With the increasing financial literacy, people are showing interest to take early retirement before they attain the age of 60. Many people want to lead a leisure life after 50, especially the jobholders. Why early retirement? The answers may be many. It is the temptation of leisure life that attracts people. But the main reason is that job holders find themselves in bondage under their employers. So, they try to get free from this bondage. Many people find their jobs or work boring. Many want to enjoy an adventurous life freely, happily without any financial woes. Here we will discuss how to retire early at 55 with proper financial planning for a happy retirement life.

How to Retire early: Points to consider

In order to make an early retirement, you need to plan from the moment when you start your first earning because you have to build a reasonable bank balance to secure the standard lifestyle after you get retired at the age of 50. The answer varies on the following factors.

- Determine how you lead your lifestyle in the upcoming year in order to continue your pre-retirement lifestyle even after retirement.

- Create a realistic retirement budget.

- The route map by which you can create your desired retirement corpus.

- Evaluate your current financial status i.e. debt, savings, the property you have.

- List the small sacrifices you can do.

Determine how you lead your lifestyle

According to most of the millionaires, nearly 90% of people cannot become rich even after their retirement, because they are not visionary. You should differentiate between your needs and wish from the start. Since you have access to laptops, tablets, and smartphones you can use Excel sheets to track expenses. Prepare a detailed expense sheet with major pockets of spends like stationery, travel, food, entertainment, and shopping. You have to maintain records under these heads. You can fix an amount for each head. In this way, you can track the expenses easily.

Surround yourself with financially educated and conscious people from whom you can learn about financial planning. Also, make sure that your group of friends comprises people who share similar financial goals. It can be difficult to adhere to financial disciplines when you spend time with spendthrifts. A great way to learn about the art of finance is to find a family friend who can mentor you throughout the process – someone who has achieved his own financial success.

Create a realistic retirement budget

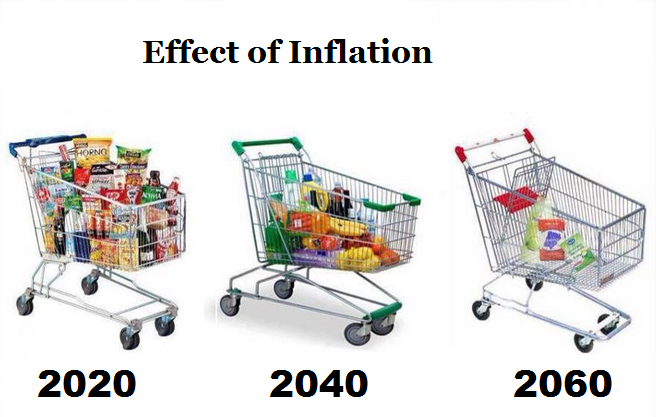

You must have a clear view and a good understanding of the expenses that will be required to live after retirement. The current inflation rate is 7% per year. It means next year you will need Rs. 107/- to buy the same product you can buy now with Rs. 100/-. So if you can fulfill your requirements with Rs. 20000/- per month now, you will need Rs. 1, 52,245/- approximately per month after 30 years. Consider the case of inflation and do the needful.

Now let’s calculate the desired corpus you need to accumulate when you retire at the age of 55 years if you have started your professional career at the age of 25 years.

Calculation of Retirement Corpus

Suppose you have started earning at the age of 25 years and your earning is Rs. 25000/- monthly. Now you wish to make an early retirement at the age of 55. So, you have got 30 years to achieve a sufficient amount in order to lead a happy and prosperous retirement life.

Your yearly salary – Rs.3, 00,000/-, assuming Rs. 25,000/- a month.

Your yearly Household Expenses – Rs. 1, 80,000/-, assuming Rs. 15,000/- a month.

Term insurance premium – Rs. 7,000/- assuming assured sum of Rs. 1 crore for a term of 30 years.

Health insurance premium – Rs. 8,000/-, assuming a cover-up to Rs. 5 lakh/ year for a term of 35 years.

Expenses on festive season = Rs. 25,000/-.

Total Expenditure

Therefore, your expected expenses throughout a year is = Rs. 1, 80,000/- + Rs. 7,000/- + Rs. 8,000/- = Rs. 25,000/- = Rs. 2, 20,000/-.

Then, the expenses at the age of 55 years assuming a current inflation rate of 7% will be = Rs. 15 lakh. [excluded term insurance premium and health insurance premium since they are fixed at the time of buying].

