Many people get in confusion where and how to invest their hard earned money. There are many options of the large basket like gold, debt securities, bonds, equity etc. Before investment in the stock market, you should consider your purpose, risk appetite, and time horizon.

The stock market will yield better returns over a long-term horizon. So, you should continue your investment for at least 10 years to get fruitful returns. In this column, we will share some valuable tips for beginners who wish to invest in the stock market i.e. how to invest in the stock market. These tips or information may be beneficial for you to achieve your financial goals in the near future.

How to Invest in the Stock Market

One individual investor can start Investment in the stock market via either direct equity by opening of a demat account or mutual funds. But putting your money physically in the stock market by any means is the fourth step of investment. Getting confused? Let’s make it clear with the following picture.

First Step

The first rule of investment is to ensure sufficient fund for any kind of emergency or unforeseen situation. Every person should save a satisfactory amount per month from his income. Then he can move to any kind of investment plan or scheme. This saving amount may vary from person to person according to his status or requirements. So, create an emergency fund. Try to accumulate enough money in this fund so that you can bear your all expenses i.e., foods, clothes, insurance bills, and other necessary things of any kind of at least 6 months.

- Read also: 10 golden rules of investing in stock markets – The Economic Times

- Read also: How to Invest in Stocks: A Step-by-Step for Beginners – NerdWallet

Second Step

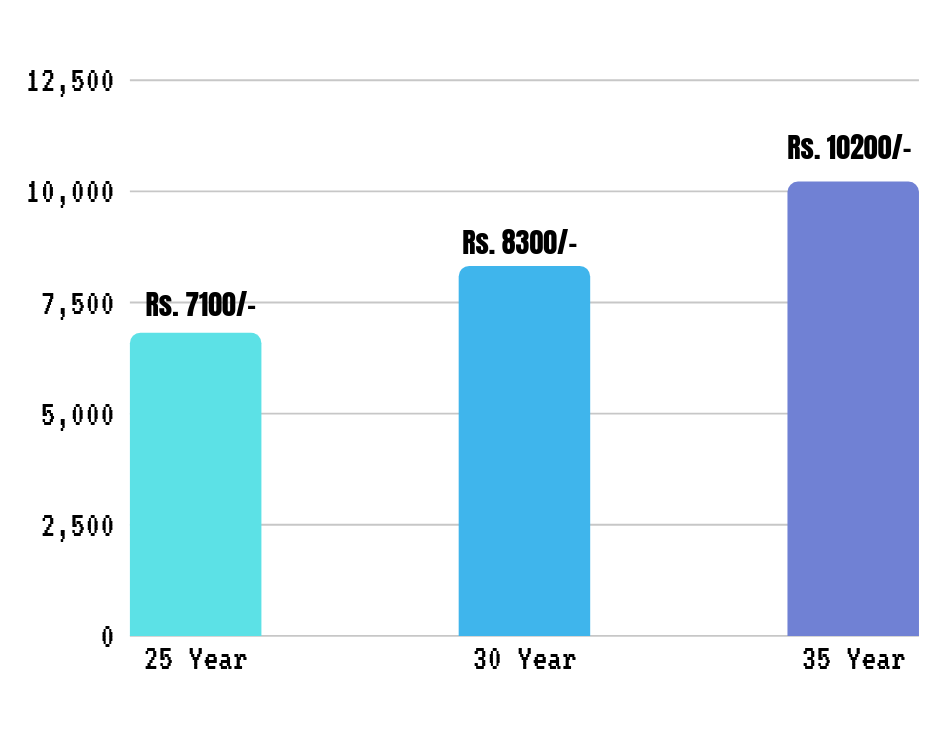

The second act is to take an insurance policy to secure your family in case of your uncertain demise. The most important thing is you should buy a term insurance plan at an early age. Whenever you start earning you should take a term plan. The earlier you take a term plan, the lesser the premium will be for the term plan.

Suppose, you buy a term plan at the age of 25 and you want to continue this plan till the age of 60 years. So, the duration of the term plan is 35 years. You can easily avail up to Rs. 1 crore as your life insurance for just Rs. 7100/- yearly. But if you delay for 5 years, you need to pay a yearly premium of Rs. 8300/-. Again if you buy a term insurance plan at the age of 35 years then you need to pay Rs. 10,200/- per year for an assured sum of Rs. 1 Crore for the upcoming 25 years.

Third Step

The third thing you need to do is to buy a health insurance policy. Health insurance or Medi-claim Policy is an insurance that covers any kind of health hazards or the risk of the health of a person wholly or partially. It bears the medical expenses of a person that is incurred. You can opt for a health insurance for any kind of uncertain or accidental health problems.

To get the health insurance you need to select a lump sum amount and on the basis of it, you are to pay a premium either monthly or quarterly or yearly basis. The insurance covers the medical expenses when you suffer from any health hazards and it helps to carry out the investment without worry. In other words, the health insurance policy will ensure fund on physical ailments of you as well as your family. This medical insurance policy diminishes the heavy medical bills. After doing the above-said things you are free to invest in the stock market.

Finally, Start Investment

In order to make an investment in the stock market, the beginners have two options. The first option is to invest via direct equity by opening a Demat account and the second one is via a mutual fund. In order to make a profit in the stock market via direct equity, you need to analyze the fundamentals, business analysis, balance sheet, profit and loss account, free cash flow while choosing the stock in which you are going to invest.

