Looking for the Best credit cards to buy in India? If yes then stick with the post. Here we will discuss different 17 types of credit cards in India along with usage, benefits, and charges and finally points to consider while choosing the best credit cards.

What is a Credit Card?

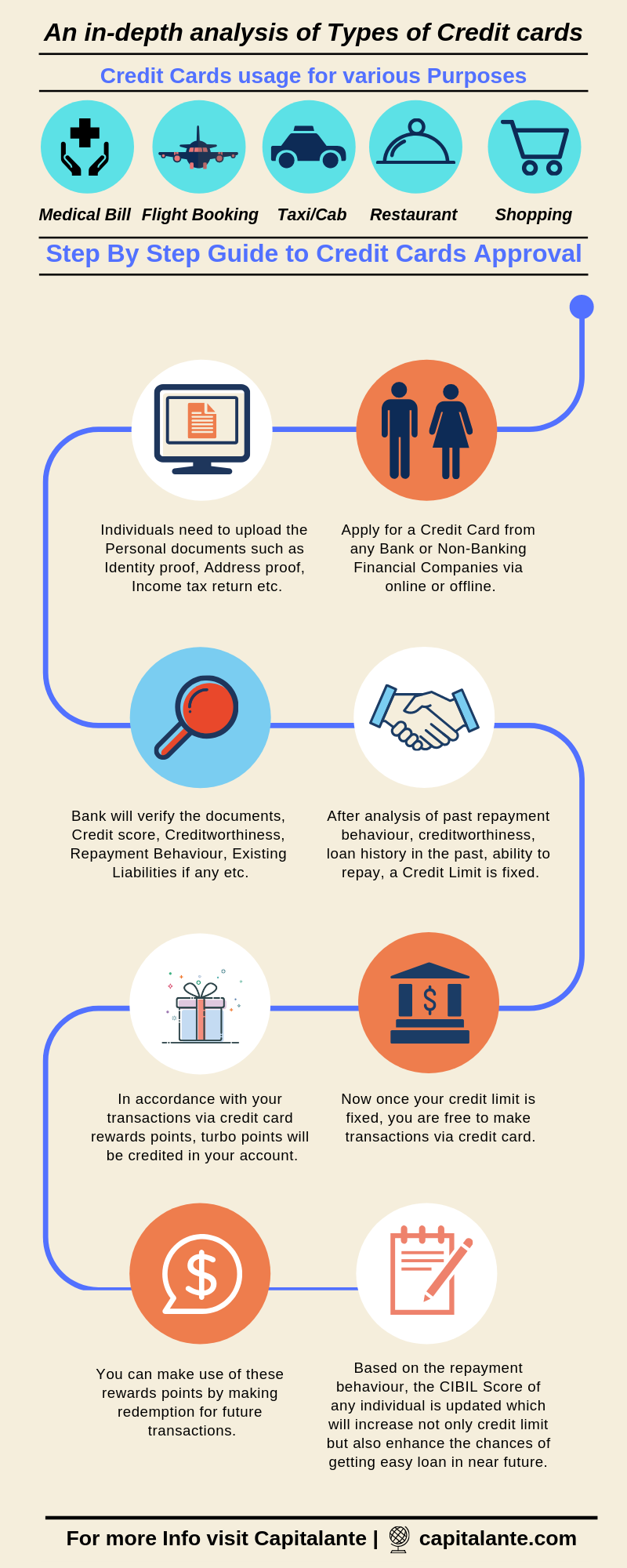

A credit card is just like a debit card issued by the banks and Non-banking financial institutions. A credit card allows users to pay bills to a pre-approved limit fixed by financial institutions. You can use this credit card anywhere and at any moment. You can make payments by swiping this credit card at shops, malls, restaurants, hotels, or any other places. Any Individual can book flight tickets, train tickets, pay electricity bills, or insurance premiums. You can also make online shopping with this credit card.

How to apply for a credit card?

An individual can apply for a credit card by visiting the nearby bank preferably in which bank he has an account or by visiting any other bank branches also. Nowadays if your online banking is activated you can apply for the credit card online also. You need to upload documents such as address proof, identity proof, passport size photograph, and signature. After the application is processed the credit card will be delivered at your registered home address in accordance with the document you have provided.

Who are eligible for apply for a credit card?

The eligibility criteria may vary from bank to bank, but you will easily get a credit card if you fulfill the above criteria namely,

- Good credit score.

- A regular source of income of at least Rs. 20,000/- per month.

- If you are a salaried employee then 3 years of continuous service.

- If you are a businessman then you have to be engaged in the business since the last 5 years.

Top 17 types of credit cards in India

Fuel credit card

This type of credit card has been designed to save consumers’ money every time while they make payments after buying petrol or diesel from any petrol pump. Usually, several banks have a tie-up with oil marketing companies in order to save money to some extent and then these credit card companies provide you reward points.

