Retirement planning is an important thing for all persons engaged in Govt. Service or Private Service or any other sector where there is provision for retirement after attaining the age of 60 years.

A person should think about retirement planning right after joining his/her job. Early retirement planning will ease the life after retirement. Many a person has some misconceptions regarding planning for retirement and makes some common mistakes.

Mistake #1. Avoid early retirement planning

After getting a job most of people think that they are too young to plan for retirement. They believe that they have much time to plan for retirement. They ignore this vital thing that early planning will secure financial needs after their retirement.

Like this, they spend years after years and when the age of 60 comes close they find themselves with very little savings for the post-retirement life. So a sincere person will keep this thing in mind and try to do planning for his or her post-retirement life.

Mistake #2. Unable to visualize the situation after retirement

First of all, let’s assume that a person gets a job at the age of 25 years. So he will have a service period of 35 years. This service period may vary from person to person and may be of 27 or 30 or 33 years or more. Generally, we can assume that a person has a service period of 30 years. You must have a clear view and a good understanding of the expenses that will be required to live after retirement.

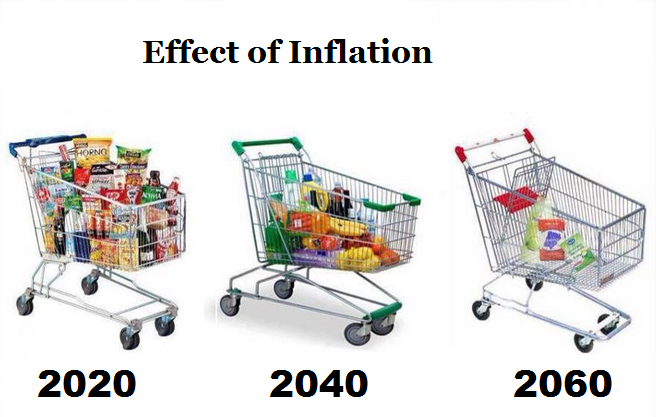

The current inflation rate is 7% per year. It means next year you will need Rs. 107/- to buy the same product you can buy now with Rs. 100/-. So if you can fulfill your requirements with Rs. 20000/- per month now, you will need Rs. 1, 50, 000/- approximately per month after 30 years assuming a 7% inflation rate. Consider the case of inflation and do the needful.

Mistake #3. Unable to save money

After getting a job many people spend lavishly. They think this current flow of income will remain forever. They do not focus to save money. Before spending they do not think whether it is necessary to invest the money on useless things. So make savings from the very fast day of your earning.

At first, start investing at least 20% of your income. Then increase savings in accordance with your salary hike. In this way, your investment corpus will increase year by year. By doing this you are not supposed to become a billionaire but definitely will be able to fulfill your financial requirements easily after your retirement.

Mistake #4. Consider kids as retirement corpus

There is a conception that children will take care of their parents. So some parents do not value savings for the future and lead a life of luxury and false show-off. But it is needless to say the reality.

We may witness that children after being grown up do not show interest to bear the expenses of their parents. Now let’s understand what to do. You should start investing at an early age in your career.

Try to save at least 20% of your income and invest it among different asset class i.e., PPF, NSC, Equity Mutual Fund, Gold, etc. You should continue this till your retirement.

Be careful not to touch this money for any ordinary financial needs like a tour, buying a Four Wheeler or any luxury items. Do not show off luxury and stop spending on unnecessary things. Make expenses according to your income.

You may use your surplus money to pay your must needs like health insurance premium, life insurance premium, etc. For any kind of adverse situation, you may create an emergency fund to tackle emergency conditions like health hazards.

This fund will be your oxygen for post-retirement life. Last of all hurry up! You do not have much time left. Your retirement is knocking the door. You will not even realize when these 30 or 35 years have crossed.

How to Calculate Retirement Corpus

In order to make an early retirement, you need to plan from the moment when you start your first earning because you have to build a reasonable bank balance to secure the standard lifestyle after you get retired at the age of 60. The answer varies on the following factors.

