The Insurance sector is a great addition to an investor’s stock portfolio. The insurance sector not only delivers better returns in the long run but also is a recession-proof sector, since insurance is everyone’s basic need nowadays after the corona pandemic. When you will leverage various valuation matrices, you will find the best insurance stocks to buy at an attractive valuation.

3 Points to Consider before investing in Insurance Stocks

When you are investing in any industry-specific stocks to diversify your stock portfolio, do consider the following points.

Do you have a clear idea about the business model of a company?

Have you a clear understanding of how the company generates its revenue? Will the products of the company tackle the peer competition? What are the future plans of the company? If yes, then you are free to invest in any sector without any woes.

Whether the products or services of any sector will still relevant after 30 or 50 years?

This is the must question you should consider. After proper analysis when you find that the sector has huge upside potential in the near future, stay invested in that sector for the long run to create wealth.

Are you investing in any stock recommended on CNBC?

Don’t invest blindly in the stock market without analyzing the earnings, valuations, etc. that are recommended by weekend warriors on CNBC.

How to Pick Insurance stocks for Consistent Returns

After choosing the sectors where you wish to invest, you need to pick the best stocks for consistent returns. In order to pick the best stock, you should check out the following parameters of the company.

Parameter #1. Revenue – Revenue or net sales of a company should be constant for at least 5 years. You may check that the company has been generating sales growth annually during the last 5 financial years of at least 10%.

Parameter #2. Net Profit – The net profit of a company increases at least 15% on a year-on-year basis.

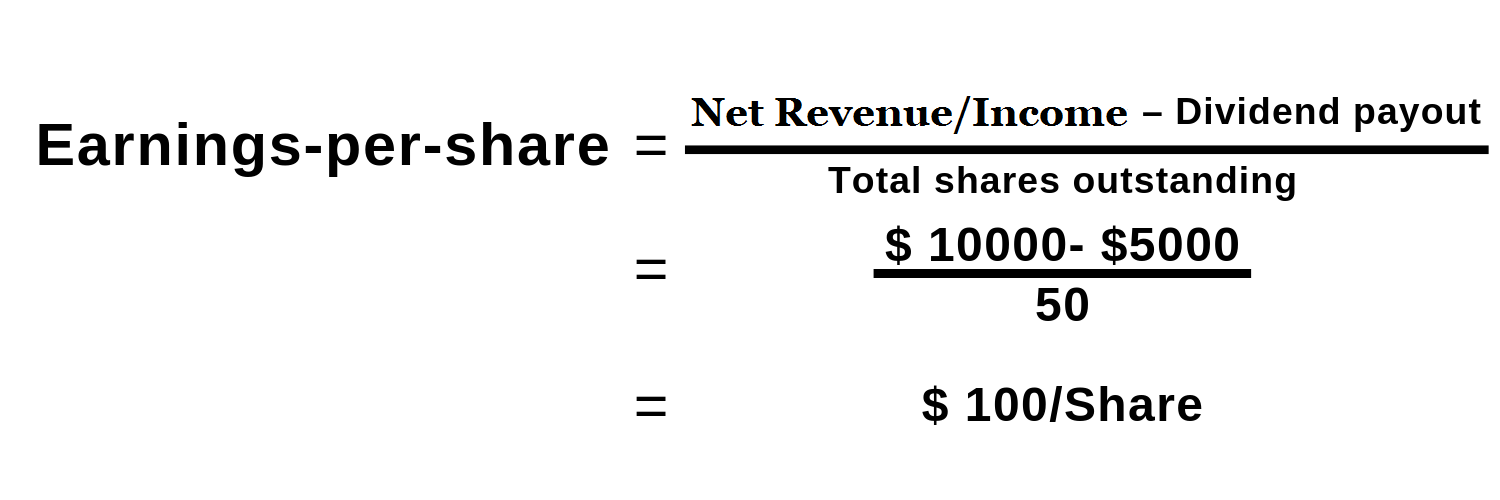

Parameter #3. Healthy dividend payout and stable Earnings-per-share

Let’s assume, a company has a net income of $ 10,000 per year. It Pays $5,000 in a preferred dividend to investors. It has 50 shares outstanding.

It is a good idea to invest your money in those stocks that regularly pay a dividend and deliver a Healthy dividend payout. The stocks which have delivered healthy dividend-paying must have the following features

- Consistent dividend payout over the past 5 years.

