With the appropriate tax planning anyone can save a good amount of tax and with this planning his/her money will not turn into black money. The money will be white and of course legal. Tax planning is not overnight planning at all. You need to know the deductions allowed by the income tax act under the chapter VI-A, and then you can make good use of the Income tax deductions available.

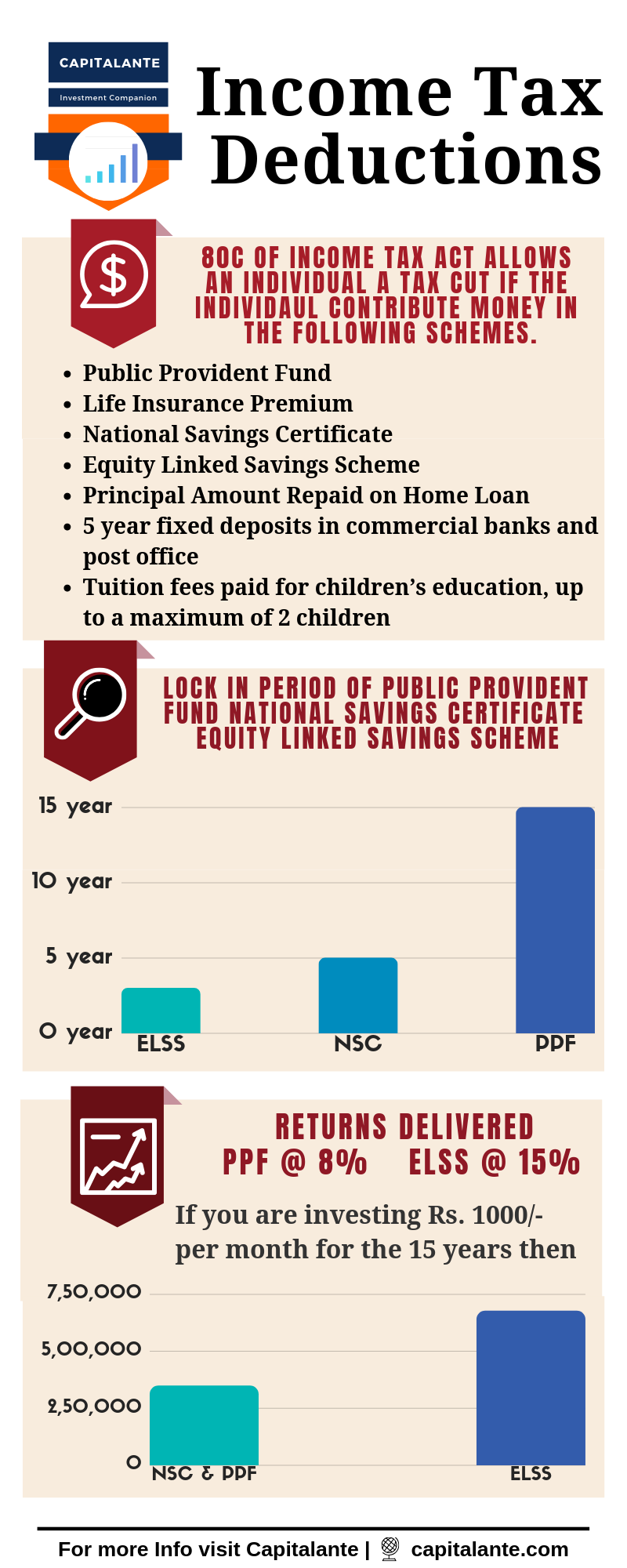

Tax Saving Options under section 80C of the income tax act, 1961

You can avail the benefits of section 80C of the Income Tax Act by depositing money in the following schemes.

- Public Provident Fund

- Life Insurance Premium

- National Savings Certificate

- Equity Linked Savings Scheme

- Sukanya Samriddhi Yojana

- Principal Amount Repaid on Home Loan

- 5 year fixed deposits in commercial banks and post office

- Tuition fees paid for children’s education, up to a maximum of 2 children

Tax Saving Options under section 80CCC of the income tax act, 1961

You can avail the benefits of section 80CCC by depositing money in Notified Pension Scheme i.e., Annuity Plan of LIC. Under this section, an individual can avail tax deduction equal to the amount paid or deposited in any annuity plan of LIC or any other insurer. But in the year when the policy is surrendered, the interest or bonus or any amount received from the amount is taxable in respect of that year.