But in the case of mutual fund investment, you need not analyze the above-mentioned points. Mutual funds are managed by fund managers who are active in this field for a long time and possess vast knowledge and experience. The fund managers pick stocks or shares in which your money is to be invested.

The fund manager of the respective mutual fund invests your money in different sectors like Banking, Finance, FMCG, Infrastructure, Automobiles, Information Technology, and Manufacturing, etc. You may invest a lump sum amount at once or you may opt for a monthly, quarterly or yearly basis via SIP.

If you are confused about which route you should follow to start investing in the stock market, i.e. direct equity or mutual fund you may read the article How you can invest, directly in equity or via mutual funds.

- Read also: best sectors to invest in India for long term

- Read also: Best stocks to buy in India for long term

Documents required to open a Demat account or a mutual fund folio in order to invest in the stock market

To open a mutual fund account or a Demat account you need the following documents: a Savings bank Account, a cancelled Cheque of the same account, Identity Proof like a PAN Card, Address Proof like Aadhar Card, Voter ID Card, etc., Two Passport Photograph.

Choose the right Stockbroker

Before you choose a broker, you should know that there are two types of brokers namely Full-service brokers and Discount brokers.

Full-Service Broker

A full-service broker offers services like giving you a savings bank account, a Demat account, a trading account, a detailed analysis of stocks, investment advice etc. The savings account, Demat account, and trading account are commonly named as a 3-in-1 account. A full-service broker gives the stock recommendation, trading calls, and future & option strategy.

Discount Broker

A discount broker is a type of broker who gives you only Demat cum trading account from where you can make trades i.e., buying and selling of stocks or intraday trading. Unlike a full-service broker, a discount broker does not provide any research analysis or investment advice. If you want trading tips and advice you need to pay separately for that. Again a discount broker has a low brokerage charge in comparison to a full-service broker.

Diversification of your portfolio

Mutual funds are managed by fund managers who are in the market for a long time and have vast knowledge and experience. The fund managers pick stocks or share across various sectors and industries in which your money is to be invested. If you give the fund Rs. 100/- then the mutual fund invests your money in different sectors like banking, FMCG, Infrastructure, Automobiles, IT Sector etc. You may invest lump sum amount at once or you may opt for monthly, quarterly or yearly basis via SIP.

On the other hand in the case of investment via direct equity you need to choose and invest accordingly in those stocks or sectors whose business model is clear to you i.e., how the company earns money, whether it will exists after 20-30 years, what are the risk factors for the company etc. The next thing is to you need to invest your money into at least 10 sectors and 2 stocks of each sector.

If you are confused how to diversify your portfolio, you may read the article How to Diversify Stock Portfolio.

How to Pick Best Stocks for Consistent Returns

After choosing the sectors where you invest, you need to pick the best stocks for consistent returns. In order to pick the best stock, you should check out the following parameters of a company before investing in it.

Parameter #1. Revenue – Revenue or net sales of a company should be constant for at least 5 years. You may check that the company has been generating sales growth annually during the last 5 financial years of at least 10%.

Parameter #2. Net Profit – The net profit of a company increases at least 15% on a year-on-year basis.