Let’s make it clear with the help of the following example. State bank of India has a tie-up with various oil marketing companies such as HPCL, BPCL, Indian Oil Corporation. When you fill your vehicle’s petrol or diesel then they usually offer cashback offer up to a limit of 0.75% directly on your registered bank account within 3 business days. In addition, various credit card companies offer a reversal of 2.5% fuel surcharge and offer 2.5% additional cashback on fuel transactions. Apart from this, various credit cards offer you reward points in your account. For example, ICICI Bank Credit card offers 4 Turbo points for the purchase of petrol or diesel of every Rs. 150/-. So, the 4 Turbo points can be redeemed in order to get free fuel in the petrol pumps.

Business credit card

Business credit cards enable an entrepreneur to keep his business expenditures such as office supplies, machinery, the salary of employees, etc. differently from personal expenditures. It helps to calculate the business transaction i.e. expenses and taxes payable thereof. The business credit card has the following features and benefits.

- The business credit card is designed for business. It is quite helpful for higher expenses since it has a higher credit limit.

- All the payments i.e. utility bills, purchase of office supplies, machinery, and salary of employees’ can be made. So, it is quite helpful to calculate the total expenditure and therefore calculation of profits.

- Since all the bills are paid through one credit card, the card owner earns more reward points. These points may be redeemed for future transactions to get attractive discounts, cashback while purchasing gifts, and much more.

- Enables various offers such as complimentary hotel night stays, complimentary airport lounges visit twice in a quarter.

- Offer reward points and air miles during travel, shopping. Suppose you have 1000 reward points which will be equal to Rs. 300/- which can be redeemed for booking an air ticket or for airport lounges.

- Various credit cards offer comprehensive insurance coverage up to Rs. 50 Lakh.

Contactless Credit Card

Unlike other credit cards where you need to swipe your card in the POS machine. This type of credit card executes payments without any physical contact. Contactless Credit cards work in accordance with Near Field Communication (NFC) technology. This technology enables wireless data transfer such as Credit Card Number, Expiry Date, Name of the cardholder, the CVV number between POS Machine, or any other device and the card. To make a payment, you need to forward your credit card within the area of 5-10 cm of the card reader, and your transaction is executed. Here are the key features of Contactless credit cards.

- Since all the data in the credit card is encrypted, it is next to impossible to read the data if anyone steals your credit card.

- According to the guidelines issued by RBI, you need to enter your PIN to execute payment even for it is Rs. 1/-. You may feel free even if you lose your credit card or it is stolen. All you need to do is to block the card and apply for a new one.

Balance Transfer Credit Card

Balance Transfer Credit card enables a cardholder to transfer existing outstanding loan amount from one credit card lender to another lender. The biggest advantage of this type of credit card is that it allows interest rate subvention for the first three months. You need to consider the following points.

- You need to transfer the balance to those lenders who offer a lower interest rate and a penalty from the existing lender.

- Check out the processing fees and other details to make sure that the balance transfer is actually beneficial for you.

- Fill out the required details such as credit score, Address Proof, the outstanding amount of the existing credit card, credit card statement of the past one year.

Cash back credit card

Usually, cash back credit cards offer consumers cash back on every purchase on certain spending categories. This card enables a cardholder to get back a certain amount of percentage of the amount he spends on his cash back cards. Varying on the credit card issuer the card company may send your cash back amount directly to your bank account or adjust as a credit on your monthly credit card bill. The key features of the cashback credit card are as follows.

- 5% cash back on utility bill payments, movie tickets, shopping at departmental stores, railway ticket booking, cab riding.

- 1% fuel surcharge waiver on fuel transaction between Rs. 400/- and Rs. 5,000/-.

- 15% cash back on dining from network restaurants.

Entertainment credit card

In order to enjoy an active entertainment lifestyle, credit card companies offer reward points in lieu of expenditures which are incurred on booking concerts, music shows, movie ticket, and tickets to major sports or entertainment events. They also offer cash back offers apart from reward points on the expenses incurred on above-mentioned purposes. Here are the key features of the Entertainment credit cards,

- Any individual will get 10,000 bonus reward points on spending above Rs. 2 Lakhs.

- Once every month, you can get Rs. 500/- on movie tickets on spending Rs. 2,000/- or more at bookmyshow.

Lifestyle credit card

Owing to the increase in real disposable income people are shopping savvy. This credit card not only offers cash back offers on various categories but also offers discount offers on several occasions. Usually, credit card companies tie up with various companies in this segment. When you shop across the accessories providers they offer various lucrative cash back and heavy discount offers on various products. Here are the key features of Lifestyle credit cards.

- Any individual will get 10,000 bonus reward points on spending above Rs. 3 Lakhs.

- Exciting discount offers at Spa and departmental stores.

