In India, every person who comes under taxable income keeps no stone unturned to save his/her taxes. He or she tries to avail of various deductions as permitted under section 80C to 80U available under the income tax act 1961. Fortunately, now in India, there are various incomes and investments that are tax-free. In this column, we will discuss the 27 tax-free income sources in India that are exempted from tax under the income tax act, 1961.

Source #1. Agricultural income

The Indian economy is basically an agricultural economy. Needless to say, the base or backbone of the Indian economy is agriculture. The government of India encourages agriculture, so govt. allows rebate in the income from agriculture. Income from any kind of farming is tax-free such as processing & selling agricultural crops from agricultural land. The government does not impose any tax at any level on agricultural income. Agricultural income refers to –

- Production, processing & sale of agricultural crops i.e. Wheat, Rice, pulses, vegetables, fruits, spices, etc.

- Rental income from agricultural land or building.

- Profits made from the sale or purchase of agricultural land.

Source #2. Various components of salary received from the employer

If the sum of a person’s salary in a whole year crosses the exemption limit of income tax, he is liable to pay income tax. But some components of income from salary are exempted from income tax and they are as follows

- Medical reimbursement

- Transport allowance

- Meal coupons

- Mobile phone bills

- Internet bills

- Leave travel allowance

- Leave travel concession i.e. LTC

- Reimbursement of any kind of liveries bill.

Source #3. House rent allowance from the employer

House rent allowance or any fund received for accommodation by an employee from his/her employer is tax-free up to a certain limit. But this house rent allowance is taxable when the employee resides in his/her house which is owned or co-owned by him/her.

Condition 1

If the employee resides in the accommodation of his/her employer, the house rent is tax-free. Since the employer allots the accommodation and the employee pays rent to the employer for the accommodation, it is considered that the employee resides in rental accommodation.

Suppose a person receives a net salary of Rs. 3,00,000/- and gets Rs. 1,00,000/- as house rent from his/her employer. Then he/she can get the deduction of the maximum amount of Rs. 90,000/- on his/her house rent allowance. The standard deduction is @30% of the salary received as per section 80GG.

Condition 2

Another condition is if the employee does not receive any house rent allowance from his/her employer, he or she is liable to take a rebate of Rs. 5000/- per month i.e. Rs.60,000/- in a financial year.

Source #4. Profit from partnership firm

A partnership firm is a joint organization of two or more persons. Income tax is imposed on the income of the firm and then income tax is deducted from the income of the firm accordingly. After that, the partners receive their shares from that income. Now, a partner is exempted from income tax when he/she receives the share.

Source #5. Individual share from HUF

The income of HUF is taxable. HUF itself is considered a taxable body. Income tax is paid on the income of HUF. Then the remaining income is distributed among its members. So, the members are not liable to pay income tax.

Source #6. Benefits from retirement

A person receives some benefits from its employer on his/her retirement. These benefits are either wholly or partially exempted from tax depending if he/she is a government or non-government employee and the amount received. They are as follows,

- Provident fund

- Gratuity

- Leave encashment

Source #7. Income from Provident funds

In India, Provident funds are compulsory for every employee working in such companies that are registered under The Companies Act, 1956.

With the increase in age, the savings increase proportionately. After retirement, an individual earns the respective Provident Fund (PF) money which is exempted from tax.

The Employee Provident Fund offers tax-free returns if it has received an active contribution for more than 5 years even if an individual has changed multiple employers in the said period.

Source #8. Income from Gratuity

Gratuity is a fund an employer provides to its employees. It is one kind of gift that is paid as extra. The following conditions are applicable.

- Superannuation: It means when an employee attains the age of retirement i.e. the age of 60 years.

- Resignation: For some reason, an employee may resign his/her job.

- On sudden death or any physical loss or health hazard due to accident or disease of the employee.

