With increasing financial awareness, people have become very eager for insurance plans. There are various types of insurance schemes that cover security from your body to business or vehicle etc. Here we will have a discussion on different types of insurance policy available in India.

Types of Insurance policy in India

Agricultural Insurance

Agricultural insurance can be defined as to provide financial support to farmers against loss or damage to crops or livestock due to natural calamities like droughts, floods etc. In 2016, Respectable Prime Minister Narendra Modi launched Pradhan Mantri Fasal Bima Yojana i.e. Prime Minister’s Crop Insurance Scheme. A farmer can insure his agricultural products and livestock under this scheme. According to the scheme a farmer need to pay only 2.0% of the Maximum Insurance sum assured for Kharif Crops and 1.5% of the maximum Insurance sum assured for Rabi Crops. The rest will be provided by the central government.

Property insurance

This type of insurance covers insurance to the whole property and all the physical things or assets present inside it. The insurance includes land, building, furniture in it, machinery, books, papers everything. The insurance policy ensures damage or loss due to any natural calamity, theft or any other way of loss.

Flood Insurance

Flood insurance can be defined that protects against the losses sustained by water damage, such as losses sustained by fire, wind damage and falling trees due to flooding etc.

Income Protection Insurance

The Income Protection Insurance is an insurance policy which provides an Income Replacement to policyholders who are incapacitated and unable to work owing to illness or accident. You should buy income protection insurance if you are the only bread earner of your family to ensure regular income for your family even if you are not around.

Business interruption coverage

This type of insurance protects the policy holder’s business. Actually, this insurance provides security to the business or the source of income from any damage or loss. You as an owner of the business should take the policy. Then the company will give coverage to your business.

Commercial Insurance

Commercial insurance can be defined as an insurance that protects against the losses sustained by theft, liability, and property damage of any commercial property. This type of insurance also covers the employees’ injuries too.

- Read also: Types of Life Insurance – HDFC Life

Travel Insurance

Travel insurance is a type of insurance that covers the costs and losses such as loss of luggage, delays, and death or injury while in a foreign country. Here is the snapshot of advantages of travel insurance.

- Travel insurance offers reimbursement for medical expenses that are incurred owing to accidents and illnesses by the policy holder even in the foreign countries.

- Travel insurance also provides protection against trip cancellation and interruption to any individual.

- Travel insurance provides protection against death because of an injury experienced by the policy holder during tour within 12 months of the trip.

- The expenditure incurred owing to flight delay for at least 6 hours and you take a room and eat foods during that time, you will be reimbursed by the insurance company.

- Owing to the accident if you’re sick or injured and can’t get home, the insurer provides protection against additional accommodation and travel costs.

Vehicle Insurance

Almost everyone has vehicle either two wheeler or four wheeler. We have to take insurance for our vehicles to secure them from theft, accident, damage due to natural disaster etc. In accordance with the latest judgment by the Supreme Court of India, every car or bike will have to take insurance policy mandatorily for at least 3 years. Needless to say the said policy provides coverage of own damage to the insured vehicle caused by,

- Accident by external means like fire, explosion, self-ignorance, lighting, earthquake, landslide, flood, or any other natural calamity.

- Accident due to hit to any other vehicle, tree, stone, pillar, wall, a person or any other object.

- Transit by road, rail, inland waterways, air, lift.

- Burglary, housebreaking, theft.

- Terrorism, riots, strikes, malicious acts.

