According to the ace investor Warren Buffet, an individual should create at least two sources of income to achieve financial freedom. So, if you want to create wealth you may head to various investment options available in India. This investment will turn into a second source of income in the future apart from your current income from salary or business or any other source.

Now, a perfect investment portfolio is not an easy task to create, because it will have to fit in accordance with your time horizon and risk appetitive. In this column, we will discuss the top 23 investment options in India which will help you to achieve financial freedom. You need to choose the perfect investment options in accordance with your time horizon and risk appetite.

Top 23 Best investment options in India

Option #1. Public Provident Fund (PPF)

Public Provident Fund is a tax saving instrument in India to promote small savings and investments. This scheme offers deductions under section 80C of the income tax act, 1961 on the contributions made. Any individual irrespective of resident or non-resident Indian citizen can open with a minimum investment of Rs. 500/-. Here are the features of the Public Provident Fund.

- Tax-free maturity benefit on the total amount received as well as interest income.

- The duration of the public provident fund is of 15 years. But an individual can extend the term of 5 years further.

- Any individual can avail partial withdrawal facility from the 7th financial year onwards.

- Interest is compounded annually.

- You can get a loan against your PPF account from the 3rd financial year. The interest rate will be the current interest rate + 2%.

- Premature closure of the PPF account is allowed only after completion of tenure of 5 years for the purpose of medical treatment of self or the family members or for higher education only.

Option #2. Employees Provident Fund

In order to secure the post-retirement life of the employees who work in the organized sectors i.e. electrical, mechanical or general engineering products, iron and steel, paper, textile, EPF was introduced as a retirement benefit plan. Under the scheme, not only employees but also employer contributes 12% of the basic salary [Basic Pay + Dearness Allowance] of an individual towards the employee’s EPF account. Here are the features of the Employee Provident Fund.

- Interest is calculated on a monthly basis.

- Tax deduction under section 80C is allowed on contributions made.

- Any individual can withdraw the amount when the employee remains unemployed for more than 2 months.

- Tax-free maturity or withdrawal benefit is available if the contribution is carried out for the minimum of 5 years.

- Partial withdrawal is available for the purpose of house construction, higher education, medical expenses, etc.

Option #3. National Savings Certificate

A national savings certificate or NSC is a scheme run by the Central Government of India. The scheme aims at generating income for Indian citizens. This scheme is executed via the Indian Postal Department. One can invest minimum Rs. 100/- and there is no upper limit. Additional investment can be made in the multiple of Rs. 1000/-.

You can put the money into the scheme at once and further you may add capital year after year. Time duration will be started when you make the first investment. National Savings Certificate has a lock-in period of 5 years. Before that, you cannot withdraw your money. The lock-in-period is calculated from the date on which you make the first contribution of either lump sum amount or year on year basis.

