Historically, the equity asset class has delivered better returns in comparison to other asset classes. But the investors need to be cautious about the valuation of the company’s stocks. In order to determine whether the stock is undervalued, they make use of book value and market value. Both are quite useful to identify such stocks which are undervalued with robust earnings growth. Here we will discuss what Face value, Book value, Market value is and the difference between Face value, Book value, and Market value.

Face Value

Face value is the value listed in the accounting books and share certificate including currency. The company decides the face value of any stock when it goes public via initial public offerings. Let’s assume ‘capitalante’ decides to issue $1000 to raise capital for the expansion of the business. If the company decides that the face value of the share is $10, then ‘capitalante’ would have to issue 100 outstanding shares to raise the capital of $1000.

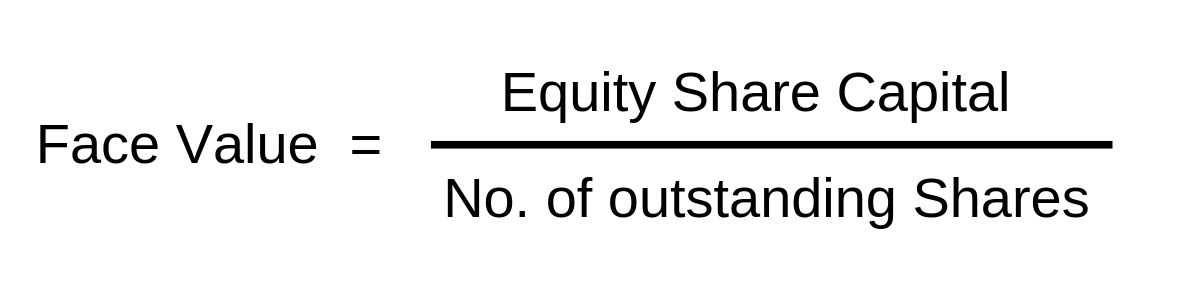

In order to calculate one individual need two numbers namely,

- Equity Share Capital

- The number of outstanding Shares.

You will find both the numbers in the balance sheet of any company.

How to calculate Face Value

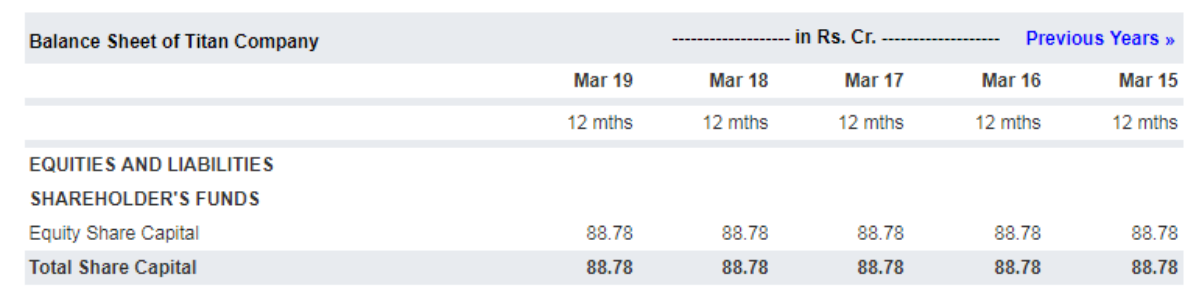

Let’s calculate the face value of Titan Company. As we have discussed earlier that you will find the equity share capital and No. of outstanding shares in the balance sheet,

The equity share capital of Titan Company = Rs. 88.78 Cr.

No. of total shares outstanding = 88.78 Cr.

Face Value of the Titan Company = 88.78/88.78 = Rs. 1/-.

Face value is not affected by the price fluctuation of any stock. The face value of any company is fixed but will reduce in the case of stock split and increase if the reverse-stock split happens. Suppose the face value of any stock is Rs. 10, and the company announces the stock split in the ratio of 1:1 then the face value of the company will be Rs. 5/- since the total outstanding shares are doubled.