So, you have to accumulate a corpus of [Rs. 15 Lakh × 20 years = Rs. 3 Crore] at the age of 55 years, assuming you will live at least 75 years.

In addition,

Let’s assume you have two kids i.e. one daughter and one son. So, the Education cost of son & daughter as well as the daughter’s marriage after 20 years = Rs. 40 Lakh.

Total amount need = Rs. 3 Crore + Rs. 40 Lakh = Rs. 3.4 Crore.

- Read also: Here’s How to Retire Early — The Motley Fool

- Read also: How to gain financial independence and enjoy a very early retirement

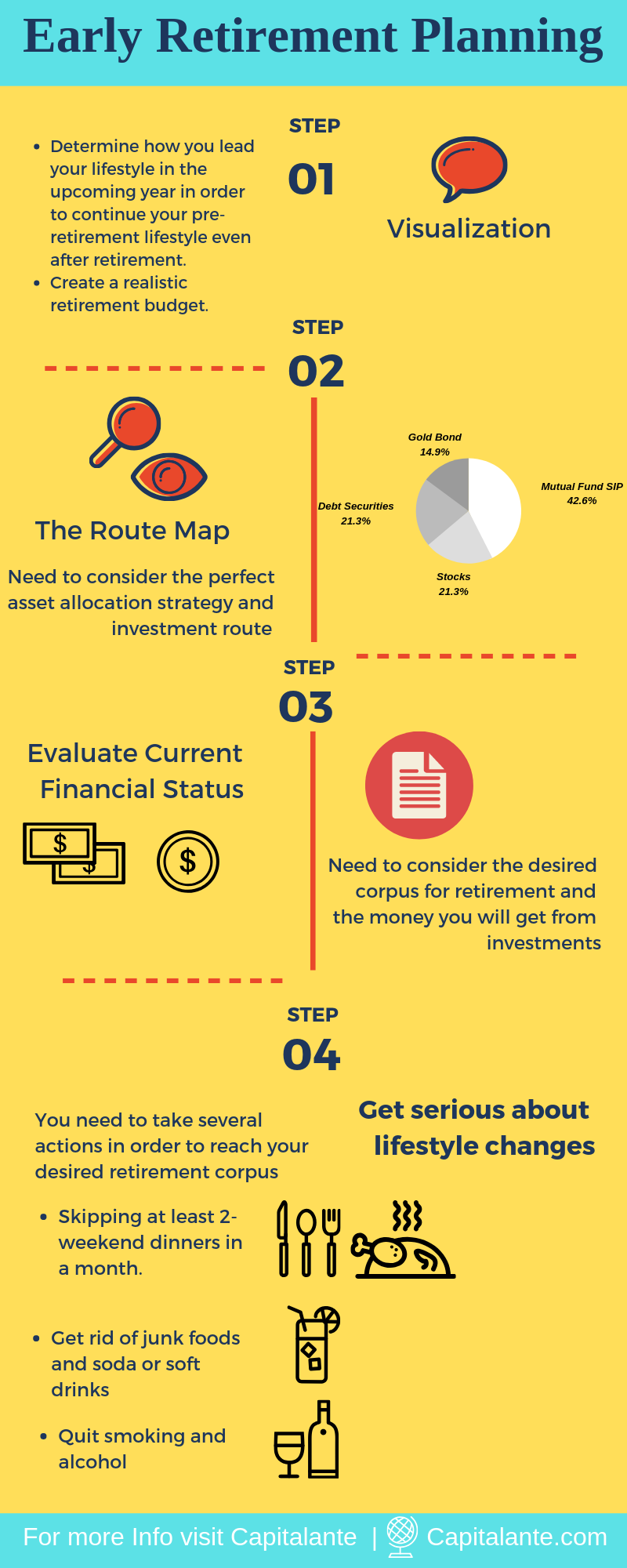

Make a roadmap to reach your desired retirement corpus

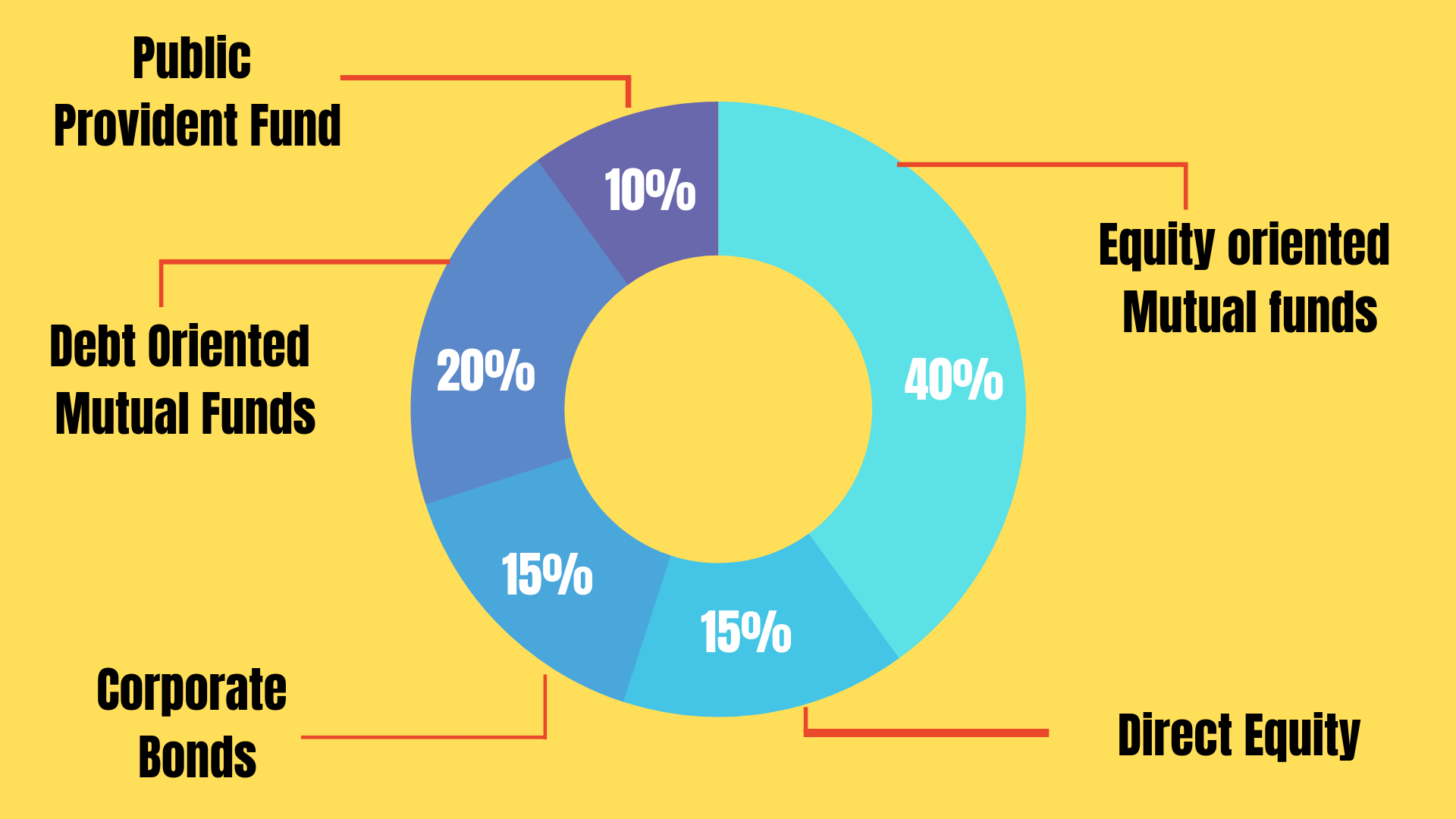

Now, you need to consider the perfect asset allocation strategy and investment route to make an early retirement.

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class that has some moderate risk than the other asset class like a bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities. If your risk appetite is high, for better returns over a long period of time you can invest your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young, you can afford to wait and see for a long time. Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

- If you are confused about the asset allocation strategy you may read the article Asset Allocation Strategy in Easy Steps.

By which route a common individual start investment in the stock market?

In order to make an investment in the stock market, the beginners have two options. The first option is to invest via direct equity by opening a Demat account and the second one is via a mutual fund. In order to make a profit in the stock market via direct equity, you need to analyze the fundamentals, business analysis, balance sheet, profit and loss account, free cash flow while choosing the stock in which you are going to invest.