Option #4. National Pension Scheme

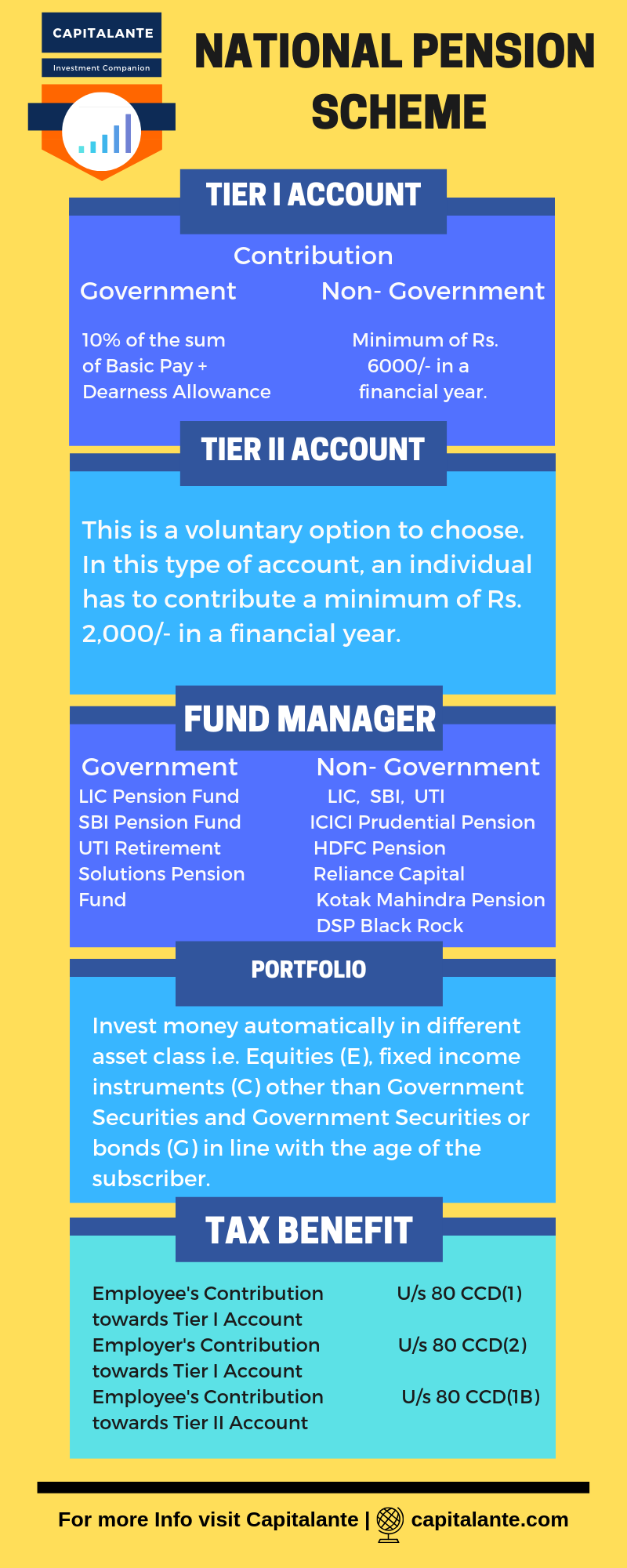

The National Pension Scheme’s main object was to lower the liabilities of the Government of India with regards to the total pension as well as to ensure that the country’s citizens would earn a stable income following the retirement along with helping them earn decent returns on their investment. For more details, you may read the article National Pension Scheme.

Key Features of the National Pension Scheme

From the year 2009, the scheme has been made open to every individual Indian Citizen whether Government Employee or Private Employee or unemployed or any other resident in India or Non-Resident Indian (NRI) who is between the age of 18 & 65.

The money invested in the National Pension Scheme is managed by the Pension Fund Regulatory and Development Authority (PFRDA), a Government Organization. It deals with the management of funds. This authority transfers the funds of individuals to these registered Pension fund managers like LIC Pension Fund, SBI Pension Fund, UTI Retirement Solutions Pension Fund, etc. The scheme invests money in Equities (E), invests in fixed income instruments (C) other than Government Securities, makes investment in alternative investment schemes (A) and in government securities or bonds (G).

The national pension scheme offers two choices namely auto choice and active choice. Under the Auto Choice, the contributions made by any individual have invested automatically in different asset classes mentioned above. But under the Active choice, the individual can choose as per the life cycle fund matrix designed by experts i.e. An Aggressive Fund, the Conservative Fund, and the Moderate Life Cycle Fund.

Option #5. Sukanya Samriddhi Scheme

This scheme was launched in 2015 with the motto “Beti Padhao, Beti Bachao” by the Government of India. This scheme is very popular for not only its objectives but also a tax deduction it allows up to Rs. 1.5 Lakh under the Income Tax Act, 1961.

Key features of Sukanya Samriddhi Scheme

Under this scheme, a bank account is opened in the name of the girl child. This account can be opened anytime after the birth of the girl child till she attains the age of 10 years by any of her parents or guardians.

In a financial year minimum amount of Rs. 1000/- and maximum of Rs. 1.5 lakh can be deposited.

