Looking for the Best Mutual funds to invest in India for long-term Investment that may give a steady return with minimum risk? Picking the best mutual funds to buy in India for long-term investment is a difficult jargon to solve. But you can pick good mutual funds after making a proper analysis. Here we will recommend you the top 10 best mutual funds to invest in for the long-term to get consistent returns.

Why should you invest in Mutual Funds?

You can invest little amount per month via Systematic Investment Plan (SIP) in mutual funds because,

- To beat the inflation

- Better Growth potential over a long-term horizon

- Passive income source

- To create a second source of income

- You can start an investment with a small amount of Rs. 500/-

- No lock-in period

- Power of compounding.

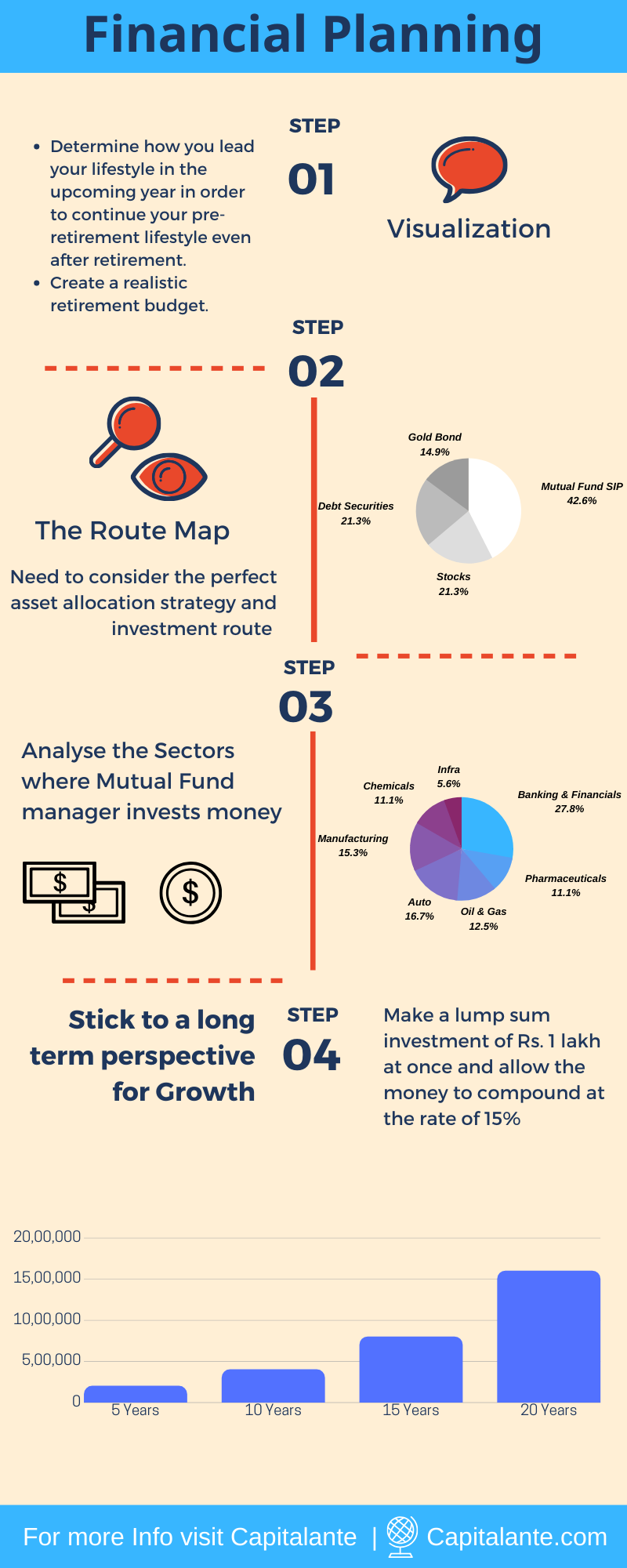

Set up a realistic corpus you need in the future by proper financial planning

In order to make perfect financial planning, you must have a clear view and a good understanding of the expenses that will be required to live even after your retirement. Many persons just start investing in mutual funds, just because it gives a better yield in the long term than the bank FDs. They are not aware of the risk associated with an investment in the stock market. On the other hand, mutual funds carry less risk. It is seen that mutual funds provide a satisfactory return after a long period.

