Have you ever received any SMS or Mail like this, “Pay the first installment of advance tax before 15th June’’? But you get confused about what is an advance tax, who will mandatorily pay advance tax, how to pay advance tax, and what are the consequences if you miss the advance tax payment within due dates. In this column, we will discuss the above-mentioned points.

What is Advance Tax?

Advance tax can be simply described as after calculation of taxable income as well as taxes payable. You need to pay the whole tax amount in installments within the due dates prescribed under the income tax act, 1961.

Who will mandatorily pay advance tax?

Irrespective of individual or company or firm all are liable to pay advance tax if the total tax liability exceeds Rs. 10, 000/- in any financial year. If you are a salaried employee and your total tax liability exceeds Rs. 10, 000/- for any financial year, then your employer will deduct the tax automatically. But in the case of income from capital gains or business income with a total turnover above Rs. 2 crores then you need to pay advance tax irrespective of the taxes payable less than Rs. 10, 000/-.

What are the due dates?

In accordance with the Income-tax act, 1961, both corporate assessee and companies need to pay advance tax in 4 installments.

| Due Date | Advance tax |

| On or before 15th June | 15% of Income Tax |

| On or before 15th September | 45% of Income Tax |

| On or before 15th December | 75% of Income Tax |

| On or before 15th March | 100% of Income Tax |

How to calculate the advance tax payment?

In order to calculate let’s calculate the total taxes any individual need to pay. But before the calculation, let’s discuss some of the income tax deductions under Chapter VI-A.

- Tool: Advance Tax Calculator

Tax Saving Options under section 80C of the income tax act, 1961

You can avail the benefits of section 80C of the Income Tax Act by depositing money in the following schemes.

- Public Provident Fund

- Life Insurance Premium

- National Savings Certificate

- Equity Linked Savings Scheme

- Sukanya Samriddhi Yojana

- Principal Amount Repaid on Home Loan

- 5 year fixed deposits in commercial banks and post office

- Tuition fees paid for children’s education, up to a maximum of 2 children

Tax Saving Options under section 80CCD(1) of the income tax act, 1961

This section allows a tax rebate for individuals for contribution to their pension accounts. Contribution up to 10% of the sum of [Basic Pay + Dearness Allowance] or 20% of gross total income (in case the taxpayer being self-employed) or Rs. 1, 50,000/- in a year whichever is less is allowed under section 80CCD (1).

Employer’s contribution to NPS – Section 80CCD (2)

This section allows an additional deduction made to an employee’s pension account by his/ her employer. This contribution can be up to 10% of the salary of the respective employee and there is no monetary ceiling on this deduction.

Any individual can avail the benefits of Section 80CCD (1B) by depositing money into their NPS account. The Contributions to Atal Pension Yojana are also eligible for deductions.

Tax Saving Options under section 80D of the income tax act, 1961

Indian Government allows tax benefits on health insurance/Medi-claim Policy U/s 80D of the income tax act, 1961, available to an individual or a HUF in for payment of

- The insurance premium of self, spouse, and dependent children.

- The insurance premium of parents.

For home rent

Under section 10(13A) of the income tax act enables an individual to save taxes by the exemption of a part of the HRA allowance that an individual or is actually paid if he is a self-employed individual. The exemption limit is minimum among the three conditions.

- Actual HRA received by an employee from the employer.

- If the individual resides in metro cities then the exemption limit is 50% of the [Basic pay + DA] and 40% if resides in non-metro cities.

- Actual rent paid – 10% of [Basic pay + DA]