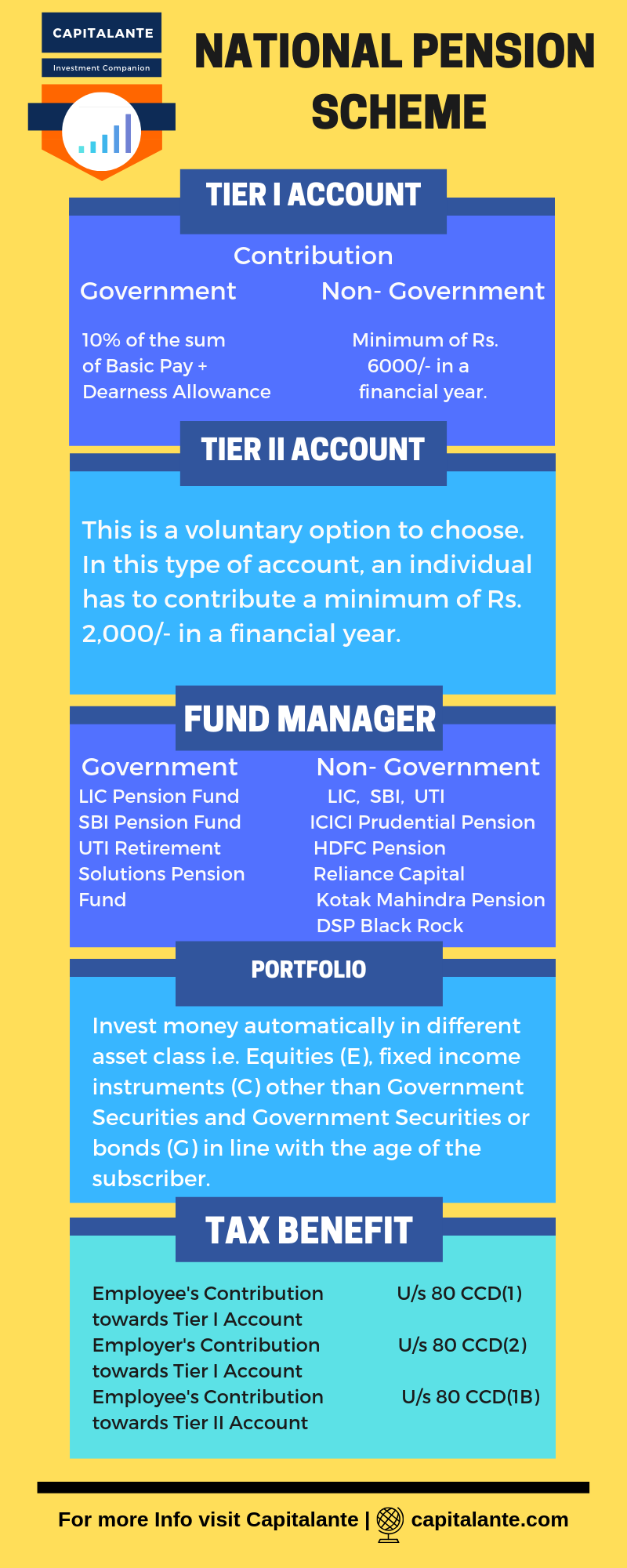

Tax Saving Options under section 80CCD(1) of the income tax act, 1961

This section allows a tax rebate for individuals for contribution to their pension accounts. Contribution up to 10% of the sum of [Basic Pay + Dearness Allowance] or 20% of gross total income (in case the taxpayer being self-employed) or Rs. 1, 50,000/- in a year whichever is less is allowed under section 80CCD (1).

Employer’s contribution to NPS – Section 80CCD (2)

This section allows an additional deduction made to an employee’s pension account by his/ her employer. This contribution can be up to 10% of the salary of the respective employee and there is no monetary ceiling on this deduction.

Any individual can avail the benefits of Section 80CCD (1B) by depositing money into their NPS account. The Contributions to Atal Pension Yojana are also eligible for deductions.

Tax Saving Options under section 80CCG of the income tax act, 1961

Any resident individual whose gross total income is less than Rs. 12 lakhs can avail the deduction. There are some conditions applicable to get the deduction.

- The person has to be a new retail investor.

- The person has to fulfill the requirements specified under the notified scheme.

- There is a lock-in period of three years.

Tax Saving Options under section 80D of the income tax act, 1961

Indian Government allows tax benefits on health insurance/Medi-claim Policy U/s 80D of the income tax act, 1961, available to an individual or a HUF in for payment of

- Insurance premium of self, spouse and dependent children.

- Insurance premium of parents.

Tax Saving Options under section 80DD of the income tax act, 1961

This deduction is available to a resident individual or a HUF if the individual satisfies the following conditions:

- Expenditure incurred on medical treatment (including nursing), training and rehabilitation of handicapped dependent relative of the individual.

- Payment or deposit to the specified scheme for the maintenance of dependent handicapped relative.

