In order to finance the operating cost and expansion plants, the companies usually utilize profits earned from business operations. But as a start-up company, you do not have any revenue or profits. So, in order to get fund, you are left with only two options namely Debt financing, and Equity Financing. In this column, we will discuss what is debt financing and equity financing, the advantages, and disadvantages of Debt Financing and Equity Financing, and a comparison between Debt Financing and Equity Financing, Debt Financing Vs. Equity Financing.

What is Debt Financing?

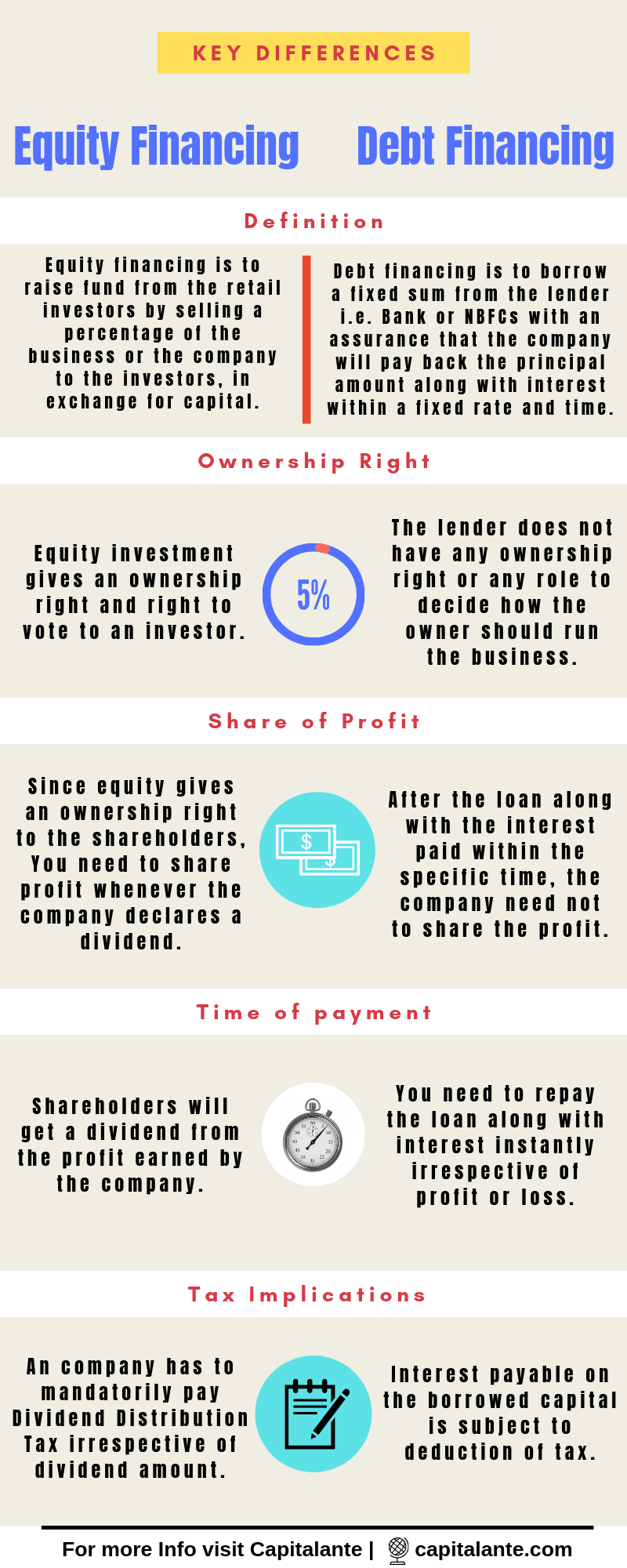

When a company requires cash to finance several requirements such as the expansion of business or set up a new unit, the company makes use of debt financing. Debt financing is to borrow a fixed sum from the lender i.e. Bank or NBFCs with an assurance that you will pay back the principal amount along with interest within a fixed rate and time.

Advantages of Debt Financing

Here are the advantages of debt financing.

Control: The lenders give you a loan with a fixed interest rate which is to be repaid within a specific time they are the creditors of the company. The lender does not have any ownership right or any role to decide how the owner should run the business.

Tenure of the loan repayment period: The principle and interest payable are calculated at the time of the loan, you can choose the repayment period i.e. long term or short term in accordance with profitability and cash flow of the company.

Tax deduction: The current tax structure allows the companies to deduct the interest paid on the borrowed capital from the gross income by running a business.

