Many beginners invest in the stock market to make their fortune. But after sometimes they leave the market suffering a huge loss. It is also seen that many investors can never make a profit they also give up the investment in the share market. It is seen that due to some blunders in their decisions they make the loss. This is not your problem only. Usually, 90% of the investors entered the stock market and made a huge loss. Here we will discuss why people lose money in stock market i.e. the common mistakes a retail investor makes while investing in the stock market,

Top 10 Reasons why people lose money in Stock Market

Reason #1. Being guided by fake information from the cheat

Very often, as an investor, you may receive various phone calls, messages or e-mails from different unknown sources. There you will find information regarding investment. This information is meant to misguide you and sent by insiders of any company who has a personal purpose to fulfill. They actually conduct illegal insider trading exploiting your interest. In an illegal insider trading, an insider of a company along with a small group of people buys a particular stock and share price-sensitive information. So, huge artificial demand is created for the particular stock resulting in higher prices.

Then, at a certain point when the prices hit the ‘satisfactory’ level, the insider exits the company along with his small group of people. In other words, this insider sells stocks and makes profits. Soon the stocks plummet resulting in huge losses for the retail investors.

Solution – Skip these type of Information

Through messages or via email you will get several insider information like some company’s profit margin will be tripled and if the price of that stock is now Rs. 100/- then the stock will go to Rs. 200/- within 3 or six months or one company will give 1:1 bonus share or one company is getting merged with a larger company etc. They usually name a large and famous company like Titan Company, Infosys to impress you.

As an investor, you should be cautious to avoid getting into the quagmire of insider trading scams. Never invest in a company or an industry that you have never heard of even if you get a tip-off.

Reason #2. Get tempted to Marginal trading

Margin trading is a high-risk strategy that allows you to buy more stock than you are able to. Buying on margin means to borrow money from a broker (similar to a loan) to purchase stock. The retail investor can take a position in the market by paying an initial margin of 50 percent (your own money), while the broker can finance the balance 50 percent value of the stock.

Let us imagine you have Rs. 500/- in your account. And your broker offers you to borrow Rs. 500/- for marginal trading. You are amazed that you are eligible to buy share worth Rs. 1000/- instead of Rs. 500/-. You buy that share in the morning at a cost of Rs. 1000 and in the afternoon you notice that your share price is down to Rs. 900, so you lose 10% of your money besides brokerage. Your broker tells you to repay his Rs. 500/-. Then you sell the share at Rs. 900/- and repay your broker Rs. 500/- along with brokerages.

Finally,

In the morning whereas you had Rs. 500/- and in the evening now you have Rs. 400/-. So you lose 20% of your money besides brokerage.

Your broker is always gained. Whenever you buy or sell shares he gets his brokerages irrespective of loss or gains you make. So, avoid Marginal Trading.

Reason #3. Following the advice or tips offered by so-called analysts

According to the author of the ‘The Intelligent Investor’ by Benjamin Graham “You can’t predict Market”.

Maximum retail investors while buying share do not analyze the fundamental, technical, qualitative analysis, balance sheet, profit and loss account, dividend history, EBITDA Margin, PAT Margin etc.

Many business news channels show intraday trading tips delivered by various analysts. These analysts discuss various trading tips all day long. Watching this, a retail investor gets amazed and acts accordingly.

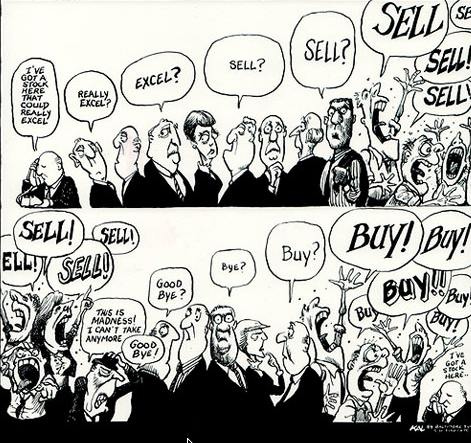

When the stock market is up, these analysts give a buy call and when the market corrects they give a sell call.

I have seen in my experience that when Apollo tyres, Titan Company, Motherson Sumi, HPCL scale to new highs these analysts advise buy recommendation with a higher target on the intraday basis or monthly basis. After 3 months when these shares correct which is quite obvious, these analysts recommend selling with a lower target and stop loss.

What to avoid,

These analysts are not God. They can’t predict the market. If they are able to predict the market then they are the only persons who make a huge profit and get rich very easily. If I can predict the market then why shall I offer you free advice to make you rich? These analysts get paid by either TV channels or companies which they recommend. They are just doing their job to earn money for them.

