Historically, the equity asset class has outperformed all other asset class i.e., debt, gold, bond, etc. in the long run. So, it is quite clear that you can invest in stocks via either direct equity by opening a Demat account or mutual fund. Both the investment strategies enable an investor to beat inflation as well as generate better returns in the long run. In this column, we will discuss how to make money in the stock market.

While investing in the stock market you should consider two points, the time horizon i.e., short term or long term and the risk appetite i.e., moderate or high.

Why short term and long term matters

According to one famous investor of all time Benjamin Graham, the stock market behaves like a voting machine for a short-term where someone goes up for sometimes and later someone else goes up beating the first one behind. On the other hand, in the long run, the stock market acts like a weighing machine that has only one option left to move upwards.

“In the short run, a market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham.

For a certain period, no one can predict the market and its movements. But historically stock market inches towards higher level for sure. Let’s make it clear with an example. The benchmark index Nifty traded at Rs. 1000/- in 1996, but in 2018 the Nifty is trading at Rs. 11,000/-. In this period there have been many ups and downs in the stock market. But in the long term, you will surely be a winner.

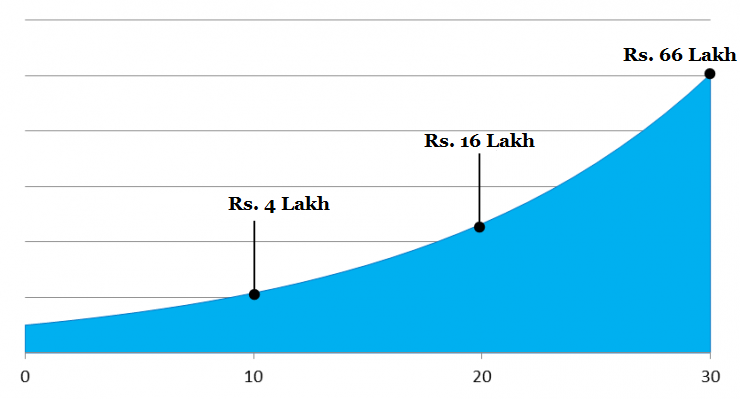

One of the major benefits, when you invest over a long-term horizon, is compounding interest. Let’s make it clear with the following example. Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

Why risk appetite matters

Usually, midcap stocks and small-cap stocks are capable of giving you better returns than the large-cap stocks. But they are more volatile than the large-cap stocks. But if you invest your money in the short term just to say 5 years or less, you should go with the large-cap stocks. It is because they are less volatile than the mid-cap or small-cap stocks. Even if you are investing in mid-cap companies after checking out their fundamentals, balance sheet, profit, and loss account, you may not get the desired return.

Castles are not built within one day, it takes time.

- Read also: How to earn money from the stock market – The Economic Times

- Read also: 7 Quick Ways to Make Money Investing $1,000 – Entrepreneur

Which stocks are good for common men

Usually, for the short term, the stocks are quite volatile. But in the long run, the market is left with only one option which is to grow. So, you need to do the following things in order to get better returns,

- Identify a good stock,

- Invest consistently for the long term for at least 10 years,

- Stay invested unless the fundamental or earnings number is deteriorating.

What are the good stocks?

Let’s make it clear with an example. Back in January 2014 Titan company had a stock price of Rs. 230 and in January 2020 the price of the above said stock is Rs. 1000/-. So, from this data, we can conclude that Titan Company has delivered 29% CAGR during the past 6 years. The average inflation rate during the past 6 years is 6.92%. The return delivered by the Titan Company during the past 6 years is 4 times the current inflation rate. So, you need to invest in these types of companies or stocks which can not only beat the inflation rate but also generate a satisfactory return in the long run.

How to ensure stock prices will go upward in the long run

To solve the riddle you need to consider the following points.

