Credit card is an option to receive fund from a bank or any non-banking financial institution for various purposes. Credit card holder is provided with money as credit at first. Then the person pays off the money including interest within a stipulated time of usually 40-45 days. Credit card can be used anywhere, from shops, malls, petrol pumps or to pay the grocery bills i.e. utility bills via online payment system etc. Now, the use of credit card is increasing rapidly. People are showing more and more interest to possess and use credit card. However credit card has some problems associated with it. In this column, we will discuss the top 10 worst credit card mistakes to avoid while make use of credit cards.

Top 10 common Credit card mistakes to avoid

Compromising Credit Card Details

The greatest mistake is to share the credit card details to anyone i.e. any information about your credit card. Never share your credit card information with anyone. You may come across persons claiming to be the representatives of your credit card issuer. They will ask for card details, secret Pin number etc. Do not put your legs into this kind of trap. That person totally intends to cheat you. Banks or Non-banking financial institutions never call or ask for any details regarding credit card. If your card details are hacked then the credit card can be misused for the purpose for shopping, online bill payments or any other purpose. So, stay cautious about any communication about your credit card to get rid of cheating. Be careful when you make use of credit card at open places like merchant outlets, petrol pumps etc.

Failing to pay on time

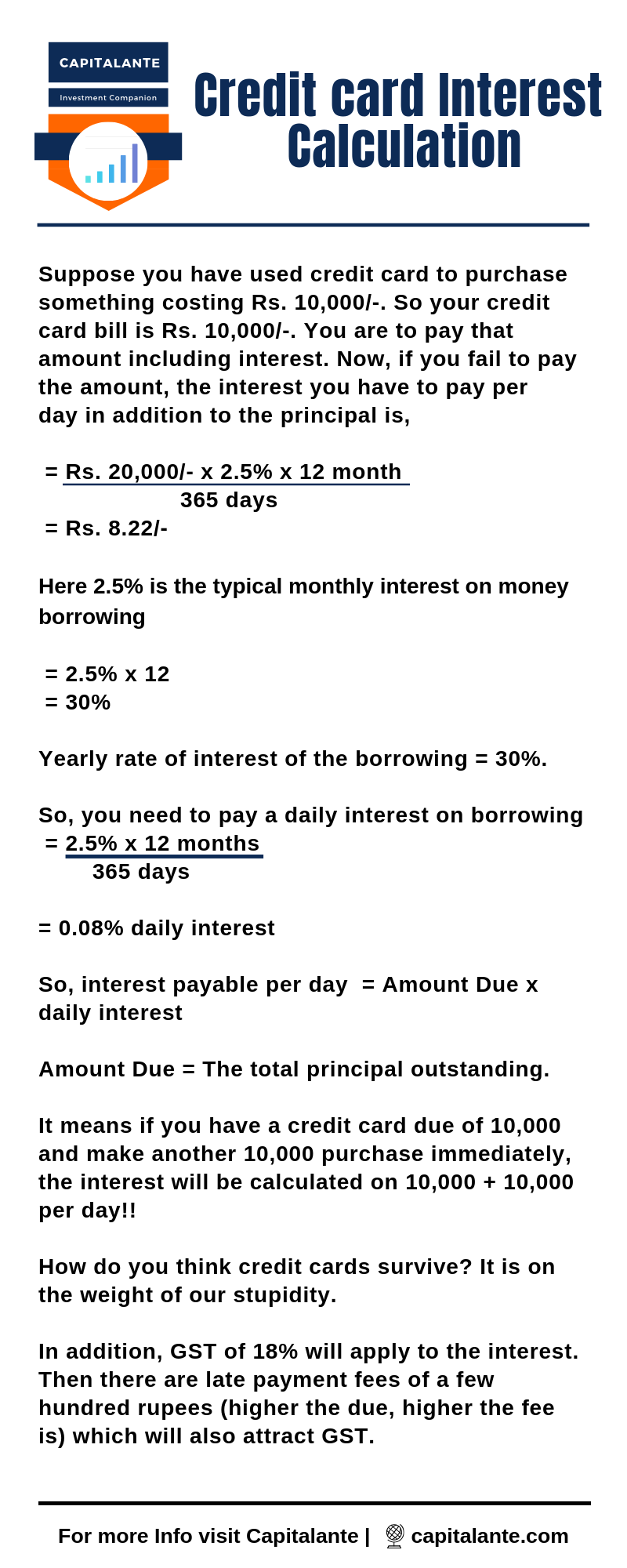

You receive credit card from your credit card issuer and the card issuing authority gives you a stipulated time of 40-45 days to repay the amount. Now it is your responsibility to pay off the amount timely. This will not only increase your creditworthiness but also affect your CIBIL Score. If you fail to pay off the credit then the company usually charges between 2-3% interests on monthly basis. If calculated on yearly basis then you need to pay an interest of around 40% yearly. In the event of you fail repeatedly to pay off the dues then it will affect your creditworthiness and CIBIL score. The direct impact of this will be that you won’t be able to get Credit Card in the near future by any credit card issuer.

- Read also: 6 Major Credit Card Mistakes – Investopedia

Paying only minimum due

Credit card companies expect that you continue your debt to them and pay the whole amount with in the period of 40-45 days. But in order to avoid late fees you clear only an amount which is less than the total amount you make use of. This leads to lose your interest free days for the next month. You then carry forward the due balance of previous month and the interest on the balance. This leads you to pay for a longer time and Credit Card Company gets its permanent earning. So, try to receive credit as much as you need and can repay within the stipulated time usually when you get your salary.

Withdrawing cash

