Whether you are looking for capital to start/boost a small business or to avail facilities such as a home, car, study, etc., there are several types of loans available from the banks or non-banking organizations. You need to select a loan based in accordance with your requirements. In this column, we will discuss the top 25 Different Types of Loan you can withdraw in India.

25 Different Types of Loan in India

Usually, there are two types of loans available in India namely secured loans and unsecured loans. In the case of Secured loans, the borrower has to pledge some assets (such as property, car, shares, debentures, etc.) as collateral. But in the case of unsecured loans, the borrower’s assets are not pledged as collateral. The loan is given on the basis of the creditworthiness of the borrowers.

Loan#1. Home Loan

Any Individual can get a home loan if the individual has a good credit score. A home loan is available for any of the following purposes.

- Loan for purchase of land

- Construction of home

- Loan for home renovation

- Home extension

- Payment of stamp duties

Generally, you can get a maximum amount of 85% of loans against the value of the property from the bank or any other financial institution. If the value of the property is Rs. 30 Lakh then you will get a maximum amount of [85% of Rs. 30 Lakh = Rs. 25.5 Lakh.]

The home loan repayment tenure is generally of longer tenure varying between five years and twenty years. The Interest rate offered by some of the top banks in India is between 8% and 8.6%.

Loan#2. Education Loan

Education loans are granted for Indian national students for pursuing higher education either in motherland India or abroad. The maximum amount of loan sanctioned is up to Rs.7.5 lakh for studies in India and up to Rs. 15 lakh for studies abroad. The repayment of education loans is not required during the study period. But you need to start the repayment of the loan between six months and two years after the course completion. Usually, the tenure of repayment of education loan varies between 10 years and 15 years in accordance with the loan amount and when the repayment of education loan begins. The interest rate varies between 11% and 15%.

Loan#3. Car or Vehicle Loan

Car or Vehicle loans are easily granted if you have fulfilled the following conditions with less paperwork and within one week. You will get a vehicle loan with ease if you satisfy the following conditions,

- The minimum net annual salary or income of any individual should be between Rs. 10,000/- per month and Rs. 2.5 Lakh of the respective lender.

- Minimum one-year continuous employment.

- Minimum Net Annual Business income varies between Rs. 10,000/- per month and Rs. 1, 80,000/- per annum for self-employed persons.

- Minimum 3 years of employment in the current business.

The maximum amount of loan sanctioned is up to 85% of the on-road price or 90% of the ex-showroom price. Usually, the tenure of repayment of car loans varies between 1 year and 7 years according to the loan amount. The interest rate varies between 9% and 14%.

Loan#4. Personal Loan

Most banks offer Personal loans that help an individual to meet financial needs such as medical expenses, travel costs, wedding expenses, home renovation, etc. Generally, Personal loans are unsecured loans since your lender i.e. Bank or financial organization gives you the amount without any collateral.

Points to consider

But in order to get a personal loan, you need to comply with the following points,

- Net income should vary between Rs. 10,000/- per month and Rs. 25,000 per month for salaried persons engaged in government, private or MNC companies.

- Net Income should vary between Rs. 2.5 Lakh and Rs. 5 Lakh for self-employed professionals such as Doctors, Engineers, Chartered Accountants, Architects, etc.

- Employment tenure can be between one year and 3 years.

The Personal loan is available for a minimum amount of Rs. 24, 000 and a maximum amount of 24 times the Net Monthly Income or Rs. 15 Lakh which is less. The repayment of loan tenure is between one year and five years. The interest rate is between 11% and 15%.

