Investment in the stock market is getting popular day by day. As the interest rate of FDs in Banks or Post Offices and Government Securities is falling from time to time, people are heading to the stock market in search of better returns to beat the inflation. The stock market is a profitable asset class to invest in. All you need to do to invest in the stock market is to find out the right broker who has less expense ratio in order to optimize returns. In this context, we will discuss how to choose a stockbroker in India intelligently.

Types of Broker

Before you choose a broker, you should know that there are two types of brokers namely Full-service brokers and Discount brokers. There is a misconception that Discount brokers are not genuine. As they provide service for very little charges compared to the Full-service brokers their authenticity is doubtful. On the other hand, Full-service brokers charge much higher, so people think that they are real and have government recognition. But the reality is after reviewing the services i.e. the trading platform, services offered and other factors SEBI has registered Discount brokers as stockbrokers. Irrespective of full-service brokers and discount brokers after reviewing them, SEBI has given recognition to both types of brokers as stockbrokers.

Full-Service Broker

A full-service broker offers services like giving you a savings bank account, a Demat account, a trading account, a detailed analysis of stocks, investment advice, etc. The savings account, Demat account, and trading account are commonly named as 3-in-1 account. A full-service broker gives stock recommendations, trading calls, and future & option strategy.

Discount Broker

A discount broker is a type of broker who gives you only demat cum trading account from where you can make trades i.e., buying and selling of stocks or intraday trading. Unlike a full-service broker, a discount broker does not provide any research analysis or investment advice. If you want trading tips and advice you need to pay separately for that. Again a discount broker has a low brokerage charge in comparison to a full-service broker.

- Read also: How to choose a stockbroker? – Moneycontrol.com

- Read also: How to choose a stockbroker in India for a beginner – Quora

Since full-service brokers offer customer service, detailed analysis of stocks, and investment and trading calls, they charge a little bit higher than the discount brokers.

The pros of full-service brokers are as follows,

- They offer a 3-in-1 account i.e., savings account, a Demat account, and a trading account.

- They allow the transfer of fund from savings account to Demat account and vice versa seamlessly. You need not manually transfer the funds to your broker’s account while buying a stock.

- They have many registered offices across the country. So you can go to any office according to your convenience.

- They provide complete guidelines of investment advice, trading tips of stocks, Mutual fund, IPO’s, Commodity, and Derivatives, etc.

The cons of a full-service broker are as follows,

- As full-service brokers provide investment advice and trading calls, they charge the customer a quite higher for account opening charge, annual maintenance charge and higher brokerage on every trade.

- Full-service brokers, of course, provide research reports and analysis of various stocks, but the problem is that these stock recommendations or calls are crap. In maximum cases, these suggestions are found to be useless. These brokers have nexus with different companies. Obviously they will try to provide profit to the companies they are paid for. So, these trading calls are intended to increase the trading frequency and earn brokerage.

Here is a comparison table between the full-service broker and a discount broker.

| Points | Full-Service Broker | Discount Broker |

| Account type | Offers 3-in-1 account | Only Demat i.e., Trading account. |

| Investment | Available but absolutely crap | Unavailable. |

| Charges | Higher Opening charges, Annual Maintenance Charges, Brokerages. | Lower opening charges, annual maintenance charges, and brokerages. |

| Physical presence | Offices are present for customer service i.e. PAN INDIA Network. | Available only online. |

| Transfer of Fund | Easily transfer funds from Demat account to savings account or vice versa. | Fund transfer from Demat account to savings account is time-consuming and sometimes chargeable. |

How to select a stockbroker in India

Stockbrokers offer their services through apps for android or windows smartphones. These apps help an investor not only to track stocks, mutual funds, commodities with updates but also provides minute to second updates on various stocks in market timing to make a profit. In order to choose the best stock broker in India, one individual should check out the following points.

Background & Reliability

It is very important to do proper research about the background and market reputation of the stockbroker. You can make use of reviews, complaints, how many years the stockbroker is operating in the industry and past performance. In order to avoid frauds, it is advised that you should check the app rating while installing it from the play store in your smartphone and comments thereof about the app.