You have to continue the contribution of minimum Rs. 1000/- and maximum Rs. 1.5 lakh in a financial year till the girl child attains the age of 15 years.

You cannot withdraw any part of the money before the scheme’s maturity. But only for your daughter’s higher study 50% of the money you invest can be withdrawn. The account will mature when the girl attains 21 years of age. If the girl gets married after 18 years of age, but before the age of 21 the account will be closed and the whole amount can be withdrawn by the girl or transferred to her Aadhaar enabled bank account.

- Read also: Best Investment Options for Girl Child

Option #6. Atal Pension Yojana

Atal Pension Yojana (previously known as Swavalamban Yojana) is a government-backed pension scheme targeted at the unorganized sectors. This scheme will ensure the pension for workers such as personal maids, drivers, gardeners, etc. after they attain the age of 60 years. Atal Pension Scheme secures a pension for a subscriber when he or she attains the age of 60. At that time when an individual subscriber takes retirement, this scheme provides him a pension for his livelihood in old age.

Under the Atal Pension Yojana, there is a guaranteed minimum monthly pension for the subscribers i.e., Rs. 1000/-, Rs. 2000/-, Rs. 3000/-, Rs. 4000/-, Rs. 5000/- per month. Under the scheme, the government of India contributes 50% of the total contribution of workers such as personal maids, drivers, gardeners, etc. ranging between Rs. 1000/- or 50% of the total contribution in a year whichever is less for the initial 5 years.

- Read also: Step by Step Guide to Atal Pension Yojana

Option #7. Recurring Deposit in Bank and Post Office

Recurring deposit is one of the best investment options with a systematic and disciplined investment process for risk-averse investors. Any individual can start with recurring deposits in either post office or banks for tenure between one year and five years. The interest is fully taxable in accordance with income tax law, 1961. Irrespective of bank or Post office both allow premature withdrawals at any point with a penalty of 1% less than the interest rate offered.

Option #8. Fixed Deposit in Bank and Post Office

If you are a risk-averse investor and wish to invest your money through a secured investment option, apart from the recurring deposit, a fixed deposit (FD) is one of the best options available. Usually, banks or post offices offer a fixed deposit for a tenure varying from 7 days to ten years. The interest income is taxable in the hands of the investor according to the income tax law, 1961. Irrespective of bank or Post office both allow premature withdrawals at any point with a penalty of 1% less than the interest rate offered.

Top 10 investment options – The Economic Times

Investment Options – 15 Best Investment Options in India – PolicyBazaar

Option #9. Post Office Monthly Income Scheme

Post Office Monthly Income Scheme is a Government-backed scheme where an individual invests a lump sum amount which offers a fixed interest every month. Unlike the Public Provident Fund, the interest income in the hands of an individual is fully taxable. The interest rates vary in accordance with the instructions from the Government of India. The key features are as follows.

- Any individual can invest in this scheme between a minimum amount of Rs. 1500/- and a maximum of Rs. 4.5 Lakh.

- The tenure of the scheme is 5 years.

- After a one-year premature withdrawal is permitted.

Option #10. Tax-free Government Bonds

Tax-free Government bonds are types of goods or financial products which the government enterprises issue to collect their capital from the investors to either run their business or expand the business by issuing securities or bonds with a guarantee to repay the amount of the invested money when the security or bond is matured. Here are the key features of Tax-free Government bonds.

- Interest received from the bond is completely-tax free.

- Any individual can invest up to 20 lakh rupees.

- An individual can’t redeem before the tenure of the bond.

- The higher lock-in period is between 10 years and 30 years.

Option #11. Senior Citizen Savings Scheme

The senior citizen savings scheme is one of the few investment options for post-retirement. The scheme is run by the Government of India for senior citizens. The scheme is focused to generate regular fixed income to meet the expenses after the retirement of people. Here are the key features of the scheme.

- It is a risk-free scheme unlike the equity, stock market. It yields a greater return than Bank FDs or Post Office Monthly Income Schemes.