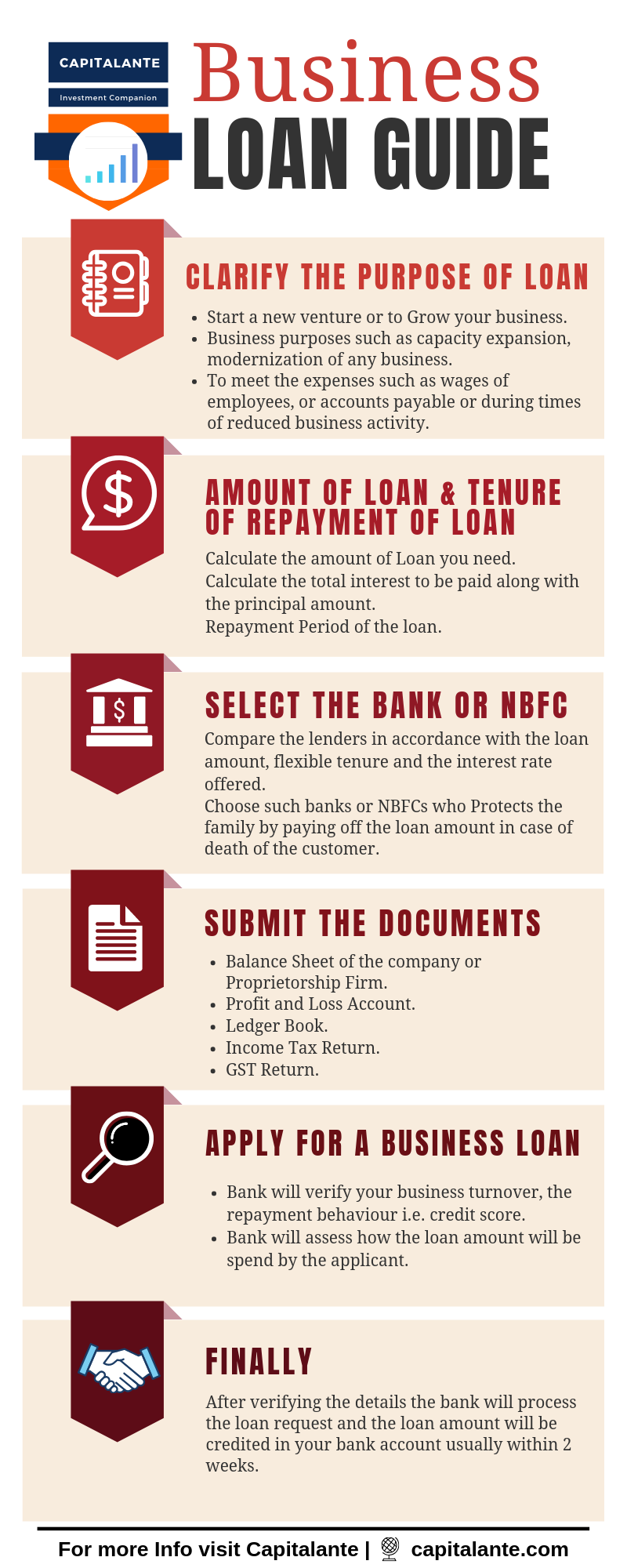

Loan#5. Business Loan

A Business loan is availed by self-employed and businessmen for business purposes such as financing or expansion of any business. The loan amount varies between one lakh and one crore. You will get an easy business loan if you have a good credit score and you are running the business for the past 3 years. The tenure of the business loan varies between 6 months and 5 years. The interest rate varies between 12% and 17%.

Loan#6. Demand Loan or Working Capital Loan

Working capital loans are availed by business organizations or firms for financing their day-to-day business operations. The loans are usually taken to meet the expenses such as wages of employees, or accounts payable or during times of reduced business activity. The loan amount you will get depends on business turnover, the repayment behaviour i.e. credit score, and relation with the lender. The tenure of this type of loan varies between 3 months and one year. The interest rate varies between 12% and 16%.

Loan#7. Cash against Invoice or Invoice Financing

Are you from those suppliers or vendors waiting for payments from your partners who typically take a long time to settle the outstanding dues? Owing to outstanding dues, you are unable to expand your inventory or halt your business expansion. Invoice financing may enable a vendor to borrow the money from the banks or financial institutions against the dues from the customers to meet its short-term liquidity needs. With the help of this loan, the vendor can run its day to day business. In other words, the invoices of dues work as a guarantee for the vendor.

The benefit of invoice financing is that the company can utilize the fund whenever received from banks or lenders to pay the salary to employees or to buy equipment etc. without waiting for account receivables to come from the clients.