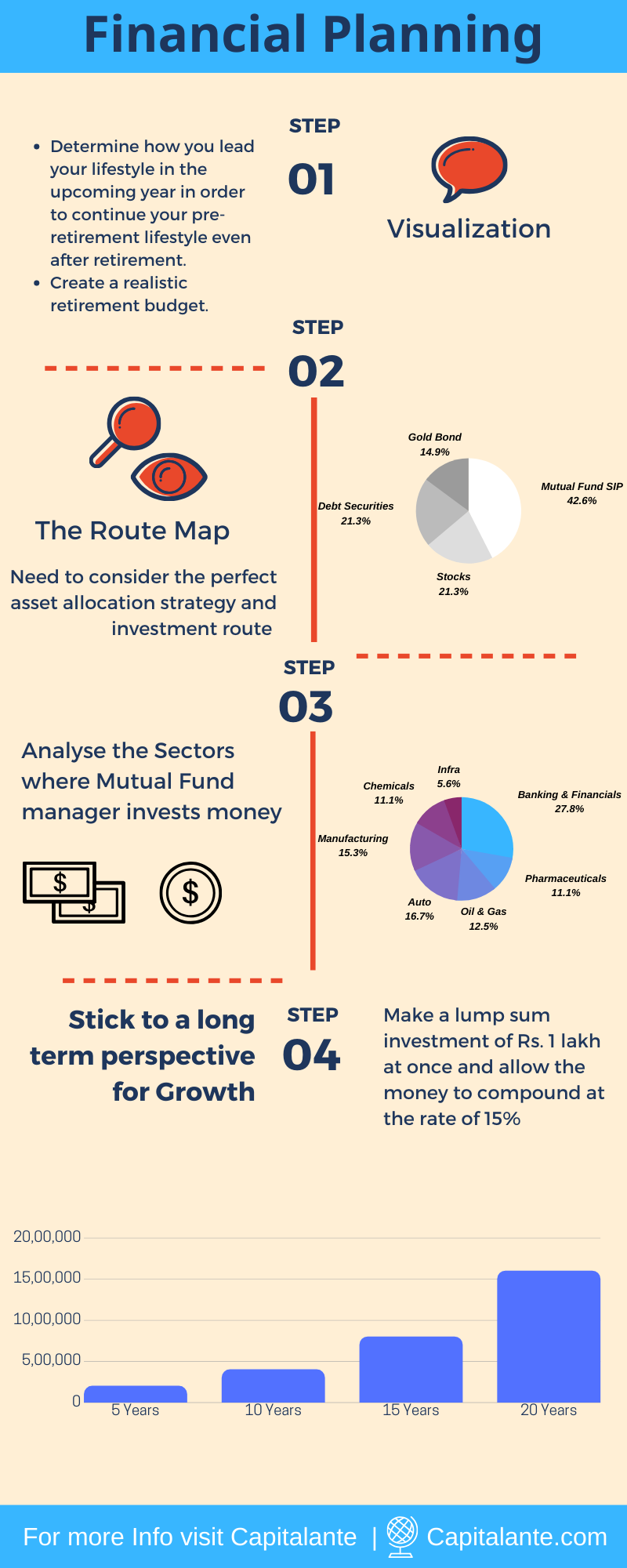

- Determine how you lead your lifestyle in the upcoming year in order to continue your pre-retirement lifestyle even after retirement.

- Create a realistic retirement budget.

- The route map by which you can create your desired retirement corpus.

Determine how you lead your lifestyle

According to most of the millionaires, nearly 90% of people cannot become rich even after their retirement, because they are not visionary. You should differentiate between your needs and wish from the starting.

Since you have access to laptops, tablets, and smartphones you can use Excel sheets to track expenses. Prepare a detailed expense sheet with major pockets of spends like stationery, travel, food, entertainment, and shopping. You have to maintain records under these heads. You can fix an amount for each head. In this way, you can track the expenses easily.

Surround yourself with financially educated and conscious people from whom you can learn about financial planning. Also make sure that your group of friends comprises people who share similar financial goals.

It can be difficult to adhere to financial disciplines when you spend time with spendthrifts. A great way to learn about the art of finance is to find a family friend who can mentor you throughout the process – someone who has achieved his own financial success.