- Read also: Historic Returns – Top Ranked Funds

Let’s make it clear with the following example,

Suppose you are of 30 years and you have got one daughter and a son and taken a home loan of Rs. 20 lakh which is to be repaid in the upcoming 20 years.

Home loan = Rs. 40 Lakh

Education cost of children after 15 years = 30 Lakh

Marriage cost of Daughter after 20 years = 40 Lakh

Your total cost in the upcoming 20 years = 40 + 30+ 40 = Rs. 1 Crore and 10 Lakh.

Retirement Planning

Now let’s calculate the desired corpus you need to accumulate when you retire at the age of 60 years if you have started your professional career at the age of 25 years.

Your yearly salary – Rs.3, 00,000/-, assuming Rs. 25,000/- a month.

Your yearly Household Expenses – Rs. 1, 80,000/-, assuming Rs. 15,000/- a month.

Term insurance premium – Rs. 7,000/- assuming assured sum of Rs. 1 crore for a term of 35 years.

Health insurance premium – Rs. 8,000/-, assuming a cover up to Rs. 5 lakh/ year for a term of 35 years.

Expenses on festive seasons = Rs. 25,000/-

So, your expected expenses throughout a year is = Rs. 1, 80,000/- + Rs. 7,000/- + Rs. 8,000/- = Rs. 25,000/- = Rs. 2, 20,000/-.

Then, the expenses at the age of 60 years assuming a current inflation rate of 7% will be = Rs. 21 lakh. [excluded term insurance premium and health insurance premium since they are fixed at the time of buying].

So, you have to accumulate a corpus of [Rs. 21 Lakh × 20 years = Rs. 4.2 Crore] at the age of 60 years assuming you will live at least 80 years.