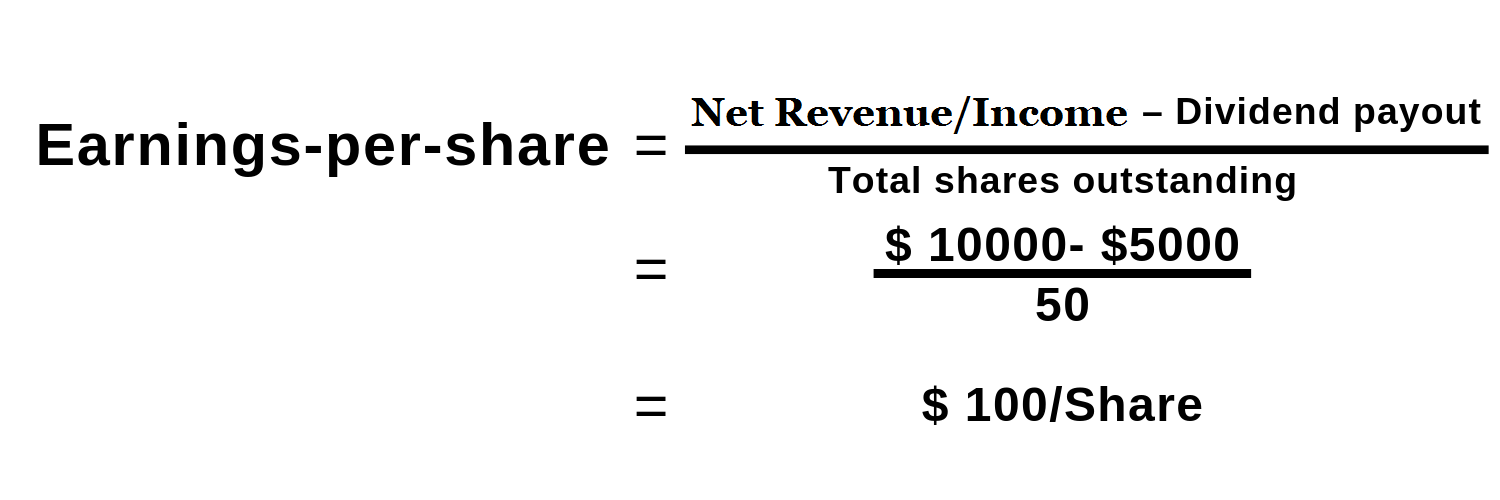

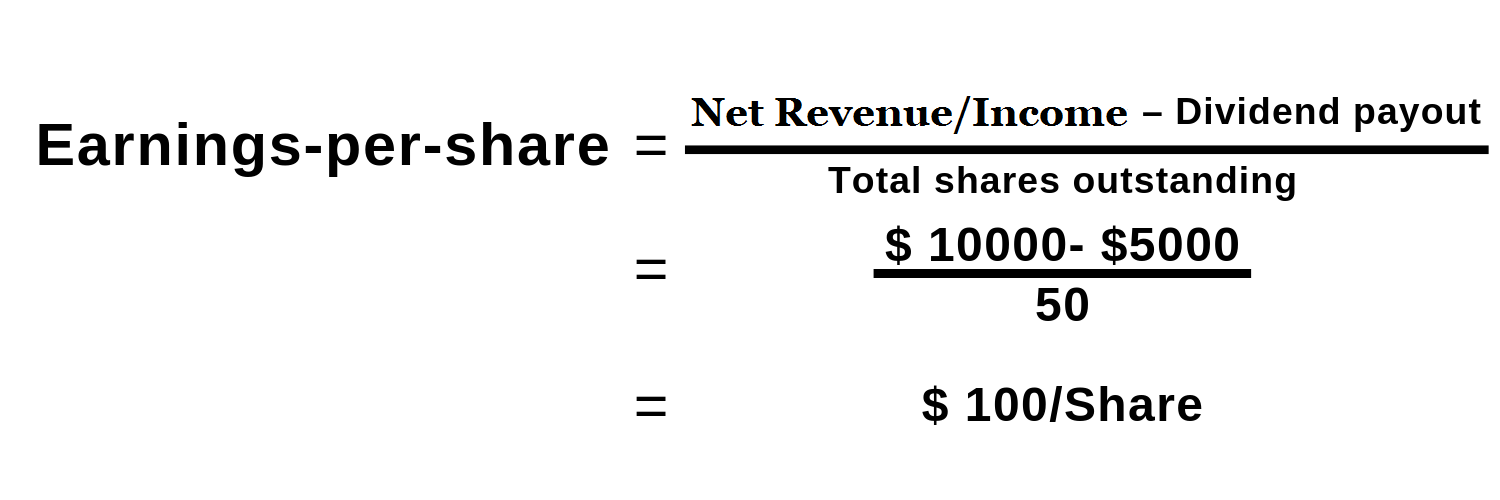

Parameter #3. Healthy dividend payout and stable Earnings-per-share

Let’s assume, a company has a net income of $ 10,000 per year. It Pays $5,000 in a preferred dividend to investors. It has 50 shares outstanding.

It is a good idea to invest your money in those stocks that regularly pay a dividend and deliver a Healthy dividend payout. The stocks which have delivered healthy dividend-paying must have following features

- Consistent dividend payout over the past 5 years.

- High dividend yield for the last 5 years.

- Growth in dividend per share from time to time.

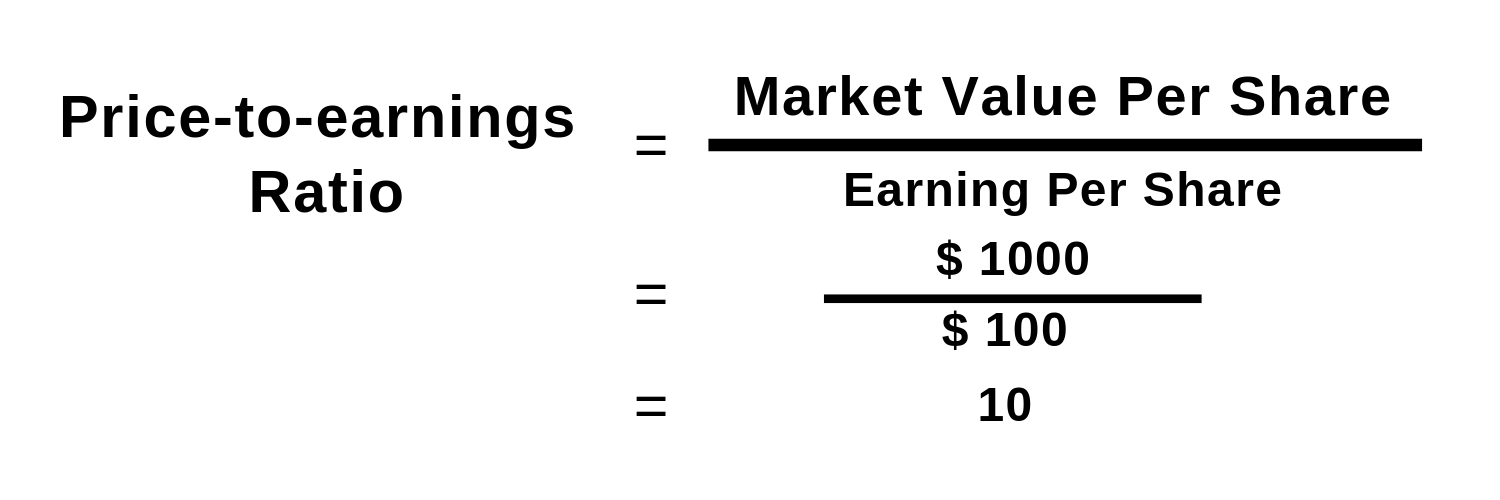

Parameter #4. Price to Earnings Ratio (P/E)

P/E ratio should be low as compared to the other peer companies active in the same industry.

