In order to start a profitable venture, the venture capitalist is an essential part of the start-up ecosystem. When any start-up has a robust business plan, marketing strategies, and offers products or services which cater to a larger portion of people to solve their problem, the most important requirement is an ample amount of money to start a profitable venture. In this column, we will discuss what is Venture capital Financing, venture capital advantages, and disadvantages, methods of venture capital financing, stages of venture capital financing, funding process of venture capital financing, features of venture capital, venture capital financing in India, venture capital example.

What is Venture capital financing?

A new venture or start-up requires funding. There are various sources of funding namely,

- A business loan from banks or NBFCs,

- Funding from friends or relatives,

- Crowds funding.

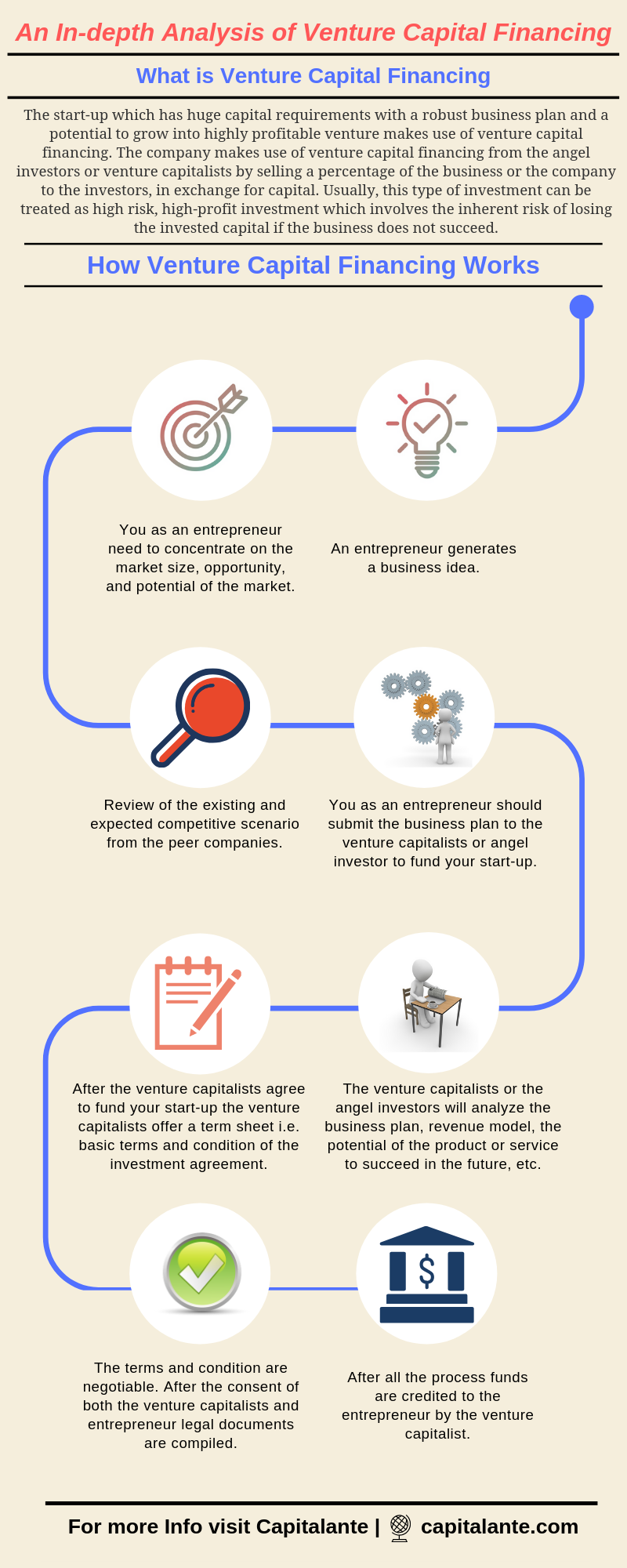

But for that start-up which has huge capital requirements with a robust business plan and the potential to grow into a highly profitable venture makes use of venture capital financing. The company makes use of venture capital financing from angel investors or venture capitalists by selling a percentage of the business or the company to the investors, in exchange for capital. Usually, this type of investment can be treated as high risk, a high-profit investment that involves the inherent risk of losing the invested capital if the business does not succeed.