- An individual can invest a maximum of Rs. 15 lakh. But the person cannot invest more than the amount he/she receives on retirement.

- The tenure of Senior citizen Savings Scheme is five years and can be further extended for 3 more years. Premature withdrawal is possible after one year, but it attracts a penalty.

- Investment in Senior Citizen Savings Scheme qualifies for tax deduction under section 80C up to the maximum limit of Rs. 1.5 Lakh. But the interest earned from the Senior Citizens Savings Scheme is fully taxable according to the Income Tax Act, 1961.

Option #12. Prime Minister Vaya Vandana Yojana

As the senior citizen savings scheme, this scheme is also focused to generate regular fixed income to meet the expenses after the retirement of people. Here are the key features of the scheme.

- A senior citizen is allowed to make the investment up to Rs. 15 lakh.

- The last date to apply for this scheme is 31st March 2020.

- The current interest rate of the scheme is fixed at 8%.

- The interest will be paid monthly, quarterly or annually.

- The term period of the scheme is 10 years. The premature exit is possible for the purpose of the treatment of self or spouse.

Read also: The Best Investment Options Post Retirement

Option #13. 7.75% Government of India Bonds

The 7.75% Government of India Bonds is one of the best investment options for conservative investors. This scheme assures a fixed rate of interest with the safety of the principal amount. In order to make an investment, you need to open a Demat account. The key features are as follows.

- There is no maximum limit for investment unlike Senior citizen savings scheme or Post office monthly income scheme.

- The tenure of the bond is 7 years.

- Interest income is fully taxable in the hands of the investor.

- This scheme is ideal for those who have exhausted their limit in senior citizen savings scheme and post office monthly income scheme.

- Premature withdrawal is permitted, but only for a senior citizen on certain circumstances.

Option #14. Sovereign Gold Bonds (SGBs)

Historically, Gold is one of the best risk-averse asset classes. The simple reason behind that is consistently increasing the price over time. Backed by the Government of India, the Sovereign Gold bond is an investment option to hold physical gold in the Demat form i.e. another way to own gold. Since the gold is in Demat form the gold does not require storage cost and does not carry any risk of theft. Here are the key features of Sovereign Gold Bonds,

- Any individual, Trusts, HUFs, Charitable Institutions, and universities can invest in Sovereign Gold Bond Scheme.

- The interest rate of the SGBs is 2.5% annually.

- The tenure of the SGBs is 8 years.

- The minimum investment is 1 gm of gold and the maximum is 4 kg of Gold for individuals.

Option #15. Corporate Bonds

Owing to the higher interest rate of 16%-17% in business loans the companies collect their capital from the investors to either run their business or expand the business by issuing securities or bonds with a guarantee to repay the amount of the invested money when the security or bond is matured. The duration of the corporate bonds varies between one year and thirty years. In order to make an investment in corporate bonds, you need to consider the following points,

- The creditworthiness of the bond issuing authority.

- You need to check out the rating of the bond marked by rating agencies like CRISIL, CARE, and ICRA, etc.

- Expenses & Exit Load of the corporate bond.

- The risk associated with the concerned bond issuing authority.

Option #16. Company Fixed Deposit

Company Fixed Deposit or Corporate Fixed Deposit can be defined as a term deposit which is held over a fixed period of time and with a fixed rate of interest. This scheme is offered by various financial and Non-Banking financial companies i.e. NBFCs. The duration of the corporate fixed deposits varies between one year and five years. Here are some key features of the company’s fixed deposit.

- It offers a higher rate of interest than the scheduled banks.

- Interest payment options are available on monthly, quarterly, annually.

- Interest income is fully taxable as per the income tax act, 1961.

- You need to check out risk factors associated with fixed deposit Issuance Company, rating by various rating agency i.e. CRISIL, CARE, and ICRA, etc.