- The high dividend yield for the last 5 years.

- Growth in dividend per share from time to time.

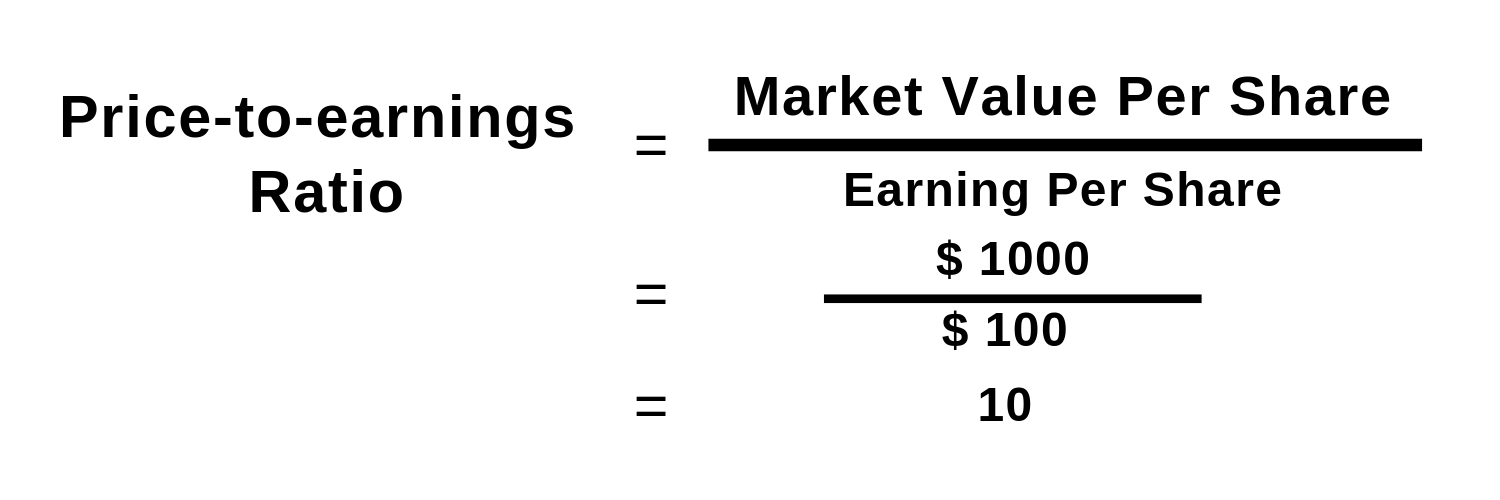

Parameter #4. Price to Earnings Ratio (P/E)

P/E ratio should be as low as compared to the other peer companies active in the same industry.

Let’s assume, a company has a net income of $10000 per year. It Pays $5000 in preferred dividends to investors. It has 50 shares outstanding.

Now, if the stock currently trades at $1000, then

You need to choose such stocks that have P/E less than 9. But P/E varies from sector to sector. Lower P/E ratio of sectors does not mean that this sector is undervalued and is going to boom and deliver a multi-bagger return in the near future compared to that sector which has a higher P/E ratio. These sectors have higher valuation just because the market is bullish on these sectors and their future potential like Automobile, FMCG, Petroleum, etc. They are the core sectors of the Indian economy and have the potential to deliver a robust performance in the upcoming years.

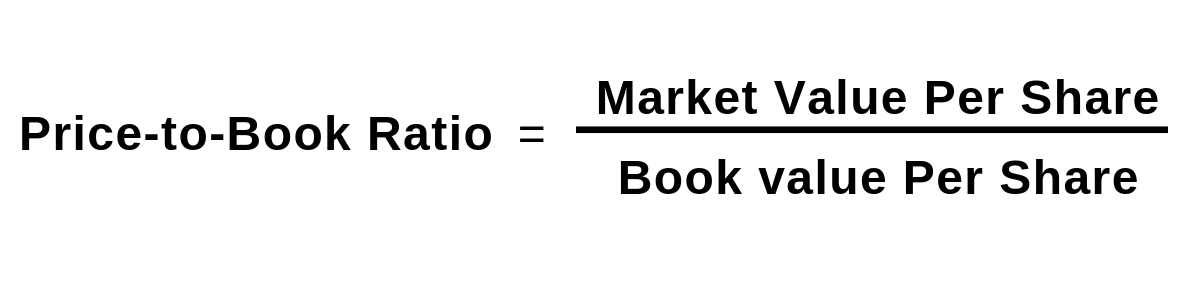

Parameter #5. Price to Book Ratio (P/B)

P/B should be low as compared to the peer companies operating in the same industry.