Create a realistic retirement budget

You must have a clear view and a good understanding of the expenses that will be required to live after retirement. The current inflation rate is 7% per year. It means next year you will need Rs. 107/- to buy the same product you can buy now with Rs. 100/-. So if you can fulfill your requirements with Rs. 20000/- per month now, you will need Rs. 1, 52,245/- approximately per month after 30 years. Consider the case of inflation and do the needful.

Now let’s calculate the desired corpus you need to accumulate when you retire at the age of 60 years if you have started your professional career at the age of 25 years.

Calculation of Retirement Corpus

Suppose you have started earning at the age of 25 years and your earning is Rs. 25000/- monthly. Now you wish to make an early retirement at the age of 60. So, you have got 30 years to achieve a sufficient amount in order to lead a happy and prosperous retirement life.

Your yearly salary – Rs.3, 00,000/-, assuming Rs. 25,000/- a month.

Your yearly Household Expenses – Rs. 1, 80,000/-, assuming Rs. 15,000/- a month.

Term insurance premium – Rs. 7,000/- assuming assured sum of Rs. 1 crore for a term of 30 years.

Health insurance premium – Rs. 8,000/-, assuming a cover-up to Rs. 5 lakh/ year for a term of 35 years.

Expenses on festive season = Rs. 25,000/-.

Total Expenditure

Therefore, your expected expenses throughout a year is = Rs. 1, 80,000/- + Rs. 7,000/- + Rs. 8,000/- = Rs. 25,000/- = Rs. 2, 20,000/-.

Then, the expenses at the age of 60 years assuming a current inflation rate of 7% will be = Rs. 21 lakh. [excluded term insurance premium and health insurance premium since they are fixed at the time of buying].

So, you have to accumulate a corpus of [Rs. 21 Lakh × 20 years = Rs. 4.2 Crore] at the age of 60 years, assuming you will live at least 80 years.

In addition,

Let’s assume you have two kids i.e. one daughter and one son. So, the Education cost of son & daughter as well as the daughter’s marriage after 20 years = Rs. 40 Lakh.

Total amount need = Rs. 4.2 Crore + Rs. 40 Lakh = Rs. 4.6 Crore.