Generally, it is seen that these so-called experts recommend some shares to buy. But after 6 months they recommend selling these shares. What has happened in the last 6 months is that the company has gone bankrupt, or its business has been closed. Then why do these so-called analysts alter their recommendation within the span of 6 months? The reality is they have been paid by such companies to promote or recommend the stock so that the demand of that stock can be increased. Then the owner of the concerned company will get hid money and minimize loss or gain profit. But you as an investor will lose your money.

- Read also: How do investors lose money when the stock market crashes?

- Read also: Why People Lose Money in the Market – The Balance

Reason #4. Investment with Borrowed money

It is seen when the market touches its lifetime high many people consider it an opportunity to make money. So, they borrow money and invest in share market hoping the market will reach towards its new lifetime highs. But after a week or month or more when the market moves into correction they get panicked and try to sell the stocks which have already corrected about 30% within a week. Let’s understand it with an example.

Suppose, a retail investor invests Rs. 1 Lakh when the market is in lifetime high. There are instances that several stocks irrespective of Large-cap or Mid-cap or Small-cap that have yielded a 50% return in the past 6 months correct to 30% from their peak price. Suppose you bought Titan Company in December 2017 at the price of Rs.456/-. Now after 6 months titan hits its lifetime high of Rs. 976/share. Then the stock goes into correction and corrects to Rs. 780/share. After this huge correction who invested in Titan Company in December 2017 had a return of 85% within 8 months which is great. Now as a trader if you had bought the same stock at the peak price of Rs. 976/ share then after correction you would have made a loss of 32%.

So,

If the investment had been made with borrowed money the situation would have been worst. Share market is a very lucrative sector. People often get tempted to invest in the stock market. Sometimes they borrow or withdraw loan and invest. Then this kind of incident of correction takes place that leads to a loss for the investors especially the new ones or temporary ones.

Reason #5. Chicken Heart Mentality

Confidence is an important thing to get success in stock investment. In some case, it is seen that people cannot hold their confidence after making an investment. This kind of investors holds the negative thought that they will eventually lose their money. Due to the negative mentality, they cannot earn a profit. Let’s make it clear with an example. Whenever market goes into correction, many news channels, as well as analysts, recommend sell option. Usually retail investors i.e., chicken heart investors sell their stocks driven by these morons. When the market goes into correction you need to invest more because you get the stocks at an attractive valuation. Don’t panic when the market experiences a sharp correction. Hold your hand tight with petty cash. When the market corrects considerably, then you should start infusing money in the falling market.

Solution

You need to check out the company’s quarterly or annual results during the volatile market. If they are satisfactory then you need to continue the infusion of money in these stocks. In the volatile market, many analysts recommend the selling of the shares. They are in search of such stocks which are available in the best valuation. If you sell the stocks they will buy them. This is their tactics. And when the market inches towards higher, then they again recommend buying an option to book their profit.

Let’s illustrate this with an example. After watching out the products that you want to shop have come down by 30% within one week, you rush to buy them. You should apply this theory to the stock market also. When the stocks are available at an attractive valuation then you should buy more shares unlikely the people who sell their shares or stocks at the time of correction.

Reason #6. Lack of Patience

Patience is the most crucial factor to get success in the stock market. Patience is the main key to make fortune here. Like a good investor, you can buy or rather to say invest in stocks and stay calm for a long period. You or any investor must spend allot time to your stocks and wait.

Generally, many people lose money in the stock market due to many reasons the lack of patience is one of them. After making a proper analysis of any stock people choose and invest in good stocks, but after some time, they suffer loss. It is because this kind of people cannot have patience, they actually hurry to gain a huge profit from their investment. At least 2-3 years time should be spent on good stocks to find a profit.

How Lack of Patience affects,

When stocks show correction of 20%-30%, impatient investors lose their control and sell the stock quickly at a lower price obviously making a loss. After some months, these stocks again trade on 40%-50% more from their initial price. These investors cannot even wait for 3-4 months. In the hard times of correction lack of patience or herd mentality subdues the intelligence.

“No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

Have you ever come across that a baby has been born in a quarter or within a half year? The answer is quite clear no. Like this, the stock market is quite volatile in a short-term period, to say one year or two years, but not forever. You should focus on investment for a long-term horizon of 10 years or more. According to its nature, share market corrects itself shortly time to time. But don’t worry. This short-term correction will be recovered very soon. A smart investor utilizes the volatile condition of the market as an opportunity to invest more and more. This will in future yield better returns over a long time perspective.