Let’s assume, a company has a net income of $10000 per year. It Pays $5000 in preferred dividend to investors. It has 50 shares outstanding.

Now, if the stock currently trades at $1000, then

You need to choose such stocks that have P/E less than 9. But P/E varies from sector to sector. Lower P/E ratio of sectors does not mean that this sector is undervalued and is going to boom and deliver a multi-bagger return in the near future compared to that sector which has a higher P/E ratio.

These sectors have higher valuation just because the market is bullish on these sectors and their future potential like Automobile, FMCG, Petroleum, etc. They are the core sectors of the Indian economy and have the potential to deliver a robust performance in the upcoming years.

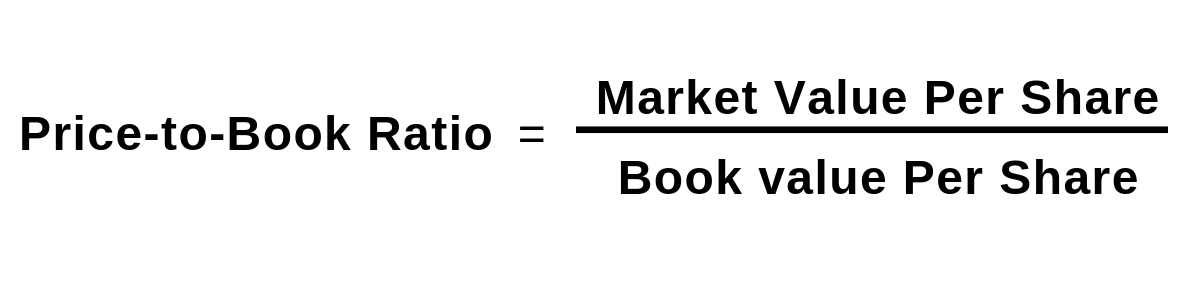

Parameter #5. Price to Book Ratio (P/B)

P/B should be low as compared to peer companies operating in the same industry.

Let’s assume, the stock currently trades at $ 100 and the book value per share is $ 10 then,

P/B Ratio = [$100/$ 10] = 10.

You need to pick such stocks that have a P/B ratio of less than one.

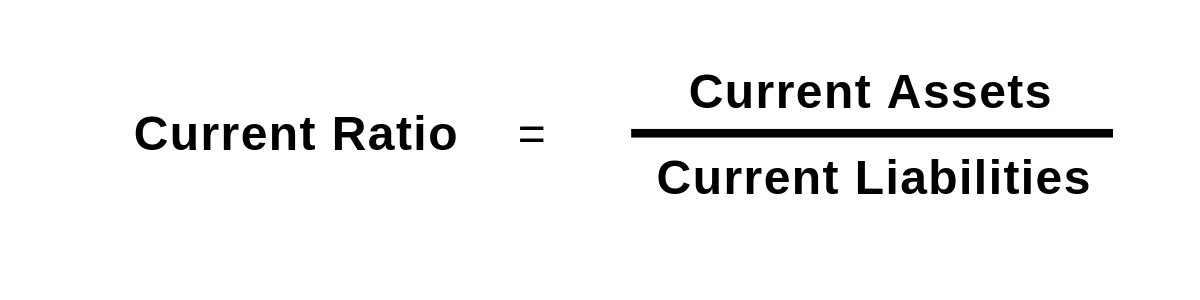

Parameter #6. Current Ratio

The ratio is the snapshot of the asset and liabilities of any company. You will find the assets and liabilities a company has in its balance sheet. Find such quality stocks that have a current ratio of more than 1.5.

Let’s assume, the current assets of any company is $ 1200 and current liabilities is $ 400 then,

Current Ratio = [$1200/$ 400] = 3.