Types Life Insurance Policy in India

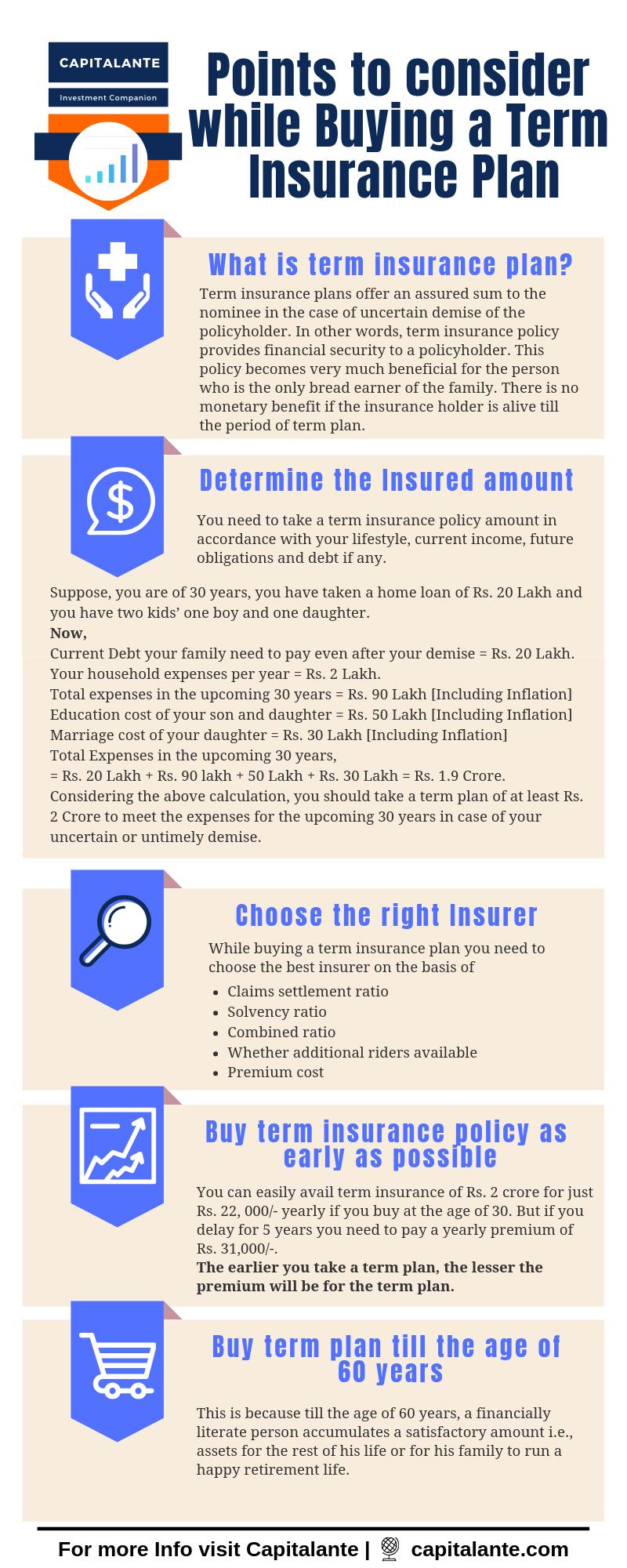

Life insurance covers the physical loss of the policy holder or provides lump sum amount to the nominee on sudden death of the policyholder. There are many kinds of life insurance like term plan, ULIP, money back or endowment policy. Term insurance plans offer an assured sum to the nominee in the case of uncertain demise of the policyholder. In other words, term insurance policy provides financial security to a policyholder. This policy becomes very much beneficial for the person who is the only bread earner of the family in the case of death or permanent disability of the policy holder. Let’s dig into the various life insurance policies here under.

Term Plan

Under the scheme term insurance policy is to secure the immediate needs of nominees or beneficiaries in the event of the sudden or unfortunate demise of the policyholder. Under this policy, you set an amount for any unfortunate death. You have to pay insurance premium whether monthly or quarterly or yearly basis till the term you opt for. During the policy term, if you die, the amount you have opted for will be credited to nominee’s bank account. There is no monetary benefit if the insurance holder is alive till the period of term plan.

Money back or Endowment Policy

Money back policy assures an amount to the policyholder for any kind of accidental or natural death till a certain period. If a policyholder dies within the term period then the money is credited to nominee’s bank account. The nominee needs not to pay any premium. In the case of policyholder remains alive, after the maturity of the policy he will be credited the assured amount unlike term insurance policy where no monetary benefit if the policy holder is alive till the period of term plan.

