Today there are many investment plans available before investors for tax savings instruments. These plans offer a variety of investment options that can fulfill all their investment criteria such as high returns, low risk, maintaining liquidity of portfolio, and advantage of tax saving. Public Provident Fund (PPF), NPS, NSC, ELSS Mutual Fund are the popular tax saving investment options. In this column we will discuss what is ELSS, why Invest in ELSS and the best ELSS funds to invest in India.

What is ELSS?

Equity Linked Saving Scheme (ELSS) is a kind of mutual fund offered by several Mutual Fund houses. In this scheme, your money is invested in several companies just like normal mutual fund schemes. It allows investors to save taxes up to Rs 1.5 lakh under Section 80C of the income tax act, 1961. It has a lock-in period of 3 years. You are free to invest either by giving a lump sum amount at once or make investment via the SIP route. In the case of ELSS, an investor can stop contribution but cannot withdraw wholly or partially of his total investment before 3 years from the date of the first contribution.

Why ELSS?

One: To beat the inflation

Most investment options available under Section 80C like Public Provident Fund, National Savings Certificate, etc. are government-backed investment options. These schemes typically offer modest returns of 7-8% per annum as these schemes invest the money in Debt instruments, Bonds, and Government securities. That means investors would find it difficult to create wealth after beating the inflation with these investments as the inflation rate is 7%. It is important to beat inflation to create wealth for long-term goals. On the other hand, ELSS Invests the maximum amount of money in equities. It has given around 15-16% return over the past 10 years.

Two: Better Growth potential over a long-term horizon

An ELSS invests mostly in stocks. It is a well-accepted fact that equity has the potential to generate superior returns than other asset classes over a long period. Many studies and records justify this claim. So, if you want inflation-beating, better post-tax returns, you should invest money in ELSS funds.

Suppose you start investing with Rs. 1000/- per month in ELSS Mutual Fund, after 15 years your absolute return will be Rs. 6,17,355/- assuming 15% CAGR.

Three: Shortest Lock-in Period

ELSS has the shortest lock-in period among the investment options available like PPF, NSC, etc. under Section 80C of the income tax act, 1961. An ELSS has a mandatory lock-in period of three years. It has a plus point that investment can be stopped even after one month. But one can withdraw money partially or wholly after the completion of 3 years Lock-in-period.

Four: Minimise the Market Volatility

ELSS funds curb the volatility associated with the stock market. Many retail investors get panic when they see their investments losing value significantly. But after a certain period market recovers its loss and yields a significant return. As the ELSS scheme has a mandatory lock-in period of three years a market can never be downward for three years. It will definitely go upward and offer a superior return in the long term.

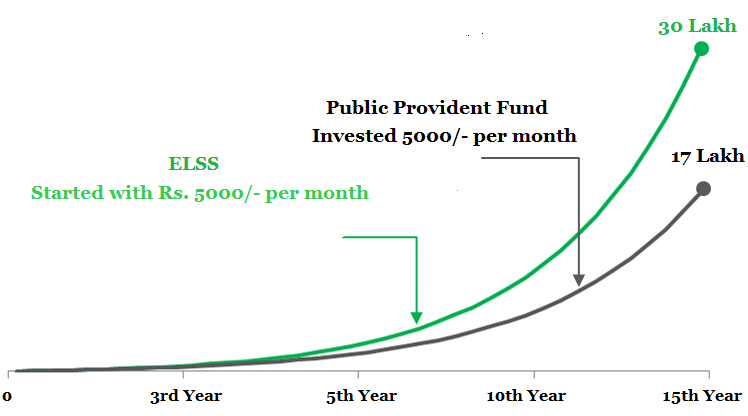

Let’s understand this by comparison of return between ELSS and other options like PPF, NSC, etc. with the following graph.

As shown in the graph if you make a contribution of Rs. 5000/- per month for the upcoming 15 years, then you will get Rs. 17 Lakh in the case of Public Provident Fund assuming an 8% return. But if you make a SIP of Rs. 5000/- per month for the upcoming 15 years, then you will get Rs. 30 Lakh in the case of ELSS assuming a 15% return.

Five: You can start an investment with a small amount of Rs. 500/-

Nowadays, there has been a tradition that people go to restaurants or hotels once a week. They spend at least Rs. 1000/- for four members of the family. This extra luxury can be skipped once in a month. If you manage to skip once and start an investment with this Rs. 1000/- for the rest 30 years you will get Rs. 46 lakh after 30 years assuming 15% CAGR.

Six: Reduce Taxable Income

Let’s understand this with an example.

Usually, Bank FDs offer a 7-8% interest rate. In this case, let’s assume that the interest rate is 8%.

Investment corpus = Rs. 5 lakh.

Time horizon = 5 years.

Rate of interest = 8%

Interest earned = Rs. 2 Lakh.

So, you need to pay tax on the Rs. 2 lakh on the basis of your income which is between 10%-30%. In this case, you need to pay 10% taxes which means you need to pay = 20% of Rs. 2 lakh = Rs. 20000/-

So, your absolute return after taxes = Rs. 5 lakh + Rs. 1.8 lakh= Rs. 6.8 Lakh.