Make a roadmap to reach your desired corpus

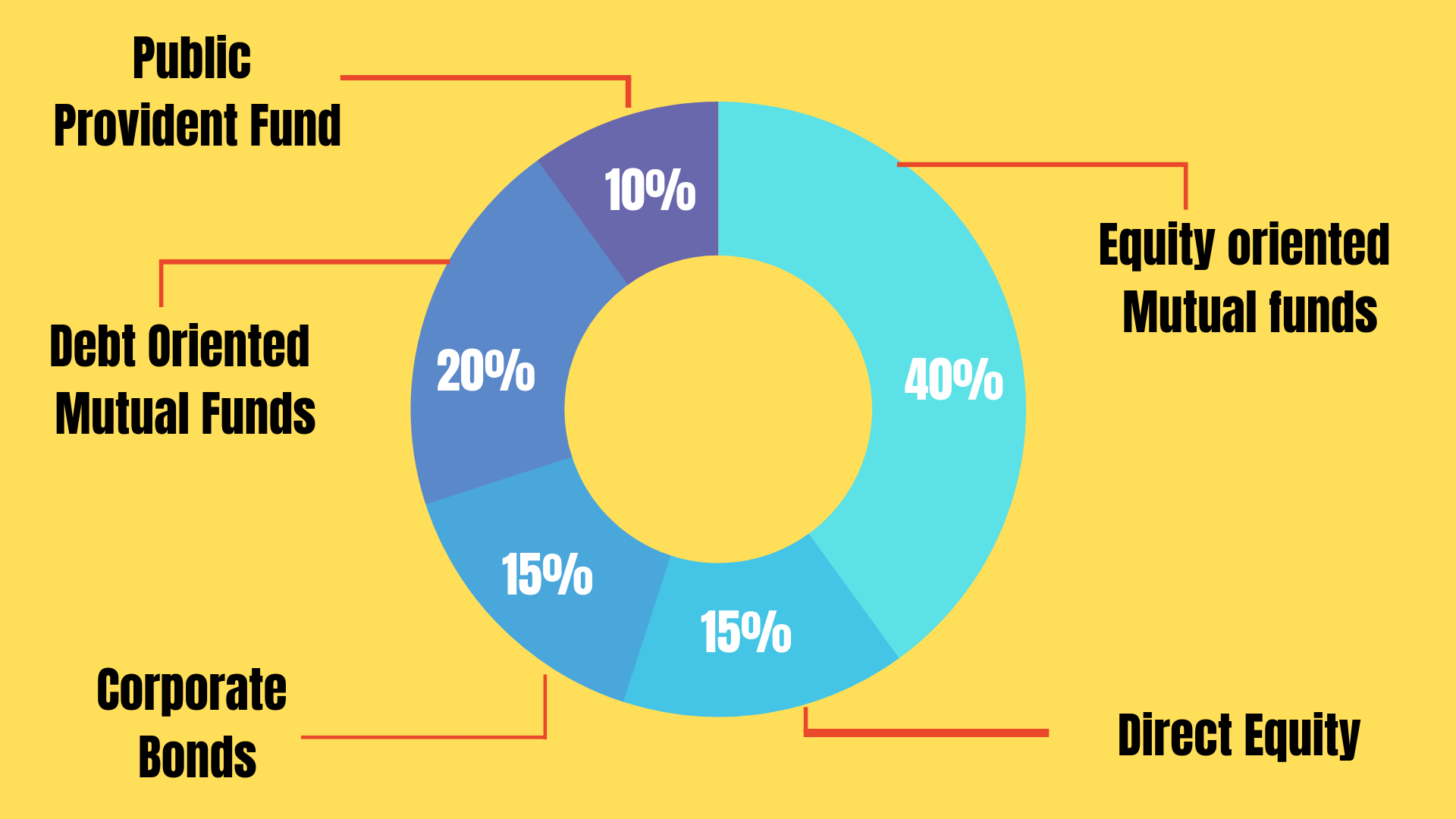

Now, you need to consider the perfect asset allocation strategy and investment route to make an early retirement if want so.

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class that has some moderate risk than the other asset class like a bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities. If your risk appetite is high, for better returns over a long period of time you can make your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young you can afford to wait and see for a long time. Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

- If you are confused about the asset allocation strategy you may read the article Asset Allocation Strategy in Easy Steps.

How to Pick best Mutual Fund

In order to pick the best Mutual funds for consistent returns, you should check out the following parameters of a fund before investing in it.

Identify the goal and risk tolerance

Usually, risk and returns are directly proportionate. The higher is the return the higher will be the risk involvement. Before making an investment you should consider your goals and then invest accordingly. Suppose you have a long time horizon of 20 years or above, you can consider the small-cap or mid-cap oriented mutual funds for investment. If you are a salaried person and will retire after 30 years then you can make a portfolio of small-cap or mid-cap mutual funds. Small-cap and mid-cap mutual funds have the potential to give you better returns, but they are more volatile as compared to the large-cap mutual funds.

On the other hand, if you have a short time span of 5 years or less then you can invest in large-cap oriented mutual funds. Large caps are less volatile and can give you steady returns over the years.

Style & Fund type

If you want a long term capital appreciation you can opt for equity-oriented mutual funds. But to generate regular income with low risk, you can select income funds since these funds invest in govt. Securities, corporate bonds, debt instruments, etc. There are instances when investors cannot assume the risk. Therefore, a balanced fund is the best option to choose in this situation. Balanced funds invest your money in both equity and debt securities.

In which sectors the mutual funds invest the money from the retail investors?

