Are you planning for retirement or specifically early retirement? Want to live a worry-free retirement life?

Then you must apply goal-based planning to cover all of your future expenses like to own a house, buy a car, education cost of children, and above all retire with $3 million in your bank account to live a happy retirement life. This article will give you a snapshot of Goal-based Planning.

What is Goal-Based Planning?

Goal-Based Planning helps a retail investor to find the exact financial goals. It offers investment solutions to meet the goals in the future. Goal-based planning means you plan early about future obligations yet to come. You make a roughly estimate about the money you will need after your retirement for livelihood, education, and marriage cost of your children or any other obligations. When you are hunting high and low to achieve financial inclusion then you should apply goal-based planning.

While opting for goal-based planning you should consider how you will lead the retirement life or what exact amount of money you should have in your bank account when you are going to retire. Here are the few goals that can be achieved when you apply Goal-based planning,

- Buy a residential house

- Buy a luxury Sedan

- Prepare a fund for children’s education or career-making and marriage

- Retirement planning

- Renovation of your existing house

- Go to the internal vacation

- Gift your spouse with a diamond ring.

The Advantages of Goal-Based Planning

Here are the 3 advantages when you apply goal-based planning,

You will save more – When it’s time to create a corpus for the future and meet the obligations, you will witness a hike in savings. Goal-based planning becomes must for those who live paycheck to paycheck. From the latest studies, it has been found that the families who have prepared goal-based planning have higher savings than those who don’t.

Investing regularly – When you have calculated the desired corpus that will lead to a happy retirement you will eager to stick with the SIPs irrespective of market volatility, to achieve success. The calculation for the desired corpus will lead you to stick to the SIPs irrespective of market volatility. You have applied goal-based investing means you are looking for long term goals rather than the current market scenario.

Balanced Lifestyle – Increase in your income on year on year basis is an opportunity to save more to create a budget to meet future obligations namely children’s education or marriage. You will save more without eroding your increased disposable income to upgrade the lifestyle.

7 Step process to prepare a Goal-Based Planning

Here is the 7 step process to achieve financial freedom by making use of Goal-Based Planning.

- Step #1. Decide how to lead a retirement life.

- Step #2. Calculate the corpus to meet the future obligation and retirement fund.

- Step #3. Check the current scenario.

- Step #4. How much you are fall short of the required corpus.

- Step #5. What strategies you should apply to save and invest more.

- Step #6. How to invest in various asset classes.

- Step #7. Start Investing Now.

Step #1. Decide how to lead a retirement life

First of all, consider the wish and need to lead a worry-free retirement life. If you want to travel to Paris, but have a limited fund, then you should visit Paris, Texas in the US instead of Paris in France.

Apart from that, you should prepare a budget for household groceries, Netflix subscriptions, medical casualties, etc. Cut the entertainment if your budget doesn’t support those items.

read aslo : Should I Retire with $1 Million

Step #2. Calculate the corpus to meet the future obligation and retirement fund

Let’s calculate the corpus that will be needed to lead a happy retirement life without woes.

Suppose you are of 30 years and your yearly expenditure is $45,000 now.

So, your annual expenditure after 30 years [at the age of 60 years] will be $94,391 assuming a 2.5% inflation rate.

So, in order to lead a happy retirement life after 60 years of age and if you live at least 80 years, then you will need to manage a corpus of [$94,391 × 20 years = $18,87,820].

Now after creating a retirement fund, it’s high time to create a fund to meet the future obligations.

Suppose, you stay with your family in any rented house in California and you have got one son and one angel. So, in order to meet the future obligations like to own a house, the education cost of son and angel, the marriage ceremony cost you need goal-based planning. Let’s calculate it.

Suppose the tuition fees and boarding fees in a public college of 4 years program is $21000 a year for a child. Now, the total cost for the higher education of your daughter and son, let’s say after 15 years = $231,728, assuming a 2.5% inflation.

If the marriage cost right now is $34000 then the marriage cost of your daughter and son including inflation after 20 years will be $110,000, assuming a 2.5% inflation.

Now if the amount needed to own a house is $430,000 then the desired amount needed to own a house after 20 years including inflation = $622,768, assuming a 2.5% inflation.

Now, the total fund you will need = [$1.9 million + $231,728 + $110,000 + $622,768] = $3.2 million.

Step #3. Check the current scenario

After calculating the numbers, now it’s time to evaluate the current financial condition. If you have a current cash flow then you should try to achieve the figure before retirement. When you are 30 years apart from your retirement then its time to start a fresh beginning to achieve the figure to live a worry-free life even after retirement.

Let’s Calculate.

Suppose, your current yearly income = $51,000.

Yearly expenses i.e. household, insurance, etc. = $40,000.

Savings per year = $11000.

So, approximately you have around $900 savings per month.

If you invest this $900 per month in any equity-oriented mutual fund you will get around $2.7 million after 30 years assuming 12% CAGR.

The desired corpus you will need at the age of 60 = $3.2 million.

Step #4. How much you are short of the required corpus

From the above calculation, you are getting short of around $500,000 in order to lead a happy retirement life.

Step #5. What strategies you should apply to save and invest more

When you are lagging behind your target retirement corpus, here are the 5 strategies you may apply to reach the desired corpus.

Get serious about lifestyle changes for early retirement

with the hike in salary, invest the excess amount to secure the financial future in the long run. Don’t live a lavish life with the additional amount you have received in your checking account.

Skipping at least 2-weekend dinners in a month

Do you go to a restaurant once a week with your family? To save more, skip the weekend dinner at the restaurant instead stay at home and make a delicious recipe at home and save money. I will insist you to exercise this practice on alternate weekends to boost the retirement corpus.