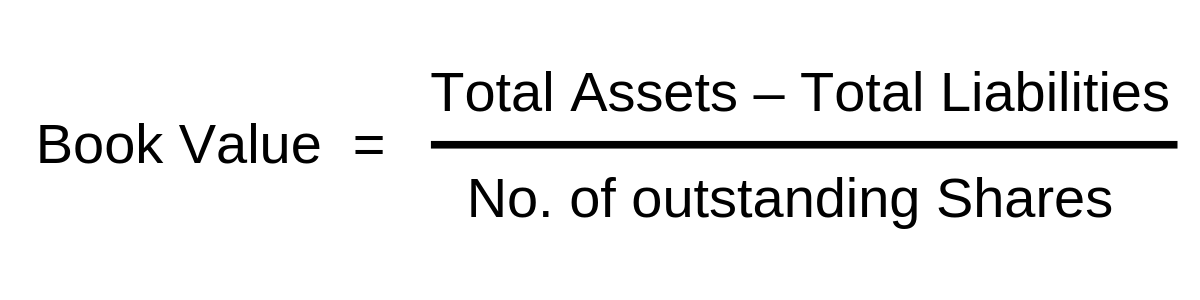

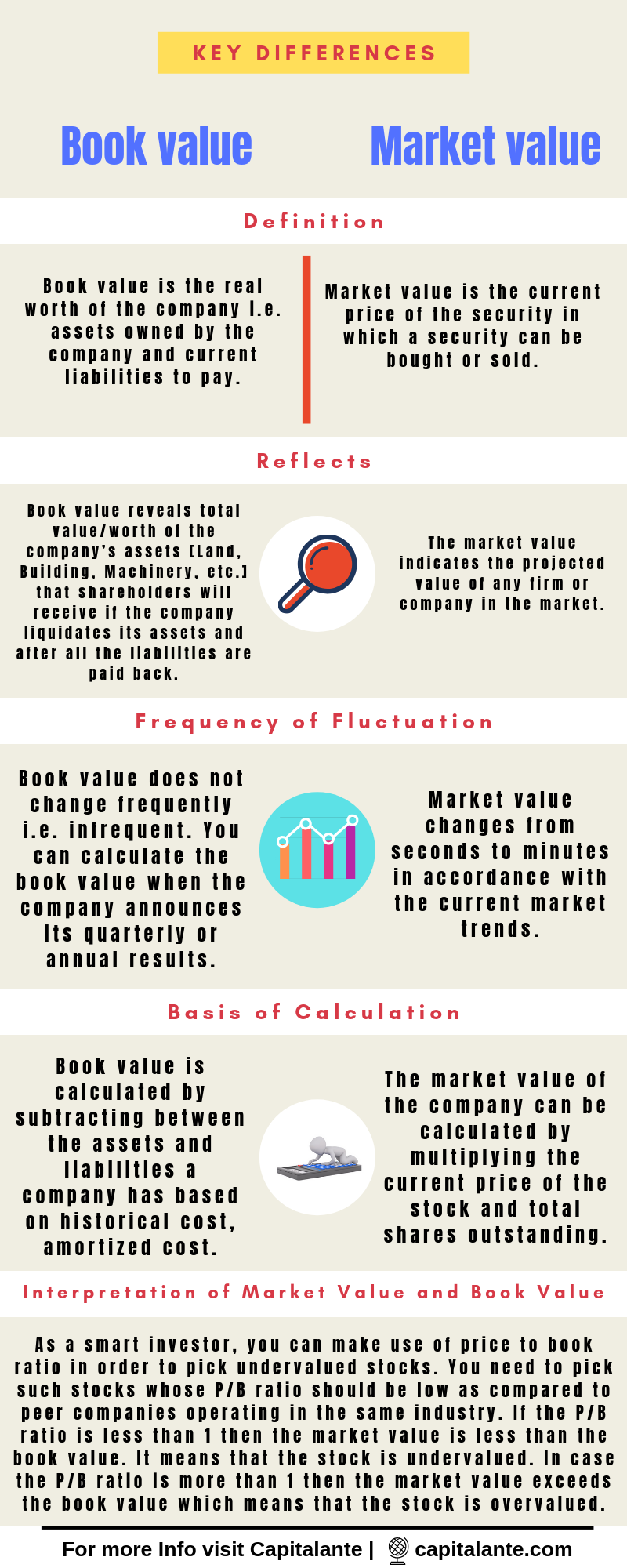

Book Value

Book value is the total value/worth of the company’s assets [Land, Building, Machinery, etc.] that shareholders will receive if the company liquidates its assets and after all the liabilities are paid back to the creditors or lenders of the company. In order to calculate one individual need three numbers namely,

- Total Assets,

- Total Liabilities,

- The number of outstanding Shares.

