Is it mandatory for an individual to file Income Tax Return (ITR) even if the individual’s tax liability is zero? The clear cut answer is no. An individual is not compelled to file ITR if his/her income is below the tax bracket after availing all the deductions under chapter VI-A of the income tax act, 1961. Many people think that as their income is below the tax bracket then they don’t need to submit ITR. But it is quite beneficial for individuals to file ITR even if their income is below the tax bracket. Here we will discuss how to file income tax return step by step even though your tax liability is nil.

Who will File Income Tax Return

Now we will discuss who will mandatorily file an income tax return.

- The persons have to file income tax returns whose yearly income exceeds the specified limit of Rs. 2.5 lakh below the age of 60, 3 lakh between the age of 60 and 80, and 5 lakh whose age is above 80 years.

- Individuals who have suffered a loss in any kind of business or profession.

- Individuals who are below the income tax exemption of Rs. 2.5 lakh but have paid advance tax or deposited TDS should file the income tax return to claim a refund.

- One can file an Income tax return even if the income is below the taxable income.

Income Tax Return forms

Now one of the major confusion is which form one needs to submit when filing income tax returns either offline or online. Here are a snapshot of the different categories of Income Tax Return (ITR) forms and which income tax return form is applied to an assessee.

The Income Tax Return 1 Sahaj

The Income Tax Return 1 Sahaj to be filed by an individual or Hindu undivided family i.e. HUF who have

- Income from salary,

- Income from house property,

- Income from other sources but not from winning a lottery or Income from racehorses,

- Income from agriculture is less than Rs. 5000/-.

The Income Tax Return 2

The Income Tax Return 2 to be filed by an individual or Hindu undivided family i.e. HUF who have

- Income from salary,

- Income from house property,

- Income from other sources including from winning a lottery or Income from racehorses.

- Income from capital gains i.e. from the sale of house property, share or units of mutual funds.

- Income from foreign assets or foreign companies.

- Income from agriculture is more than Rs. 5000/-.

The Income Tax Return 3

The Income Tax Return 3 to be filed by an Individual or Hindu undivided family i.e. HUF being a partner in any firm who have

- Income from salary,

- Income from house property,

- Income from running out any proprietary business or profession.

The Income Tax Return 4

The Income Tax Return 4 to be filed by an individual or Hindu undivided family i.e. HUF or Firm who have

- Income from salary.

- Income from house property.

- Income from presumptive business i.e. goods transportation business under section 44AD/ 44AE or Income from profession under section 44ADA.

- Income from other sources but not from winning a lottery or Income from racehorses.

The Income Tax Return 5

The Income Tax Return 5 to be filed by a Partnership firm, Limited Liability Partnership i.e. LLPs, Association of Persons i.e. AOPs, Body of Individuals i.e. BOIs having

- Income from Business.

- Income from house property.

- Income from capital gains i.e. from the sale of house property, share or units of mutual funds.

- Income from other sources but not from winning a lottery or Income from racehorses.

The Income Tax Return 6

The Income Tax Return 6 to be filed by a Company other than companies claiming exemption under section 11 having

- Income from Business.

- Income from house property i.e. but only from charitable or religious purposes.

- Income from capital gains i.e. from the sale of house property, share or units of mutual funds.

- Income from other sources but not from winning a lottery or Income from racehorses.

The Income Tax Return 7

The Income Tax Return 7 to be filed by a Trust having

- Income from Business.

- Income from house property i.e. but only from charitable or religious purposes.

- Income from capital gains i.e. from the sale of house property, share or units of mutual funds.

- Income from other sources but not from winning a lottery or Income from racehorses.

Documents Required for Income Tax Return filing in India

Now, in order to file Income Tax Return, you here are the list of required documents needed while filing the Income-tax return,

Form No. 16

It is a detailed description of the salary and other emoluments received by an employee from his or her employer irrespective of the Government or Private sector. If you are a salaried person it is the most useful document while filing the income tax return. The form No. 16 reveals not only the salary, bonus, etc. but also the deductions under chapter VI-A, tax deducted from your House by your employer.