Advantages of Venture capital Financing

Here are the advantages of venture capital financing.

No collateral required – If you have a business plan along with the business model and profitability then angel investors or venture capitalists invest in your project without any collateral.

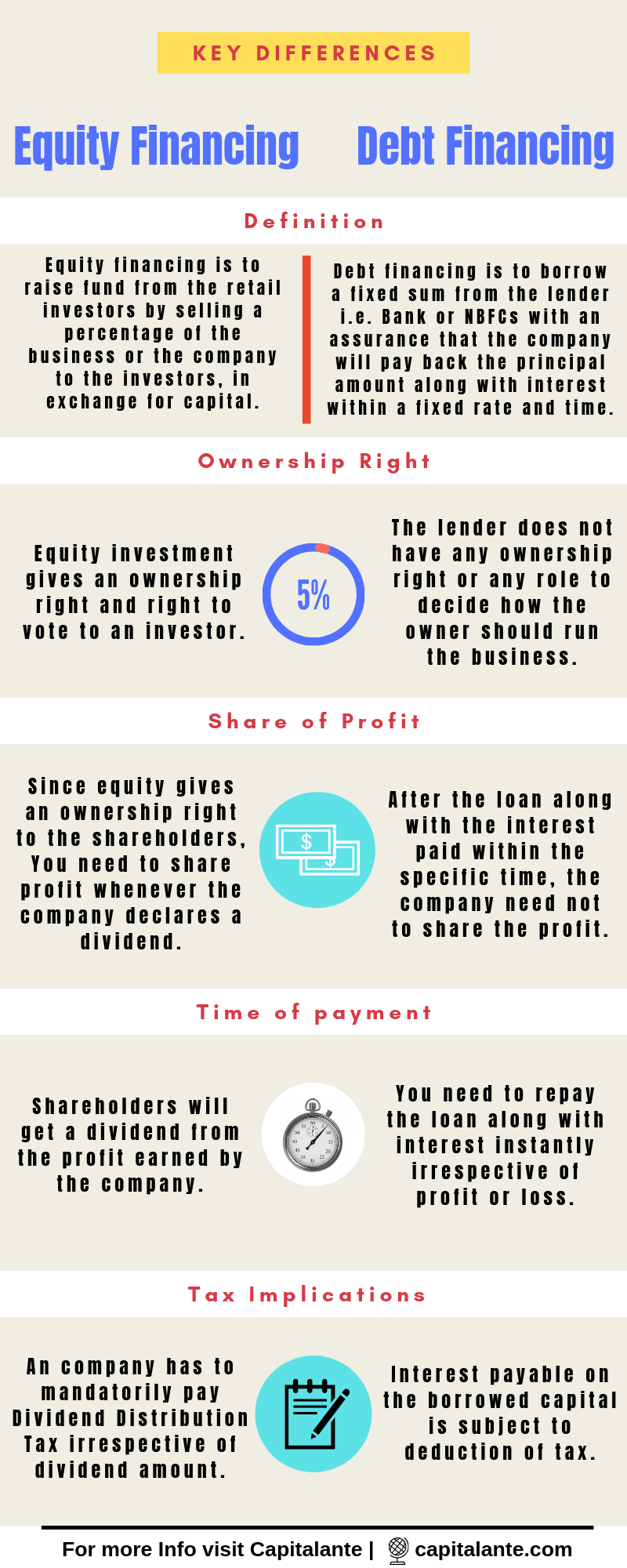

No repayment period – Unlike debt financing, you need not pay any fixed monthly or yearly payments to make it happen. This enables a company to manage funds efficiently for expansion of business or purchase of machinery to boost production.