- Read also: Retirement planning – The Economic Times

Make a roadmap to reach your desired retirement corpus

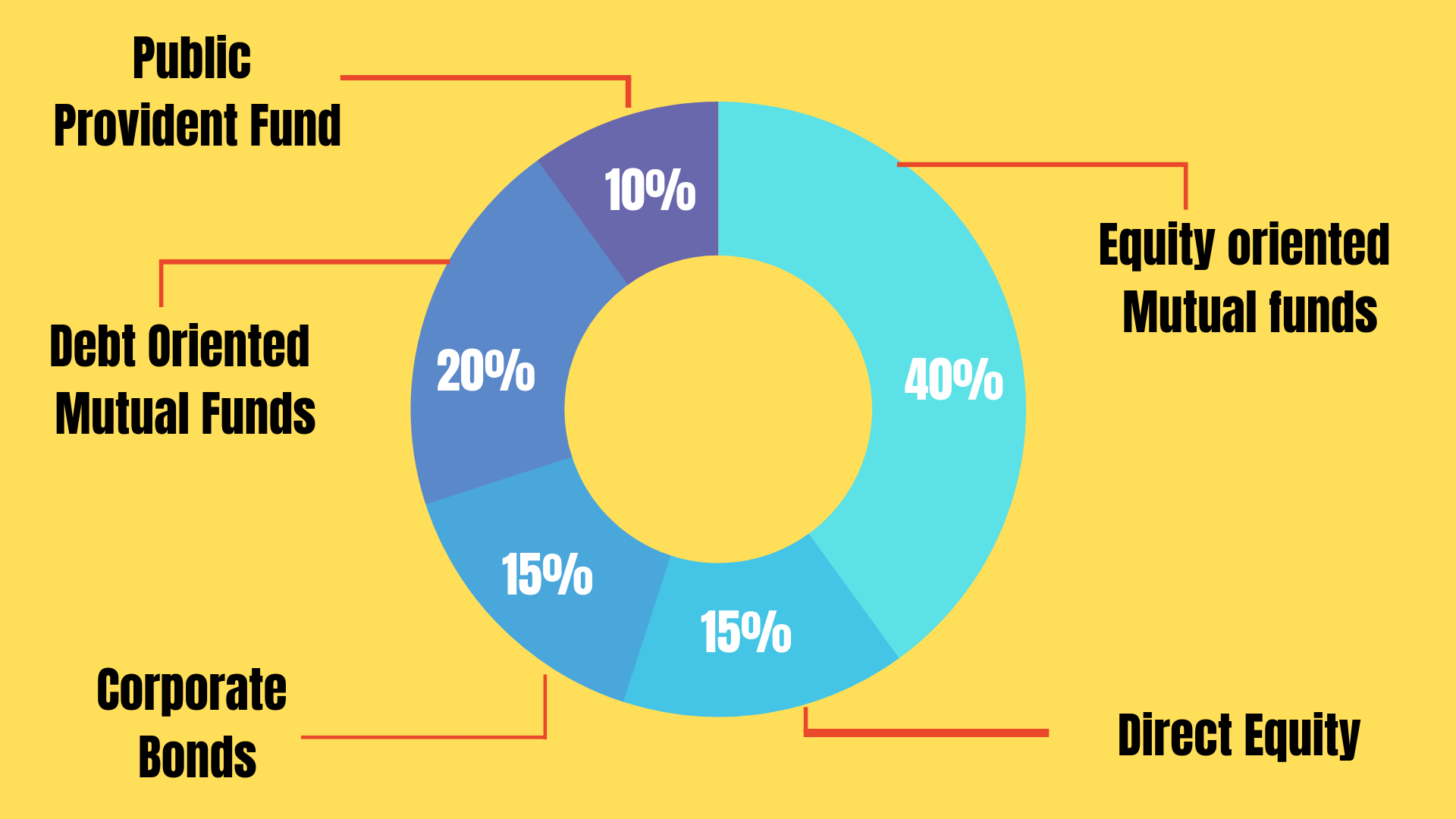

Now, you need to consider the perfect asset allocation strategy and investment route to make an early retirement.

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class that has some moderate risk than the other asset class like a bond, debt securities. But historically, equity yields more returns over a long period of time.

So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities.

If your risk appetite is high, for better returns over a long period of time you can invest your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young, you can afford to wait and see for a long time.

Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

- If you are confused about the asset allocation strategy you may read the article Asset Allocation Strategy in Easy Steps.

By which route a common individual start investment in the stock market?

In order to make an investment in the stock market, the beginners have two options. The first option is to invest via direct equity by opening a de-mat account and the second one is via a mutual fund.

In order to make a profit in the stock market via direct equity, you need to analyze the fundamentals, business analysis, balance sheet, profit and loss account, free cash flow while choosing the stock in which you are going to invest.

In the case of Mutual Funds,

But in the case of mutual fund investment, you need not analyze the above-mentioned points. Mutual funds are managed by fund managers who are active in this field for a long time and possess vast knowledge and experience.

The fund managers pick stocks or shares in which your money is to be invested. The fund manager of the respective mutual fund invests your money in different sectors like Banking, Finance, FMCG, Infrastructure, Automobiles, Information Technology, and Manufacturing, etc. You may invest a lump sum amount at once or you may opt for a monthly, quarterly or yearly basis via SIP.

If you are confused which route you should follow to start investment in the stock market, i.e. direct equity or mutual fund you may read the article How you can invest, directly in equity or via mutual funds.

Why should I start early and stick to a long term investment in the stock market?

To gain one of the major benefits, when you invest over a long-term horizon, is compounding interest.