You will find both the numbers in the balance sheet of any company.

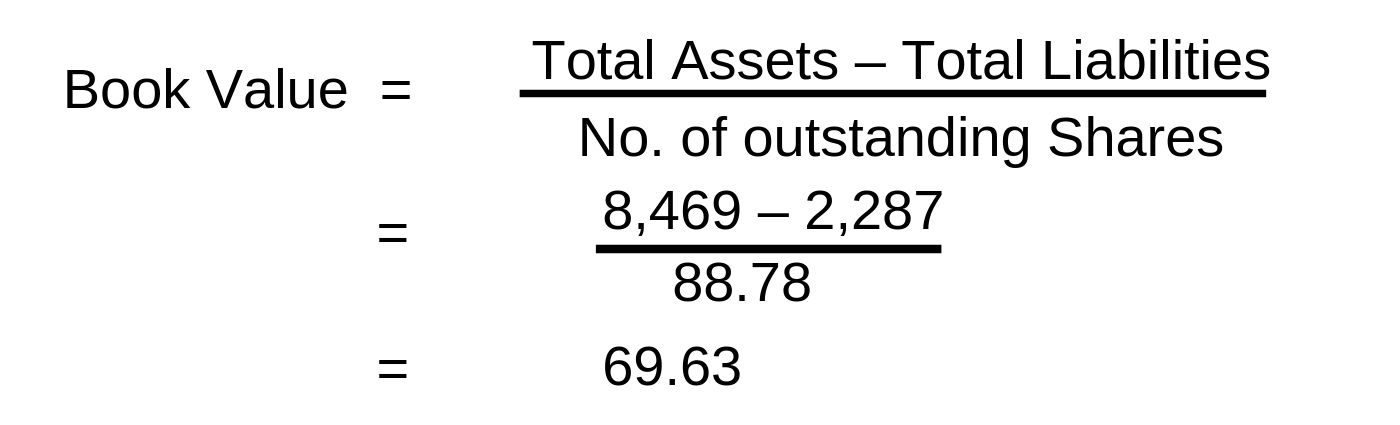

How to calculate Book Value

Let’s calculate the face value of Titan Company. As we have discussed earlier that you will find the Total Assets, Total Liabilities, and No. of outstanding shares in the balance sheet,

- Total Assets of Titan Company = Rs. 8,469 Cr.

- Total Liabilities of Titan Company = 2,287 Cr.

- The number of outstanding Shares of Titan Company = 88.78 Cr.

Market Value

Market value is the price of the security at which price the security trades. If a stock trades at a share price of Rs. 1241/-, then this is the market value of the stock. Unlike Face value, the market price of a company or stock fluctuates during the trading session i.e. 9:00 to 16:00.