Option #17. Non-Convertible Debentures

Usually, non-convertible debentures are long-term securities that yield a fixed rate of interest [10%-11%], over a fixed period of time. The scheme is offered by various financial, housing, and Non-Banking financial companies i.e. NBFCs. Convertible debentures can be converted into shares or equities in accordance with the issuer, but non-convertible debentures can’t be converted into shares or equities. Needless to say, equity or share is a unit of ownership that represents an equal proportion of a company’s capital. It entitles the shareholder to an equal claim on the company’s profits and an equal obligation for the company’s debts and losses. Usually, non-convertible debentures are issued through a public issue aiming to give a buying opportunity so that potential investors can buy NCDs.

Option #18. Direct Equity by opening a Demat account

It is a proven fact that the equity asset class gives better returns over all asset classes for a period of 15-20 years. In the case of direct equity investment, an investor needs to gather sufficient knowledge about the stock market and the stocks or shares he wants to buy.

Many investors invest in direct equity without doing proper fundamental analysis, technical analysis, and qualitative analysis and without checking balance sheet, profit and loss account, etc. And then waits only for one year or two years to get satisfactory returns. Then, in most of the cases, these investors make a loss because of their lack of knowledge and proper analysis.

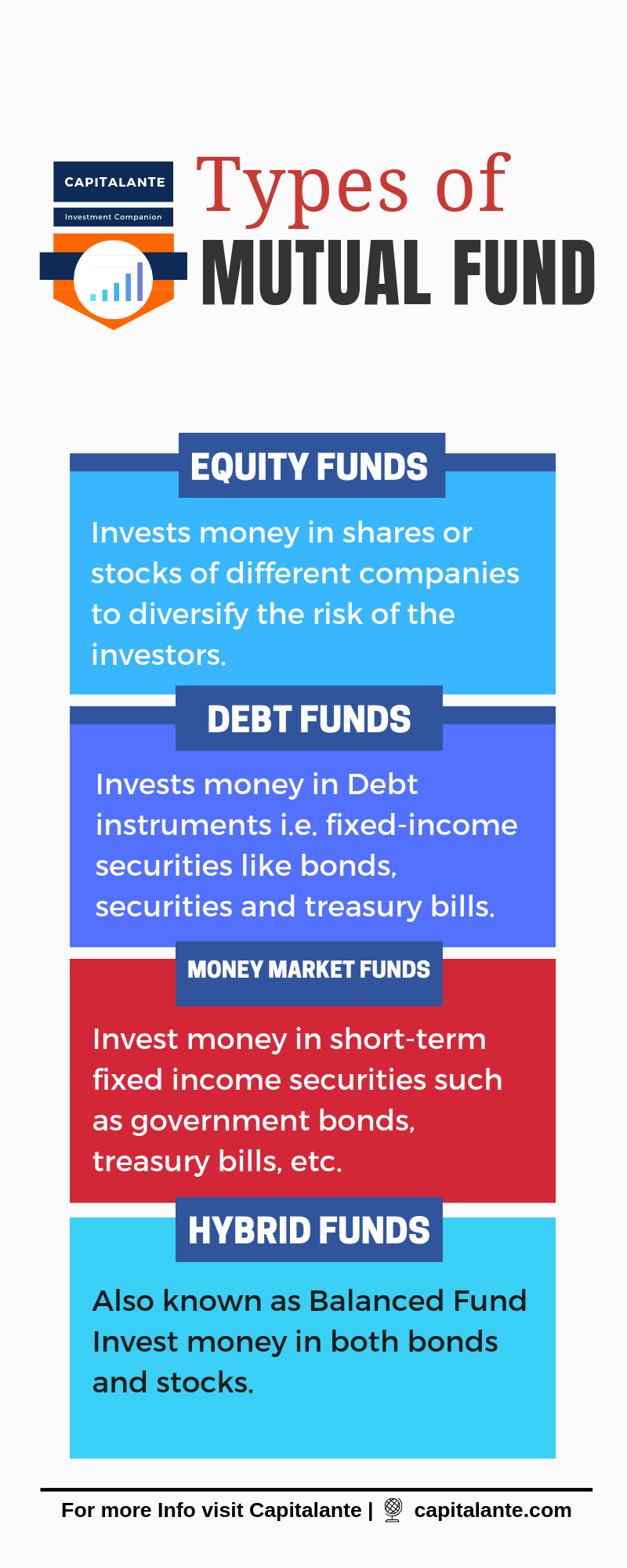

Option #19. Mutual Fund

As a novice investor arguably mutual funds are one of the best investment options available. Mutual funds offer investment options among different asset class i.e. debt securities, equity or stocks and balanced funds i.e. a mixture of debt and equity both. If you have a long-term horizon you may invest in equity-oriented mutual funds that yield better returns over any other asset class.

The biggest advantage is that if you invest via mutual funds, you do not need to read anything about a company nor you need to keep an eye on that company and its price movement. You can start investing in a mutual funds either via a Systematic Investment Plan or a lump sum investment. Then, the respective fund manager will invest your money in around 25-30 companies or stocks to diversify the risk. Thus, you can lessen the risk factor and generate better returns in the long term.

Option #20. Unit Linked Insurance Plan

Unit Linked Insurance Plan (ULIP) gives investors both insurance and investment under a single integrated plan. It is not only an insurance policy but also covers risk for the policyholder along with investment gateway in many asset classes like stocks, Mutual Funds, debt instruments, Corporate bonds, Government securities, etc. If an investor has a low-risk profile and an investment horizon of 5 years investing in ULIPs with a major portion in stocks is not a good idea. Similarly, an investor with a longer investment horizon and high-risk appetite should go for equity-oriented ULIPs that make bigger exposure to equities. You can choose ULIP investments to plan for significant milestones like marriage, home purchase, education or marriage of your children.

