With increasing financial awareness, people have become very eager for term insurance plans. Term insurance plans offer an assured sum to the nominee in the case of uncertain demise of the policyholder. In this column, we will discuss how to choose the best term insurance plan and offer you top 5 best term insurance plans to buy in India.

This is a kind of insurance scheme to secure financial requirements. Term insurance plans offer an assured sum to the nominee in the case of uncertain demise of the policyholder. In other words, term insurance policy provides financial security to a policyholder. This policy becomes very much beneficial for the person who is the only bread earner of the family. Term insurance policy is to secure the immediate needs of nominees or beneficiaries in the event of the sudden or unfortunate demise of the policyholder.

Under this policy, you set an amount for any unfortunate death. You have to pay insurance premium to the insurance company, monthly or quarterly or yearly basis till the term you opt for. Then the concerned company ensures that during the policy term, if you die, the amount you have opted for will be credited to the nominee’s bank account. There is no monetary benefit if the insurance holder is alive till the period of term plan.

By which route you can buy term insurance plan i.e. offline or online

Day by day technology is stepping everywhere. So, in every work online service is being popular. All Life Insurance companies offer their services online. Now, anyone can take term insurance plan via online. The online procedure has some advantages.

- Online purchase can be done with the click of a button.

- Via online service you don’t need any middleman. So you don’t have to any kind of commission to anyone. This leads to much cheaper premium rate.

- You yourself fill the application form. So there is less scope of any error.

- Middlemen or agents can not enjoy any undue influence.

- Life insurance companies allow some discounts on online purchase. You may avail 8% on your FIRST YEAR PREMIUM.

How to choose best term insurance plan in India

In order to choose the best term insurance plan, you should consider the following points.

Age of the policyholder

It is advised that every individual should take a term insurance plan as early as possible just to say at the age of 25 years up to the age of 60 years not more than that. It is because, at the age of 25 years, a person is bound to fulfill many financial responsibilities in his or her life. At an early age, a person’s earning also remains little and limited. So, it makes sense to take a term insurance plan in accordance with the need in case of uncertain demise or loss of physical ability.

Take Term insurance plan as early as possible

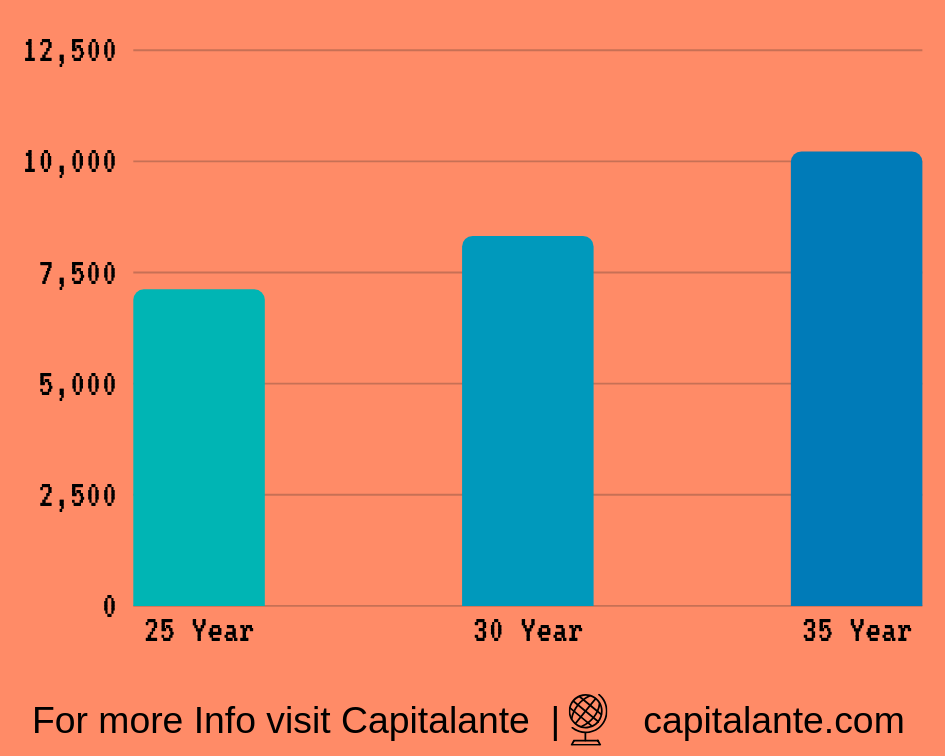

If you opt for term insurance plan at your early age, you will need to pay the lesser premium. To make it clear concentrate on the graph.