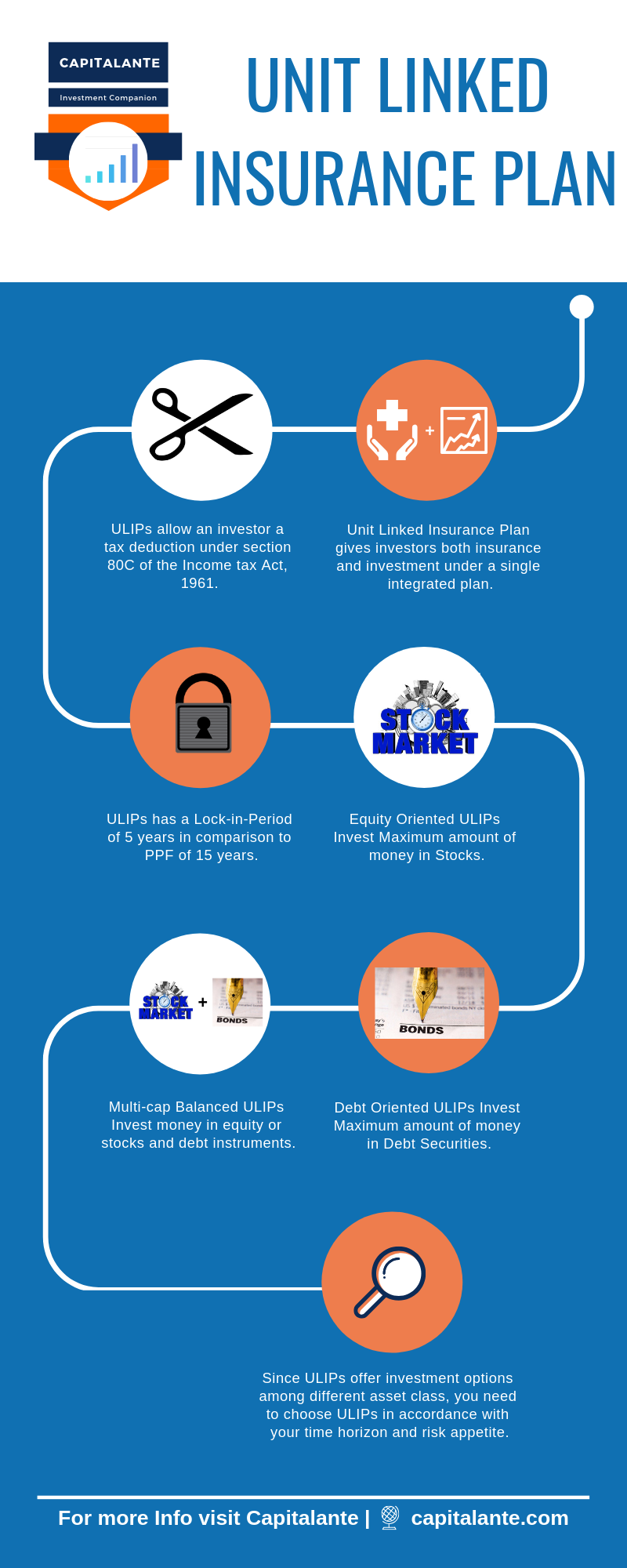

Unit Linked Insurance Plan

Unit Linked Insurance Plan (ULIP) is a service offered by insurance companies. It has an extra benefit like a pure insurance policy. It gives investors both insurance and investment under a single integrated plan. ULIP is not only an insurance policy but also covers risk for the policyholder along with investment gateway in many asset classes like stocks, Mutual Funds, debt instruments, Corporate bonds, Government securities etc.

Workers’ Compensation Insurance

If you have an organization where you have appointed employees, you need to take insurance plans for them. If there is any loss of physical health of a worker you will have to compensate it. In that case workers’ compensation insurance will secure your workers or employees.

If you have any question regarding types of insurance policies India feel free to comment so that we have a discussion. If you have found this post helpful feel free to share with your loved ones.