In the case of Mutual Funds,

But in the case of mutual fund investment, you need not analyze the above-mentioned points. Mutual funds are managed by fund managers who are active in this field for a long time and possess vast knowledge and experience. The fund managers pick stocks or shares in which your money is to be invested. The fund manager of the respective mutual fund invests your money in different sectors like Banking, Finance, FMCG, Infrastructure, Automobiles, Information Technology, and Manufacturing, etc. You may invest a lump sum amount at once or you may opt for a monthly, quarterly or yearly basis via SIP.

If you are confused which route you should follow to start investment in the stock market, i.e. direct equity or mutual fund you may read the article How you can invest, directly in equity or via mutual funds.

Why should I start early and stick to a long term investment in the stock market?

To gain one of the major benefits, when you invest over a long-term horizon, is compounding interest.

Why Start Early

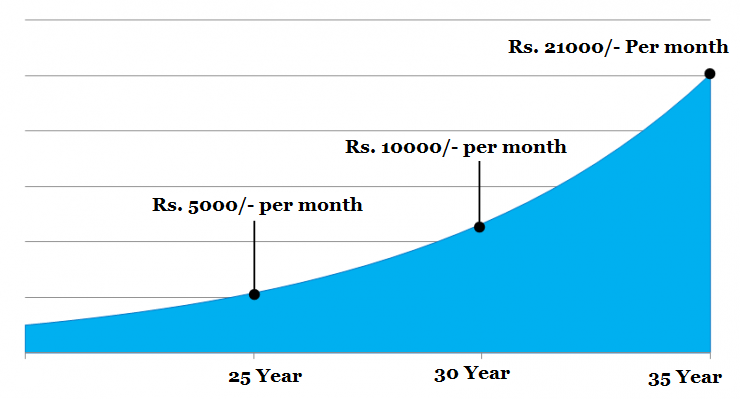

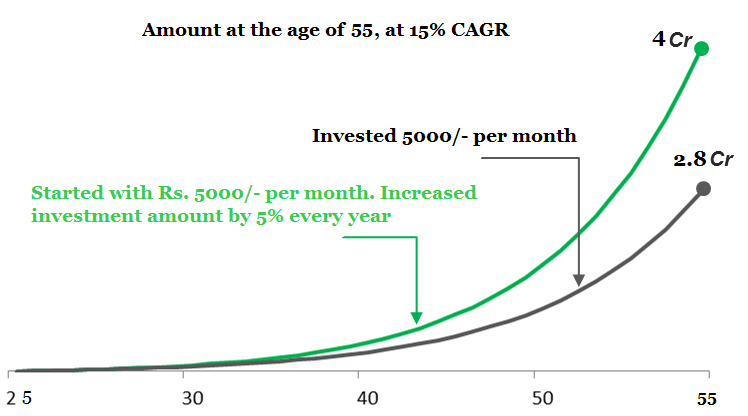

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just Rs. 5000/- per month then you will get Rs. 2.8 Crore when you are 55, assuming 15% CAGR. If you are late by 5 years i.e., you start investing at the age of 30, then you need to invest Rs. 10000/- per month to get the same corpus at the age of 55 years. Again, if you start investing at the age of 35 years then you need to invest Rs. 21000/- per month.

Why Long-term Horizon

“In the short run, the market is a voting machine but in the long run it is a weighing machine” – Benjamin Graham.

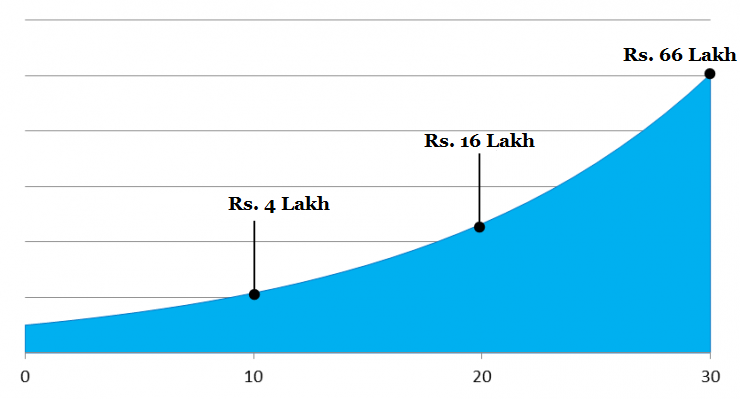

Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

Start with a little amount and don’t forget to increase whenever possible

To get the benefit of compound interest you may start with a little amount of Rs. 1000/-. You may then increase the amount of SIP every year with a little extension of 5%. Let’s understand it with the following graph.

