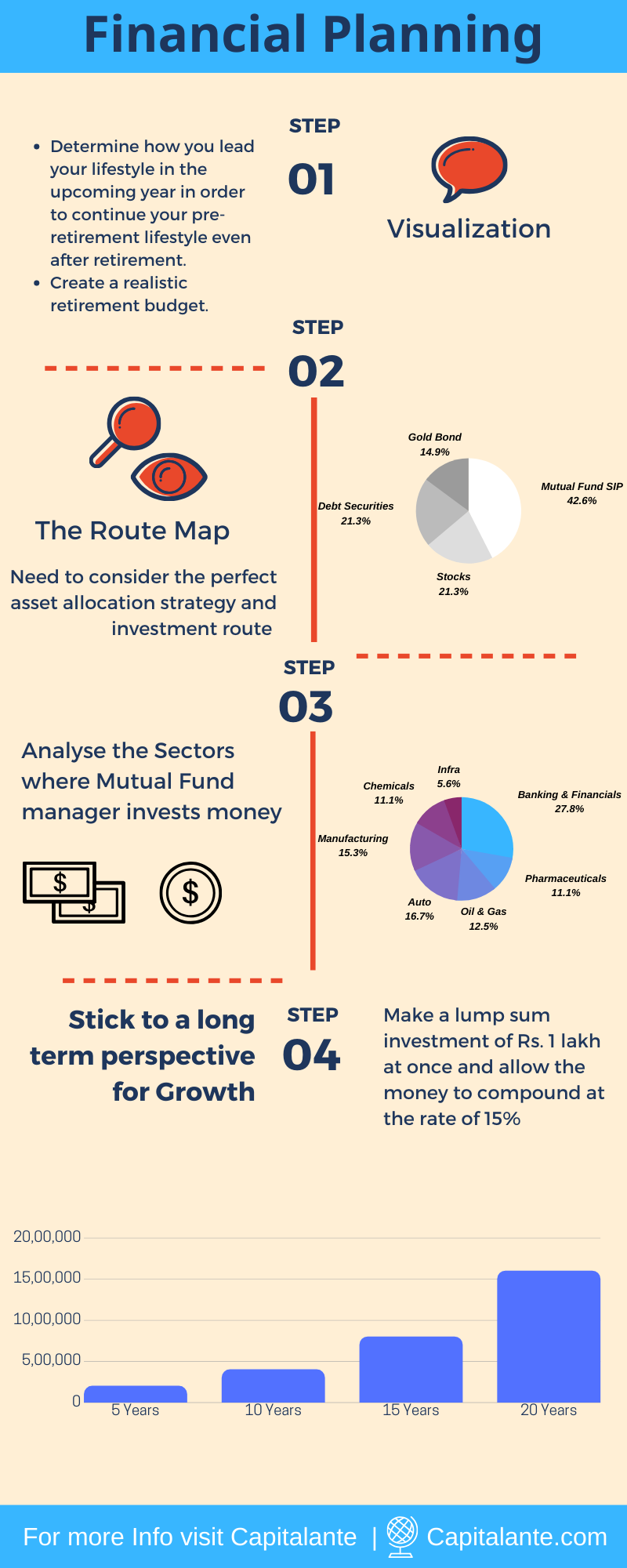

Make a roadmap to reach your desired corpus

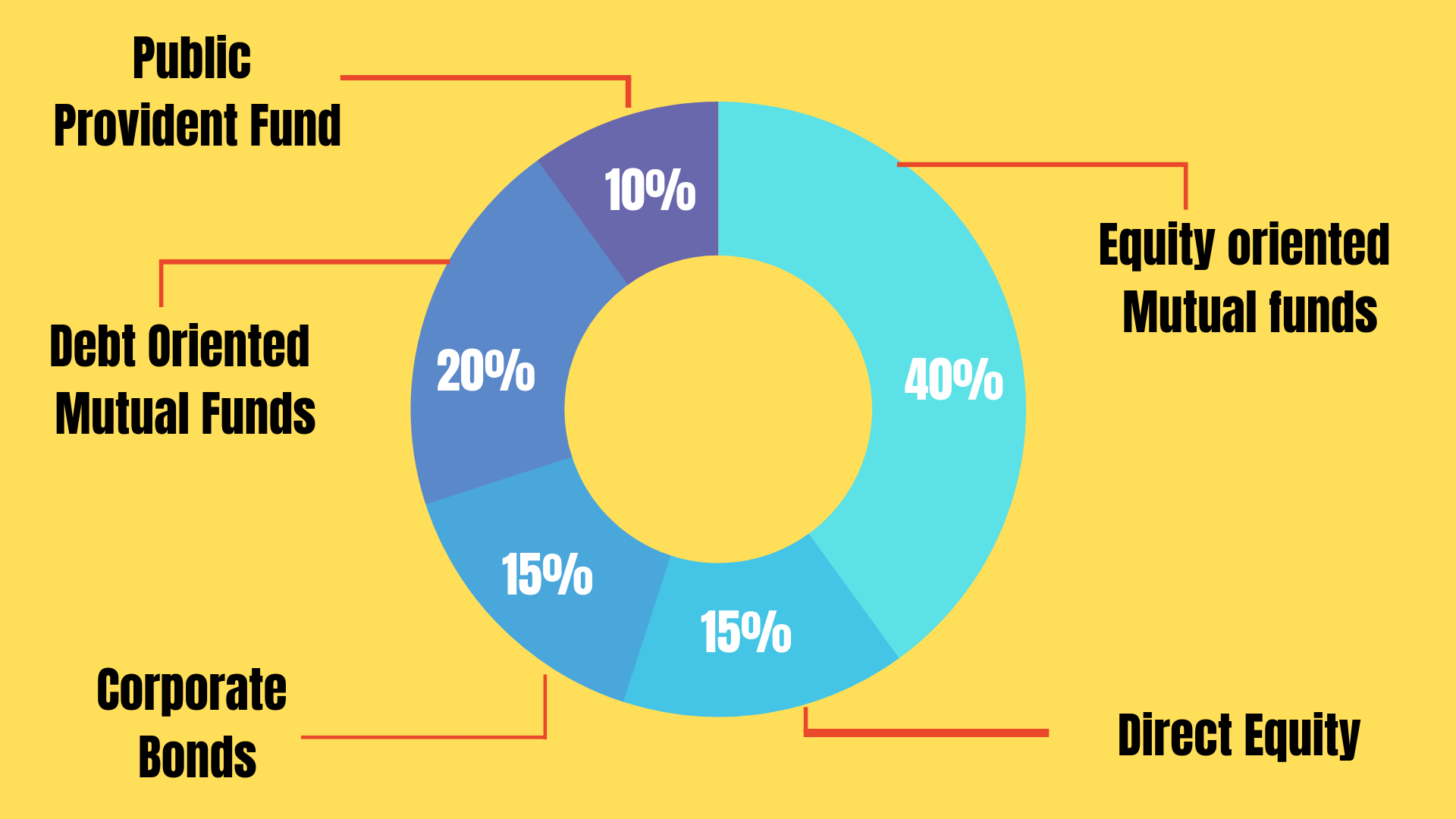

Now, you need to consider the perfect asset allocation strategy and investment route to make an early retirement if want so.

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class that has some moderate risk than the other asset class like the bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Asset Allocation Strategy

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities. If your risk appetite is high, for better returns over a long period of time you can invest your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young you can afford to wait and see for a long time. Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

- If you are confused about the asset allocation strategy you may read the article Asset Allocation Strategy in Easy Steps.

By which route a common individual can start investing in the stock market

In order to make an investment in the stock market, the beginners have two options. The first option is to invest via direct equity by opening a Demat account and the second one is via a mutual fund. In order to make a profit in the stock market via direct equity, you need to analyze the fundamentals, business analysis, balance sheet, profit and loss account, free cash flow while choosing the stock in which you are going to invest.

Via Mutual Fund

But in the case of mutual fund investment, you need not analyze the above-mentioned points. Mutual funds are managed by fund managers who are active in this field for a long time and possess vast knowledge and experience. The fund managers pick stocks or shares in which your money is to be invested. The fund manager of the respective mutual fund invests your money in different sectors like Banking, Finance, FMCG, Infrastructure, Automobiles, Information Technology, and Manufacturing, etc. You may invest a lump sum amount at once or you may opt for a monthly, quarterly or yearly basis via SIP.