Use a bike or Public transport instead of 4 wheeler car

What is the distance between your office/place of work and your house? If the to and fro distance is more than 40 km then you should take a public bus and perform the duty. When you don’t buy a car and invest the lump sum amount, your invested capital is likely to grow and help you to achieve financial inclusion.

Smoking or taking alcohol increases not only the probability to get admitted to the hospital but also the term insurance premium. Needless to say, nicotine causes cancer. So, it is a good idea to quit smoking and taking alcohol right now. This not only destroys your health but also minimizes your earnings significantly.

Get rid of junk foods and soda or soft drinks

It is a proven fact that US children and adults consume junk foods namely pizza, burgers, and soft drinks excessively. This habit increases obesity, cholesterol, etc., and makes your health prone to diabetes and other incurable diseases. To get rid of these diseases and health problems, avoid the consumption of fast food, soda, and soft drinks, etc.

Get rid of spending on sale

Shopping malls or shops, as well as online e-commerce companies, offer different discounts or cashback offers from time to time, especially on occasions like New Year, Christmas, Halloween, Thanks Giving day, etc. When a user like you and me find some exciting deals that allow 50% or 70% discount, people gets tempted to avail of these exciting offers even when we don’t need them. These offers and discounts are the business policy of retailers to increase the sale of products or services. In this way, many people pay a huge bill to buy unnecessary items that are not essential anymore. To achieve financial freedom you should avoid the sale when you don’t need the stuff right now.

Step #6. How to invest in various assets classes

At the time of investing, you should diversify the fund across various asset classes namely Stock Market, Bonds, Gold, etc. to minimize risk. When you are investing for the long run then you should invest in the stock market, since historically, the stock market has surpassed all the asset classes in respect of return on investment. To meet the short-term obligations like buying a car, or going on a vacation, invest in bonds as in the short-run stock market is a voting machine but in the long-run stock market is a weighing machine.

Step #7. Start Investing now

To lead a happy retirement life, you need to start investing as early as possible.

But why should I need to invest early?

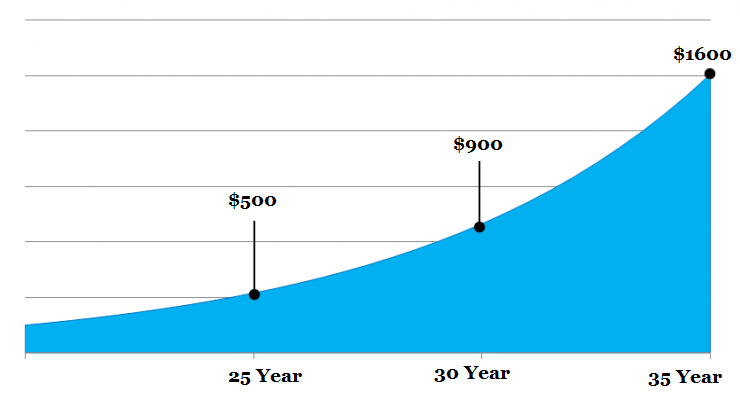

To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just $500 per month then you will get $2.7 million when you are 60 assuming a 12% CAGR. If you are late by 5 years i.e., start investment at the age of 30, then you need to invest $900 per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 35 years then you need to invest $1600 per month.

Additionally, when you start investing early you can start investing with a little amount. You can get a much higher corpus when you will increase the investment amount owing to the salary or income hike.

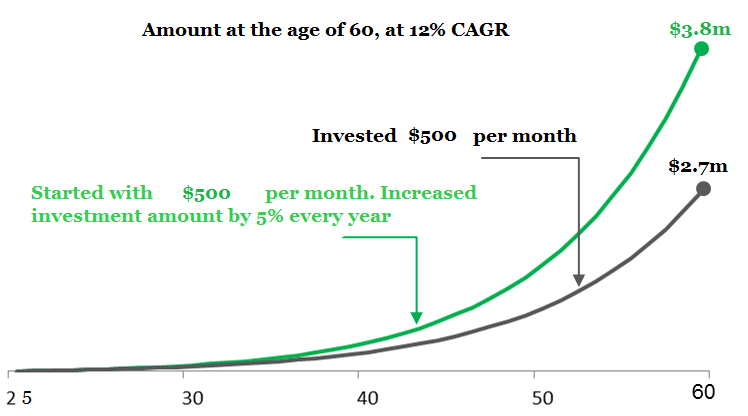

Let’s understand it with the following graph.

As shown in the graph if you make a SIP of $500 per month for the upcoming 35 years, then you will get $2.7 Million. If you increase the SIP amount by 5% every year then you will get $3.8 Million after 35 years. So, step up your SIP amount as possible.

| 10 Step to Start Investing in Stock Market for Beginners |

How to meet the retirement corpus?

To meet the desired corpus here is the step by step strategy to meet the goals in the long run. Let’s discuss.

To create the Retirement Fund

If you start investing in any equity-oriented mutual fund schemes at the age of 30 years with just $700 per month then you will get $2 Million when you will be 60 assuming a 12% CAGR. If you are late by 5 years i.e., start investment at the age of 35, then you need to invest $1200 per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 40 years then you need to invest $2200 per month.

To meet the Education cost

If you start investing in any equity-oriented mutual fund for the period of the next 15 years with just $500 per month then you will get $48,000 after 15 years, assuming a 12% CAGR.

To meet the Marriage cost

Any equity-oriented mutual fund schemes for the period of the next 20 years with just $150 per month will yield $137,928 after 20 years assuming a 12% CAGR.

Fund to buy a house

When you start investing in any equity-oriented mutual fund scheme with just $700 per month, you will get $6,43,279 after a span of 20 years assuming a 12% CAGR.

Hope this article will help you to prepare Goal-based planning. If you find this article helpful feel free to share it with your loved ones.