When a company requires money to finance the several requirements such as the expansion of business or set up a new unit, the company makes use of equity financing from the retail investors by selling a percentage of the business or the company to the investors, in exchange for capital. Usually, a company can raise fund by issuing two types of stocks namely Preferred stocks and Common stocks. In this column, we will discuss preferred share and common share, features of preferred share and common share, how to buy preferred stock and the difference between Preferred Share and Common Share i.e. Preferred share vs. Common Share.

What is Preferred Share?

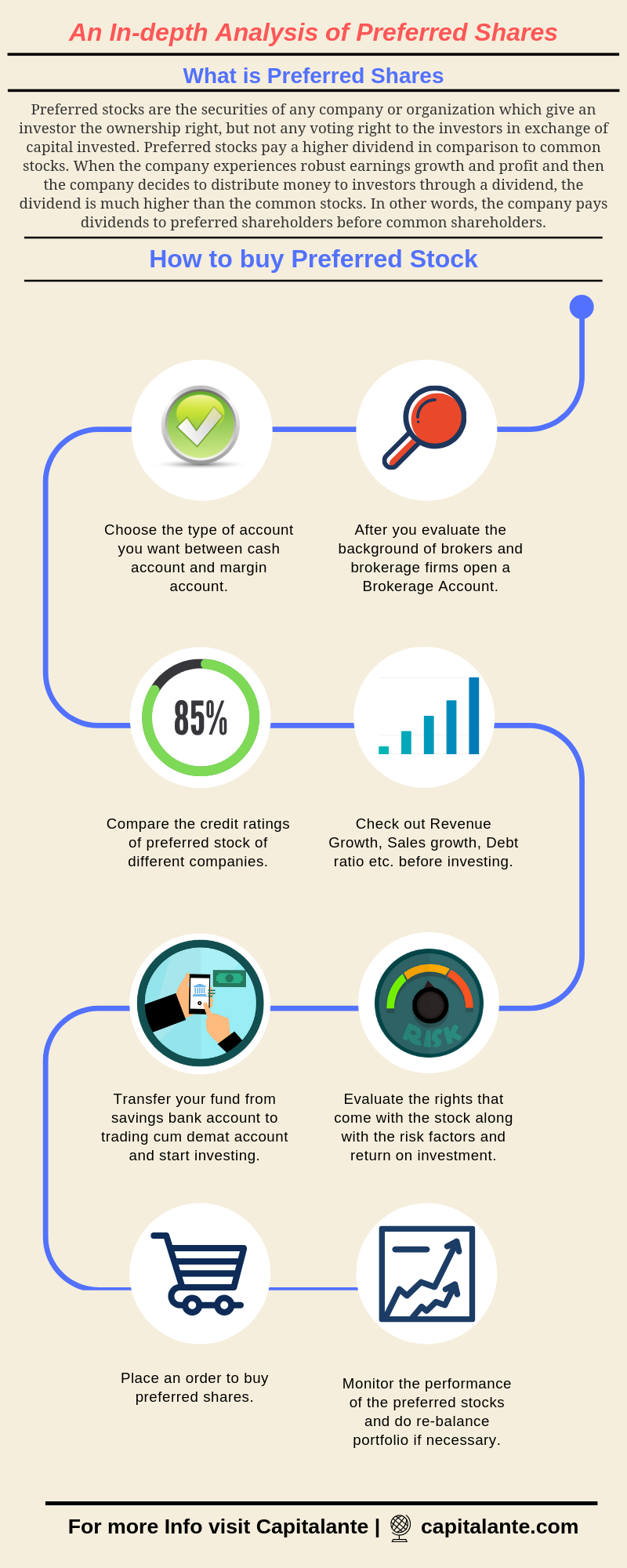

Preferred stocks are the securities of any company or organization which give an investor the ownership right, but not any voting right to the investors in exchange of capital invested.

Features of Preferred Share

Here are the key features of Preferred shares,

Preference on the assets of the company – When the company liquidates its assets the preferred stockholders get priority over common stockholders to claim the company’s assets.

Dividend Payment – Preferred stocks pay a higher dividend in comparison to common stocks. When the company experiences robust earnings growth and profit and then the company decides to distribute money to investors through a dividend, the dividend is much higher than the common stocks. In other words, the company pays dividends to preferred shareholders before common shareholders.

Convertibility to common stocks – On board of directors’ accord, the preferred stocks can be converted to the common stocks. The issuers also have the right to repurchase or buyback or redeem the preferred stocks from the market after a predetermined period.

No Voting rights – Even though you have the ownership right, you have no voting right. So, you have no rights to choose the board of directs or on any form of the corporate policy of the company.

How to buy Preferred Stock

Types of Preferred Share

There are 4 types of Preferred stocks namely,

Convertible Preferred stock – This type of preferred stocks gives a shareholder an option to convert the preferred shares to a fixed number of common shares after a predetermined date. This convertible preferred stock is exchanged on the request of the shareholders and sometimes by the board of directors.

Cumulative Preferred stock – If the company runs into the financial problems and does not able to pay dividend then the company must pay the dividend owed to the preferred shareholders when the company gets through the trouble.

Exchangeable Preferred stock – This type of preferred stocks can be exchanged for some other type of security i.e. convertible securities, convertible bonds.

Perpetual Preferred stock – This type of preferred stocks do not have any fixed date on which the shareholders will receive back the invested capital i.e. no fixed maturity or no specific buyback date.

Advantages of Preferred Share

Control remains with the company – Lack of a voting right of the preferred shareholders is quite beneficial for the company since there is no dilution of control i.e. no voting right. The company i.e. board of directors can make any decision over any issue where they may seem fit.

Dividend paid first whenever the company announces dividend – As mentioned above, you as a preferred shareholder must be paid first before any dividend paid to common shareholders. In addition, if the dividend is not paid owing to the financial problems, preference shares allow accumulation of unpaid dividends i.e. arrear of dividend if skipped.

What is Common Share?

Unlike preferred shareholders, the common shareholders enjoy not only ownership right but also voting right. This means the common shareholders can view their opinion and cast vote to choose the board of directors and the policy of the company. When the company liquidates its assets the common shareholders get priority after bondholders, creditors, and preferred shareholders to claim the company’s assets after they are paid in full. In other words, when the company goes bankrupt the common shareholders will receive the money after bondholders, creditors, and preferred shareholders are paid in full.

Features of Common Share

Ownership right i.e. voting rights – Since Common stocks give investor ownership right and voting right, the common shareholders express their decision to elect the board of directors and for the corporate policy of the company.

Long term capital appreciation – If you invest in growth stocks the share price will tend to increase in value on the wings of growth in earnings year-on-year.

Volatility – Even though the common stocks are more volatile than the preferred stocks, it has the potential to make the shareholders wealthy. Apart from the dividend from the profit earned by the company, if the company has delivered a robust earnings growth which continues in the near future the stock prices are likely to go up. A fundamentally strong company is able to return an investor’s initial investment hundreds of time in the long run.

Preferred Share Vs. Common Share

Which one you should choose?

If you can choose fundamentally undervalued stocks then the common stock will deliver better returns over the long term. Even though common stocks are riskier than the preferred stocks, the common stocks offer better returns. If you are looking for the regular dividend payment irrespective of market volatility then preferred stocks is the best bet for you. But if you are looking for the high returns in the long run then common stocks will be your preferred investment opportunity.

- Read also: Top 10 Undervalued Stocks to Buy

- Read also: Venture Capital Financing – Methods, Funding Process, Features

Hope this article will help you to understand the difference between preferred stock and common stock. If you have found any question feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.