Types of Invoice Financing

Invoice financing is made via two ways. One is Invoice Factoring and the other one is Invoice Discounting.

In the case of Invoice Factoring, a vendor or a business person approaches a financer or a bank to sell unpaid invoices. On being satisfied the lender may issue up to 75 percent of the value of the invoices to the borrower. If the lender receives full payment from customers, it will repay the balance amount less interest or other charges back to the company.

The Invoice Discounting is a way where the vendor can receive as much as 90 percent of value of the invoices. In the case of Invoice Discounting, the customers make the payment directly to the business, not the lender. Therefore the customers are not aware that the business is using Invoice Financing for its financial needs. When the payment is received from the customers the business repays the financing company without any interest or fee.

Companies can get up to 90% of the invoice amount via invoice financing. The interest rate varies between 12% and 17%.

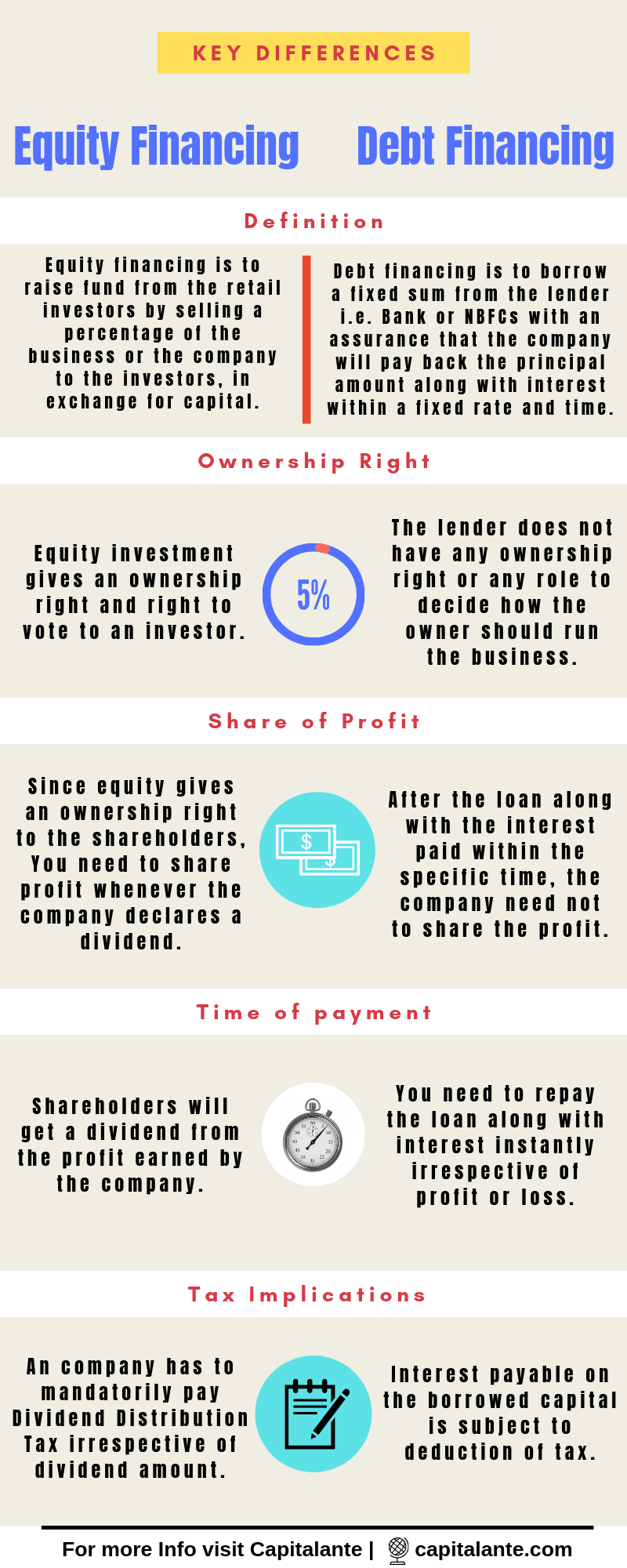

Loan#8. Equity Financing

When a company requires money to finance several requirements such as the expansion of business or to set up a new unit, the company makes use of equity financing from the retail investors by selling a percentage of the business or the company to the investors, in exchange for capital. The investors who buy the share of any company have a voting right.

