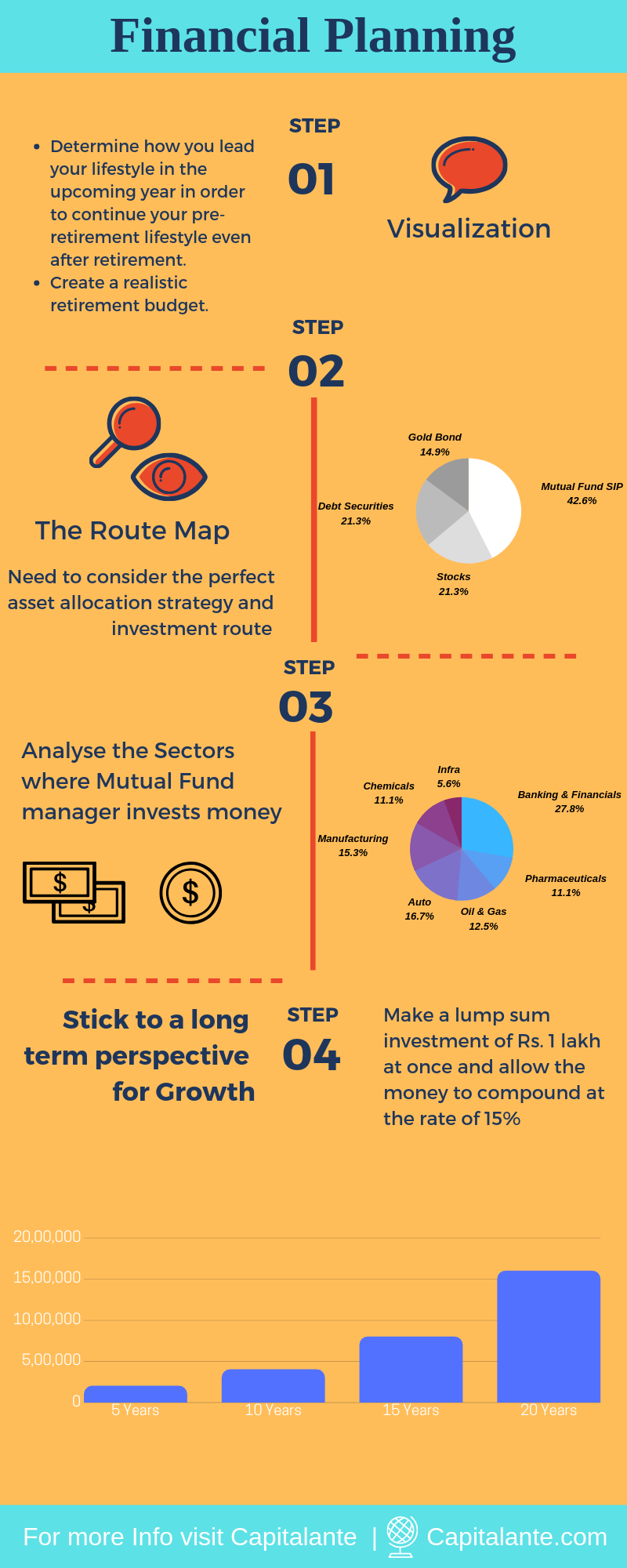

In the way of investment, the first term you need to understand is asset allocation. Asset allocation means diversification of your investment in different asset class i.e., equity, debt, bond etc. This is the most vital aspect of your investment strategy according to your risk profile and time horizon. There is a big basket of asset class namely gold, corporate bond, equity, government security etc. among which an individual has to choose. In fact, there is no fixed form of perfect asset allocation. You can consider certain factors such as your age, risk tolerance, time horizon to select the asset class where you can invest. In this context, we will guide you the asset allocation strategy among different asset class namely gold, bond, debt, equity, etc.

- Read also: Strategic Asset Allocation – Investopedia

- Read also: 4 investment asset allocation strategies to create wealth – Moneycontrol

What is asset allocation

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class which has some moderate risk than the other asset class like the bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

How to calculate perfect asset allocation strategy

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities. If your risk appetite is high, for better returns over a long period of time you can invest your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young you can afford to wait and see for a long time. Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

Factors to consider while making The Asset Allocation Strategy

In order to make a perfect asset allocation strategy, you need to consider the following factors,

- Goals.