As shown in the graph if you make an SIP of Rs. 5000/- per month for the upcoming 30 years, then you will get Rs. 2.8 crore assuming 15% CAGR. If you increase the SIP amount by 5% every year then you will get Rs. 4 crores after 30 years. So, step up your SIP amount as possible.

To conclude this, you need to gain the compounding interest.

- Start as early as you can.

- Long-term investment horizon.

- Invest consistently and step up i.e., increase your contribution.

Evaluate your current financial status

Now after calculating the desired amount of money in order to make early retirement you should evaluate your current financial situation. If you have just started your professional carrier then you can follow the above-mentioned facts since the beginning. But if you are now 20 years away from your desired retirement age, then you should plan for your targetted retirement corpus in accordance with your current financial situation.

Lets Calculate,

Suppose, our current yearly income = Rs. 5 Lakh.

Yearly expenses i.e. household, insurance, etc. = Rs. 3 Lakh.

Saving per year = 2 Lakh.

So, approximately you have around Rs. 16,000/- savings per month.

If you invest this Rs. 16,000/- per month in any equity-oriented mutual fund you will get around Rs. 2 Crore after 20 years assuming 15% CAGR.

Desired corpus at the age of 55 = Rs. 3.4 Crore.

So, you are getting short of around Rs. 1.4 crores in order to make a happy retirement life.

Get serious about lifestyle changes for early retirement

You need to take several actions in order to reach your desired amount in the upcoming 20 years in order to make a happy retirement life. You need to increase your mutual fund SIP in order to meet both ends. In order to save money here are some actions you can take.

Skipping at least 2-weekend dinners in a month

There are many families who go out for dining every weekend. If you have such kind of habit you can skip at least two-weekend dinners in a month. You can go out for dinner on alternate weekends. Suppose you are a bank employee having holidays on the 2nd and 4th Saturday of a month. You can dine out on the 2nd and 4th weekends. Thus you can save some amount every month.

Use a bike or Public transport instead of 4 wheeler car

Suppose, the distance between your house and your workplace is 10 km approximately. So, every day you have to make a two and fro journey of a total of 20 km. If you go alone to your office then you can use a bike or public transport instead of a four-wheeler car.

Quit smoking and alcohol

Many people have a common perception that term insurance plans are not worth buying as they don’t provide any monetary benefit on survival. It is a proven fact that nicotine causes cancer, but due to bad habit people cannot skip the habit. If you are a habitual smoker or consume alcohol you actually not only destroy your health but a lot of money in smoking.

Get rid of junk foods and soda or soft drinks

We all are aware of the fact that consumption of junk foods like pizza, burger, fast foods or street foods easily available in the market and soft drinks not only increases obesity, cholesterol, etc. but also increases diabetes and other incurable diseases. But due to habit whenever people go outside, they consume junk foods which cost higher. If you come out with the habit of consuming these junk foods and drinks, you will save a lot to secure your future.

Get rid of spending on sale

Shopping malls or shops, as well as online e-commerce companies, offer different discounts or cashback offers from time to time, especially on occasions like Diwali, Durgapuja, Holi, New Year, Christmas, etc. Many persons get tempted to these lucrative offer policies and buy such products, though they do not need them. These items remain unused, but a sufficient amount is spent or wasted. In a whole calendar year, all these unnecessary shopping amounts to big spending. Obviously, you will have to bear the burden. You as a smart person should avoid such kind of activities and save & invest the money.

Exchange of Smartphone

A new fashion of the exchange of smartphones has become very popular among people, particularly among youths. It is seen that a person exchanges his/her Smartphone every two or three years and sometimes after one year. But changing smartphones frequently is not a financially wise decision.

- If you are confused about how much money you should save you may read the article How to get rich by small sacrifices.

Conclusion

For perfect Retirement Planning, you need to consider the following points.

- Take a term plan to secure your family in case of your uncertain demise. The most important thing is you should buy a term insurance plan at an early age. Whenever you start earning you should take a term plan. The earlier you take a term plan, the lesser the premium will be for the term plan.

- Buy a health insurance policy that covers any kind of health hazards or the risk of the health of a person wholly or partially. It bears the medical expenses of a person incurred. You can take a family floater term insurance policy for your family also.

- Make investment planning across all the asset classes with an asset allocation strategy in order to make early retirement planning.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

If you have any questions regarding early retirement feel free to comment so that we have a discussion. If you found this post helpful don’t forget to share this post.