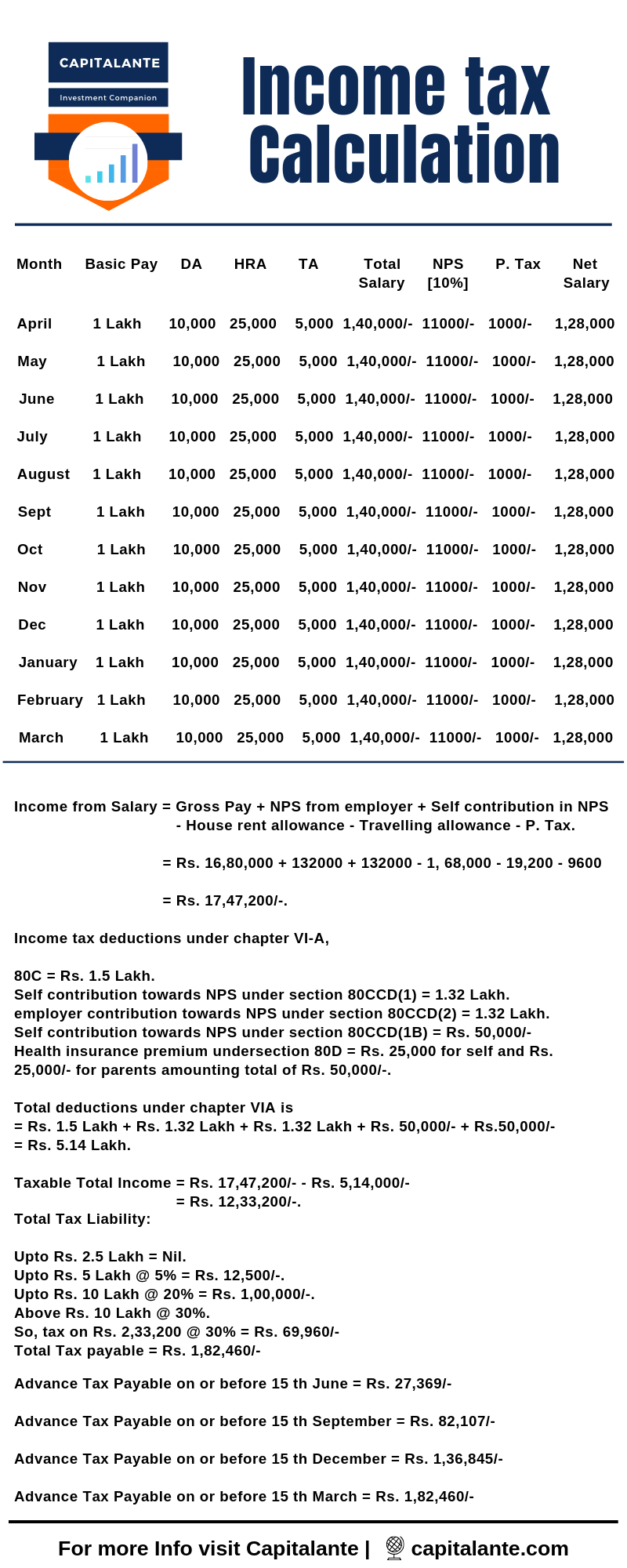

Now we will discuss how to prepare a salary statement where your employer does not give you any Form No. 16 or you are working in unorganized sectors where Form No. 16 is not available.

Form No. 16A

It is the document that consists of all the details related to tax that has been deducted at source either from recurring deposits, savings account, fixed deposits, etc. by a deductor other than the employer. This tax is usually deducted by banks or other financial institutions on the interest earned from fixed deposits, recurring deposits, bonds, etc. or commission which is earned by you during the year. Suppose, you have earned interest of Rs. 50,000/- from a fixed deposit. The maximum deduction allowed under section 80TTA is Rs. 10,000/-. So you have to pay tax on the rest of Rs. 40,000/- at the applicable rate of 10% and then your tax will be Rs. 4000/-. You should collect Form No. 16A from the respective banks or financial institutions.