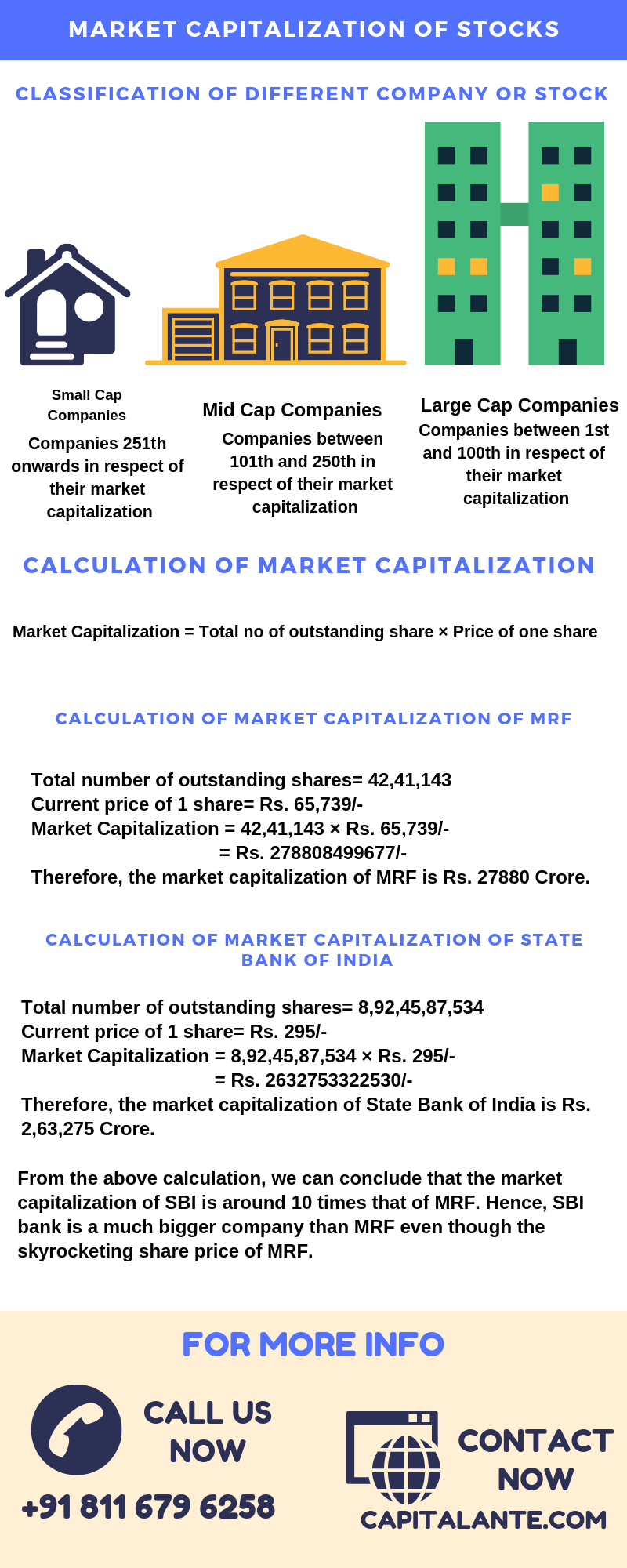

Point #1. Maintain a diversified Portfolio

The basic investment strategy is that while you invest in the stock market you need to invest in those stocks or sectors whose business model is clear to you i.e., how the company earns money, whether it will exist after 20-30 years, the risk factors associated with the company, etc. The next thing is to consider the market capitalization of different sectors such as Banking, Information Technology, Finance, Pharmaceuticals and health, Auto, Petroleum, Power, and Engineering, etc. At the time of choosing sectors, all you need to do is to focus the mother sectors like the above-said sectors which will be there even after 100 years. Then you must analyze the factors like the business model, the financial health of the sector i.e., the debt burden on the sectors, future opportunities.

If you are confused about how to diversify your portfolio, you may read the article How to Diversify Stock Portfolio.

How to Pick Best Stocks for Consistent Returns

After choosing the sectors where you invest, you need to pick the best stocks for consistent returns. In order to pick the best stock, you should check out the following parameters of a company before investing in it.

Parameter #1. Revenue – Revenue or net sales of a company should be constant for at least 5 years. You may check that the company has been generating sales growth annually during the last 5 financial years of at least 10%.

Parameter #2. Net Profit – The net profit of a company increases at least 15% on a year-on-year basis.

