The Cheque is a dated and signed document which enables a person to withdraw money from the bank account or to transfer money into someone else’s bank account. The cheque is a piece of paper issued by the bank where you or someone has a bank account. In a cheque, your name, bank account number, IFSC code, MICR code are written. Every transaction you make is operated with your account. If you withdraw money, money will be deducted from your account and if you pay someone, the money will be deducted from your account. In this column, we will discuss the top 11 types of cheques in India.

What is Cheques?

Generally, you can withdraw or transfer fund to someone else’s account. When you want to pay someone, you need to write the name of the bearer and the amount. Then you as the account holder will sign on the cheque. The account holder has to sign the other side of the cheque. After this, the bearer to whom you have issued the cheque will go to the bank. The bank authority will verify the signature and the account details and will process the request to payment to the respective person.

Top 11 types of cheques in India

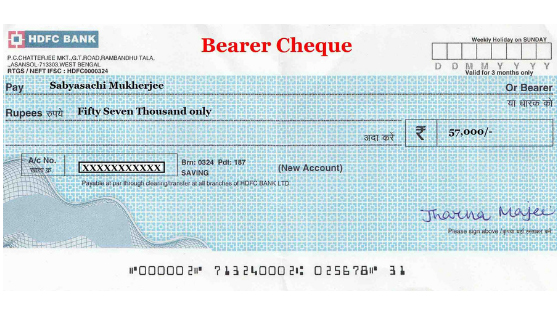

Bearer Cheque

Bearer cheque is a kind of cheque where the name of the bearer or to whom it is addressed to is written. And obviously, the amount is also written. It is not crossed nor is the account number of the payee is mentioned. This type of bearer cheque can be encashed by any person irrespective of whom it is addressed. The cheque can also be encashed by the person whoever presents it to the bank. In reality, this kind of bearer cheque carries risk with it.

If the cheque is lost or stolen by any way along with the signature put in the cheque and the cheque is presented to the bank by any other person irrespective of payee name mentioned in the cheque, the bank will make payment to any person. If you write “Self” in the Payee column then it is called self-cheque. You can withdraw the money where you have a bank account.