Brokerages and other charges

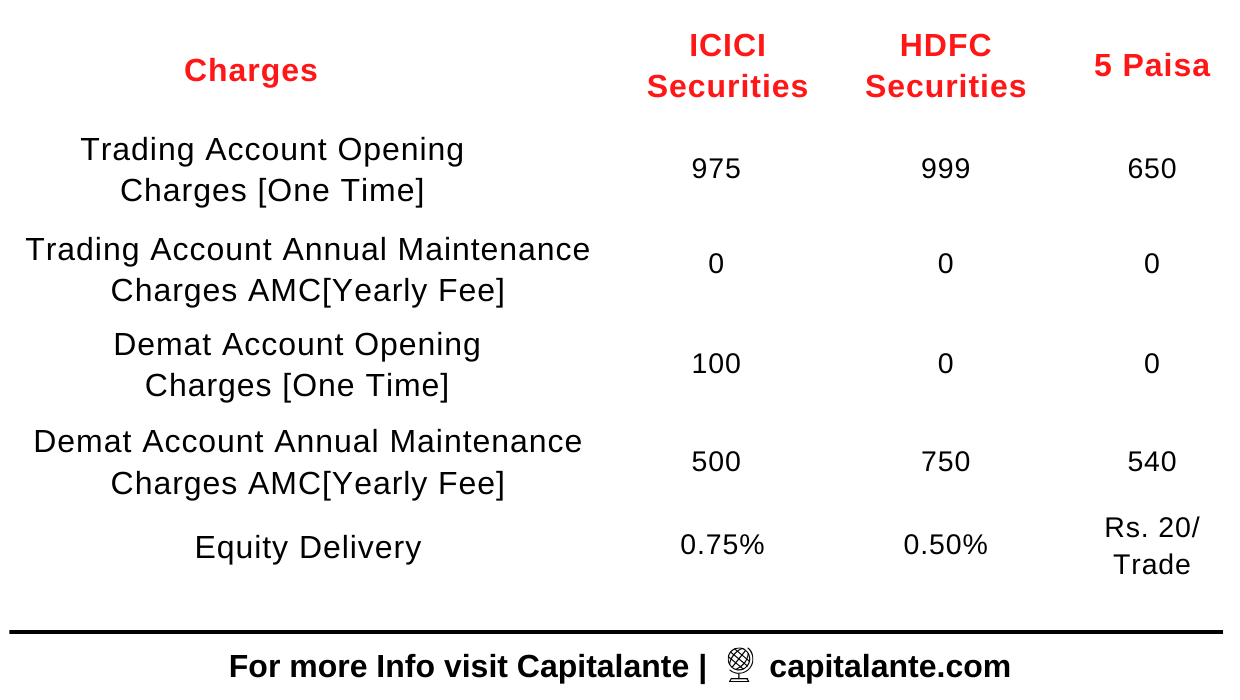

You should check out the charges i.e. account opening charges, delivery charges on equity, intraday, futures, and options, account maintenance charges on trading as well as Demat account, etc. As a smart investor, you should check out whether the respective broker has levied hidden charges to avoid unpleasant surprises.

Trading Platform

This is one of the crucial factors while choosing a stockbroker. You should check whether the trading platform offered by the respective broker is fast and user-friendly and can meet the evolving needs of the traders as well as investors. You must choose such a broker which has a great sound history of providing a stable and reliable trading platform.

Look for the minimum balance to be kept in the trading account

You need to examine whether the respective broker asks to maintain the minimum balance in the trading account just like the minimum balance in the savings bank account. You need to enquire about the minimum amount to be kept in various broking firms.

Ease of fund transfer

You must watch out whether the broker offers a 3-in-1 account i.e. savings bank account, trading account, Demat account. In the case of discount brokers, they do not usually offer a 3-in-1 account, but the full-service brokers offer such services. In the case of discount brokers, you should check whether they offer easy linking facility i.e. transfer of amount between a savings account and trading account.

Availability

If you are an intraday trader, you need to enquire about the availability of the stockbroker in market timing to ensure the timely execution of the order to make a profit. The availability of your broker plays a great role because the market or stocks fluctuate to a larger extends in a very short span of time.

Advisory and research facilities

If you are a novice investor or trader and not planning to invest yourself and need advisory services then you should check out whether the respective stock broker offers such services. You must check out the reliability and past performance of the stockbroker in advisory and research categories.

Best Stockbroker for you

The answer is hidden in your investment style. If you are a long term investor i.e. buy-and-hold investor then you need not concentrate on whether you should opt for a full-service broker or discount broker.

But if you are a trader who is interested in quick and dirty gains based on short term price volatility, then you should choose a discount broker with very low brokerages and trading fees. If you choose regular brokers then brokerages and trading fees take a big bite out your intraday returns.

- Read also: Top 21 Stock Market Books Must Read Right Now in India

- Read also: How to make money in the stock market

If you have any questions regarding How to Choose a Stockbroker in India for beginners feel free to comment so that we have a discussion. If you have found this post helpful don’t forget to share with your loved ones.