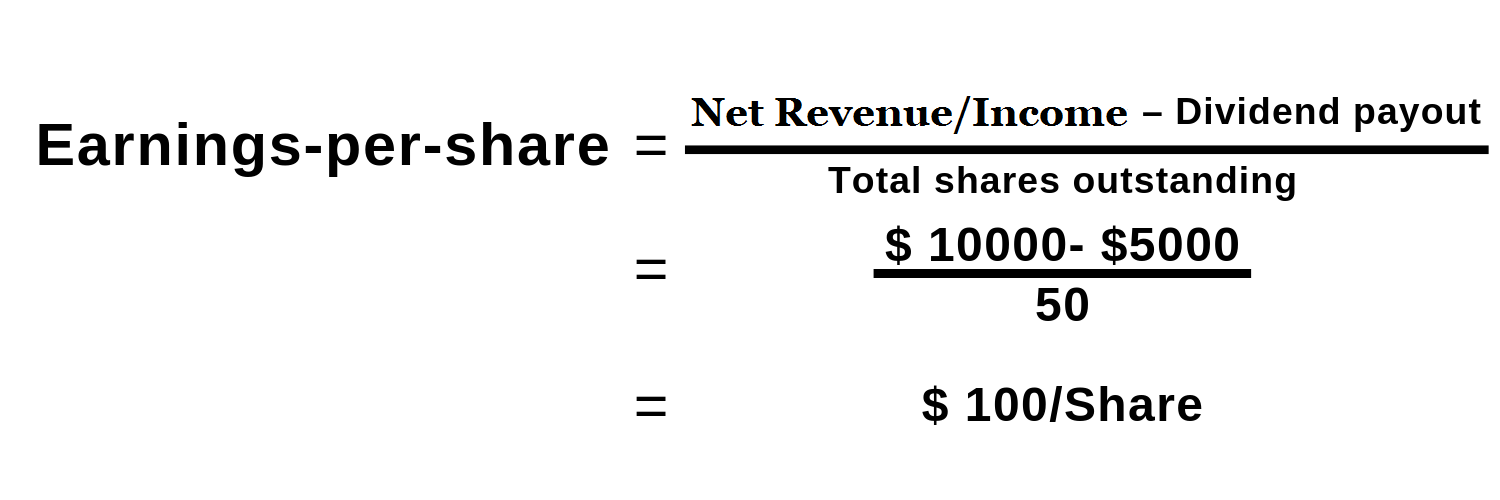

Parameter #3. Healthy dividend payout and stable Earnings-per-share

Let’s assume, a company has a net income of $ 10,000 per year. It Pays $5,000 in a preferred dividend to investors. It has 50 shares outstanding.

It is a good idea to invest your money in those stocks that regularly pay a dividend and deliver a Healthy dividend payout. The stocks which have delivered healthy dividend-paying must have following features

- Consistent dividend payout over the past 5 years.

- High dividend yield for the last 5 years.

- Growth in dividend per share from time to time.