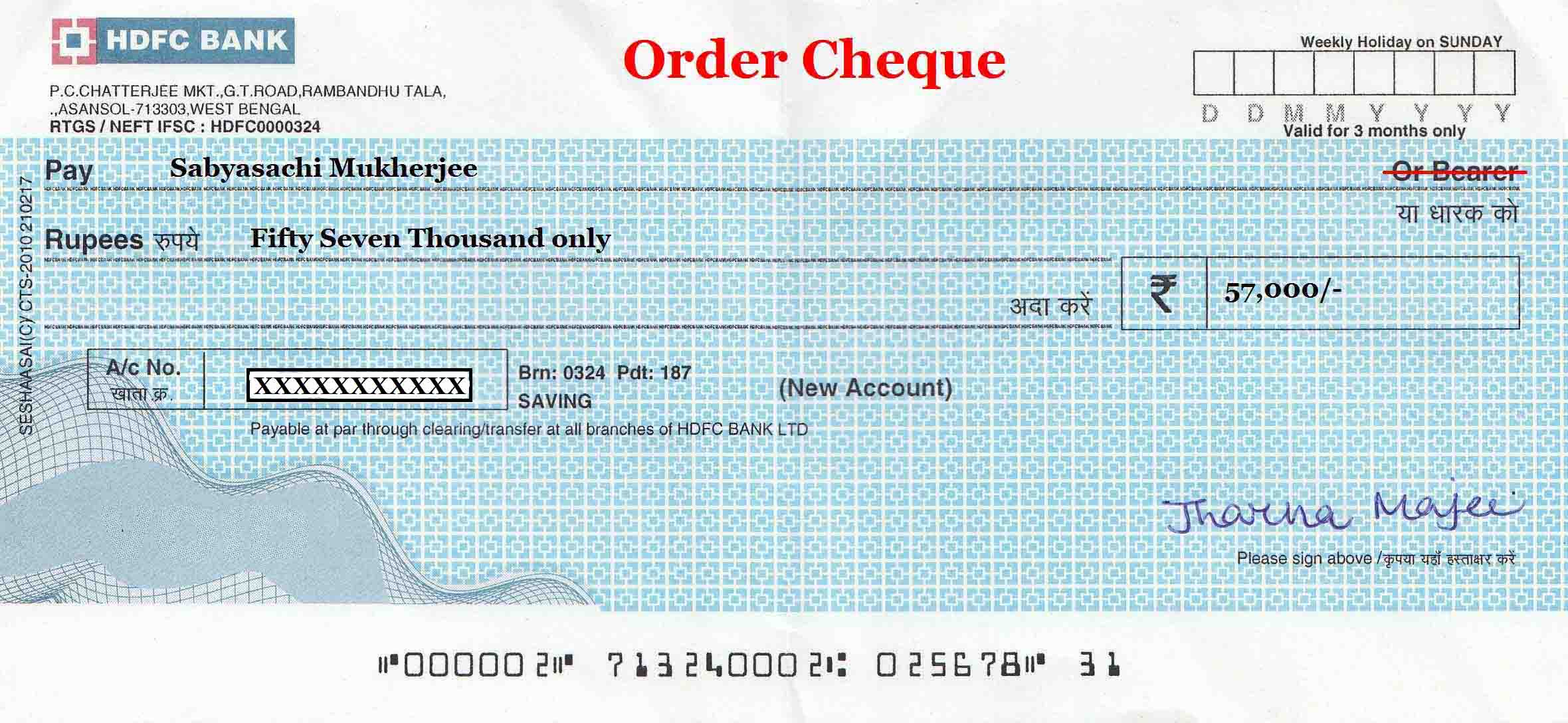

Order cheque

Unlike the bearer cheque, when the “or Bearer” appearing on the cheque is cancelled and you write the word “or order” then it is converted into order cheque. The amount specified in the order cheque can be encashed or transferred. The amount specified in the cheque to the self bank account or someone else’s by signing on the back side of the cheque.

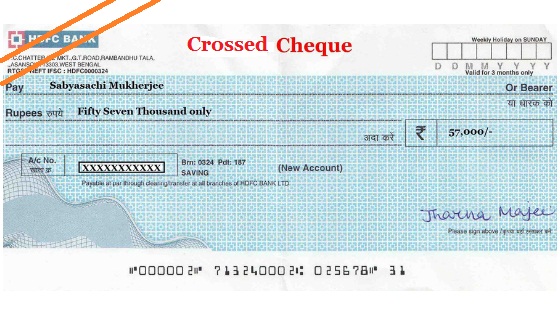

Crossed Cheque

When the two lines are drawn on the top right corner of the cheque, the cheque is called crossed cheque. The amount mentioned in the cheque is only being transferred to the bank account of the payee’s name in the cheque. This cheque is best, because no cash payment from the bank counter is permissible in the case of crossed cheque.

Uncrossed or Open cheque

When the cheque is not crossed on the top right corner of the cheque the cheque is called open cheque. Unlike the crossed cheque, this cheqkue allows cash withdrawal to the payee as mentioned in the cheque from the bank counter.

Antedated Cheque

When the date mentioned in the date column along with the payee name of order or bearer cheque is earlier than the current date then it is called antedated cheque. Antedated cheque is valid up to 3 months from the date mentioned in the date column of the cheque.

Post dated cheque

When the date mentioned in the date column along with the payee name of order or bearer cheque is yet to come than the current date, then it is called postdated cheque. This type of cheque is considered for a security purposes.

Stale Cheque

Suppose you have mentioned a payee and the amount thereof along with date. But the cheque is neither enchased from the bank nor the amount of money is transferred till the three month. This type of cheque is called Stale Cheque.

Mutilated Cheque

Suppose you have mentioned a payee and the amount thereof along with date. But the cheque is found to be damaged by oil, water, and fire or torn into two or more pieces then it is called mutilated cheque. Usually, the bank refuses to pay or transfer the amount to the payee without getting confirmation of the drawer.