More cash on hand – You have more cash on hand and no loan burden. So, you as the company can declare a dividend to the shareholders in accordance with the profitability of the company.

Long term planning – Since the investors do not expect the immediate return on their investment, you can manage the funds efficiently which will yield better returns in the near future.

Disadvantages of Venture Capital Financing

Here are the disadvantages of venture capital financing.

Complex Process – In order to raise funds you need to approach venture capitalists or angel investors by submitting a robust business model, future revenue projection, whether your venture will succeed in the future, profitability, etc. So, raising a fund from venture capitalists is quite a long and complex process.

Share of Profit of the company – Since equity gives an ownership right and voting right to the shareholders, the dividend paid to the shareholders is more than the interest payable in the case of debt financing.

Loss of control – Since the shareholders are the owners of the company, you need to consent or consult with the shareholders in the case of differences of opinions among the shareholders.

Methods of venture capital financing

In order to raise funds to survive and grow a profitable venture for a longer period, start-up companies make use of various methods namely.

Equity Financing

When a company requires money to finance the start-up which has huge capital requirements with a robust business plan and has the potential to grow into a highly profitable venture, the company makes use of equity financing. Companies offer a percentage of the business or the company to the investors, in exchange for capital when the company or firm is not able to give timely returns to its investors. The investors who buy the share of any company have a voting right.

- Read also: Venture capital financing – Wikipedia

Conditional Loan

Unlike bank loans, conditional loans have neither pre-determined repayment schedule nor any fixed interest rate on the borrowed capital. In the case of conditional loans, an entrepreneur needs to pay the lender in the form of royalty when the company is able to generate revenue or profit. No interest is payable to the lender for the loan amount. The royalty rate varies between 2% and 15% on the basis of revenue, profit percentage, cash flow of the venture, etc. In the case of conditional loans, an entrepreneur needs not pay interest or principal amount instantly unlike Debt financing where you need to pay back the principal along with interest within the fixed schedule irrespective of profit or loss.

Conventional Loans

Unlike conditional loans, where the entrepreneurs need not pay any interest to the lender, in the case of the conventional loans an entrepreneur has to pay interest initially but with a low-interest rate on the borrowed capital. The interest rate will increase as per the increase in profit. Along with the interest on the borrowed capital, an entrepreneur needs to pay a royalty in accordance with the sales/profit.

Income Note

This is the combination of both the traditional loans from banks or NBFCs and conditional loans. Here are the key features of income note,

- Entrepreneurs need to repay the principal amount along with the interest within the predetermined stipulated period.

- Entrepreneurs need to pay a royalty on sales or profit.

Debentures

The start-up companies raise funds by issuing debenture with a guarantee to repay the amount of the invested money when the security is matured. In other words, whenever capital is required the companies issue a debt paper for a specific period of time. Then the company pays out the interest on the money invested at the fixed maturity date. Usually, the interest on debentures is payable at three various rates in accordance with the phase of operation or business,

- Before the commencement of operation – NIL.

- Commencement of operation – Low rate of interest.

- After reaching a particular level of sales or profit – A high rate of interest.

There are two types of debentures the companies offer namely Convertible Debenture and Non-convertible debentures. The convertible debentures can be converted the debt to the equity shares which have the ownership right. While in the case of Non-convertible debentures the company does not convert the debt into the equity shares.

Note: This is the few lessons from the book which I discovered from Andrew Romans’s brilliant book The Entrepreneurial Bible to Venture Capital.

Stages of venture capital financing

Venture capital financing is quite helpful to nurture and grow a start-up into a profitable venture. Here are the different stages of venture capital financing.

Seed Stage

As the term suggests the start-up will grow by making use of the capital invested by angel investors or venture capitalists. In this stage, an investor investigates the business plan and the potential of the product or service to succeed in the future, which is to be delivered by the entrepreneur.