Income from House Property

If you have an income from house property then you should furnish the following details.

- Income from the house property in case the property is on rent.

- Proper address of the house property of which you are a sole owner.

- If you are the co-owner of any house property then details of the co-owners i.e. the proportion of money which is earned from the above-said property and PAN details.

- If you have purchased any property on loan then the certificate for home loan interest from your borrower.

Bank details

To file an income tax return you need to provide your bank account details like account no, IFSC code, name of the bank, etc. If there is any refund against you or your PAN, the amount will be credited to the bank account which is quoted in Income-tax Return.

Tax-savings documents

You can avail of the benefits of deductions allowed under Chapter VI-A of the Income Tax Act by depositing money in the following schemes.

- Public Provident Fund

- Life Insurance Premium

- National Savings Certificate

- Equity Linked Savings Scheme

- Principal Amount Repaid on Home Loan

- 5 year fixed deposits in commercial banks and post office

- Tuition fees paid for children’s education, up to a maximum of 2 children

- Health insurance of self as well as parents and dependents

At the time of filing the ITR, you need to sum up all the deductions you want to avail and put them accordingly. You need to preserve these documents as the income tax department may ask them any time to verify the deductions availed by you.

Capital Gains Statement

Capital gains statement is the detailed summary of your capital gains from selling of shares, mutual funds either in the short term or long term. You need to pay a 15% tax on short term capital gains and 10% on long term capital gains via the selling of stocks or mutual funds. You can collect this document from your broker or you can prepare this by yourself.

If you have capital gains either from stock market investment or selling of property irrespective of the short term or long term you should furnish the following details.

- Stock trading statement in case of capital gains from selling stocks i.e. purchase details, selling details. You can find the statement from your trading account.

- You must furnish the mutual fund statement in case of capital gains from the selling of equity mutual funds or ELSS.

- If you make a profit by selling a house or property then you must furnish the sale price, purchase price, details of registration and capital gain details.

Form No. 26AS

It is the detailed report of taxes which have been deducted from you or deposited by you or deposited on your behalf by your employer. This is just like your savings account passbook in which the following information is available.

a) If your income exceeds the taxable limit of Rs. 2.5 lakh, then your employer deducts the TDS and deposits the tax in Central govt. bank account on your behalf.

b) TDS deducted by banks or financial institutions if the interest income exceeds the maximum limit of Rs 10,000 as we have discussed earlier.

d) Advance taxes paid by you during the respective financial year.

e) Self-assessment taxes paid by you via 280 challans.

To download this statement you may go to the official website of the income tax department. There you may create your profile quoting Name, Pan No. Aadhar No. etc. But if you are already registered you can get this Form No. 26AS from the income tax website. Go to the ‘My Account’ tab and click no View 26AS. You will be redirected to the TRACES website from where you can easily download your Form No. 26AS.