If you are confused about which route you should follow to start investing in the stock market, i.e. direct equity or mutual fund you may read the article How you can invest, directly in equity or via mutual funds.

Manage your Debt wisely

If you have withdrawn any kind of loan, make proper planning on how to repay the loan. Of course, you have the time duration within which you are to pay off the debt. So spend accordingly and cut your unnecessary expenditures. You can withdraw a loan from that bank or any source where the interest rate is the least.

After getting a job every Indian has a common dream to own a house. Since this is a long-term goal, you have to start investing for at least 20 years so that you can buy your own nest without the worry of paying EMIs on a monthly basis. If you start investing Rs. 6000/- per month for the next 20 years, you will get Rs. 80 lakh assuming 15% CAGR.

How to manage debt judiciously

In order to fix that problem, we will make use of famous The 20 Percent Rule, The Income Rule, The 28/36 debt Rule, to calculate the money which you are free to put to buy a home or a flat. Let’s illustrate these famous rules to calculate spending to buy a home.

- According to The 20 Percent Rule, an individual should put at least 20 percent down when buying a home. This rule ensures that any individual does not spend more amount while buying a home than what the individual can afford.

- According to The Income Rule, an individual should buy a house cost of which does not exceed his three years’ worth of the gross annual income when buying a house. This rule ensures that any individual doesn’t spend more amount while buying a house than what the individual can afford.