Let’s assume, the stock currently trades at $ 100 and the book value per share is $ 10 then,

P/B Ratio = [$100/$ 10] = 10.

You need to pick such stocks that have a P/B ratio of less than one.

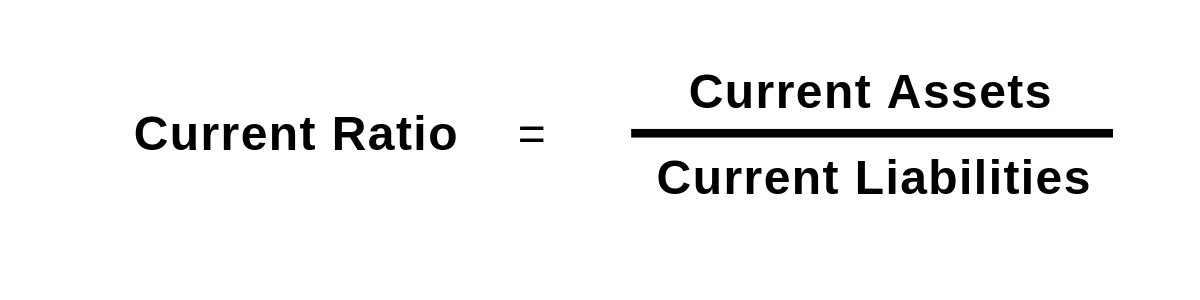

Parameter #6. Current Ratio

The ratio is the snapshot of the asset and liabilities of any company. You will find the assets and liabilities a company has in its balance sheet. Find such quality stocks that have a current ratio of more than 1.5.

Let’s assume, the current assets of any company is $ 1200 and current liabilities is $ 400 then,

Current Ratio = [$1200/$ 400] = 3.

Parameter #7. Debt to Equity Ratio

This is the comparison between a company’s own capital and the debt which the company borrows from a bank or a financial institution.

Suppose a company has a capital of Rs. 100/- and it has borrowed Rs. 100 from a bank.

So the debt ratio of the company is 100:100 = 1

A debt-free company is desirable. If not so the ratio must be low to 0.10 or 0.25.

If the company has marginal or low debt or it is a debt-free company, the company is worth investing in. Let us illustrate what is the difference between a high debt company and a debt-free company. When a company has huge debt from the market or bank or any other commercial institutions, then the company concentrates on the debt and its effort goes to pay the debt.

It cannot be sincere about the service, quality of the product, or any other important aspects needed in the business. On the other hand, if the company is debt-free, the company can concentrate on product quality, service, and customer satisfaction only. That is why a debt-free company is better than a high debt company.

Parameter #8. Return on Equity (ROE) – should be greater than 20%

Parameter #9. Dividend Yield – You can ensure about good dividend yield by the company.

Parameter #10. Beta

Beta is a measurement of the volatility of a share in respect of the market. When Beta is less than 1, it means that the share is theoretically less volatile than the market. It means the common individual may invest his money for the long term. Again, if Beta is more than 1 means that the share is theoretically more volatile than the market. For example, if a stock’s beta is 1.2, it means the stock is 20% more volatile than the market. So, a lesser beta means people are investing in that specific stock with a long-term perspective.

Parameter #11. The cash flow of the company

To understand a company’s true economic condition one should check the free cash flow of the respective company. Free cash flow actually reveals the profit the company makes. It implies a broader range in the company’s functioning in the overall business.

Whenever you check the free cash flow of a company, you should analyze from which source the company is gaining its capital for its day-to-day business. Usually, there are two sources, the first one is earning from running operations i.e., business, and the second one is receiving debt from the market i.e., debt financing. If the company runs its operation from the profit earned by running operation you should stay invested with the company. But if the company runs its business with debt financing, naturally the debt will increase from time to time. So, stay clear of these types of companies or stocks.

Free Cash flow is one of the most reliable and widely used metrics among value investors, as it provides an accurate position of the company’s financial condition. In simple words, free cash flow is an account of how much cash a company is left with after paying for all expenses.

Companies that manage to generate consistently large cash flows without incurring much capital expenditure are always valued higher by investors. Negative free cash flows are a sign of the deteriorating health of a company.