Usually, a company can raise funds via issuing Initial Public Offerings, or via venture capital financing. Venture capital financing is beneficial to raise money from high net worth individuals who are looking for investment across various companies to diversify and minimize the risks associated.

In the case of initial public offering when the company raises funds from retail investors the venture capitalists have an option to sell or reduce their stake by selling equity shares to institutional or retail investors.

Should you opt for Equity Financing?

If you have started a start-up with no operating profits and history, still you can raise funds from angel investors and venture capitalists. The venture capitalists focus on such companies that are in the cyclical sectors with the potential to generate huge returns in the near future i.e. 5-6 years. The venture capitalists or angel investors who focus on the business model, competition in the industry, profitability, etc.

Loan#9. Professional loans

Professional loans are disbursed by scheduled commercial banks and non-banking financial institutes to self-employed professionals i.e. chartered accountants, doctors, lawyers, etc. in accordance with individual credit history. The loan amount disbursed varies from bank to bank. This type of loan is secured since the borrower pledge non-agricultural land, national savings certificates, government bonds, term deposits, etc. in case the loan amount exceeds 15 Lakh. Any professional needs to furnish the following details,

- How you will utilize the money and repayment schedule.

- Personal statements such as bank statement, CIBIL Score, etc.

- Two-year balance sheet, income tax return, etc.

The interest rate for a professional loan varies between 12% and 16%. The tenure of the Professional varies between 12 months and 84 months.