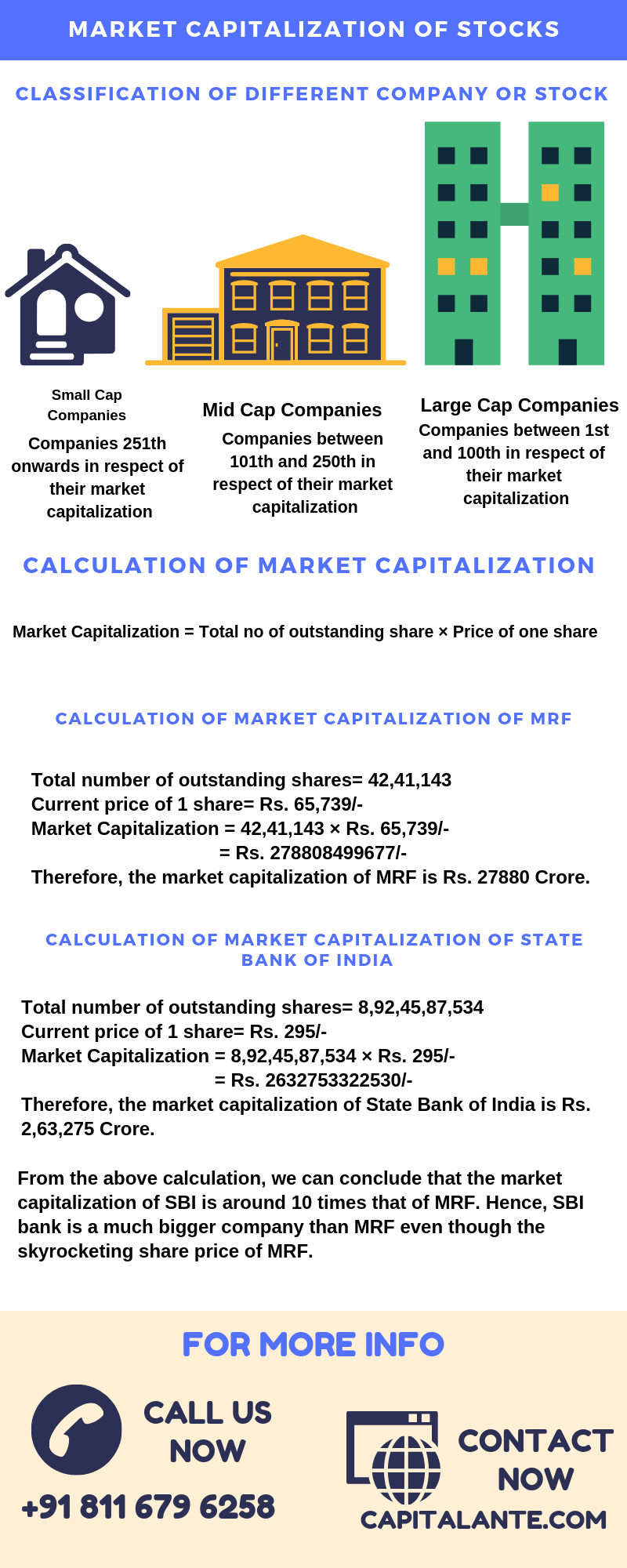

How to calculate the market capitalization of any company or stock

Market capitalization refers to the share value of any individual stock i.e. the current market price of one share and number of outstanding shares issued by any specific company. Since the market price of the stock changes the market capitalization also changes.

Outstanding Shares can be defined as the shares currently owned by stockholders, company officials, and investors in the public domain which are available for trading.

Now let’s dive into the calculation of Market Capitalization,

Interpretation of Face Value, Market Value and Book Value

Face value is the theoretical numbers which are made an entry for the sake of bookkeeping purposes only. Apart from the Face Value, you need to concentrate on the Market value and the Book value of the stock.

If the Market value is greater than the Book Value

This indicates that the investors are an optimist about the earnings growth, profitability, expansion, which will increase the book value of the company.

If the Market value is less than the Book Value

There are two possibilities if the market value is less than the book value. First, the existing investors are not confident enough that the company does not deliver the expected earnings growth or profitability or it has experienced a problem in business. Second, the stock does not come in the radar of the market even it has delivered a robust earning numbers, profitability i.e. it is undervalued.

As a smart investor, you can make use of price to book ratio in order to pick undervalued stocks. You need to pick such stocks whose P/B ratio should be low as compared to peer companies operating in the same industry. If the P/B ratio is less than 1 then the market value is less than the book value. It means that the stock is undervalued. In case the P/B ratio is more than 1 then the market value exceeds the book value which means that the stock is overvalued.

The difference between Book value and the Market value

- Read also: How to Analyse the Balance Sheet of a Company

- Read also: Top 10 Undervalued Stocks to Buy

Hope this article will help you understand the Face value, Book value, and Market value of any company and stock. If you have any question regarding Face value, Book value, and Market value feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.