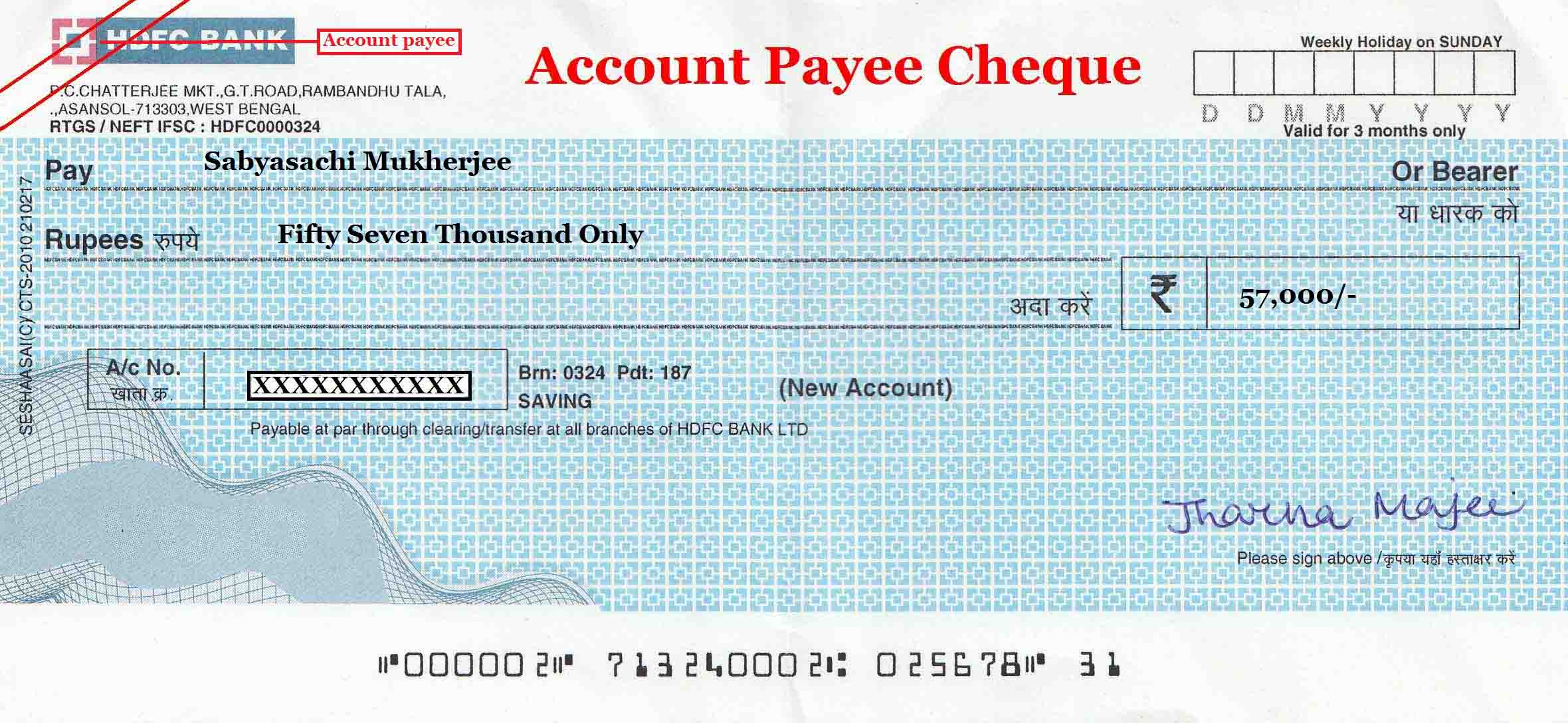

Account Payee Cheque

Just like crossed cheque when “Account Payee” is written on the top right corner of the cheque it is called account payee cheque. The amount mentioned on the cheque is only transferred to the bank account of the payee whose name is mentioned on the cheque. No cash payment is permissible from the cash counter of bank branch.