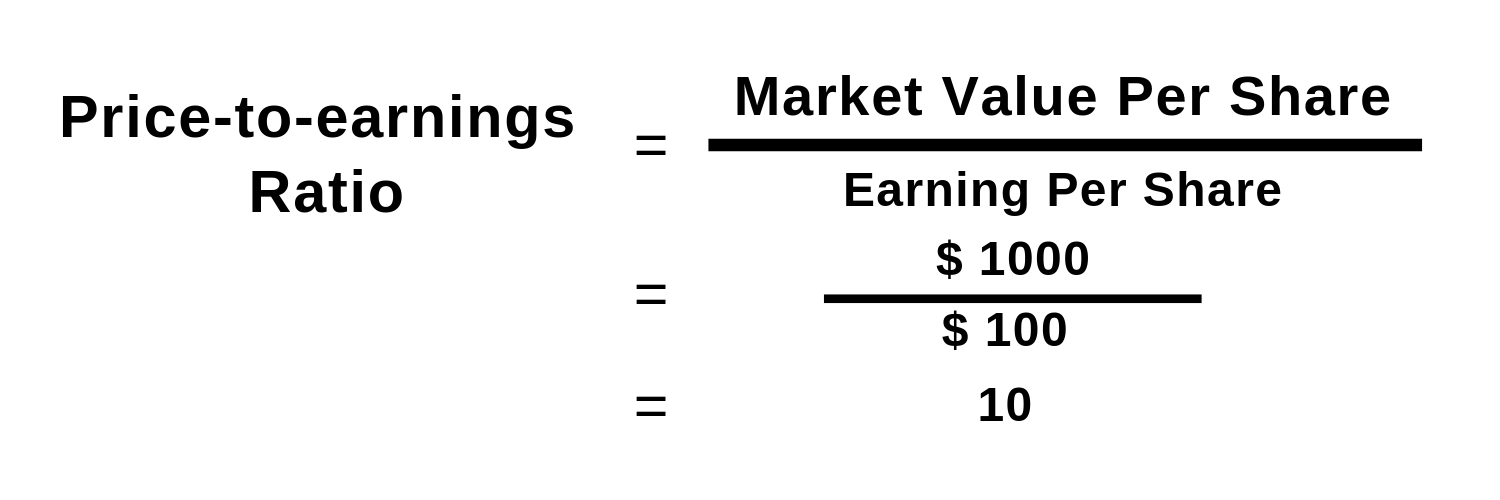

Parameter #4. Price to Earnings Ratio (P/E)

P/E ratio should be low as compared to the other peer companies active in the same industry.

Let’s assume, a company has a net income of $10000 per year. It Pays $5000 in preferred dividend to investors. It has 50 shares outstanding.

Now, if the stock currently trades at $1000, then

You need to choose such stocks that have P/E less than 9. But P/E varies from sector to sector. Lower P/E ratio of sectors does not mean that this sector is undervalued and is going to boom and deliver a multi-bagger return in the near future compared to that sector which has a higher P/E ratio. These sectors have higher valuation just because the market is bullish on these sectors and their future potential like Automobile, FMCG, Petroleum, etc. They are the core sectors of the Indian economy and have the potential to deliver a robust performance in the upcoming years.

Parameter #5. Price to Book Ratio (P/B)

P/B should be low as compared to peer companies operating in the same industry.

Let’s assume, the stock currently trades at $ 100 and the book value per share is $ 10 then,

P/B Ratio = [$100/$ 10] = 10.

You need to pick such stocks that have a P/B ratio of less than one.

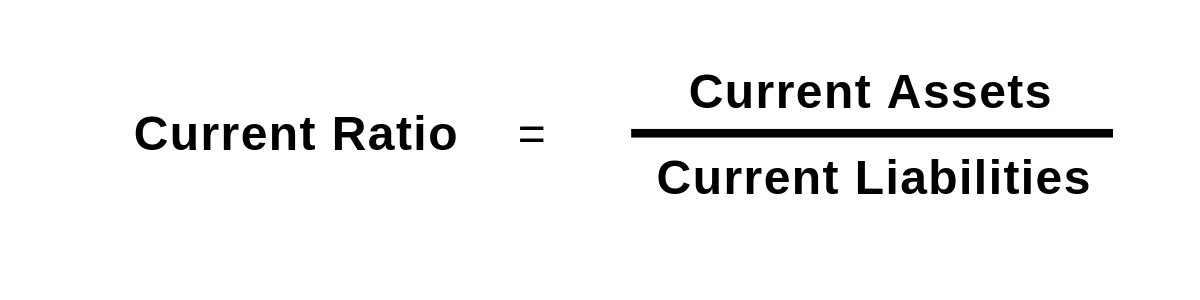

Parameter #6. Current Ratio

The ratio is the snapshot of the asset and liabilities of any company. You will find the assets and liabilities a company has in its balance sheet. Find such quality stocks that have a current ratio of more than 1.5.

Let’s assume, the current assets of any company is $ 1200 and current liabilities is $ 400 then,

Current Ratio = [$1200/$ 400] = 3.

