The scheme, term insurance policy is to secure the immediate needs of nominees or beneficiaries in the event of the sudden or unfortunate demise of the policyholder. Under this policy, you set an amount as insurance for unfortunate death. You need to pay insurance premium whether monthly or quarterly or yearly basis till the term you opt for. During the policy term, if you die, the amount you have opted for will be credited to the nominee’s bank account. There is no monetary benefit if the insurance holder is alive

8 points to consider while buying a term insurance plan

Buy term insurance policy as early as possible

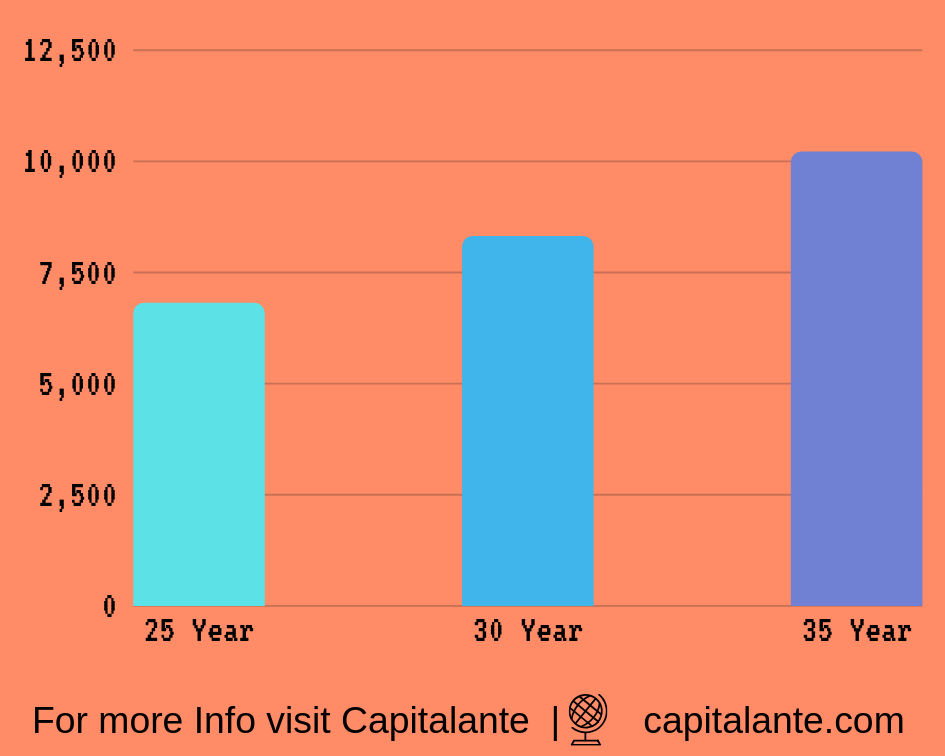

The most important thing is you should buy a term insurance plan at an early age. Whenever you start earning you should take a term plan. The earlier you take a term plan, the lesser the premium will be for the term plan. Suppose, you buy a term plan at the age of 24 and you want to continue this plan till the age of 60 years. So, the

Buy term plan till the age of 60 years

Should you opt for a term plan till the age of 80 years? The clear cut answer is no. You or any individual should buy a term plan for the age of 60 years only. It does not matter what the individual’s current age is. When you are young, you are bound to fulfill many financial responsibilities in your life. At

The life after the age of 60 years is considered retirement life. After this

Buy the basic version of term insurance plan

Now a day, term insurance companies offer various options to choose from. These choices are namely single premium term insurance policy, regular premium term insurance policy either monthly or quarterly or yearly basis etc. The single insurance policy enables an individual to take a term plan in which he has to pay a single premium. Then he does need to pay anything for the policy.

Many

Don’t be misguided by ‘per day premium’ marketing strategy

Many insurance companies sell their term plan policies in a tricky way. They advertise that you can avail Rs. 1 crore insurance only for Rs. 25/- per day. There are many such ads telecast in electronic media. Some people get trapped

- Read also: Term Insurance: How to buy the right term insurance plan

- Read also: 20 things to consider before buying term insurance – A

complete Guide

Take term insurance riders accordingly

- Accidental death rider

- Permanent & Partial disability

- Critical illness

If your occupation is such that you have to travel a lot, you can opt for accidental death rider along with

Disclose whether you are alcoholic or smoker to the insurance company

If you consume alcohol or you are an active smoker, just disclose this to your insurance company at the time of purchasing term plan or while medical examination. Many a person has a perception that he is not a smoker or alcoholic if he consumes alcohol 2 or 3 times in a year or the same in the case of smoking. If you consume alcohol or smoke once in a year, you are smoker and alcoholic. If you hide this fact from your insurer then there is a great possibility that your insurance can be rejected at the time of claim.

Don’t hide your family’s health information

If you have any major health issue or have undergone any kind of operation or surgery you should disclose this to your insurance company. You need to furnish the health information in respect

Don’t get trapped into the policies of 10 times of your yearly income

There are many lucrative schemes that claim to ensure 10 times of your annual income. Just ignore them. At the time of taking a term plan, you should consider your assets and liabilities for

You are an individual with an annual income of 5 lakh.

Condition I

Suppose, you have taken a home loan of Rs. 20 Lakh and you have two kids’ one boy and one daughter. By taking a loan of 20 lakh on EMI option you are subject to pay around 17000/- per month @ 8% for the next 20 years. A total repayment paid by you to the lender is around Rs. 40 lakh. Now, at this point

Home loan = Rs. 40 Lakh

Education cost of children after 15 years = 30 Lakh

Marriage cost of Daughter after 20 years = 40 Lakh

Your total cost in the upcoming 20 years = 40 + 30+ 40 = Rs. 1 Crore 10 Lakh.

Considering the above calculation, you should take a term plan of at least Rs. 1 Crore to meet the expenses for the upcoming 20 years in case of your uncertain or untimely demise.

Condition II

On the other hand, if you move with 10 times of your annual income policy and you opt for such a term plan of that then it is figured out like this = Rs. 3 Lakh × 10 = Rs. 30 Lakh. This is not adequate to meet the above expenses in the future if there is

The bottom line

- Read also: 10 Reasons to buy

term insurance plan - Read also: Top 5 Best term insurance plan in India

If you have any question regarding term plan then make a comment and if you have found this post helpful please share with your loved ones.