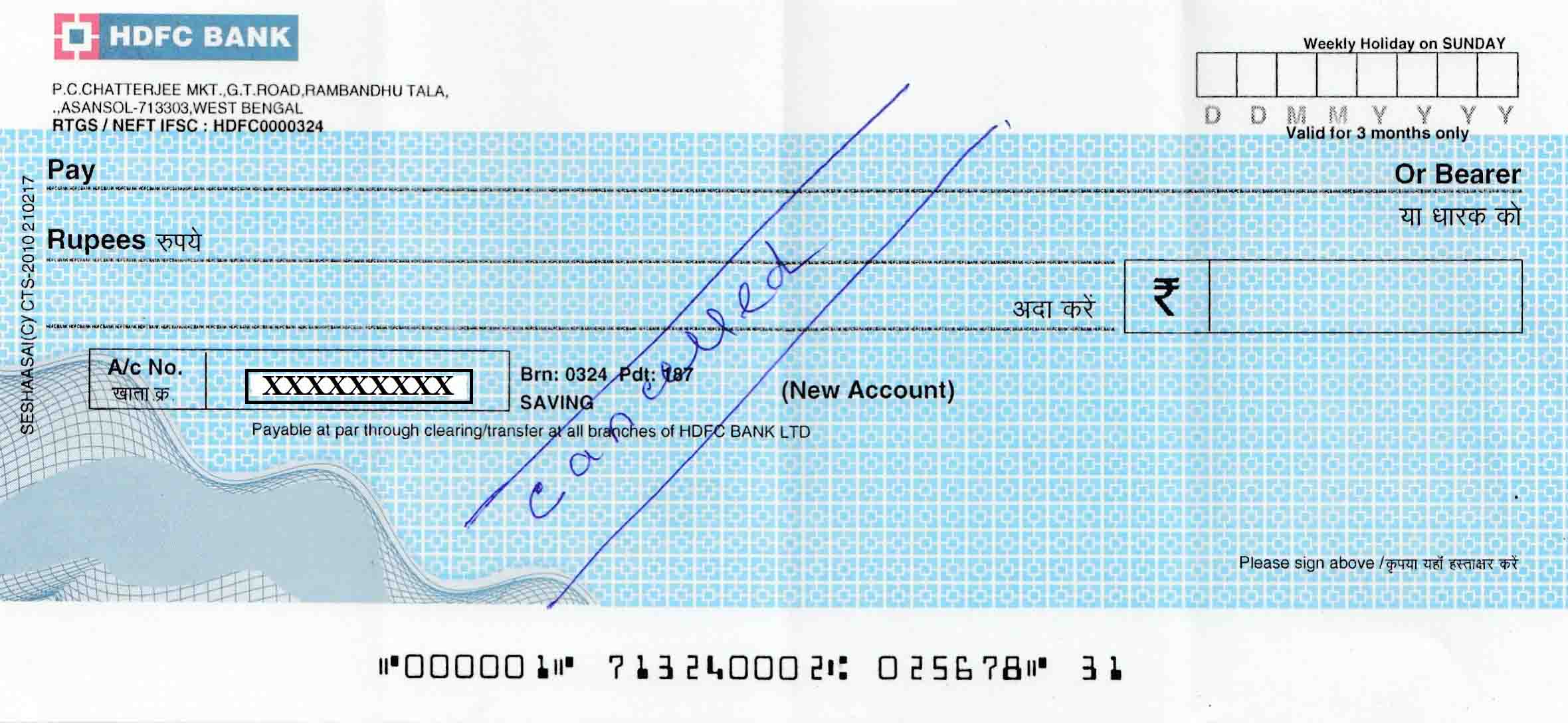

Cancelled Cheque

When the cheque is crossed on the centre of the cheque and “Cancelled” is written, the cheque is called Cancelled cheque. This cancelled cheque has no monetary value, because no amount or payee name is mentioned here. It is usually used for the purposes of verifying the bank account or for KYC i.e. Know Your Customer by various authorities or organizations.

Blank Cheque

In this type of cheque one individual or any organization puts the signature only leaving all other columns i.e. amount, date empty.

- Read also: Top 17 Types of Loan in India

Let me know if I have missed any other types of cheques in India. If you have any questions regarding types of cheques feel free to comment so that we can have a discussion. If you have found this post helpful, share it with your loved ones.