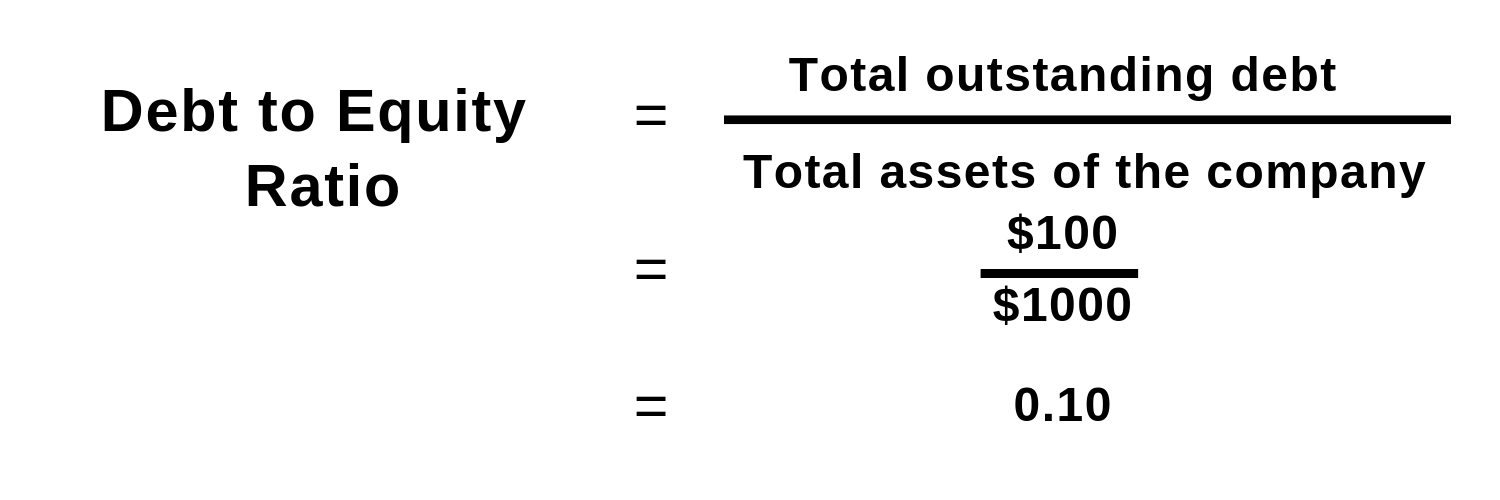

Parameter #7. Debt to Equity Ratio

This is the comparison between a company’s own capital and the debt which the company borrows from a bank or a financial institution.

Suppose a company has a capital of Rs. 100/- and it has borrowed Rs. 100 from a bank.

So the debt ratio of the company is 100:100 = 1

A debt-free company is desirable. If not so the ration must be low to 0.10 or 0.25.

If the company has marginal or low debt or it is a debt-free company, the company is worth investing. Let us illustrate what is the difference between a high debt company and a debt-free company. When a company has huge debt from the market or bank or any other commercial institutions, then the company concentrates on the debt and its effort goes to pay the debt.

It cannot be sincere about the service, quality of the product or any other important aspects needed in the business. On the other hand, if the company is debt-free, the company can concentrate on product quality, service and customer satisfaction only. That is why a debt-free company is better than a high debt company.

Parameter #8. Return on Equity (ROE) – should be greater than 20%

Parameter #9. Dividend Yield – You can ensure about good dividend yield by the company.

Parameter #10. Beta

A beta is a measurement of the volatility of a share in respect of the market. When Beta is less than 1, it means that the share is theoretically less volatile than the market. It means the common individual may invest his money for the long term. Again, if Beta is more than 1 means that the share is theoretically more volatile than the market. For example, if a stock’s beta is 1.2, it means the stock is 20% more volatile than the market. So, a lesser beta means people are investing in that specific stock with a long-term perspective.