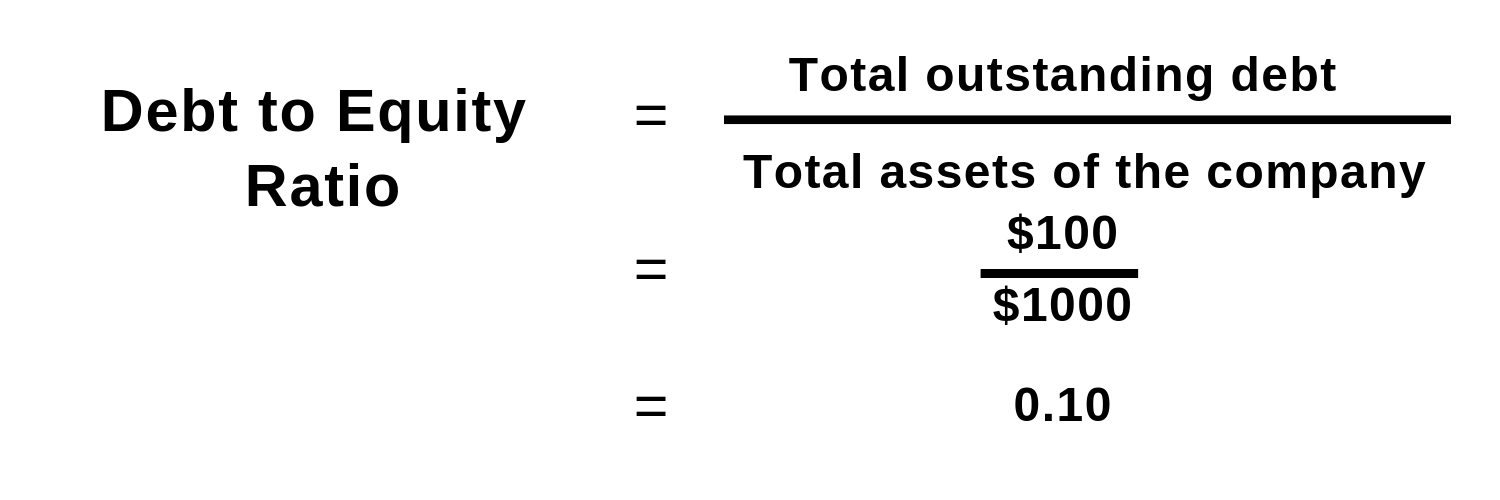

Parameter #7. Debt to Equity Ratio

This is the comparison between a company’s own capital and the debt which the company borrows from a bank or a financial institution.

Suppose a company has a capital of Rs. 100/- and it has borrowed Rs. 100 from a bank.

So the debt ratio of the company is 100:100 = 1

A debt-free company is desirable. If not so the ration must be low to 0.10 or 0.25.

If the company has marginal or low debt or it is a debt-free company, the company is worth investing. Let us illustrate what is the difference between a high debt company and a debt-free company. When a company has huge debt from the market or bank or any other commercial institutions, then the company concentrates on the debt and its effort goes to pay the debt. It cannot be sincere about the service, quality of the product or any other important aspects needed in the business. On the other hand, if the company is debt-free, the company can concentrate on product quality, service and customer satisfaction only. That is why a debt-free company is better than a high debt company.

Parameter #8. Return on Equity (ROE) – should be greater than 20%

Parameter #9. Dividend Yield – You can ensure about good dividend yield by the company.

Parameter #10. Beta

A beta is a measurement of the volatility of a share in respect of the market. When Beta is less than 1, it means that the share is theoretically less volatile than the market. It means the common individual may invest his money for the long term. Again, if Beta is more than 1 means that the share is theoretically more volatile than the market. For example, if a stock’s beta is 1.2, it means the stock is 20% more volatile than the market. So, a lesser beta means people are investing in that specific stock with a long-term perspective.