You can withdraw cash with your credit card from ATMs. But it attracts high rate of interest. Any withdrawal from ATMs attracts as much as 2-4% per month and the interest is calculated from the first day of the withdrawal. So, it is advised not to withdraw from ATMs with your credit card except on emergency situations. Again, small withdrawals attract high charges.

Utilising full limit

Suppose your credit card issuer allows you to spend Rs. 100/- per month. So, in order to boost your credit score don’t make use of above 30% of your available credit limit. Here it is Rs. 30/-. It is advised that make use of only 15-20% credit allowed to your card. If for any reason you have to use more than 80% or the full 100%, try to pay off the amount within the stipulated time.

Spending to earn rewards

Credit card companies encourage their card holders to gain more and more reward points. To earn reward points you need to utilise card more and more. In this way you accumulate points and then will receive a gift or cash back on purchases. But don’t forget that you will have to repay the credit and the interest on the credited amount. In the purpose of gaining reward points you may come under huge debt. So, use credit card to spend when you need and according to your capacity to repay the credit.

Applying for Multiple cards

Don’t apply or take multiple credit cards owing to offers like free credit card, reward points, or bonus miles. If you take multiple credit cards you have problems like maintenance, misplacement, trackability, timely payment of credits. Each credit card application has the potential to knock points off your credit score. If you apply for multiple credit cards it sends a strong signal to the companies that you are a risky candidate for loans.

Choosing the wrong type of card

There are various types of credit card, you should at first think carefully what your need is. Suppose you go for travel once in a year. Now, for this purpose you take traveller card. It is not a smart act to do. You have to bear the annual charge for that card. Before taking a credit card you should take into account whether you need that kind of card. Many people take credit card due to enthusiasm only and lucrative cash back or discount or reward points. Then eventually they end up repaying the charges associated with credit card.

Use credit card on emergency situation

If any emergency situation arises people are readily make use of credit cards. Then they come under the cycle of debt payment. Yes, you can make use of credit card up to a limit 30% but not much more than that. It is because this will impact your credit score. It is advised that you should make emergency fund which consists of your six months’ income to tackle any unforeseen expenditure.

Getting late for reporting a credit card loss or treachery

You should be conscious about the theft or any treachery of your credit card. If the card is lost or stolen or hacked or gets subject to any treachery immediately report it to the card company and block your credit card accordingly.

- Read also: The Pros and Cons of Credit Card Step by Step

- Read also: How to manage Emergency Fund Step by Step

Hope the article will help you to avoid credit card mistakes as mentioned above. If you have got any questions regarding credit card mistakes to avoid feel free to comment so that we can have a discussion. If you have found this post helpful share this post with your loved ones.