Now, you need to analyze in which sectors the mutual funds make the investment. You need to consider the future potential of the sector, competitive advantage, whether the demand for the sectors or products will remain constant in the near future, the growth possibility, if the industry or the sector has any strong entry barrier, etc.

For Example,

We can take examples of mining and utility products. They have delivered better returns in the recent past, but now they are not able to deliver a satisfactory return and their future possibility is also less. So, as a smart investor, you need to choose such mutual funds that make the investment in such sectors that have an untapped market opportunity and a strong growth opportunity in the future. We are now going to discuss some sectors which have the following entry barriers.

- These sectors have prestigious and established brands that work as a strong entry barrier for newcomers.

- The existing companies have various patents.

- Irrespective of software company or an FMCG company or insurance company, one needs to fulfill a number of legal requirements and stringent Government policy.

- High capital requirements.

- The suppliers are already satisfied with the profitability that the traditional brands offer and they do not prefer to take a risk with the new entrants.

If you are confused how to analyse any sector, you may read the article Top 10 best sectors to invest in India for long term

Sectors to Invest

Here are the top 11 sectors which fulfill the above-mentioned points.

- Banking Sector

- Information Technology

- Finance Sector

- Fast Moving Consumer Goods (FMCG)

- Automobile industry

- Manufacturing

- Chemicals

- Engineering & Capital Goods

- Pharmaceuticals

- Consumer durables

- Services Sector

You need to watch out whether the mutual funds invest 80% fund in these core sectors which have a sustainable competitive advantage, the constant demand for the services or products they offer, the growth possibility, strong entry barrier, etc.

Expense Ratio

The expense ratio is a charge that your Mutual fund Company or your agent/distributor/broker imposes on you for its services. If you invest your money in many mutual funds i.e., more than five, you will be subject to pay more and more service charges as the expense ratio. So it is advised that you may include a maximum of 3-4 mutual funds in your portfolio. You may rather increase your investment amount via SIP instead of increasing the number of your mutual funds.

Evaluate portfolio management and past results

A quote is relevant in this case, “Past performance does not guarantee future returns”. So you should keep an eye on the management of the mutual fund or the investment strategy of the fund manager. Mutual funds usually distribute your money into many companies or stocks. Here you may check-in which stocks your money is invested. You may also check the returns your mutual funds generate for you once in a year. Further, you may check the mutual funds’ performance and their portfolio before starting investment in them.

Asset size

The lower the asset size of your equity mutual fund is the higher the risk is involved. So you need to choose such an equity-oriented mutual fund which has a comfortable asset size in hundred of Crores Indian rupee.