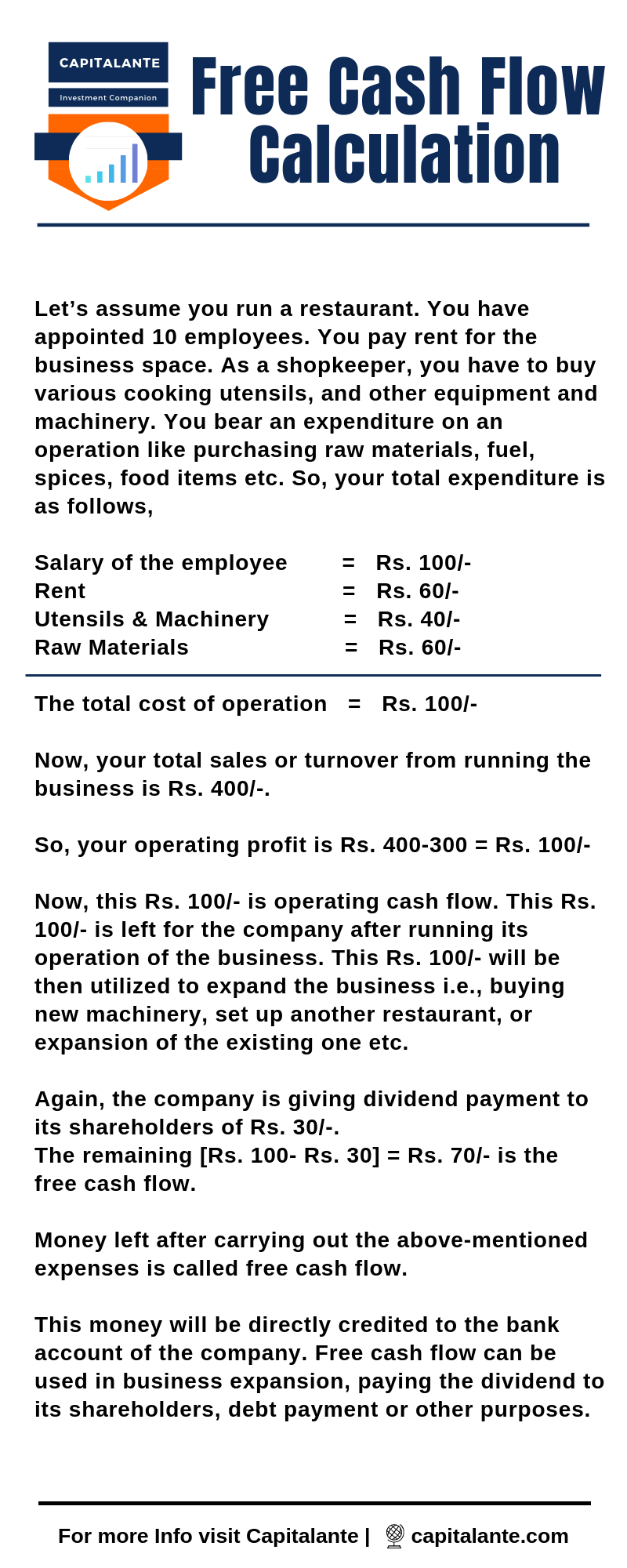

Parameter #11. The cash flow of the company

To understand a company’s true economic condition one should check the free cash flow of the respective company. Free cash flow actually reveals the profit the company makes. It implies a broader range in the company’s functioning in overall business.

Whenever you check the free cash flow of a company, you should analyze from which source the company is gaining its capital for its day-to-day business. Usually, there are two sources, the first one is earning from running operation i.e., business and the second one is receiving debt from the market i.e., debt financing. If the company runs its operation from the profit earned by running operation you should stay invested with the company. But if the company runs its business by debt financing, naturally the debt will increase from time to time. So, stay clear of these types of companies or stocks.

Free Cash flow is one of the most reliable and widely used metrics among value investors, as it provides an accurate position of the company’s financial condition. In simple words, free cash flow is an account of how much cash a company is left with after paying for all expenses.

Companies that manage to generate consistently large cash flows without incurring much capital expenditure are always valued higher by investors. Negative free cash flows are a sign of the deteriorating health of a company.

Parameter #12. Current Inflation

In countries like India, you should watch out inflation because the P/E ratio is adversely affected by current inflation. Owing to inflation, retail consumers spend less and the expenses rise. This will decrease the Earning per share. When EPS falls, it, in turn, increases the P/E ratio making stocks overvalued. In addition, for a growing economy like India too low inflation rate also adversely affects the stocks. So, as an intelligent investor, you should analyze the following points,

- Reserves growth must be more than the current inflation rate.

- Asset growth must be more than the current inflation rate.

- Sales growth must be more than the current inflation rate.

- Cash flow growth must be more than the current inflation rate.

Parameter #13. Enterprise Value

You need to analyze whether the enterprise value of any stock is less than its market capitalization. Usually when the stock’s enterprise value is less than the market capitalization, then it is considered that the stock is undervalued.

Parameter #14. Investment Rating

There are many rating agencies which are in operation like Crisil, Morgan-Stanley, and Standard & Poor, etc. You have to follow the rating given by these rating agencies. Generally, B+ rating is an ideal investment grade in which you are free to invest your hard-earned money. The rating B+ indicates that the company is stable and likely to grow in the near future.

Parameter #15. Business Model

Ace investor Warren Buffet once suggested that an individual investor should invest in such companies or stocks whose business model or modus operandi is clear like a day to the investors. It is very important to understand what the business of the company is like. In other words, what the company sells or what services it offers and how the company makes profit from its operations are to be considered.

Investors should also see whether the demand of the product the company sells will remain constant or move upward in future. For example, food products, steel, electronic tools are inevitable for everyday life. So, the demand of these things will remain constant or increase in the future. The companies operating in these sectors will make profit.