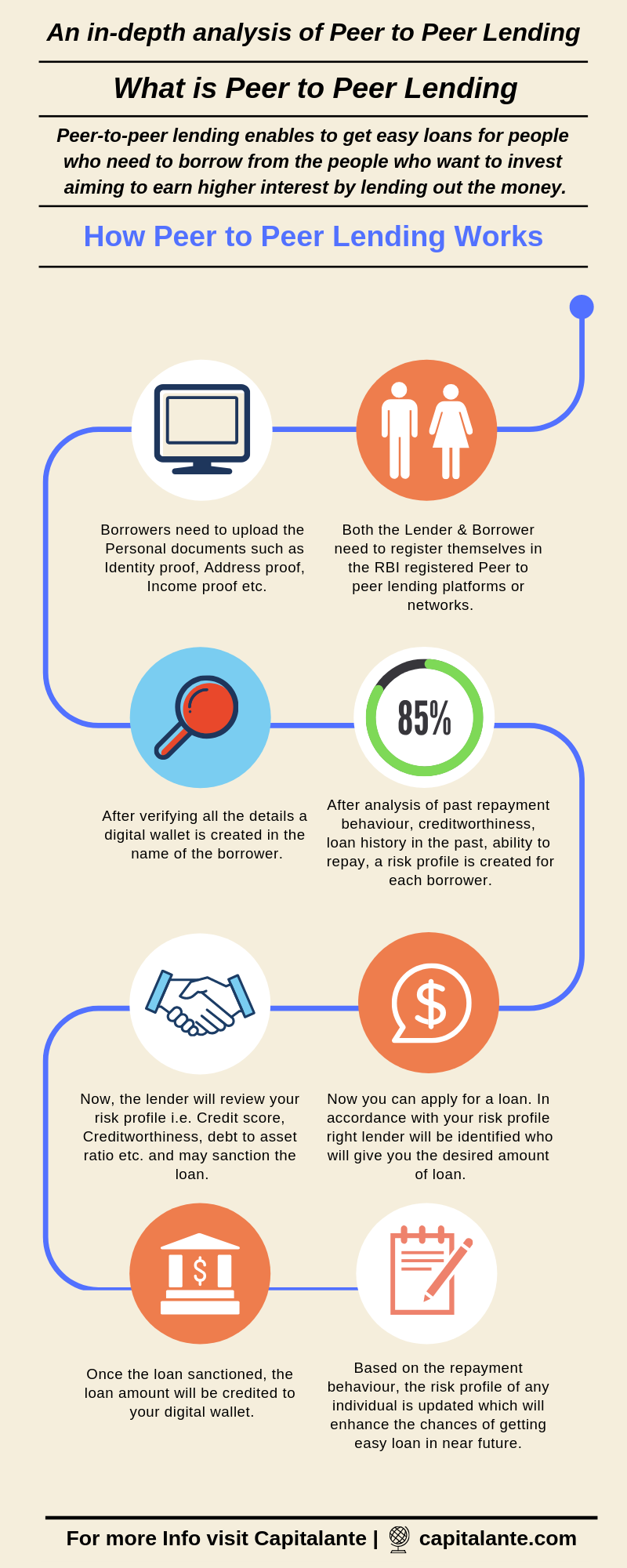

Loan#10. Peer to Peer Lending

In order to get a quick loan with affordable interest rate peer to peer lending is a good option. Peer to peer lending option is getting popular in India because it does not require any mortgage to get a loan and without any financial institution as an intermediary. Peer to peer lending is a marketplace where both the lenders and the borrowers need to get registered in P2P networks or platforms which have got a node from RBI. P2P platform works as a bridge between the lenders and the borrowers in order to facilitate loan with ease.

How to apply for Loan

There are many RBI registered P2P platforms where any individual may register for lending as well as borrowing. These platforms are like websites just like any banking websites where you can get a loan or may lend anyone online. Any individual can apply for a loan online in these platforms. Whenever your loan is sanctioned by any lender the loan amount will be credited to your bank account.

Now when the lenders sanction your loan proposal they usually check the following points. After that, they sanction your loan proposal.

- Credit score,

- Creditworthiness i.e. whether you have cleared all the debt amount at a regular fixed interval in the recent past if any,

- Your profile’s debt to asset ratio i.e. the possibility of repayment of a loan by selling your asset whenever required.

Loan#11. Bridge Loan

The bridge loan is quite beneficial when buyers have a temporary cash crunch while buying a new residential property and the buyers wait for their current residential property to sell. A bridge loan enables an individual to borrow the down payment in order to acquire a new residential property before selling the current residential property. The key benefit of the bridge loan is that a home buyer can purchase a new residential property if the existing home is not sold. The bridge loan does not levy any interest for the first 4 months, but you need to pay the interest accrued when the loan amount is paid upon sale of the property. The tenure of Bridge loans varies between 6 months and one year. The interest rate of Bridge loans varies between 12% and 14%.

Loan#12. Term Loan

A Term loan can be defined as a loan from a bank for a fixed sum with a specified repayment schedule and fixed or floating interest rates. Term loan enables a company or an individual to get loans for a longer duration of time-varying between one year and 30 years. The rate of interest charged under Term loans may be fixed or on a floating basis.

Term loans are secured loans since a company or an individual needs to pledge the assets as collateral security. The interest rate is fixed after evaluating credit risk, loan amount, creditworthiness, past repayment history, etc. Term loans are repayable in equal quarterly installments or semi-annual installments. The interest paid by the individual on the loan amount attracts tax deduction. The borrowers need to pay a penalty in case the foreclosure of the loan amount along with interest is paid before maturity term.

Loan#13. Consumer Durable Loan

Just married? Looking to upgrade your home with a new home theatre system or with a flat TV, or gifting a Smartphone to your spouse? If yes, then consumer durable loan can make this happen. Consumer durable loan is offered by various scheduled commercial banks and non-banking financial institutions to an individual. It enables the consumer to buy a Laptop, Flat TV, Washing Machine, Air conditioner, Refrigerator, Smartphone, and many more consumer durable items.

The lenders will check creditworthiness, past repayment behaviour, CIBIL Score before disbursement of the loan to your bank account. The consumer durable loan amount varies between Rs. 30,000/- and Rs. 1.5 Lakh. The biggest benefit of consumer durable loan is that you can foreclose your loan at no additional cost. The repayment tenure varies between 12 months and 36 months. The interest rate varies between 12% and 15%. Sometimes the lenders offer a 0% interest rate for promotional purposes. Additionally, the lender will charge a processing fee either 1-3% of the loan amount or a flat fee.