Tax Saving Options under section 80DDB of the income tax act, 1961

To avail tax deduction under section 80DDB one has to satisfy the following conditions-

- Any expenses incurred towards the treatment of certain specified medical diseases or ailments i.e. Cancer, Thalassemia for himself or any of his dependents.

- The Individual must have to submit a certificate in the prescribed form from a neurologist or an oncologist or a urologist or a hematologist or an immunologist or such other specialist as may be prescribed working in a Government Hospital.

Tax Saving Options under section 80E of the income tax act, 1961

To avail tax deduction under section 80E i.e. for interest on a loan, one has to satisfy the following conditions-

The loan was taken for the purpose of pursuing higher education of self, spouse, or dependent children such as

- Full-time studies for any Graduate or post-Graduate course in Engineering (including technology/ architecture)

- Medical

- Management

- Post-Graduate course in applied science or pure sciences including Mathematics and statistics

He had taken a loan from any financial institutions such as banking company or notified financial institutions like HDFC Ltd., Credila Financial Services Private Ltd.

Tax Saving Options under section 80EE of the income tax act, 1961

An individual can avail the deduction if he or she is a first-time home-owner and in the condition that the value of the property purchased is less than Rs 50 lakh and the home loan is less than Rs 35 lakh.

- Read also: Income tax deductions – The Economic Times

Tax Saving Options under section 80G of the income tax act, 1961

This section allows deduction made in various government welfare funds. The deduction may be either 100% or 50% with or without restriction as provided in section 80G.

- National Defence Fund set up by the Central Government

- Prime Minister’s National Relief Fund

- An approved university/educational institution of National eminence

- Fund set up by a State Government for the medical relief to the poor

Tax Saving Options under section 80GG of the income tax act, 1961

The Income tax act allows an individual this facility if he is staying on rent and he is not the owner or co-owner of a house where he is staying on rent. The amount you can save U/s. 80GG is as follows.

Condition 1

Suppose the individual/the assessee is engaged in an unorganized sector. The person does not get any house rent from his/her employer separately and pays a house rent to his/her parents then he/she is eligible for the maximum deduction of Rs. 60000/-.

Condition 2

But in the case where the individual/the assessee receives house rent separately apart from the salary the following calculation is applicable.

Let’s assume a person receives a net salary of Rs. 3,00,000/- and separately receives Rs. 1,00,000/- as house rent from his/her employer, then he/she can get the maximum amount of deduction of Rs. 90,000/- as per section 80GG.

Tax Saving Options under section 80GGC of the income tax act, 1961

Any contribution made to a political party or an electoral organization is allowed to tax deduction. There is a condition that the contribution should be made in any electronic mode of payment other than cash.

Tax Saving Options under section 80QQB of the income tax act, 1961

The Income tax act allows an individual this facility in respect of royalty income of authors if he satisfies the following conditions,

- The book authored by an individual of literary artistic or scientific nature such as computer programme, finance, etc.

The taxpayer shall have to furnish a certificate in form no 10CCD from the person responsible for paying the income.

Tax Saving Options under section 80RRB i.e. Royalty on patents of the income tax act, 1961

The Income tax act allows an individual this facility in respect of royalty income of patentee i.e. the person (being the true and first inventor of the invention), whose name is entered on the patent register as the patentee in accordance with the patent act 1970.

Income tax deductions in respect of interest income under section 80TTA

Maximum of Rs. 10,000/- earned as interest from any scheduled Bank or registered financial institution is exempted from income tax for a financial year. Interest earned more than this is taxable. If anyone gets Rs.20,000/-as interest he is liable to pay tax on (Rs.20,000-Rs.10,000=Rs.10,000/-). This is the current amount for the financial year 2018-19.

Income tax Deductions in respect of interest income under section 80TTB for senior citizens

Maximum of Rs. 50,000/- earned as interest from fixed deposits, recurring deposits, and term deposits from any scheduled Bank or registered financial institution is exempted from income tax for a financial year. Interest earned more than this is taxable.

Tax Saving Options under section 80U of the income tax act, 1961

The Income tax act allows an individual this facility if he/she satisfies the following conditions,

- An individual suffering from a physical disability (including blindness) or mental retardation.

- An individual suffering from severe disability.

Final Thoughts

So, friends, these were the various sections you or anyone can avail to get a deduction on his/her income. Thus he or she can save a huge amount of tax by making use of Income tax deductions.

- Read also: How to File Income Tax Return in India

- Read also: 29 Tax-free income sources in India

Finally, if you have any question regarding income tax deductions under chapter VI-A feel free to make a comment so that we can have a discussion. If you have found this post helpful please share with your loved ones.