- Waiver of Rs. 500/- once in a month while booking movie tickets from bookmyshow.

- Waiver of fuel surcharge of 2.5%.

Travel credit card

We all know that Indians are travelling savvy. Travel credit card companies have a tie-up with various airlines companies, hotels, and travel-related companies to offer various travel related services. They include,

- When you book an air ticket then you will earn air miles. You can convert these air miles to upgrade your seat next time.

- Credit card providers enable free access to airport lounges for the customers.

- Discount and cash back offer while booking hotel rooms, dining at hotels during travel.

- Free travel insurance.

Co-Branded credit card

These types of credit cards are offered by various banks and retail companies. Suppose you are a big fan of Titan Company for its unique design of Jewellery, Wristwatches, etc. In addition to this, you like Arvind for the quality of clothes. Usually, banks have a tie-up with brands like Titan, Arvind, etc. Whenever you shop at their stores these companies i.e. brands offer you the best cash back, discount offers. In addition to this, they offer a lower interest rate on the purchase, discount on processing fees, easy EMI offers. In addition to this, if you have high spending on fuel purchases you may opt for co-branded credit cards. These cards enable a cardholder to save a handsome amount of money in the long run.

Classic credit card

Various banks offer basic credit cards for those persons or individuals with income between one lakh and two lakh. Usually, These credit cards offer neither airport lounge access nor attractive cash back offers like co-branded credit cards. These credit cards can be availed against a fixed deposit. These credit cards offer a fixed usage limit against the overall credit limit. Since you have got this credit card backed by your fixed deposits, a credit limit is fixed according to your fixed deposit amount.

Premium credit card

Unlike classic credit cards, premium credit cards charge substantial annual maintenance charge, but they offer exclusive credit offers. The premium credit card has the following features,

- Fuel surcharge waiver up to a maximum limit of Rs. 400/- on the purchase of petrol or diesel between Rs. 400/- to Rs. 4000/-.

- Easy EMI offers for purchases above Rs. 2500/- and above.

- Various premium club memberships.

- Airport lounge access worldwide.

- Cashback offer for dining & hotel reservations.

Prepaid credit card

Any individual can avail credit cards irrespective of credit rating, salary or income. It does not require any bank account of any individual at all. The prepaid credit cards have the following features,

- You can apply online for prepaid credit card.

- You can set a PIN code in most of the prepaid credit cards.

- Unlike other credit cards, this credit card offers customers to set a credit limit apart from the credit card issuer.

- It offers cash back and rewards points like other credit cards.

Credit Cards for Women

These credit cards are specifically designed for women to meet specific expenditures. This type of Credit card offers lucrative shopping offers for women since they are fond of online shopping. Here are the key features of the women’s credit card.

- Get exciting rewards points, air miles while travelling,

- Cashback offers for shopping vouchers,

- Easy EMI for items above Rs. 2500/-,

- Surcharge waiver for several items,

- Insurance for a Rs. 10 Lakh.

Silver and Gold credit card

Both the silver and the gold credit card hold similar features. Different card companies have different benefits, but gold credit card offers travel insurance which makes it different from a silver credit card. The gold credit cards have the following features in comparison to the silver credit cards,

- Higher credit limit.

- Higher annual maintenance fee.

- Better cash back offers.

- Higher Reward points

- Free accidental death insurance

- Free fire and burglary protection of goods during travel.

Platinum and Titanium credit card

Many credit card holders consider either Platinum or Titanium credit card as their status symbol. They want to impress their friends by paying for dinner at any business meeting or at any restaurants. This type of credit card is designed to such extends that will definitely impress the others by its dashing look and matching colour combination. Since this card provides various features to the cardholders, it attracts a higher fee. The card has the following features.

- Higher credit limit.

- An incentive like flyer miles while travelling via airlines.

- Attractive cash back offers.

- Attractive discounts while booking from network travel companies.

- Travel insurance of Rs. 10 Lakh.

Points to consider while choosing the best credit cards

Credit card companies encourage their cardholders to gain more and more reward points. So, you need to consider the following points while choosing the best credit card.

Spending you should make

If you are among those persons who want to earn reward points or cash back on purchases luxurious items like washing machine, Smartphone, you need to pay without fail. But if you are a spendthrift then in order to gain reward points or cash back you may come under huge debt. So, use the credit card to spend when you need and according to your capacity to repay the credit.

If you are using the credit card for emergencies then choose such credit cards which offer higher credit limit and lower fees structure.

Credit Limit

In accordance with the loan repayment in the recent past i.e. credit history, creditworthiness, the credit card issuers have fixed an amount of money to let you borrow. So, you should not touch more than 30% of the limit, because it affects your credit score. Suppose your credit card issuer allows you to spend Rs. 100/- per month. So, in order to boost your credit score don’t make use above 30% of your available credit limit. Here it is Rs. 30/-. It is advised that make use of only 15-20% credit allowed to your card. If for any reason you have to use more than 80% or the full 100%, try to pay off the amount within the stipulated time.