How to file Income Tax Returns

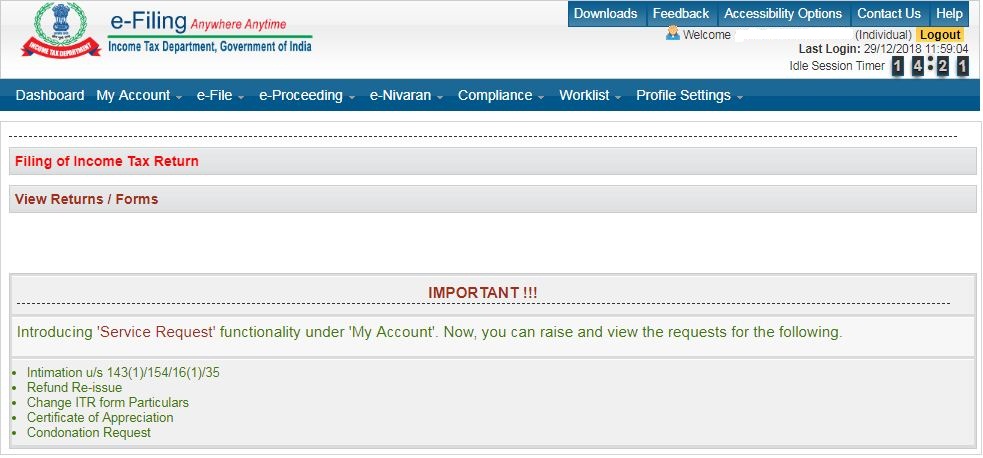

Go to the Income-tax India e-filing and if you are not registered yet then register yourself by quoting your details i.e. Name, Address, PAN, Aadhar No, etc.

Now after registering yourself Login to the profile by quoting User ID which is your PAN, password, and date of birth.

Before filing the Income-tax return view your tax credit statement i.e. Form 26AS.

Now click on the ‘Filing of income tax return’.

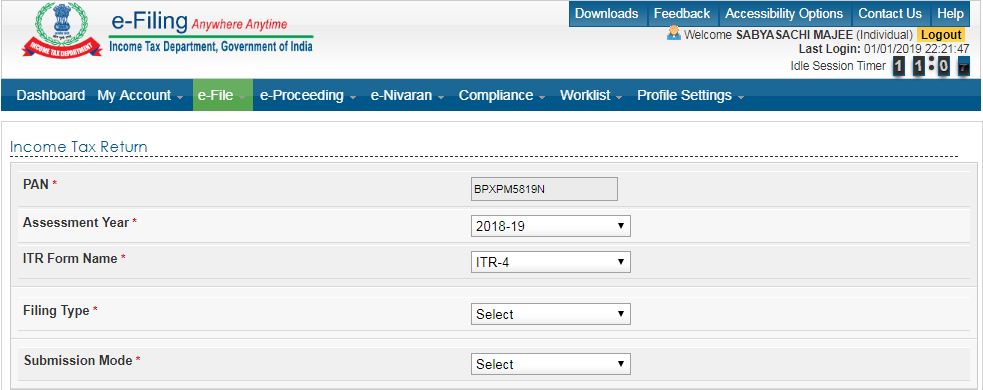

After clicking Filing of Income Tax return system will be redirected to a page where you need to choose the relevant Assessment Year, ITR Form Name i.e. which ITR you should file i.e. ITR1, ITR2, ITR3, ITR4, ITR5, etc.

Now after choosing your respective Income Tax Return form, you need to choose between whether you want to file this return form between Original/Revised return and Filing against Notice or Order.

Now you need to choose Submission Mode. If you are filing ITR 1 or ITR 4 then you can submit the return in two ways either via upload XML or prepare and submit online. But if you choose the ITR2, ITR3, ITR5, etc. then you should download the Excel utility and after preparing the respective Excel utility to upload them in the portal.

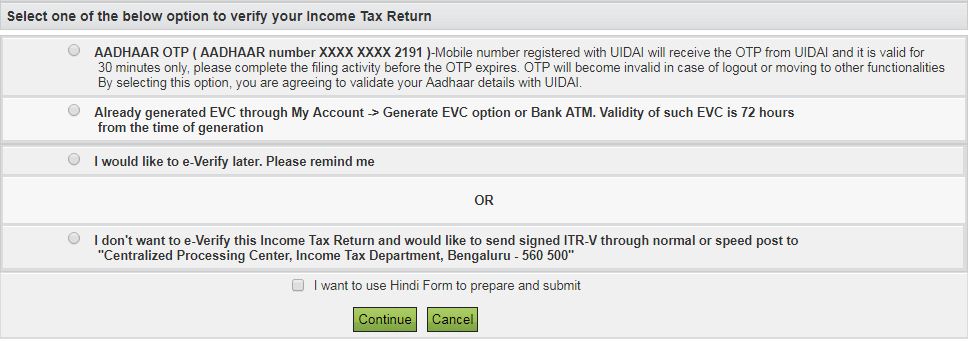

Now after that you need to choose by which option you need to verify your return.