Loan#14. Prime Minister Mudra Yojana

In order to create employment opportunities and to boost agriculture, manufacturing sectors MUDRA Yojana was launched. It is a special scheme set up by the Government of India through an apex body named Micro Units Development & Refinance Agency Limited i.e. MUDRA in order to facilitate financing aid. Any individual can get an easy loan to meet the expenses like business purposes, capacity expansion, modernization, etc. To avail this type of loan no collateral is required. The loan amount is between Rs. 50,000/- and Rs. 10 Lakh. The tenure varies between 1 year and 5 years. The interest rate is between 12% and 17%.

Loan#15. Agricultural Loan

Agricultural loans are considered as the backbone of the Indian economy because it boosts the rural economy by giving easy loans at an affordable rate. This loan can be availed for different kinds of farming-related activities such as buying of necessary inputs, fertilizers or seeds or insecticides, etc., and to buy farming equipment, for the purchase of land, etc. Any individual can get easy loans from National Bank for Agriculture and Rural Development i.e. NABARD.

In addition to

Agriculture loan is not only availed for crop production but also for dairy farming, honey bee production, silk farming, animal husbandry, etc. Any individual can avail a loan amount to between Rs. 50,000/- to Rs. 3 Lakh. The interest rate is 7%. But the government of India allows an interest subvention of 3% per annum for those people who pay their loans regularly at fixed intervals.

Loan#16. Overdraft Loan

Basically, an overdraft is a facility given to any individual to continue withdrawing money even if the individual has no funds to encash. The bank allows an individual to withdraw money to meet the emergency situation. The maximum limit of overdraft is granted on the basis of the account balance, repayment behaviour i.e. credit score. This is a short term credit provided to any individual who needs to pay within a stipulated time.

As per RBI guidelines any individual can get maximum overdraft up to 3 times of the current monthly salary or income. This type of loan does not require any collateral. The repayment period varies between 3 months and one year. The interest rate is 2% above the base rate. Currently, the base rate is 8.5%. So, the applicable interest rate is 8% + 2% = 10%.

Loan#17. Loan against Car

You can get an easy loan against your car from the bank or post office or Non-banking financial institutes. The loan amount will be the maximum of 70-85% of the value of the car. Since you have used your car as collateral or asset, the chances of approval of a loan against the car will be higher. The lenders watch out the car model, the age of the car, total usage before approval of the loan against the car. The repayment of loan tenure of loan against car ranges from 12-60 months but does not exceed 7 years. The interest rate is between 13% and 17%.

Loan#18. Loan against property

Any salaried individual or self-employed person can get an easy loan against property from bank or post office or Non-banking financial institutes. The loan amount will be a maximum of 65-80% of the value of the property. Since you have used your property as collateral or asset, the chances of approval of loan against car will be higher. The lenders watch out the land, its location, future possibility of promotion, etc. before approval of loans against the land. The repayment of loan tenure is from 2 years and 15 years. The interest rate is between 11% and 15% up to the loan of Rs. 25 Lakh.

Loan#19. Loan against Public Provident Fund

One individual/you can get a loan against your Public Provident Fund (PPF) from the bank or post office. The loan amount will be 25% of your contribution towards PPF. You are eligible to get the loan against PPF in the 2nd financial year. Suppose you have a contribution of 1 lakh up to the 2nd financial year, then you are eligible to get a loan of 25% of Rs. 1 Lakh i.e., Rs. 25000/-. If the current interest rate of PPF is 8% then you will be charged with 2% above the current interest rate i.e., [8 % + 2% = 10%]. The time for repayment the loan is 36 months from the month of approval of the loan.

Loan#20. Loan against Fixed Deposits

You can get an easy loan against your fixed deposits from the bank or post office. The loan amount will be 80%-90% of the value of FD you have made. If the valuation of the FD is Rs. 1 Lakh then you can get the maximum amount of [90% of Rs. 1 Lakh = Rs. 90,000/-]. The interest rate is 2%-3% higher than the interest rate of the FD. If you receive 8% interest on FD then the interest rate applicable for your loan is [8% + 3% = 11%]. The repayment period is between one year and 10 years.