Start-up Stage

If the idea/product has the potential to cater or solve any problem then the entrepreneur needs to submit the business plan along with,

- In-depth analysis of revenue model i.e. how the company generates revenue,

- Current competition in the peer industry or sector,

- Details of the management i.e. CEO, CIO, Director of the company and their work experience apart from educational qualification,

- Size and potential of the desired market.

After analysis of the above-mentioned points venture, capitalists decide whether they are going to invest. At this stage, the risk factor is quite high because there is an inherent risk of losing the invested capital if the business does not succeed. The money invested by the venture capitalists will be used for the development of product or services and marketing strategies.

Early-stage/First stage

This stage is also known as the emerging stage. The capital received from the venture capitalists goes into manufacturing products or delivering services by setting up an office to capture the market shares from the competitors in the industry. Venture capitalists have a close eye on the management to know the capacity of the management and how they can tackle the competition from the peer companies. In this stage, the capital is invested to grow inventory to increase sales.

The Expansion stage/Second stage/Third stage

In this stage, the capital is provided for marketing and promotion of the product, expansion, and acquisition to keep up with the demand of the product. Venture capitalists funding in the emerging stage is largely used for market expansion by setting up a new factory or acquisition of factory and product diversification.

Venture capitalists intend to invest in this stage since the chances of failure in the emerging stage are quite low. Apart from this venture capitalists have an option to analyze the past performance data i.e. sales, profit, etc., management team, and audited financial data of previous years.

The Bridge Stage/ IPO stage

This is the last stage of the venture capital financing process. At this stage, the company gains a certain amount of market share. In this stage, the companies give the venture capitalists an opportunity to book the profit for the risk they have taken, and exit from the company by selling their share/stake when the company announces initial public offering. The fund raised from Initial Public Offering can be used for,

- Mergers and acquisitions.

- Reduction of price and other strategies to drive out peer competitors.

- Introduction of products or services to attract new customers and markets.

Funding process of venture capital financing

To attract venture capitalists to raise fund for your start-up you need to consider the following steps,

Features of venture capital financing

Here are the key features of venture capital financing,

High-risk investment – In this case, the risk factor is quite high because there is an inherent risk of losing the invested capital if the business does not succeed. It provides the start-up capital for the high-risk high-profit venture.

Ownership right – Since venture capitalists have ownership right they have a right to vote and express their decision for the direction of the company.

Time horizon – Since the investors do not expect the immediate return on their investment, you can manage the funds efficiently which will yield better returns in the near future.

No repayment period – Unlike debt financing, you need not pay any fixed monthly or yearly payments to the investors. This enables a company to manage funds efficiently for expansion of business or purchase of machinery to boost production. So, the company can declare a dividend to the shareholders in accordance with the profitability of the company.

Venture capital financing in India

Back in 1983, the first analysis of venture capital financing in India was reported that not only new start-up companies faced entry barriers into the capital market but also raised funding which hindered future expansion and growth. IFCO was the first institution which initiated the venture capital financing after it was established in 1975. However, venture capital financing got recognition in the budget of 1986-87.

Venture capital Example

There are various venture capitalist firms which invest in technology-based and consumer services businesses from early to mid-stage venture.

- Kohlberg Kravis & Roberts [KKR] has funded Mumbai based polyester maker JBF Industries Ltd.

- Goldman Sachs and Zodius Technology have funded Pepperfry.com, the largest e-marketplace of furniture of India.

Finally, venture capital financing helps entrepreneurs to transform scientific, technology-based ideas into a profitable venture to boost the start-up ecosystem and wealth creation.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Debt Financing Vs. Equity Financing

- Read also: Cyclical Stocks Vs Defensive Stocks [With Infographics]

If you have any questions feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.

The description about venture capital is awesome. The writer of the article is very good and he has described it in an effective and efficient way. After reading this article all the doubts are cleared from my mind. thank u. Sir..