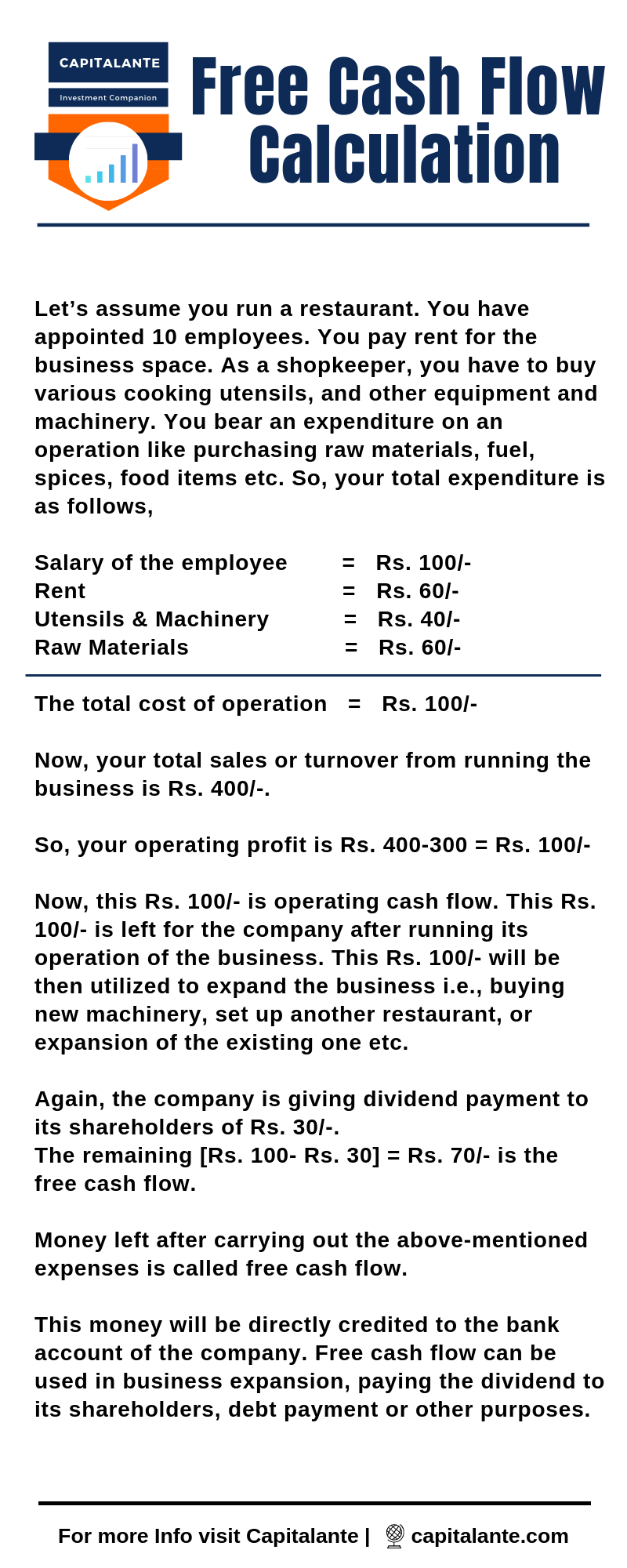

Parameter #11. The cash flow of the company

To understand a company’s true economic condition one should check the free cash flow of the respective company. Free cash flow actually reveals the profit the company makes. It implies a broader range in the company’s functioning in overall business.

Whenever you check the free cash flow of a company, you should analyze from which source the company is gaining its capital for its day-to-day business. Usually, there are two sources, the first one is earning from running operation i.e., business and the second one is receiving debt from the market i.e., debt financing. If the company runs its operation from the profit earned by running operation you should stay invested with the company. But if the company runs its business by debt financing, naturally the debt will increase from time to time. So, stay clear of these types of companies or stocks.

Free Cash flow is one of the most reliable and widely used metrics among value investors, as it provides an accurate position of the company’s financial condition. In simple words, free cash flow is an account of how much cash a company is left with after paying for all expenses.

Companies that manage to generate consistently large cash flows without incurring much capital expenditure are always valued higher by investors. Negative free cash flows are a sign of the deteriorating health of a company.

Parameter #12. Current Inflation

In countries like India, you should watch out inflation because the P/E ratio is adversely affected by current inflation. Owing to inflation, retail consumers spend less and the expenses rise. This will decrease the Earning per share. When EPS falls, it, in turn, increases the P/E ratio making stocks overvalued. In addition, for a growing economy like India too low inflation rate also adversely affects the stocks. So, as an intelligent investor, you should analyze the following points,

- Reserves growth must be more than the current inflation rate.

- Asset growth must be more than the current inflation rate.

- Sales growth must be more than the current inflation rate.

- Cash flow growth must be more than the current inflation rate.

Parameter #13. Enterprise Value

You need to analyze whether the enterprise value of any stock is less than its market capitalization. Usually when the stock’s enterprise value is less than the market capitalization, then it is considered that the stock is undervalued.

Parameter #14. Investment Rating

There are many rating agencies which are in operation like Crisil, Morgan-Stanley, and Standard & Poor, etc. You have to follow the rating given by these rating agencies. Generally, B+ rating is an ideal investment grade in which you are free to invest your hard-earned money. The rating B+ indicates that the company is stable and likely to grow in the near future.

Parameter #15. Business Model

Ace investor Warren Buffet once suggested that an individual investor should invest in such companies or stocks whose business model or modus operandi is clear like a day to the investors. It is very important to understand what the business of the company is like. In other words, what the company sells or what services it offers and how the company makes profit from its operations are to be considered.

Investors should also see whether the demand of the product the company sells will remain constant or move upward in future. For example, food products, steel, electronic tools are inevitable for everyday life. So, the demand of these things will remain constant or increase in the future. The companies operating in these sectors will make profit.

Again, how a company operates its business influences its profit margin. It is also a part of the business model of a company to distribute the profit among its share holders. How a company produces its products, how it sells them, how the packaging of the products are attractive, the company’s marketing policies all these things form a business model.

In addition to

The source of capital or fund to run or expand the business is also very crucial. An under debt company cannot afford to distribute the dividends among its shares holders, because a lion share of the profit goes to repay the debt. On the other hand, a company which is a zero debt company can yield better dividend and better return in the future. So, the above-mentioned points are treated as the business model of a company. By reviewing the business model you can get a clear idea whether the business model is unrealistic or there is any chance that the business will succeed.

Parameter #16. Management of the company

Management is the backbone of the company. A quality management will raise a company to the pick. It is a proven fact that good management in competitive industry will yield better returns than the worst management in monopoly market. In order to access the strength of management, you need to consider the following aspects.

- The persons who manage the company’s business and the persons in key positions i.e., CEO, CFO, COO & CIO.

- You need to examine the educational and employment backgrounds and previous employment records of the personnel. Suppose, the CEO previously worked in coal sector and then he has shifted to technology. There are minimum chances that he will succeed. Ask yourself whether he is able to deliver success to the company.

- You should analyse the management’s style how the team manages the business, whether they promote the business as an open, transparent and flexible way.

- You need to analyse when the management has taken charge. Suppose, the management has remained unchanged during the past 10 years. Then this long tenure of the management is a good indication. It means the management is quite successful and has delivered the desired financial results such as compounded sales growth, compounded profit growth, a good return on equity. If you see a company is changing a management team frequently then you need to invest your money to somewhere else.

- Again, if you watch only restructuring of business or management then you need to analyse carefully. The restructuring is not always bad. There are several businesses which have turned around. You need to watch out the new management team’s members, their past achievements. When company hires management it chooses wisely who can do well for the company’s current financials.