Again, how a company operates its business influences its profit margin. It is also a part of the business model of a company to distribute the profit among its share holders. How a company produces its products, how it sells them, how the packaging of the products are attractive, the company’s marketing policies all these things form a business model.

In addition to

The source of capital or fund to run or expand the business is also very crucial. An under debt company cannot afford to distribute the dividends among its shares holders, because a lion share of the profit goes to repay the debt. On the other hand, a company which is a zero debt company can yield better dividend and better return in the future. So, the above-mentioned points are treated as the business model of a company. By reviewing the business model you can get a clear idea whether the business model is unrealistic or there is any chance that the business will succeed.

Parameter #16. Management of the company

Management is the backbone of the company. A quality management will raise a company to the pick. It is a proven fact that good management in competitive industry will yield better returns than the worst management in monopoly market. In order to access the strength of management, you need to consider the following aspects.

- The persons who manage the company’s business and the persons in key positions i.e., CEO, CFO, COO & CIO.

- You need to examine the educational and employment backgrounds and previous employment records of the personnel. Suppose, the CEO previously worked in coal sector and then he has shifted to technology. There are minimum chances that he will succeed. Ask yourself whether he is able to deliver success to the company.

- You should analyse the management’s style how the team manages the business, whether they promote the business as an open, transparent and flexible way.

- You need to analyse when the management has taken charge. Suppose, the management has remained unchanged during the past 10 years. Then this long tenure of the management is a good indication. It means the management is quite successful and has delivered the desired financial results such as compounded sales growth, compounded profit growth, a good return on equity. If you see a company is changing a management team frequently then you need to invest your money to somewhere else.

- Again, if you watch only restructuring of business or management then you need to analyse carefully. The restructuring is not always bad. There are several businesses which have turned around. You need to watch out the new management team’s members, their past achievements. When company hires management it chooses wisely who can do well for the company’s current financials.

Parameter #17. Competitive advantage

A competitive advantage allows a company to produce quality service and better price for its customers. Then this competitive advantage accelerates the company’s sales margin which increases profit margin than its competitors i.e., pear companies. While you invest your money in any company you should choose such a company that has sustainable competitive advantage in respect of cost structure, brand reorganization, corporate reorganization, product quality distribution network and superior customary support. The brand value or name of any company is in the billions of money. A portfolio of brand influences the sales and growth of the company in many ways. It is a competitive advantage than its peer companies.

Let’s understand this with an example. Whenever we talk or think about adhesive the first name comes to our mind is Fevicol, Fevistick, Fevikwik, m-seal, Dr. Fixit etc. All these are brands of Pidilite industries. The products of Pidilite Industries possess a superior quality. The company maintains vast distribution network and superior customer service to establish this company as a market leader in the adhesive Sector or Industry.

Whenever we talk or think about Trolly or casual Bags the first name comes to our mind is Aristocrat, Skybags etc. All these are brands of VIP industries. So, you need to consider these factors before making investment in a company.

After selecting the company you need to analyse the industry or sectors in which the specific company is in operation i.e., the growth potential of the industry. A mediocre company in a growth industry can generate better return on equity than a good company in a dying industry. You have to watch out which industry is growing and likely to deliver better Return on equity.

Parameter #18. Whether the industry or company creates an entry barrier

Suppose, you want to open a restaurant then you can easily open a restaurant as it does not require the best skill level and large capital. But if you want to set up a company in adhesive industry or automobile industry or pharmaceutical industry you will face a great entry barrier created by these industries. These industries however have created massive barrier to make entry like large capital expenditure, exclusive distribution network, government regulations, patents, brands reorganizations and still counting. The harder the entry barrier is better the advantage for the existing companies are.

The bottom line is that you should analyse the news coming to you from various sources. Because of JIO, internet connection has become easily available. JIO has increased the use of Smartphone. So the sale of Smartphone, as well as the number of internet users, have rapidly increased and till counting. This has increased the demand of optical fiber as optical fiber is required to spread the internet connection to every nook and corner of the country. So, companies operating in this field are direct beneficiaries and by investing in this sector you will get better returns. As a fundamental analyst you need to analyse both the fundamental as well as the qualitative analysis of stocks so that you can choose your desired investment opportunity. The qualitative analysis of stocks will help you to choose the best company among the companies operating in any industry and yield better returns.