Suppose you take a term insurance plan at the age of 25 years and the sum assured is Rs. 1 crore. In this case, to avail this facility you need to pay Rs. 7100/- per year till the age of 60 years. But if you buy a term insurance plan at the age of 30 years then you need to pay Rs. 8300/- per year for an assured sum of Rs. 1 Crore for the upcoming 30 years. Again if you buy a term insurance plan at the age of 35 years then you need to pay Rs. 10200/- per year for an assured sum of Rs. 1 Crore for the upcoming 25 years.

Period the term insurance plan

You need to take a term insurance plan till the age of 60 years, because the life after the age of 60 years is considered retirement life. After this age, any kind of loss can be tackled to some extent. Till the age of 60 years, a financially literate person accumulates a satisfactory amount i.e., assets for the rest of his life or for his family to lead a happy retirement life. Again, until the age of 60 years a person does not remain the only earning member of his family and in most of the cases, that person completes all his duties or responsibilities. So, it is better to opt for a term plan till the age of 60 years.

Insured amount

You need to take a term insurance policy amount in accordance with your lifestyle, current income, and debt if any. Let’s make it clear with an example,

Suppose, you have taken a home loan of Rs. 20 Lakh and you have two kids’ one boy and one daughter. By taking a loan of 20 lakh on EMI option you are subject to pay around 17000/- per month @ 8% for the next 20 years. A total repayment paid by you to the lender is around Rs. 40 lakh.

Household expenses in the upcoming 30 years will be= 3 lakh × 30 years = 90 Lakh.

Home loan = Rs. 40 Lakh

Education cost of children assuming one daughter and one son in the upcoming 20 years = 30 Lakh

Marriage cost of Daughter after 20 years = 40 Lakh

Your total cost in the upcoming 30 years = 90 + 40 + 30+ 40 = Rs. 2 Crore.

Finally,

Considering the above calculation, you should take a term plan of at least Rs. 2 Crore to meet the expenses for the upcoming 30 years in case of your uncertain or untimely demise.

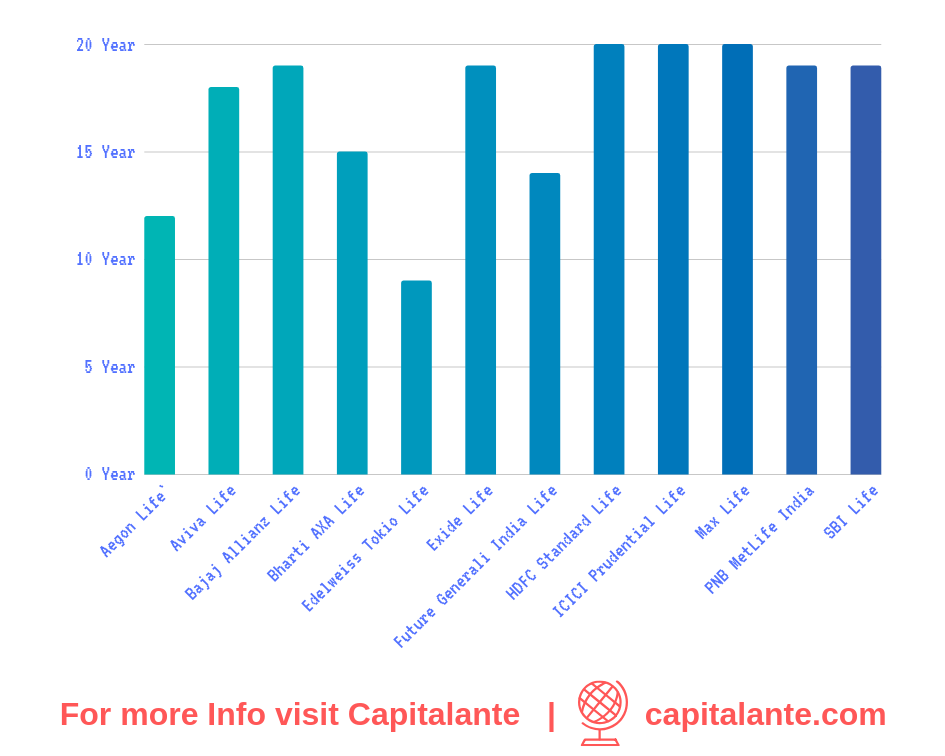

After analyzing the above-mentioned factors, while buying a term insurance plan you need to analyze the insurance company.