Parameter #17. Competitive advantage

A competitive advantage allows a company to produce quality service and better price for its customers. Then this competitive advantage accelerates the company’s sales margin which increases profit margin than its competitors i.e., pear companies. While you invest your money in any company you should choose such a company that has sustainable competitive advantage in respect of cost structure, brand reorganization, corporate reorganization, product quality distribution network and superior customary support. The brand value or name of any company is in the billions of money. A portfolio of brand influences the sales and growth of the company in many ways. It is a competitive advantage than its peer companies.

Let’s understand this with an example. Whenever we talk or think about adhesive the first name comes to our mind is Fevicol, Fevistick, Fevikwik, m-seal, Dr. Fixit etc. All these are brands of Pidilite industries. The products of Pidilite Industries possess a superior quality. The company maintains vast distribution network and superior customer service to establish this company as a market leader in the adhesive Sector or Industry.

Whenever we talk or think about Trolly or casual Bags the first name comes to our mind is Aristocrat, Skybags etc. All these are brands of VIP industries. So, you need to consider these factors before making investment in a company.

After selecting the company you need to analyse the industry or sectors in which the specific company is in operation i.e., the growth potential of the industry. A mediocre company in a growth industry can generate better return on equity than a good company in a dying industry. You have to watch out which industry is growing and likely to deliver better Return on equity.

Parameter #18. Whether the industry or company creates an entry barrier

Suppose, you want to open a restaurant then you can easily open a restaurant as it does not require the best skill level and large capital. But if you want to set up a company in adhesive industry or automobile industry or pharmaceutical industry you will face a great entry barrier created by these industries. These industries however have created massive barrier to make entry like large capital expenditure, exclusive distribution network, government regulations, patents, brands reorganizations and still counting. The harder the entry barrier is better the advantage for the existing companies are.

The bottom line is that you should analyse the news coming to you from various sources. Because of JIO, internet connection has become easily available. JIO has increased the use of Smartphone. So the sale of Smartphone, as well as the number of internet users, have rapidly increased and till counting. This has increased the demand of optical fiber as optical fiber is required to spread the internet connection to every nook and corner of the country. So, companies operating in this field are direct beneficiaries and by investing in this sector you will get better returns. As a fundamental analyst you need to analyse both the fundamental as well as the qualitative analysis of stocks so that you can choose your desired investment opportunity. The qualitative analysis of stocks will help you to choose the best company among the companies operating in any industry and yield better returns.

Let’s understand this with an example.

Whenever we talk or think about adhesive the first name comes to our mind is Fevicol, Fevistick, Fevikwik, m-seal, Dr. Fixit, etc. All these are brands of Pidilite industries. The products of Pidilite Industries possess superior quality. The company maintains a vast distribution network and superior customer service to establish itself as a market leader in the adhesive Sector or Industry.

Whenever we talk or think about Trolly or casual Bags the first name comes to our mind is Aristocrat, Skybags, etc. All these are brands of VIP industries. So, you need to consider these factors before making an investment in a company.

After selecting the company, you need to analyze the industry or sectors in which the specific company is in operation i.e., the growth potential of the industry. A mediocre company in a growth industry can generate a better return on equity than a good company in a dying industry. You have to watch out which industry is growing and likely to deliver a better return on equity.

Parameter #19. Ownership Structure

You need to check out the promoters’ stake, mutual fund holdings, Foreign Institutional investors i.e., FIIs stake, etc. As you are investing in their business, you need to know the goodwill, management intelligence, etc.

Parameter #20. Future plans

The most crucial part is to check out the future plans i.e., the expansion of business, marketing policy, etc. Suppose, Titan Company is quite famous for making ornaments, jewelry, wristwatches, etc. So, you need to keep a close eye whether Titan Company enters in a new segment or makes an expansion of business which will increase its market share.

Which investment style fits you

There are two types of investor namely Defensive Investor and Enterprising Investor. A Defensive investor always disburses his investments in various sectors like automobile, oil marketing companies, food products, jewellery, garments etc. By doing this he lessens the risk of loss. If one sector underperforms, there are the shares of other sectors that may compensate for the loss.

This type of investors invests in stocks of large companies which are pioneers in their field in terms of market share and have delivered steady returns during last 10-15 years with regular dividend payments, earnings stability, strong financial condition, earnings growth etc.

On the other hand, Enterprising Investor forecasts and anticipates the future of consumer demand. Let’s take the examples, Nowadays govt. of India emphasizes the use of an electric vehicle. In electric vehicles, engine or auto ancillary equipment is made of high-quality plastics instead of iron. So the demand for plastics in the near future will increase. Enterprising investors will predict this situation and invest accordingly. You may read which stocks will be benefitted from the electric vehicles in India.

Very recently Govt. of India has launched Bharat Mala Project to make or develop better infrastructure throughout the country. So, in near future as well as far future, the direct beneficiaries for this project will be cement companies, steel companies, tar companies, infra companies etc. The companies in these sectors will get benefited and this will improve their earnings in the upcoming quarterly and yearly results.