In the case of Equity-linked Savings Scheme,

On the other hand, the equity asset class gives a 15-16% return year-on-year.

Investment corpus = Rs. 5 lakh.

Time horizon = 5 years.

Rate of interest = 15%

Market return = Rs. 5 Lakh.

According to Government rule, you need to pay 10% taxes as a long-term capital gains tax if your return is more than Rs. 1 lakh. So, you need to pay taxes on the rest Rs. 4 lakh at the rate of 10% as long-term capital gains taxes. In this case, you need to pay 10% taxes which means you need to pay = 10% of Rs. 4 lakh = Rs. 40000/-

So, your absolute return after taxes = Rs. 5 lakh + Rs. 4.6 lakh= Rs. 9.6 Lakh.

Seven: Investing in ELSS is now a lot easier

Due to the advent of modern technology, an interested individual can invest in the stock market sitting from his or her home. To do that you need to have an e-mail id, a PAN Card, a document as an address proof, a passport size photograph, and an internet connection. Many brokers and mutual fund houses offer one hour account activation. All you need to do is to visit the official website of a stockbroker or the mutual fund house and upload the documents there. Then within 24 hours, your account will be activated. Now, you are free to invest either to direct equity or in the mutual fund as much amount as you wish to invest.

How to Pick Best ELSS Funds

In order to choose the best ELSS funds, we have taken consideration of three parameters,

Expense Ratio

The expense ratio is a charge that your Mutual fund Company or your agent/distributor/broker imposes for its services. You may rather increase your investment amount via SIP instead of increasing the number of your ELSS mutual fund.

Evaluate portfolio management and past results

A quote is relevant in this case, “Past performance does not guarantee future returns”. So you need to keep an eye on the management of the mutual fund or the investment strategy of the fund manager. The mutual fund usually distributes your money into many companies or stocks. Here you may check-in which stocks your money is invested. You may also check the returns your mutual funds generate for you once in a year. Further, you may check the mutual funds’ performance and their portfolio before starting investment in them i.e. returns delivered in the past 10 years. The average return for the past 10 years is 18-19%.

Asset size i.e. Assets under management (AUM)

The lower the asset size of your equity mutual fund is the higher the risk is involved. So you need to choose such an ELSS mutual fund which has a comfortable asset size in hundred of Crores Indian rupee.

Investment Rating

There are many rating agencies that are in operation like Crisil, Morgan-Stanley, Value Research, Standard & Poor, etc. You have to follow the rating given by these rating agencies. Generally, A+ or Rank 1 or 5-Star rating is an ideal investment grade of an ELSS in which you are free to invest your hard-earned money.

In which sectors the mutual funds invest the money from the retail investors?

Now, you need to analyze in which sectors the mutual funds make an investment. You need to consider the future potential of the sector, competitive advantage, whether the demand for the sectors or products will remain constant in the near future, the growth possibility, if the industry or the sector has any strong entry barrier, etc.

We can take examples of mining and utility products. They have delivered better returns in the recent past, but now they are not able to deliver a satisfactory return and their future possibility is also less. So, as a smart investor, you need to choose such mutual funds that make the investment in such sectors that have an untapped market opportunity and a strong growth opportunity in the future. We are now going to discuss some sectors which have the following entry barriers.

- These sectors have prestigious and established brands that work as a strong entry barrier for newcomers.

- The existing companies have various patents.

- Irrespective of software company or an FMCG company or insurance company, one needs to fulfill a number of legal requirements and stringent Government policy.

- High capital requirements.

- The suppliers are already satisfied with the profitability that the traditional brands offer and they do not prefer to take a risk with the new entrants.

Top Sectors to Invest

Here are the top 11 sectors which fulfill the above-mentioned points.

- Banking Sector

- Information Technology

- Finance Sector

- Fast Moving Consumer Goods (FMCG)

- Automobile industry

- Manufacturing

- Chemicals

- Engineering & Capital Goods

- Pharmaceuticals

- Consumer durables

- Services Sector

You need to watch out whether the mutual funds invest 80% fund in these core sectors which have a sustainable competitive advantage, the constant demand for the services or products they offer, the growth possibility, strong entry barrier, etc.

Top 5 Best ELSS funds to invest in India 2021

Why should you invest in the above-mentioned funds?

These funds have outperformed for 1 year, 2 years, and 5 years in comparison to other ELSS Funds.

The above-mentioned ELSS funds have the highest rating from Value Research and Crisil.

The ELSS Funds have Assets under management (AUM) of more than Rs. 500 Crores.

The above-mentioned funds have more than 80% exposure in the core sectors of our economy like Banking & Financials, Information Technology, Oil & Gas, FMCG, Automobile industry, Manufacturing, Chemicals, Engineering & Capital Goods, Pharmaceuticals, Consumer durables, Cement & Construction, Services Sector, etc.

How Capitalante can help you

Capitalante has a team of well qualified and professional equity analysts who will help you to prepare an effective investment strategy to reach the desired retirement corpus by proper financial planning i.e. an investment portfolio of stocks, mutual funds, etc. according to risk appetite and time horizon. For more information feel free to contact us.

If you have any questions regarding the best ELSS funds to invest in India 2021 feel free to comment so that we have a discussion. If you have found this post helpful don’t forget to share this post.