Claims settlement ratio

People take term insurance plans to secure the financial requirements after any uncertain or sudden demise of the policyholder. Now, it is a vital thing before buying a policy from a company how many claims the company settles. A term insurance company is expected to give the assured sum to the nominee on the death of the policyholder. A company receives many claims in a year. Now, it is to check how many claims are approved by the respective insurance company. The comparison of the claims made and the claims approved by the company is called the claim settlement ratio. The duration of the settlement is also a matter of concern. If a company approves of most of the claims made within a short-term, the concerned insurance company is considered a good one. So, before buying a term insurance plan form any company, just check its settlement ratio.

Solvency ratio

Solvency ratio defines the capital an insurance company owns. Many people take insurance policies from a company and the company assures a sum on the claim of the insurance. Now, you or any other policyholder or all the policyholders may get subject to sudden demise at once. So, the company will face an extreme situation. It will have to settle all the assured claims. This will be a major point of concern to solve for the insurance company to settle all the claims. So, you as a policyholder should check the capital of the insurance company. You should verify whether the company is able to settle all the claims on an extreme situation. The capital a company owns and the sum assured to all the policyholders is the solvency ratio.

Combined ratio

An insurance company earns from its premiums paid by the policyholders. It has to pay some amount to run its operations and the company is subject to bear losses also if any. The combined ratio is a measurement to check the financial health of the insurance company. The total earning is divided by the expenses incurred including losses if any. If the ratio is less than one, the company is considered a good one.

Whether additional riders available

Term insurance secures the financial security death benefit. The death may take place due to many reasons. A policyholder may die of critical illness like heart failure, cancer, AIDS etc. So, the treatments of these diseases are quite expensive. If you take critical illness cover then the insurance company covers the medical expenses like hospitalization charges, operation charges etc. So a policyholder may take a critical illness over in addition to the term plan. So, at the time of buying a term insurance plan, you may check whether the insurance company provides any critical illness cover.