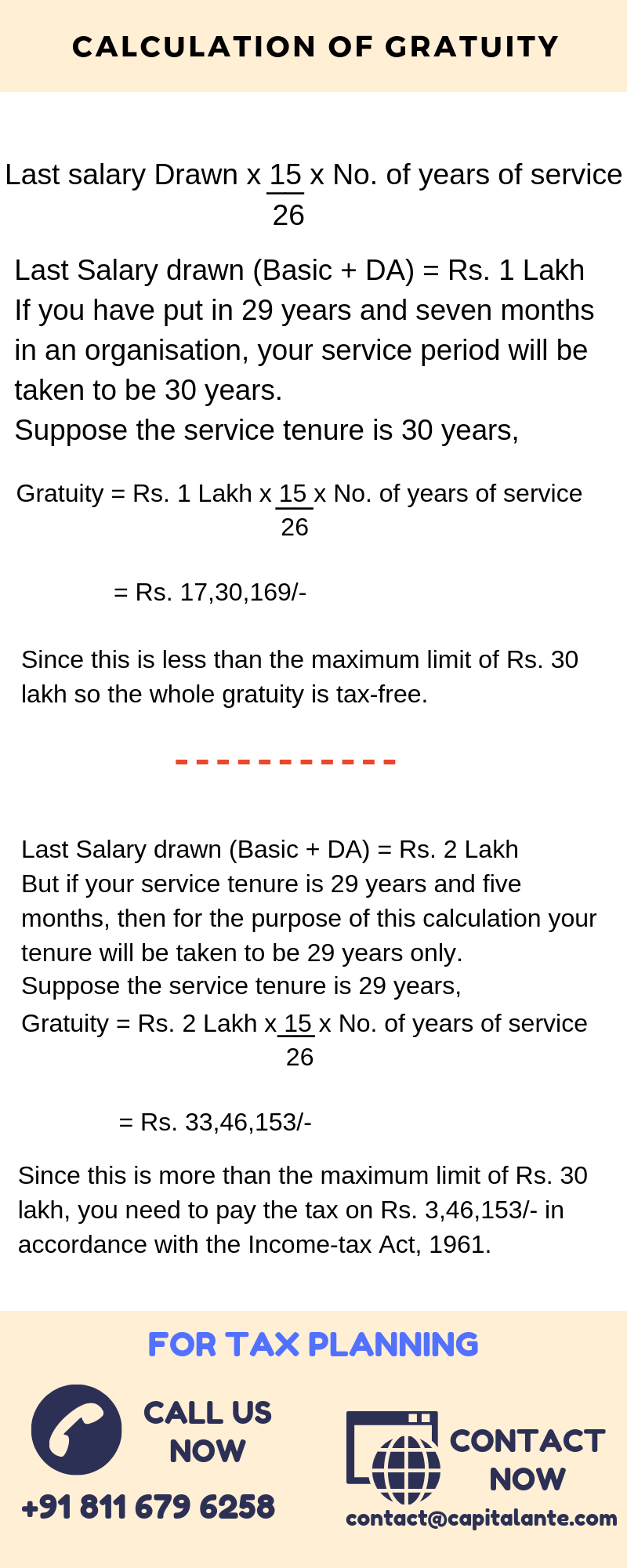

Calculation of amount

An employee can get the rebate on the gratuity of maximum Rs. 30 lakhs. More than this is taxable. The least of the following are exempted from tax:

- Last salary (basic + DA)* number of years of employment* 15/26

- Rs. 30 lakhs

- Gratuity actually received.

Source #9. Leave Salary

A central government or state government employee may encash his/her leaves accumulated throughout the service period. At the time of retirement or superannuation or resignation, an employee may encash his/her leave. The concerned person can encash a maximum of 10 months of leave. This encashment of leave salary is tax-free.

The calculation is different for private-sector employees. They can avail of the exemption of maximum Rs. 3,00,000/-.

Source #10. Tax-free pension

Pension received from some organizations like UNO is tax-free. Family pension received by the dependents of an employee is partially tax-free. It is one-third of pension or Rs. 15,000/- whichever is less. Here are some pensions which are completely tax-free,

- Pension and family pension of gallantry award winners.

- Family pension by self or family members of the armed forces personnel.

Source #11. Commutation of Pension

On retirement central and state government employees, local authority, defense services, and PSU employees can encash a part of their pension in a lump sum. It is known as commutation of Pension. This encashment of pension is tax-free.

Source #12. Income from a superannuation fund

Literally, superannuation means regular payment of money made into a fund by an employee towards a future pension. It means people pay money while they are working so that they will receive payment when they stop working. Now amount from a superannuation fund to the employee or legal heirs of any employee is completely tax-free.

Source #13. Voluntary retirement

Any employee can take voluntary retirement before his superannuation. In this case maximum Rs. 5 Lakh is tax-free. Any excess amount is taxable as applicable to that person.

Source #14. Retrenchment

If any organization or company provide any compensation to its employees due to the closure of the organization, this compensation is tax-free.

Source #15. Scholarship

Various government institutions, private organizations provide a scholarship to students. In some cases, students are awarded by several institutions. These scholarships or awards are completely tax-free.

Source #16. Awards or Rewards by Government

Any Rewards or awards given by central or state government or any government authority for literary, scientific or artistic work or for service for alleviating the distress of the poor, the weak and the ailing, for proficiency in sports and games, & Gallantry awards are completely tax-free.

Source #17. Government relief funds

Government sanctions fund for any kind of natural calamity, riot, or any disturbances like that. The money received by an individual from this kind of fund such as the Prime Minister’s National Relief Fund is not taxable.

Source #18. Gifts either in cash or in any kind

Any gift received from any relative is totally tax-free. The gift may be in the form of money, jewellery, property, vehicle or any means. But in the case of non-relatives maximum Rs. 50,000/- as a gift can be received. More than this is taxable. Any gift received at the time of marriage from either relatives or nonrelatives is tax-free. Here are some exemptions in case of a person who receives Gifts (either in cash or in any kind) from any person under the provision of Section 56(ii) of the Income Tax Act. Below are some conditions applied to gift.