Pay on time

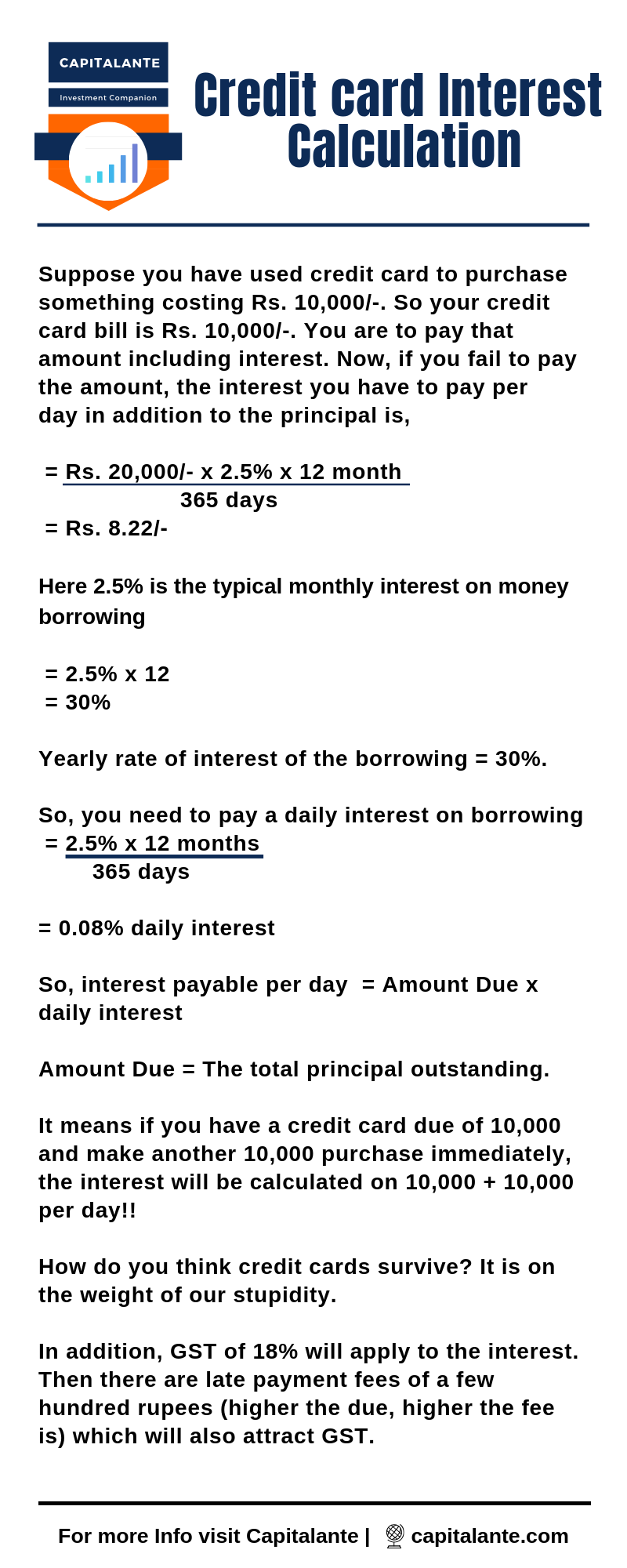

You receive a credit card from your credit card issuer and the card issuing authority gives you a stipulated time to repay the amount. Now it is your responsibility to pay off the amount timely. This will not only increase your creditworthiness but also affect your CIBIL Score. If you fail to pay off the credit then the company usually charges between 2-3% interests on a monthly basis. If calculated on a yearly basis then you need to pay an interest of around 40% yearly. In the event of you fail repeatedly to pay off the dues then it will affect your creditworthiness and CIBIL score. The direct impact of this will be that you won’t be able to get Credit Card in the near future by any credit card issuer.

Don’t Withdraw cash from the ATMs

You can withdraw cash with your credit card from ATMs. But it attracts a high rate of interest. Any withdrawal from ATMs attracts as much as 2-4% per month and the interest is calculated from the first day of the withdrawal even if you withdraw on 28th day of the month. So, it is advised not to withdraw from ATMs with your credit card except on emergency situations. Again, small withdrawals attract high charges.

Annual fee waiver

There are various credit card lenders who offer annual maintenance charge waiver if any individual makes payment via credit card for more than one lakh rupees. So, you should consider those credit card lenders which have offered such an offer.

- Read also: Top 10 Worst Credit Card Mistakes to Avoid

Hope this article will help you to choose the best credit card from different types of credit cards in India. If you have found any question feel free to comment so that we can have a discussion. If you have found this post helpful don’t forget to share it with your loved ones.