Parameter #12. Competitive advantage

A competitive advantage allows a company to produce quality service and better prices for its customers. Then this competitive advantage accelerates the company’s sales margin which increases profit margin than its competitors i.e., peer companies.

While you invest your money in any company you should choose such a company that has a sustainable competitive advantage in respect of cost structure, brand reorganization, corporate reorganization, product quality distribution network, and superior customer support. The brand value or name of a company is in the billions of money. A portfolio of brand influences the sales and growth of the company in many ways. It is a competitive advantage over its peer companies.

Let’s understand this with an example. Whenever we talk or think about Graphic card the first name comes to our mind is GeForce RTX, GeForce GTX, QUADRO RTX, G-SYNC, etc. All these are brands of ‘Nvidia’. The products of NVIDIA possess superior quality. The company maintains a vast distribution network and superior customer service to establish this company as a market leader in the Technology Sector around the globe.

After selecting the company you need to analyze the industry or sectors in which the specific company is in operation i.e., the growth potential of the industry. A mediocre company in a growth industry can generate a better return on equity than a good company in a dying industry. You have to watch out which industry is growing and likely to deliver better Return on equity.

Top 7 Best Insurance Stocks to Buy

When you are in a witch hunt for the best insurance companies to invest in, take a close eye on its free cash flow and its valuations. When management is quite efficient then the company will continue to deliver better earnings and thus reward the shareholders by announcing dividends.

Apart from that, take a close look at valuations since maintaining a margin of safety will boost better returns in the long run. When a stock trades much lower than the industry average with robust earnings, it is deemed to be the best bet.

Allstate Corporation [ALL]

This is the most valuable brands of property and casualty insurance providers. The Allstate Corporation offers life insurance, accidental coverage, and health insurance policies. It has a 12% market share in this segment. The Bank of America has a buy rating with a target price of $138 for Allstate Corporation.

MetLife [MET]

MetLife is one of the world’s largest life insurers. Metlife has a diversified product portfolio of Life insurance policy, insurance products for automobile and home-owners, and retirement products. Metlife’s revenue stream is also diversified. MetLife generates its revenue 40% from international customers, 55% from the US.

MetLife’s Price to earnings ratio is 7.81 and the Dividend Yield is 3.87%. These factors make MetLife a perfect buy when invested for the long run.

Progressive Corporation [PGR]

Based in Mayfield Village, Ohama, this insurance company is engaged in offering insurance policies for personal and commercial auto. Owing to the Covid-19, it was thought the business would be impacted. But do note that the earnings per share have grown at a level of 23% a year for the past 5 years. The Bank of America has a ‘Buy’ call for $107.

Prudential Financial (PRU)

Prudential Financial, based in Newark, New Jersey, offers various insurance products namely annuity and life insurance policies to the individual. The company offers not only retirement solutions but also a group insurance policy for corporates. They have offered individual life insurance products, retirement products to the markets of Japan, Korea, etc.

Though the stock has been punished by the market, the stock is still to deliver a 5.50% Dividend Yield. For those investors who are looking for dividend stocks, they can hold the stock for regular dividend payments.

Hartford Financial Services Group [HIG]

Hartford Financial deals in providing coverage of workers’ compensation, house property, and automobiles throughout the US. The company offers not only accident and disability coverage but also investment products for individuals.

Since the company has robust profitability and trading at an attractive valuation, the Bank of America has a ‘buy’ rating with a target of $55 for HIG.

Principal Financial Group [PFG]

This company offers various financial products that cater to all categories namely individuals, business entities, and institutions. The company offers diversified products and services including, retirement solutions, insurance products, and investment products namely asset management, annuities, and mutual funds.

Since the company is engaged in a fee-based business segment with a robust free cash flow, this will make a worth buy when invested for the long run. Additionally, it’s trading at lower P/E levels in comparison to peer companies.

Athene Holdings (ATH)

This company has engaged itself in the segment of reinsurance of retirement products. Apart from that, the company also reinsures not only individual annuities but also group annuities. Based in Bermuda the company has $145 billion in assets. A conservative investor with a low-risk appetite can invest in this growth stock.

read also : How to Invest in the Stock Market

read also : How to Pick Best Stocks for Consistent Returns

Hope this article will help you to pick the best insurance stocks that will yield better returns. Have a question? Make a comment so that we can have a discussion.