Gifts received from Relatives

Here are the details of relatives as defined by the Income Tax Department.

- Husband or wife i.e. spouse of an individual

- Brother or Sister of an Individual

- Sister or Brother of the spouse of that respective individual

- Brother or Sister of either of the parents of the individual

- Any Linear ascendant or descendant of the individual

- Any Linear ascendant or descendant of the spouse of the individual

- Spouse of the person mentioned above

Gifts are treated as tax-free income sources if the aggregate value of gifts received is less than Rs. 50,000

As mentioned earlier Rs. 50,000/- is the maximum limit of exemption when the gift is received by a non-relative. This value may be in cash or in any kind. If the value of the gift crosses the limit, the whole gift is treated as income from other sources of that receiver.

On the occasion of Marriage of an Individual

On the occasion of Marriage, an Individual can receive gifts of any valuation and the gifts may be in any form or kind. These gifts are fully exempted.

Gifts received from a will or through inheritance or in contemplation of death of the payer

Generally, people receive gifts or property or wealth from their ancestors. Anything received by any will or inheritance is not taxable. The best thing is that there is no upper limit for this kind of receiving. Any amount can be received.

Source #19. Amount received from Government Schemes

If an Indian citizen or a person of Indian origin irrespective of resident or non-resident has an income from the investment it is tax-free on the following conditions,

- If he has an income from notified Central Government Securities such as National savings certificate, issued before June 1, 2002, and subscribed in foreign currency such as Dollar, Pound, and Euro, etc.

- Public Provident Fund or Notified Provident Fund.

- Any payment from Sukanya Samriddhi Yojana.

- Partial withdrawal i.e. up to 25% of the contribution made by an employee from NPS.

- Any income earned as an interest received from Government securities, bonds, annuity certificates, savings certificates, etc.

- Gold Monetization Scheme.

Source #20. Allowances or compensation from the employer

The following allowances are completely tax-free in the hands of any individual Indian,

- Foreign allowance granted by the government of India to its employees’ posted abroad.

- The compensation received from PSU Company at the time of Voluntary retirement or superannuation.

Source #21. Capital Gains

The following Capital Gains are completely tax-free in the hands of any individual Indian,

- Capital gains on transfer of listed equity shares.

- The compensation received on compulsory acquisition of urban agriculture land.

- Under Andhra Pradesh Capital City Land Pooling Scheme, 2015.

- Capital gains by selling mutual fund units or share or stock up to Rs. 1 Lakh.

Source #22. Income received from Foreign Government

Remuneration received from a foreign government by an individual who is an Indian resident citizen in connection with any sponsored cooperative technical assistance program with the foreign government is completely tax-free.

Source #23. Maturity (or) claim from Insurance companies

Any sum received from the insurance companies including bonus [except Keyman Insurance policy]either the policyholder or the nominee of the policyholder is completely i.e. 100% non-taxable income sources on the following cases,

- The maturity money received by the policyholder from the life insurance companies on maturity, claims from money back endowment policy.

- The nominee of the policyholder from the life insurance companies on the death of the policyholder.

Source #24. Dividend Income from Domestic Companies

Starting from Financial Year 2016-17, any dividend income an individual receives when the company announces dividends is completely tax-free in the hands of any retail investor in case the net value of the dividends in a financial year not exceeding Rs. 10 lakh.

The dividend a retail investor received should be a SEBI registered Indian Company. In that case, the respective company will pay the dividend distribution taxes in accordance with the dividend amount to the government before giving it to its shareholders.

Source #25. Tax-free interest income from Bank, Post office

Maximum of Rs. 40,000/- earned as interest from regular savings account from any scheduled Bank or registered financial institution is exempted from income tax for a financial year. Interest earned more than this is taxable. If anyone gets Rs. 50,000/- as interest he is liable to pay tax on (Rs. 50,000-Rs. 40,000) = Rs. 10,000/-.

Senior citizens can avail of a tax-free income of Rs. 50,000/- from fixed deposits or term deposits in banks or post offices if the person is a pension holder.

Source #26. Interest income from NRE accounts

NRIs have a benefit that they can invest in India in NRE (Non-Resident External account) accounts. These accounts are meant for them only. Any interest earned on NRE deposits is completely tax-free. The money from the NRE account can be taken back to the country where the person originally resides.

Source #27. Benefit for the people of Sikkim

People living permanently in the state of Sikkim do not have to pay tax for their income whatever the income is since Sikkim is income tax-free state in India. The income arising from any source and by any way is totally exempted. Interest or dividends from equities or shares are also tax-free.

- Read also: How to File Income Tax Return in India

- Read also: Income Tax Deductions In India

If you have any questions regarding tax-free income sources in India feel free to comment so that we have a discussion. If you found this post helpful don’t forget to share this post.