Why you should invest in the stock market for a long-term horizon

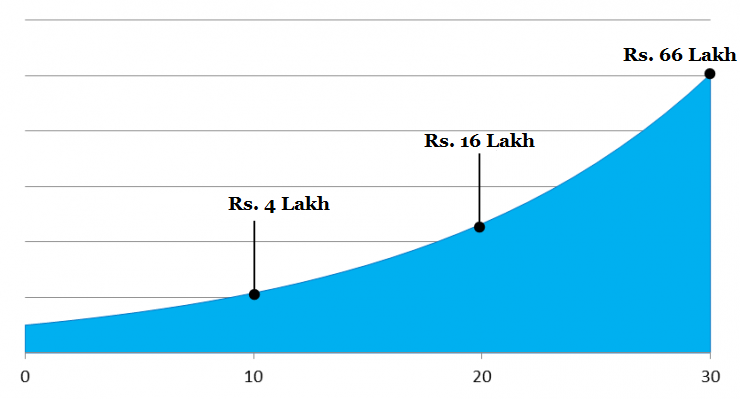

Power of compounding enables an investor to earn interest on interest. Let’s make it clear with an example. Suppose, you invested Rs. 1, 20,000/- at once in the stock market 5 years ago and the market has given 15% CAGR during this 5 years. Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

In order to avoid loss in the stock market, you need to consider the following points,

Point #1. Never make an investment with borrowed money

First of all, if you apply for a loan you will have to repay it within a scheduled time. Now when the market corrects, many good quality stocks correct up to 30%-40% from their all-time highest peak at which you bought the specific stocks. There is no certainty when the market will head again. As you will have to repay your borrowed money within the specified time and you don’t know when the market will go up, so you will be in big trouble. That is why it is suggested that you should never make an investment with borrowed money.

Point #2. Never invest in accordance with tips

Very often, as an investor, you may receive various phone calls, messages or e-mails from different unknown sources. There you will find information regarding investment. This information is meant to misguide you and sent by insiders of any company who has a personal purpose to fulfill. They actually conduct illegal insider trading exploiting your interest. In an illegal insider trading, an insider of a company along with a small group of people buys a particular stock and share price-sensitive information. So, huge artificial demand is created for the particular stock resulting in higher prices. Then, at a certain point when the prices hit the ‘satisfactory’ level, the insider exits the company along with his small group of people. In other words, this insider sells stocks and makes profits. Soon the stocks plummet resulting in huge losses for the retail investors.

Point #3. Maintain Investment Discipline

At the beginning don’t invest all the money you have. Though you don’t need the money at the moment. Try to invest regularly in little amounts. It is suggested for the beginners or the persons who don’t have much knowledge about the share market to invest via equity sip or mutual fund sip on regular basis month by month. It reduces the possibility of losing your money. Your patience in monitoring your portfolio increases the chances of generating great returns in future.

Point #4. Have patience and control your nerves

First of all, you should not invest your money in one stock. You should diversify the stock portfolio. Share prices of all companies will not fall together. When the share price of a company is increasing rapidly do not get tempted and buy more shares of that company, because in volatile market price may come down. Again at the sudden fall of share price do not worry. Generally, investors panic and lose their nerves. You should invest regularly in those stocks which are decreasing checking the fundamentals.

Point #5. Don’t ignore your long-term goal

Many persons stop investing as the market is volatile. If you invest in stocks either direct equity or via mutual fund you need not stop your SIP just because the market is declining. You need not worry about your long-term goals which are 10 years away for a certain period of the volatility of 6 months or one year. So being nervous, if you sell your share or mutual fund in a declining market definitely you will make a loss. So invest the money which you don’t need for the upcoming 10 to 15 years. It will yield wonderful returns after 15 to 20 years.

Point #6. Start with a little amount and don’t forget to increase whenever possible

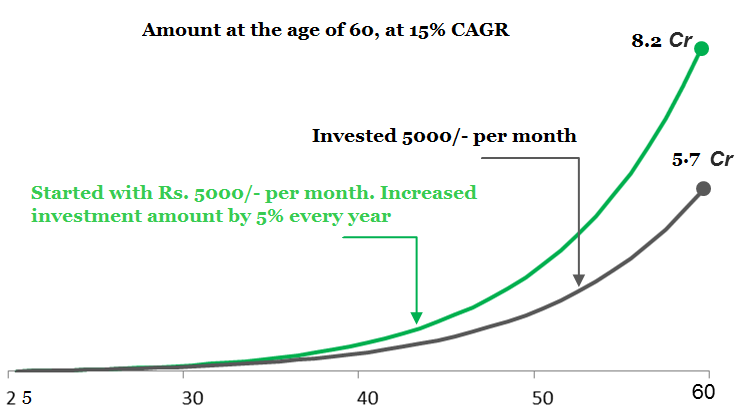

To get the benefit of compound interest you may start with a little amount of Rs. 1000/-. You may then increase the amount of SIP every year with a little extension of 5%. Let’s understand it with the following graph.

As shown in the graph if you have made a SIP of Rs. 5000/- per month for the upcoming 35 years, then you will get Rs. 5.7 crore. If you increase the SIP amount by 5% every year then you will get Rs. 8.2 crore after 35 years. So, step up your SIP amount as possible. So, the bottom line is before you make an investment, please make sure that you don’t invest your savings in the stock market. You should start investing in the stock market in accordance with your risk appetite and time horizon because the equity asset class has delivered better returns than any other asset class in the long run.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Why People Lose Money in Stock Market

- Read also: How to buy stocks in India for Beginners

If you have any questions regarding how to invest in the stock market for beginners in India feel free to comment so that we can have a discussion. If you found this post helpful don’t forget to share with your loved ones.