- According to The 28/36 Debt Rule, Debt-to-income Ratio, an individual should not spend more than 28% of gross income on housing expenses and more than 36% of all debt including car loans or housing loans, etc. In accordance with The 28/36 Debt Rule, 28% represents the monthly principal, interest payable, property taxes i.e. estate tax and insurance payable on the property. The rest 36% represents all recurring monthly debt compared to one’s gross household income including credit card debt, personal loans, EMI on Housing loan, EMI on a car loan, etc.

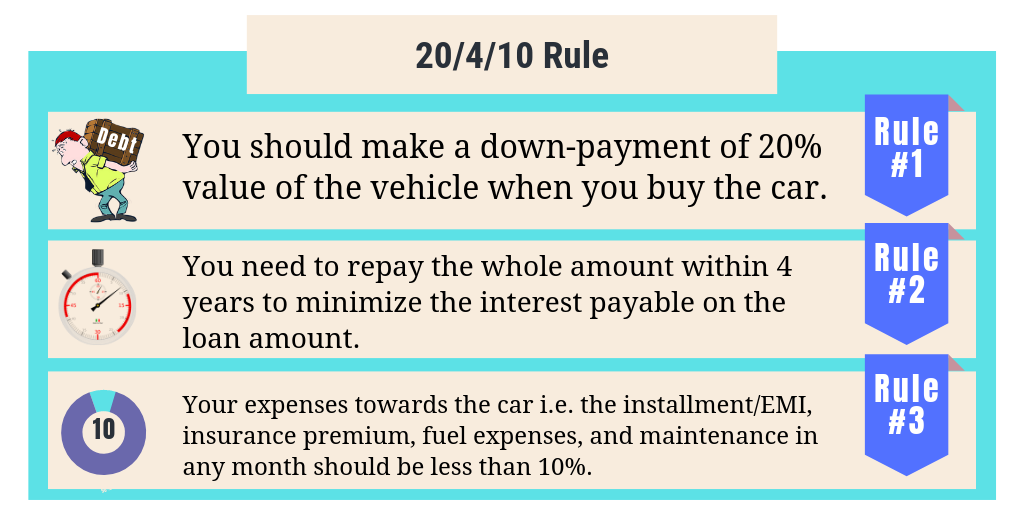

How much should you spend on a car

Now, if you are determined to buy a four-wheeler what amount you should spend is a matter of concern. You may follow some principles. In order to fix that problem, we will make use of famous The 50/30/20 Rule, The 28/36 debt Rule, The 20/10 Debt Rule, & 20/4/10 Rule to calculate the money which you are free to put to buy a car. Let’s illustrate these famous rules to calculate spending to buy a car.

- According to the 50/30/20 Rule, your income will be divided as 50% on needs [Grocery, Insurance Premium, etc.], 30% on wants [Buy a car, travelling or making tours to different places, dinner and movies out, tickets to sporting events, etc.] and the rest 20% for saving.

- According to The 28/36 Debt Rule, Debt-to-income Ratio, an individual should not spend more than 28% of gross income on housing expenses and more than 36% of all debt including car loans or housing loans, etc. In accordance with The 28/36 Debt Rule, 28% represents the monthly principal, interest payable, property taxes i.e. estate tax and insurance payable on the property. The rest 36% represents all recurring monthly debt compared to one’s gross household income including credit card debt, personal loans, EMI on Housing loan, EMI on a car loan, etc.

- According to the 20/10 Debt Rule, the first component 20 implies that any individual should not spend more than 20% of the annual income towards debt repayment. The second component 10 implies that any individual should not spend more than 10% of the monthly income towards debt repayment.

- According to the 20/4/10 rule, any individual should make down payment of 20% value of the vehicle while buying, repay the whole amount within 4 years, and expenses towards the car i.e. the installment i.e. EMI, insurance premium, fuel expenses, and maintenance in any month should be less than 10%.

Tax Planning

If your income is taxable you should calculate your tax liability at the starting of a year. You may consider income tax as an expenditure or you may take your income after deducting your tax.

Govt. allows tax rebate under 80C 80U. The most efficient way to take advantage of Section 80C is to invest in Equity Linked Savings Scheme (ELSS). It has the shortest lock-in period as compared to all the other tax-saving options available under Section 80C. In this, you can save taxes up to Rs 45000 and avail a deduction of up to Rs 1.5 lac. Additionally, the ELSS is a diversified equity fund helps you to achieve your financial goals via investment in the equity market.

Financial Planning Importance

So, from the above discussion, it is clear that financial planning is very important for all. If you are a salaried person you should start early planning for the post-retirement life. The improved medical science has increased the life span of people. On the other hand, sedentary lifestyle has made people more vulnerable to ailments. Apart from these, inflation is there. So, you need to take into consideration all these factors. To manage all the expenditures on or after your retirement you should invest for a long-term horizon in mutual funds.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Financial Planning: Money Management, Tips to Manage Money

- Read also: Top 10 Rules of Financial Planning for Beginners – ClearTax

If you have any questions regarding financial planning feel free to comment so that we can have a discussion. If you found this post helpful don’t forget to share this post.

Good article. Thank you.