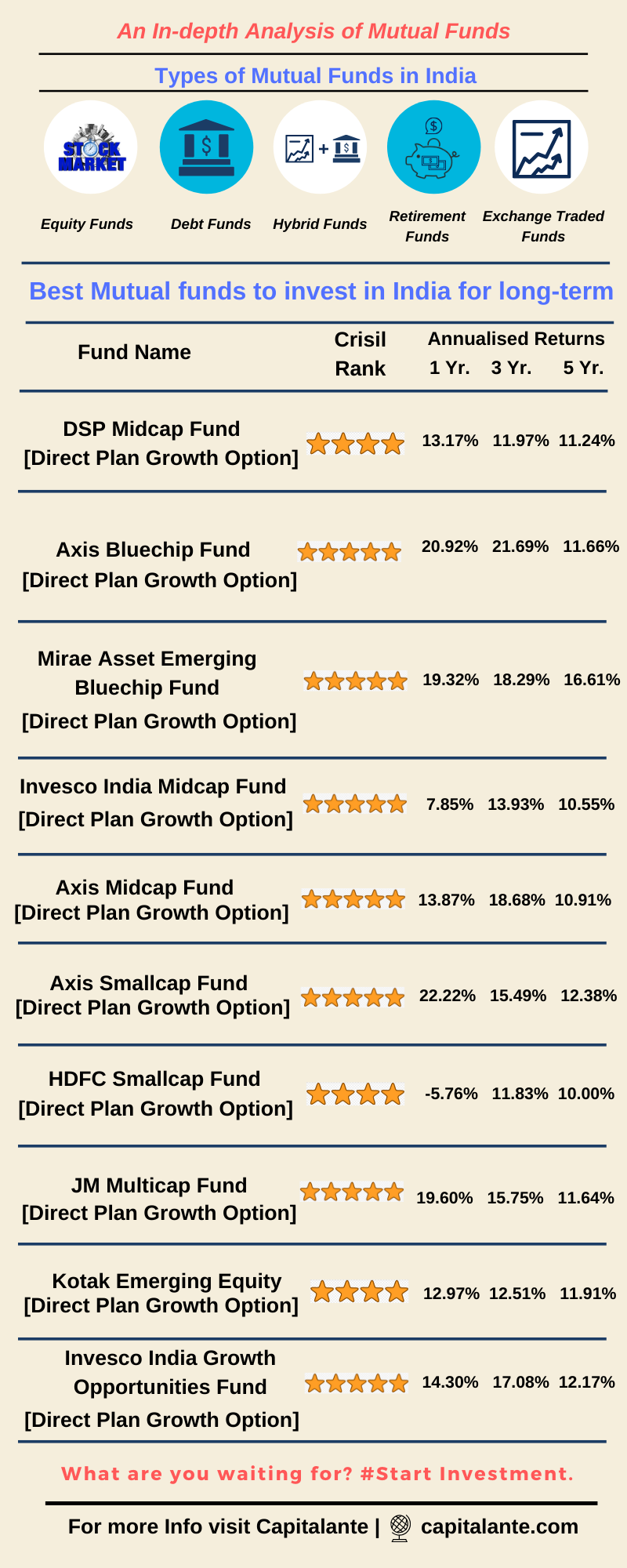

Fund Rating

Many organizations evaluate the performance of mutual funds. Then these funds are credited stars. Obviously, a higher rating indicates a good performance or good return yield by a mutual fund. We consider the rating awarded by CRISIL. The fund rating above 4 stars is considered good and any fund of that rating deserves investing.

Exit load

The exit load is calculated on the NAV of the Mutual fund at the date of redemption of the portfolio. The exit load or redemption charge depends on mutual funds, but usually, the exit load is 1% if you redeem your units within six months to two years.

Here are the Top 10 Mutual funds to invest in India for the long-term.

Why they are best

The above-mentioned funds have more than 80% exposure in the core sectors of our economy like Banking & Financials, Information Technology, Oil & Gas, FMCG, Automobile industry, Manufacturing, Chemicals, Engineering & Capital Goods, Pharmaceuticals, Consumer durables, Cement & Construction, Services Sector, etc. As the Indian economy is growing, people now have money to spend on consumer durables. So, the demand for consumer durables will increase day by day. It is a wise decision to invest in consumption stocks which may give you a steady return. The Economic Survey of India during the year 2017-18 shows that the service sector has done excellent performance and contributed 53% of the total GDP. The fund managers of the respective mutual funds invest in rising sectors like Services, Media and entertainment, etc. The fund managers irrespective of funds pick growth companies with sustainable competitive advantages, good management capabilities and which trade at reasonable valuations of different sectors.

How Capitalante can help you

Capitalante has a team of well qualified and professional equity analysts who will help you to prepare an effective investment strategy to reach the desired retirement corpus by proper financial planning i.e. an investment portfolio of stocks, mutual funds, etc. according to risk appetite and time horizon. For more information feel free to contact us.

- Read also: Top 10 Best stocks to buy in India for long term

- Read also: Top 10 Undervalued Stocks to Buy

If you have any questions regarding the best mutual funds to invest feel free to comment so that we have a discussion. If you have found this post helpful don’t forget to share this post.

Thanks for this useful information. this can be very useful to those who want to gain knowledge about this topic. Again thank you for sharing this post.

Keep writing and sharing.