Let’s understand this with an example.

Whenever we talk or think about adhesive the first name comes to our mind is Fevicol, Fevistick, Fevikwik, m-seal, Dr. Fixit, etc. All these are brands of Pidilite industries. The products of Pidilite Industries possess superior quality. The company maintains a vast distribution network and superior customer service to establish itself as a market leader in the adhesive Sector or Industry.

Whenever we talk or think about Trolly or casual Bags the first name comes to our mind is Aristocrat, Skybags, etc. All these are brands of VIP industries. So, you need to consider these factors before making an investment in a company.

After selecting the company, you need to analyze the industry or sectors in which the specific company is in operation i.e., the growth potential of the industry. A mediocre company in a growth industry can generate a better return on equity than a good company in a dying industry. You have to watch out which industry is growing and likely to deliver a better return on equity.

Parameter #19. Ownership Structure

You need to check out the promoters’ stake, mutual fund holdings, Foreign Institutional investors i.e., FIIs stake, etc. As you are investing in their business, you need to know the goodwill, management intelligence, etc.

Parameter #20. Future plans

The most crucial part is to check out the future plans i.e., the expansion of business, marketing policy, etc. Suppose, Titan Company is quite famous for making ornaments, jewelry, wristwatches, etc. So, you need to keep a close eye whether Titan Company enters in a new segment or makes an expansion of business which will increase its market share.

Point #2. Include companies of large-cap companies

There are many quality companies in different sectors, then why large-cap companies? It is because large-cap companies have following benefits namely-

- Large-cap companies have become large for a long period. They are doing their business for a long time. So, they have gained credibility. Common investors can have faith in them. There are records of their performance and can be checked at will.

- Large-cap companies have become experts at providing a constant return. They provide dividend payments to investors.

- Large-cap companies are established. They have maintained a good relationship with the investors during the course of time. Due to their business model, revenue-earning it can be expected that these companies will not face problems to generate revenue.

- Large-cap companies enjoy an advantage to put much lower capital because they can gather finances from different sources easily.

- If the large-cap company is a debt-free company, the concerned company can collect loans easily.

- On an economic crisis, large companies have the potential to perform their operations.

- Usually, large-cap stocks are less volatile than the mid-cap or small-cap stocks. Beta is a measurement of the volatility of a share in respect of the market. Large-cap stocks are half as volatile as small-cap stocks.

- Large-cap stocks are safer to invest. They have records to give a constant and dependable performance.

- If invested for a long period, large-cap companies can yield steady returns for investors.

- If you are investing in the Indian economy, large-cap companies have a good possibility to grow.

- Large-cap companies provide steady compounding and dividends on a regular basis.

Point #3. When to sell stocks in your portfolio

Here are the two points to consider while selling stocks in your portfolio.

Deterioration of Earning & Falling Stock Price

When the earning of a company deteriorates, the company can correct up to 50%-60% from its peak price in the bear market. When the stocks show a constant fall in the quarterly results, it is the best time to sell the stocks instantly. So, keep a close eye on the company’s quarterly results as well as the annual results of the stocks in which you have already invested.

Deteriorating Earnings & Rising Stock Price

There are many companies that constantly deliver a weak quarterly or annual result. But owing to bull takes control of the market, they yield a 20-30% return in any period. When the bull market is over and the bear takes control of the market, these stocks slip down 100%-120% from their peak resulting in a huge loss for the investors. There are many companies such as Meenakshi Enterprise, Vakrangee, Shilpi Cable, Bombay Rayon, Artech Power, etc. which were in their 52-week high when bull took control and with the emergence of beer, these stocks corrected up to 400% from their 52-week high.

In order to make money from the stock market, you need to consider the following points

- Invest over a long-term horizon,

- Avoid herd mentality,

- Invest in a company whose business model is clear to you,

- Analyze the fundamentals, balance sheet, profit and loss account, free cash flow statement, annual results,

- Maintain a diversified portfolio including large-cap stocks, mid-cap stocks, small-cap stocks.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Why People Lose Money in the Stock Market

- Read also: Top 10 Best stocks to buy in India for long term

If you have any questions regarding how to make money in the stock market for beginners feel free to comment so that we can have a discussion. If you found this post helpful don’t forget to share with your loved ones.