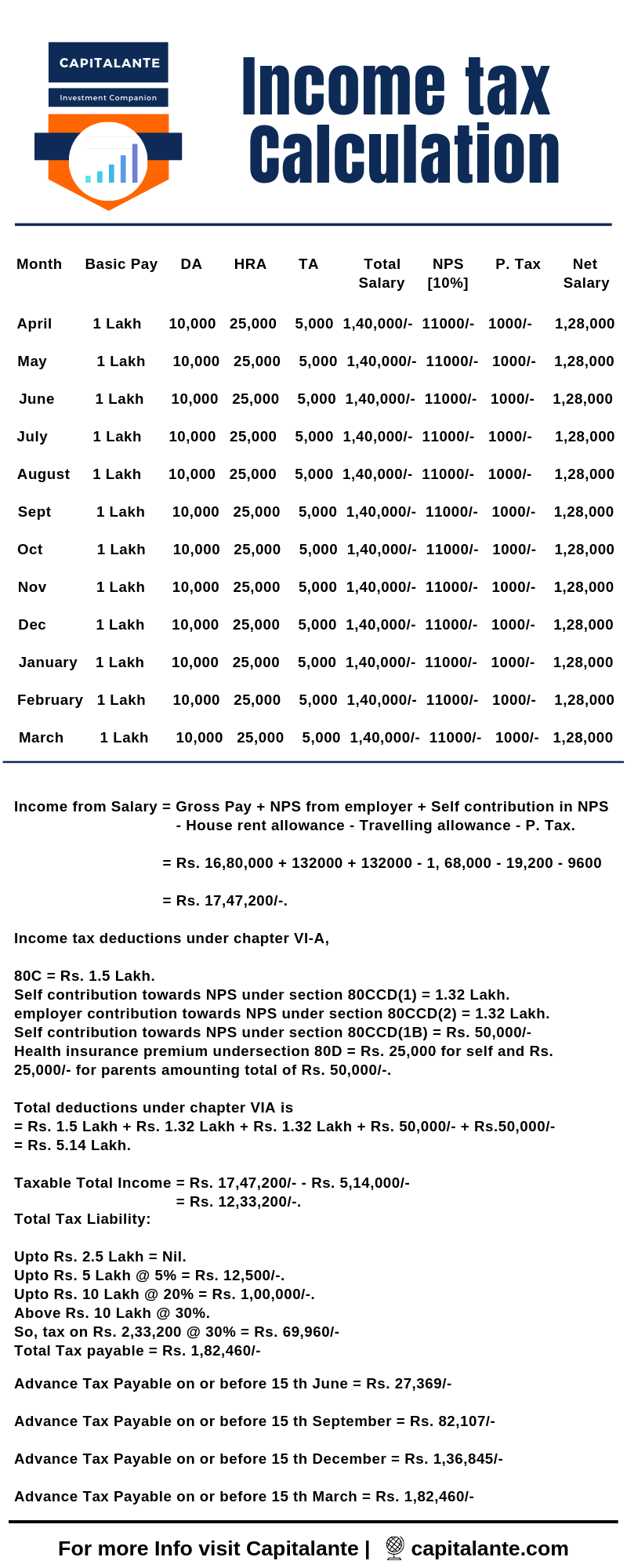

In this case let’s calculate assuming Basic pay = Rs. 1 Lakh, DA = Rs. 10,000/-, and HRA received Rs. 25,000/- a month i.e. Rs. 3 Lakh annually.

Condition 1 = Rs. 3, 00,000/-

Condition 2 = 50% of [Basic pay + DA] = Rs. 6, 60,000/-.

Condition 3 = [(25,000 × 12) – (10% × Rs. 1.1 Lakh × 12 month)]

= Rs. 3, 00,000/- – Rs. 1, 32,000/-

= Rs. 1, 68,000/-

For Transport allowance

Under section 10[14(ii)] of the income, the tax act enables an individual to save taxes by the exemption of a part of the HRA allowance a person receives. The maximum exemption limit is Rs. 1600/- per month i.e. Rs. 19,200/- annually.

How to pay Advance tax

After the computation of your tax liability, you can pay advance tax either online or offline by making use of Challan 280 by quoting PAN, Assessment Year, address, etc.

- Read also: Pay Tax Online – Income Tax Department

The penalty in the case of failing to pay the advance tax within due dates

Non-payment of advance tax within the due date attracts interest under section 234B, 234C of the income tax act, 1961.

Interest under section 234B of the income tax

If the assessee fails to pay the advance tax is less than 90% of the advance tax then the assessee shall be liable to pay simple interest at the rate of 1% for every month or a part of a month.

Interest under section 234C of the income tax

In accordance with the income tax act, 1961, the interest payable under section 234C will be as follows,

- If the assessee fails to pay any advance tax.

- If the assessee has paid the advance tax within the 15th September but tax paid is less than 30%.

- If the assessee has paid the advance tax within the 15th December but tax paid is less than 60%.

- If the assessee has paid the advance tax within the 15th March but tax paid is less than the total tax liability i.e. 100%.

If the assessee fails to pay the advance tax in full then the assessee shall be liable to pay a simple interest rate at the rate of 1% for 3 months in the case of failing to pay advance tax in full during the due dates i.e. 15th September or 15th December.

Let’s make it clear with the help of the following example,

Suppose, you are to pay advance tax payment as

- Advance tax payable on or before 15th June @15% = Rs. 27,369/-

- Advance tax payable on or before 15th September @45% = Rs. 82,107/-

- Advance tax payable on or before 15th December @75% = Rs. 1, 36,845/-

- Advance tax payable on or before 15th March @100% = Rs. 1, 82,460/-

Let’s assume any individual has paid the following installments of advance tax,

- Advance tax paid on 15th June = Rs. 25,369/-

- Advance tax paid on 15th September = Rs. 75,107/-

- Advance tax paid on 15th December = Rs. 1, 20,845/-

- Advance tax paid on 15th March = Rs. 1, 60,460/-

Computation of Interest under Section 234B

Suppose you have filed a return on 30 June 2020. Since you have paid advance tax <90% then you are liable to pay interest under section 234B.

Tax fell short = Rs. 22,000/-

Duration = 3 months [From 01/04/2020 to 30/06/2020]

Interest = 1% per month.

Interest payable = Rs. 22,000/- × 3 month × 1% = Rs. 660/-

Computation of Interest under Section 234C

| Due Date | Tax to be Paid | Tax Paid | Short Fall | Rate of Interest | Interest Payable |

| 15.06.2019 | Rs. 27,369/- | Rs. 25,369/- | Rs. 2000/- | 1% per month for 3 months | Rs. 60/- |

| 15.09.2019 | Rs. 82,107/- | Rs. 75,107/- | Rs. 7000/- | 1% per month for 3 months | Rs. 210/- |

| 15.12.2019 | Rs. 1, 36,845/- | Rs. 1, 20,845/- | Rs. 16000/- | 1% per month for 3 months | Rs. 480/- |

| 15.03.2020 | Rs. 1, 82,460/- | Rs. 1, 60,460/- | Rs. 22000/- | 1% per month for 1 month | Rs. 220/- |

| Interest Payable Under section 234C | Rs. 970/- | ||||

- Read also: Income Tax Deductions In India

- Read also: How to File Income Tax Return in India

Hope, this article will help you in computing the advance tax and pay within the due date. If you have got any questions feel free to comment so that we have a discussion. If you have found this post helpful feel free to share it with your loved ones.