Loan#21. Loan against Securities

You can get an easy loan against your Securities from the bank or post office. The loan amount varies from minimum Rs. 50,000/- to maximum Rs. 20 lakh. The loan is sanctioned on the basis of the value of securities in the Demat account or Mutual Fund.

Suppose your investment is Rs. 8 lakh and with the earned return the current valuation of total investment is Rs. 12 Lakh. Then you can get a maximum loan of 50% of Rs. 12 lakh i.e. Rs. 6 Lakh. The interest rate is 3% more than the base rate of RBI. So the customer receiving the loan will have to pay 8%+3% = 11% interest on the loan amount against securities. The total loan with interest can be paid off within the maximum period of 30 months from the date of sanction of the loan against your securities.

Loan#22. Loan against Gold

You can mortgage your jewellery or anything made of gold in a bank or a non-banking financial institution to get the loan against your gold. The banks or NBFCs generally sanction up to 60% of the current value of the gold, you mortgage for the loan. You can get a loan between Rs. 10000/- to Rs. 25 lakh.

Usually, the interest rate is 2% higher than the current Marginal Cost of funds based lending rate (MCLR) for banks. The marginal cost of funds based lending rate (MCLR) is the minimum interest rate of a bank below which the bank cannot lend. This rate is set by RBI. The current MCLR is 9.15. So, the applicable interest rate is 9.15+2 = 11.15%. The tenure is between one month and 36 months.

Loan#23. A loan from your employer

Suppose you are employed somewhere or a job holder and receive a salary from your employer. In this condition, you can get a loan from your employer. The loan amount may vary and depend on your employer. The interest rate is generally 7%-8% per annum. The tenure can vary between 12 months and 84 months depending on the amount of loan you withdraw.

Loan #24. Loan against Credit Cards

If you have a credit card and have a good CIBIL score, good repayment history, creditworthiness, then you can get an instant loan against your credit card. Unlike a personal loan, a loan against credit card requires neither any documentation nor any collateral as security to get the loan. The biggest advantage of a loan against a credit card is that the loan amount is pre-approved and can be availed instantly without visiting the bank branch physically. You can check the pre-approved loan amount by making use of Net-banking or Mobile-banking.

The loan amount varies in accordance with the type of credit card namely Gold, Silver, Platinum, Titanium, etc. HDFC Bank, ICICI Bank, HSBC Bank offer loans against credit cards within 60 minutes to your bank account. The interest rate varies between 15 and 21% per annum. The tenure of the loan against credit card varies between 3 months and 24 months.

Loan#25. Loans against Insurance Policy

You should consider loans against your insurance policy as the last option. Normally the loan amount is calculated in two ways. The first one is on the basis of the surrender value of the insurance policy and the second one is on the basis of accumulated money you have paid via regular premiums for the policy. Let’s illustrate them with examples.

Condition 1

Suppose, you have taken an insurance policy that has insurance coverage of Rs. 20 Lakh and you pay a regular premium of Rs. 50,000/-on yearly basis. Generally, the surrender value of the life insurance policy is 30% of the sum assured. It means your policy has the surrender value of 30% of Rs. 20 Lakh = Rs. 6 Lakh. So you are eligible to get a maximum of 90% of Rs. 6 Lakh = Rs. 5.4 Lakh and you can get a loan of Rs. 5.4 Lakh against your life insurance policy.

Condition 2

In the case of the second calculation, let’s assume you have taken an insurance policy that has insurance coverage of Rs. 20 lakh. At the time of applying for a loan against this policy, you have already paid a total premium of Rs. 5 Lakh. Normally it is a thumb rule that you can get maximum loan amounting to 50% of the sum of the premium you have paid in an insurance policy. As you have paid a total of Rs. 5 Lakh as a premium so you are eligible to get a maximum loan of 50% of 5 Lakh = Rs. 2.5 Lakh.

The rate of interest varies from banks to banks or insurance companies. The current rate of interest is 10%-12%. The loan amount is to be paid off within 6 months to one year from the date when the loan amount is credited.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

Let me know if I have missed describing any other types of bank loans in India. If you have found this post helpful share with your loved ones whom you care about.