Why Start Early

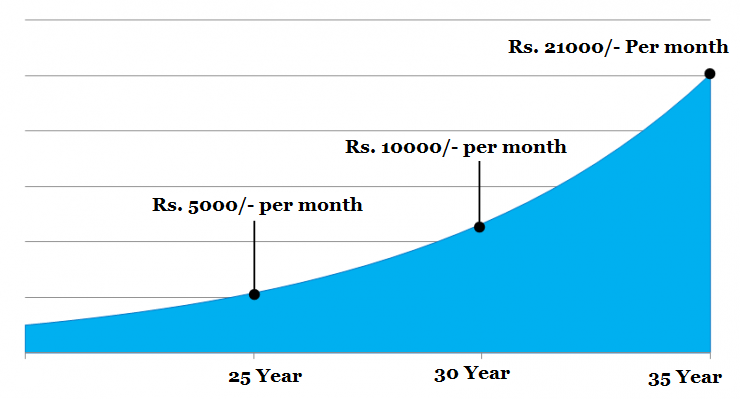

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just Rs. 5000/- per month then you will get Rs. 2.8 Crore when you are 55, assuming 15% CAGR. If you are late by 5 years i.e., you start investing at the age of 30, then you need to invest Rs. 10000/- per month to get the same corpus at the age of 55 years. Again, if you start investing at the age of 35 years then you need to invest Rs. 21000/- per month.

Why Long-term Horizon

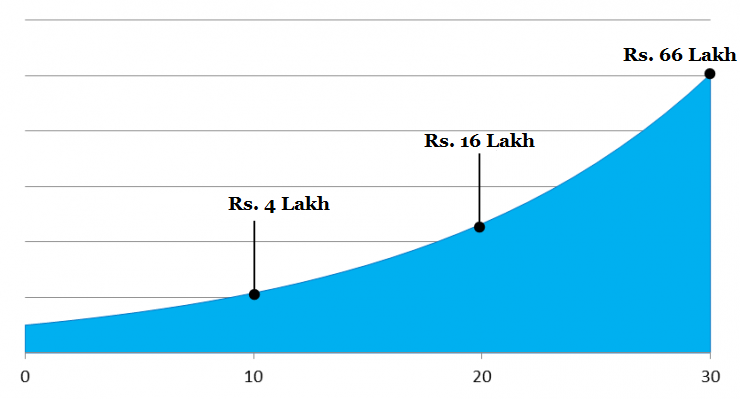

“In the short run, the market is a voting machine but in the long run it is a weighing machine” – Benjamin Graham.

Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

Start with a little amount and don’t forget to increase whenever possible

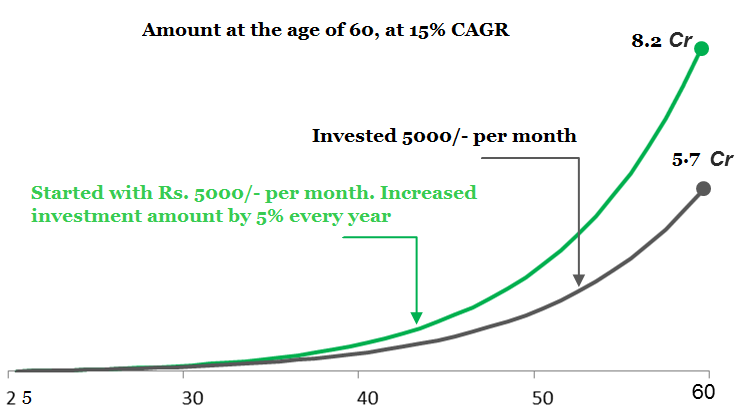

To get the benefit of compound interest you may start with a little amount of Rs. 1000/-. You may then increase the amount of SIP every year with a little extension of 5%. Let’s understand it with the following graph.

As shown in the graph if you make an SIP of Rs. 5000/- per month for the upcoming 35 years, then you will get Rs. 5.7 crore assuming 15% CAGR. If you increase the SIP amount by 5% every year then you will get Rs. 8.2 crores after 35 years. So, step up your SIP amount as possible.

To conclude this, you need to gain the compounding interest.

- Start as early as you can.

- Long-term investment horizon.

- Invest consistently and step up i.e., increase your contribution.

Retirement Planning Importance

So, from the above discussion, it is clear that retirement planning is very important for all. If you are a salaried person you should start early planning for the post-retirement life. The improved medical science has increased the life span of people.

On the other hand, sedentary lifestyle has made people more vulnerable to ailments. Apart from these, inflation is there. So, you need to take into consideration all these factors. To manage all the expenditures on or after your retirement you should invest for a long-term horizon in mutual funds.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: How to retire early at 55 in India

If you have any questions regarding retirement planning feel free to comment so that we have a discussion. If you have found this post helpful share with your loved ones.