- Time horizon.

Let’s break down the above-mentioned factors,

You need to specify your goals either it is short term or long term because you have to decide your investment portfolio in accordance with your goals. Let’s make it clear with an example if you are of 25 years and planning for retirement then you have 35 years. in this case, you should invest in the equity asset class because the equity asset class outperformed all the asset class over the long term. but if you are planning for the purchase of four

Why Time horizon matters?

It is a proven fact that equity asset class gives better returns over the all asset class for a period of 15-20 years. In the year November 1995, the benchmark index Nifty 50 was trading at Rs. 1000/-, now in January 2018 Nifty 50 is trading around Rs. 11000/-. Since inception, the benchmark has delivered a compounded annual growth of return of 12%.

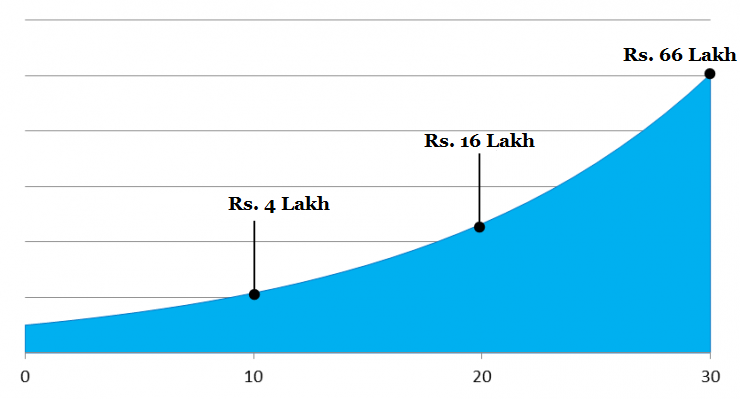

Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

Generally, many people lose money in the stock market due to many reasons the lack of patience is one of them. After making a proper analysis of any stock people choose and invest in good stocks, but after some time, they suffer loss. It is because

When stocks show correction of 20%-30%, impatient investors lose their control and sell the stock quickly at a lower price obviously making a loss. After some months, these stocks again trade on 40%-50% more from their initial price. These investors cannot even wait for 3-4 months. In the hard times of correction lack of patience or herd mentality subdues the intelligence.

“No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

What you will do when the market is volatile or witnessed sharp correction

In order to make a profit in the stock market, you should buy more shares when the market witnessed a sharp correction because you got these stocks at an attractive valuation. Actually, volatility or sharp correction in the stock market is a buying opportunity for long-term investors.

If you are confused about How to invest in the stock market and how to make money in the stock market, you may read the article How to invest in stock market & How to make money in stock market.

By which route beginners can start investment i.e. direct equity or via equity mutual fund

In order to make an investment in the stock market, the beginners have two options. The first option is to invest via direct equity by opening a demat account and the second one is via

On the other hand, if you are of 55 years or above and have saved sufficient money for

While investing in the bond market you are left with various choices to invest. These bonds are corporate bonds, govt. bonds such as treasuries, municipal bonds etc. These bonds usually have a time horizon of 10 years, 20 years or even 25 years. At this point, you need to know that the total investment, as well as the interest income, will be credited at once and at the maturity. The interest earned is totally tax-free. An investor can not withdraw wholly or partially of his investment or interest gained in bonds. Before the investment, you need to consider the rating of the bond. This rating is given by several rating agencies like CRISIL, S & P etc.

Read also: 5 Points to consider when buying corporate bonds.

Finally,

You need to create an emergency fund. Try to accumulate enough money in this fund so that you can bear you all expenses i.e., foods, clothes, insurance bills, even your SIP installments for at least 6 months.

- Read also: How to Invest in the Stock Market

- Read also: How to make money in the Stock Market

If you have any question regarding asset allocation strategy feel free to comment so that we have a discussion. If you found this post helpful don’t forget to share this post.