ULIPs are completely tax-free if you withdraw the money after the lock-in period of 5 years. In addition to the ULIPs offer partial withdrawal options not exceed 20% of the fund value of the policy.

Option #21. Equity Linked Savings Scheme

Equity Linked Saving Scheme (ELSS) is a kind of investment option offered by several Mutual Fund houses. In this scheme, your money is invested in several companies just like normal mutual fund schemes. It allows investors to save taxes under Section 80C of the income tax act, 1961. It has a lock-in period of 3 years. You are free to invest either by giving a lump sum amount at once or can make investment via the SIP route. In the case of ELSS, an investor can stop contribution but cannot withdraw wholly or partially of his total investment before 3 years from the date of the first contribution.

- Read also: Top 5 Best ELSS funds to invest in India

Option #22. Exchange-Traded Funds

Exchange-Traded Funds or ETF is a kind of mutual fund that includes 20-22 or more different shares of different sectors together. An ETF operates with various companies like an index fund, for example, Nifty Auto Index or FMCG Index. An ETF trades like a common stock on a stock exchange and its price changes throughout the day as they are bought and sold. During the trading time, you are free to buy or sell an ETF. ETFs typically have higher daily liquidity and lower fees than mutual fund shares and this makes an ETF an attractive alternative for individual investors.

An ETF allows investors to get the diversification of an index fund. It enables an investor to sell short, buy on margin and purchase as little as one share because there are no minimum deposit requirements. Another advantage is that the expense ratios for most ETFs are low.

Option #23. Real Estate

With the economic progression of India and an increase in the disposable income of Indian people, real estate has become an ideal investment option. In order to get success in real estate, you need to consider the following points.

- You need to buy such a property which is situated in a location that will attract the people who either want to rent or buy the property.

- Calculate the municipal value of the property before buying which will yield a better return in the near future.

- Try to make lump sum down payment as much as you can so that interest payment does not eat the returns.

- Calculate the costs associated with the renovation and other operations. Then decide your selling price.

Finally, where to invest the money?

The best answer to the above question is, you should invest in accordance with your time horizon and risk appetite. If you have any queries regarding where to invest money in India, feel free to comment so that we can have a discussion. If you have found this post helpful share with your loved ones whom you care about.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare an effective financial planning.