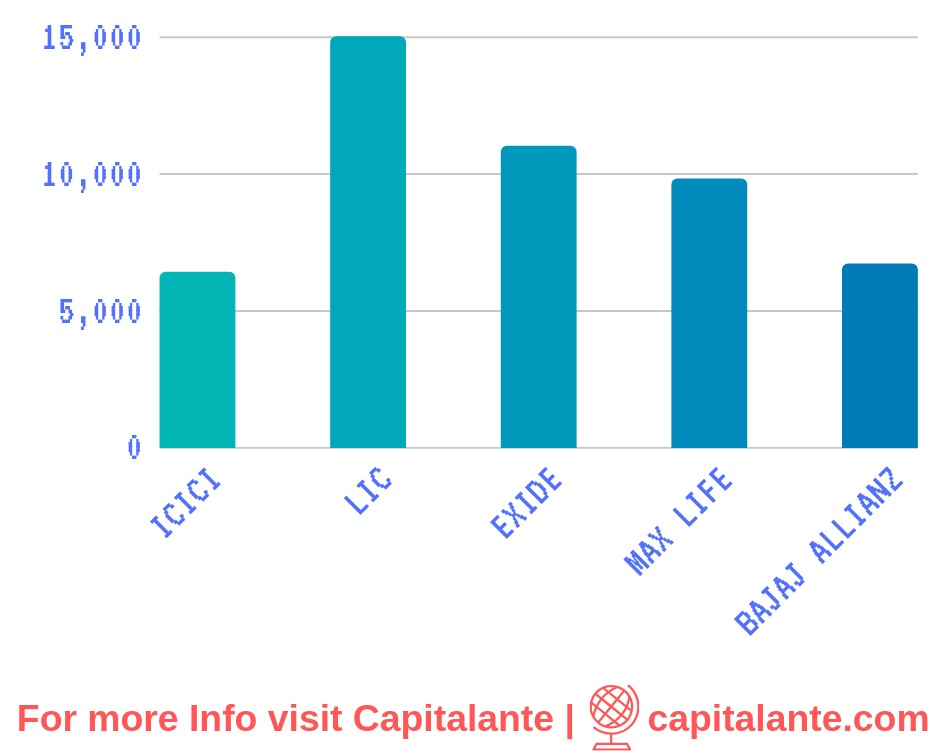

Premium cost

The earlier you take a term plan, the lesser the premium will be for the term plan. Suppose, you buy a term plan at the age of 25 and you want to continue this plan till the age of 55 years. So, the duration the term plan is 30 years. So, you need to compare the premium between the term plans. Here is the snapchat of premium cost of several companies if you take a term plan of assured sum of Rs. 1 crore for a period of 30 years in case you are of 25 years age.

- Read also: 5 Best Term Insurance Plans in India – CreditMantri

- Read also: Best Term Insurance Plans in India – Policybazaar

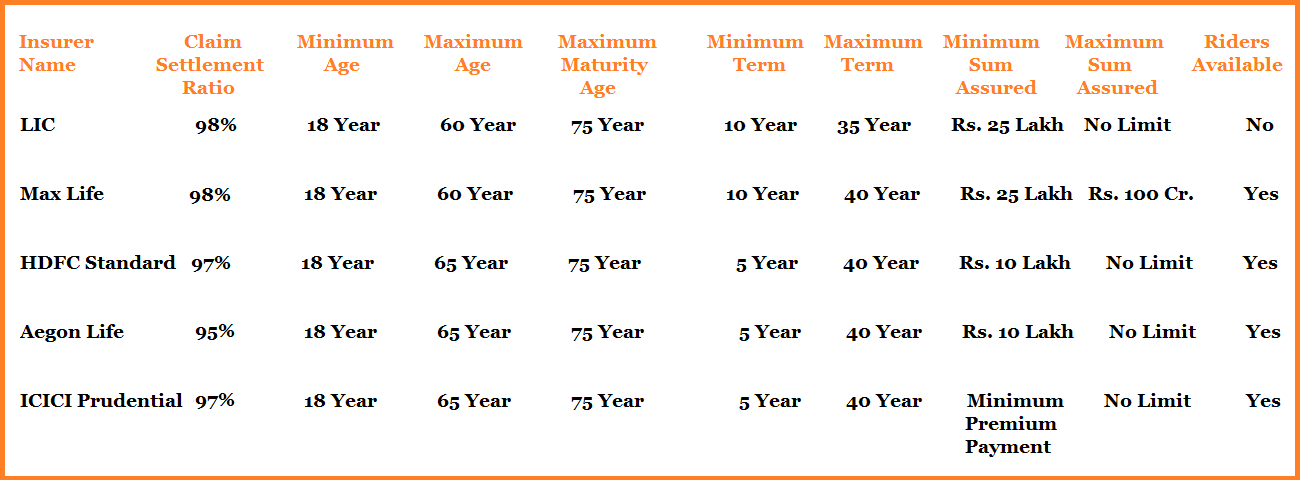

Top 5 Best Term Insurance Plans in India 2018

So in order to make a proper financial planning you need to take a term insurance policy first. So, in order to choose the best one you need to consider the following points.

Points to consider,

- Claims settlement ratio, Solvency ratio, Combined ratio, Premium cost of the respective insurer.

- Buy term insurance policy as early as possible.

- You need to buy term plan till the age of 60 years.

- Buy the basic version of term insurance plan.

- Pay your yearly premium payment in due time by make it automated via online payment.

- Take term insurance riders accordingly.

- Disclose whether you are alcoholic or smoker to the insurance company.

- Don’t hide your family’s health information.

- Don’t get trapped into the policies of 10 times of your yearly income.

Read also: 10 Reasons to Buy Term Insurance Plan

Read also: 8 Points to Consider While Buying a Term Insurance Plan

If you have any question regarding financial planning feel free to comment so that we have a discussion. If you have found this post helpful don’t forget to share this post.