What to do,

After proper analysis of a company, many retail investors choose the stock for investment. But if the stock does not give profitable return they sell the stock and looks for some other company to invest. Another common proverb is that ‘the castle does not build in a day it takes time’. No company flourishes in one year. It takes time. My suggestion for retail investors is that Infosys or TCS or any other multinational company did not form in a single day. So as a retail investor, you have to be patient and keep investing for a long-term perspective. Ace investor Warren Buffet after proper analysis of stocks selects a stock and continues investment for a long time.

Let’s take an example of Ace investor Rakesh Jhunjhunwala. He chose VIP Industries and started investing in VIP Industries in 2009. After 10 long years, the stock gave him 29% compounded return year-on-year. So, after investment, you should wait for at least 10 years to get satisfactory returns.

Reason #7. Herd mentality

Like a ship, many people act accordingly. When one ship walks in a way, the rest ships blindly follow the first one. This can be seen among investors also. Similarly, when an investor buys or sells any stock many unintelligent investors follow him blindly and buys or sells that particular stock. They do not analyze the strategy which these kinds of people follow. They do not use their present knowledge or make fundamental analysis, check balance sheet, profit and loss account of the stocks.

“Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”

Reason #8. Lack of Proper Knowledge

One of the common proverbs is ‘First learn then start to earn’. You must learn about the share market. How does it work? What are the risks involved in the share market? There are many such things to learn before investing in the share market. After gathering a satisfactory knowledge you can start investing in share market.

Many retail investors consider the suggestions delivered by the business news channels and the analysts to be the best and to be worth investing because they are analysts. This is the biggest blunder a retail investor makes. You should not do according to this. You should know properly about the company or stock in which you are putting your hard earned money. Like a smart investor, you have to check its fundamentals like debt ratio, compounded sales growth, compounded profit growth, P/E, Market cap etc. After analyzing these factors you can move to invest in that specific company. Share market requires proper knowledge about it. Lack of proper knowledge about stocks you want to invest in will definitely lead to suffer loss.

Reason #9. They want to get rich quickly

There is a basic human instinct that everyone desires to get rich as quickly as possible. Many investors find share market a platform where they can do so. These investors hurry and make a huge investment in any stock. They do not feel the need to make a proper analysis of a certain stock. They just put their money due to excitement without worrying about consequences. It is needless to say their money wasted in the market. People enter the share market and buy stocks in the hope that these stocks will soon be 5 or 10 times of the initial amount.

But what happens? After sometimes when these stocks start correcting and show a decline from their initial price, investors panic and get frustrated. Then they sell their portfolio making a loss. They have a tendency to blame the stock market that it is the place where no one can make money and investment in share market is a total waste of money and time.

Reason #10. Judge a share with its Price rather than other parameters

Many retail investors judge a share with its share price without making fundamental analysis, Technical analysis, Qualitative analysis and checking balance sheet, profit and loss account, free cash flow etc. Let’s make it clear with an example.

There is a misconception among investors that the price of share costing Rs. 50/- may easily rally to Rs. 100/- within 3-4 months, whereas the share that costs Rs. 500/- will not rally to Rs. 1000/- within 3-4 months even within one year. So, an investor with Rs. 10000/- holds that by choosing Rs. 50/- per share, he will get 200 shares whereas by opting share that costs Rs.500/- will provide him with only 20 shares. So, in the first case, he gets more shares. Now in future, if the share price goes up and becomes Rs. 100/- from Rs. 50/- rupees he will definitely make a huge profit. They think that Rs. 500/- is itself is a big amount. So, there is less possibility that this specific share may become Rs. 1000/- after 6 months or more.

This is the biggest blunder made by these investors. You must not rely only on share price, because share prices are affected by the stock split and bonus share. You may read the benefits of bonus share and stock split.

So, after analyzing these crucial reasons, my suggestion for the retail investors is that before you buy any stock you should at first analyze the company’s fundamentals, profit and loss account, balance sheet etc. and get invested in that specific stock for a long term.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Top 10 Best stocks to buy in India for long term

- Read also: 6 Signs that You are Gambling in Stocks

If you have found this post helpful feel free to comment so that we have a discussion. If you have found this post helpful share with your loved ones.

Excellent Info.

If you have found this post helpful feel free to share with your loved ones.

Worth the read. This post has summarized every single mistake a newbie retail investor does. Thank you for the post.

Thank you for your appreciation. #HappyInvesting.

Thanks really worth reading.