- Aadhar OTP or

- Verify Later or

- Send my ITR – V to Central Processing Centre, Income tax Department, Bangalore through normal or speed post.

How to prepare the respective Excel Utility,

After downloading the file you will be enabled to edit after the opening of the Excel file.

Fill all the details in the entire tab. After filling the details in each tab please confirm the data by clicking the ‘Validate’ tab.

Now generate an XML file by clicking Generate XML tab and save it on your computer or laptop.

Now upload the return and verify your return accordingly.

How Capitalante can help you

Capitalante has a team of well qualified and professional tax experts and income tax cadres who will file your business income tax returns for you in minimum time and also help you reduce your tax liabilities by proper tax planning. If you haven’t filed your tax return yet, get in touch with us for hassle-free tax filing.

Benefits of Filing Income Tax Return

Many people think that as their income is below the tax bracket then they don’t need to submit ITR. But it is quite beneficial for individuals to file ITR even if their income is below the tax bracket. Here we will discuss the 9 Benefits of Filing Income Tax Return though your tax liability is nil.

Address Proof

If you are in a transferable job then you must submit income tax return even though your income is below taxable limit. Why? When you submit ITR the income tax department will provide you with a document namely ITR-V/ Acknowledgement. This can be treated as your current or correspondent address.

Income Proof of freelancers & independent professionals

The ITR-V is treated as the most reliable proof of income source as it is provided by the Income Tax Department. This is the proof of income for those who do not get any form 16 from their employer or are engaged in the unorganized sector or self professionals. This ITR-V is the only legal document they can show as their income source and amount.

Process of loan application

To get loans like home loan, car loan, vehicle loan, personal loan, business loan, etc. irrespective of banks or non-banking financial institutions, you will be required to show a copy of ITR of at least two years. Your loan issuing authority will verify whether you have any earning and you are able to pay off the loan. At this situation this ITR will be treated as the proof of your income.

To carry forward Losses

If you file ITR you can carry forward your business losses or capital losses made in the previous years to the current financial year. You can do this up to maximum 8 years. Suppose your business loss for the assessment year 2017-18 is Rs. 1 Lakh. Then you make a profit of Rs. 3 Lakh in the assessment year 2018-19. So, you can make an adjustment to the losses made in the previous year with the current year. You can show an income of Rs. 2 lakh for the assessment year 2018-19. On the other hand, if you have not filed ITR, your taxable income will be considered as Rs. 3 Lakh according to the income tax act, 1961.

Visa Processing

You have to submit the ITR while applying for the visa irrespective of travel visa or work visa of any of the foreign countries like the USA, UK, Australia, Russia, European Union, etc. This ITR is handy when you need to prolonged stay at any of these countries.

To get Credit Card

To get a credit card from banks it is mandatory to submit the proof of income. In this case, ITR-V is treated as your proof of income. Banks actually want to verify if an individual can afford the credit card.

To buy insurance Policy for higher life cover

Various insurance companies want income proof when you opt for an insurance policy. The sum assured of your insurance policy will be in accordance with your total income. In this case, ITR-V is quite handful while buying an insurance policy.

To get Government Tender

If you want to participate in a tender either govt. or private you are required to submit ITR that may vary between two years and five years.

To get refund

Suppose you have filed ITR within the due date. After submitting the ITR you notice that you have forgotten to avail the deductions under chapter VI-A. In this situation, you can make a rectification under section 154 to claim the extra money you paid to the income tax department and this returned money is called a refund.

Suppose your age is 65 years. You have income from house property of Rs. 2 Lakh annually. You earn interest of Rs. 1 Lakh from the fixed deposit in banks or post offices. Since the maximum deduction from the interest income is Rs. 10000/-. The income tax department deducts Rs. 9000/- [10% of 90,000 = Rs. 9000/-]. As you are a senior citizen, you are not above the tax bracket of Rs. 3 Lakh. You can get Rs. 9000/- as refund after filing ITR for the respective year.

If you have any questions regarding how to file income tax return feel free to make a comment so that we have a discussion and if you have found this post helpful please share with your loved ones.