Disadvantages of Debt Financing

Here are the disadvantages of debt financing,

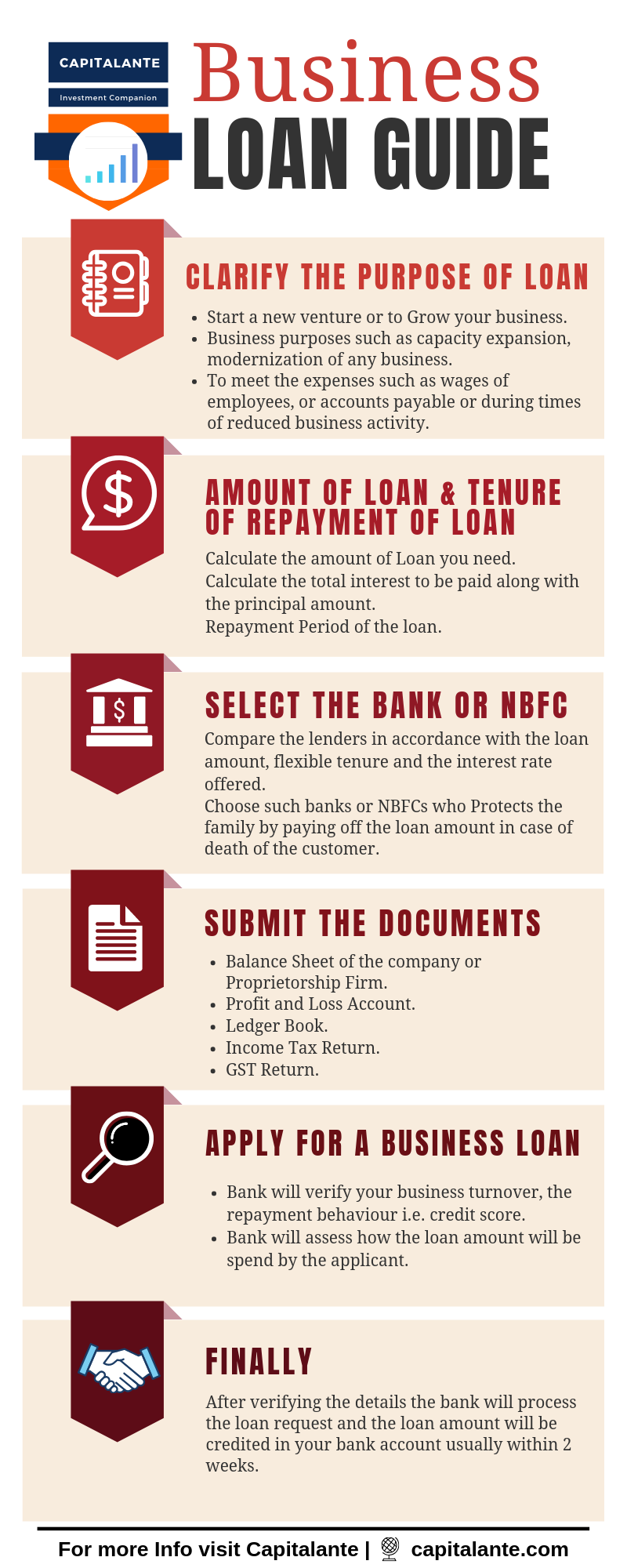

Qualification: In order to get a loan you need to furnish the Balance sheet, Profit and Loss account, business turnover for the last 3 years. In addition to this, the lender verifies the credit history, repayment behaviour in the recent past, etc.

Collateral Required: Lenders in order to give loans hold the assets of the company as collateral i.e. as the security of repayment of the loan.

Regular payments: Irrespective of loss or profit, you need to pay back the principal along with interest in the fixed schedule. The business which has experienced declining revenue or sales will create repayment default.

Impact on business: Since you need to repay the loan at a fixed time so, you can run short of money for the expansion of your business i.e. growth of the business.

Should you opt for Debt Financing?

Unlike equity financing, you don’t give the ownership right to the lenders. Since you have taken a loan in order to meet the cash requirement they are the lenders or creditors of the company. In order to qualify for a loan, you need to submit the company’s operating profits and history. This is because the lenders verify whether you have generated enough profit by running the business to repay the loan.

What is Equity Financing?

When a company requires money to finance the several requirements such as the expansion of business or set up a new unit, the company makes use of equity financing from the retail investors by selling a percentage of the business or the company to the investors, in exchange for capital. The investors who buy the share of any company have a voting right.

Usually, a company can raise fund via issuing an Initial Public Offerings, or via venture capital financing. Venture capital financing is beneficial to raise money from high net worth individuals who are looking for investment across various companies to diversify and minimize the risks associated.

In the case of initial public offering when the company raises funds from retail investors the venture capitalists have an option to sell or reduce their stake by selling equity shares to institutional or retail investors.

Advantages of Equity Financing

Here are the advantages of Equity financing,

No collateral required: If you have a business plan along with the business model and profitability then angel investors or venture capitalists invest without in your project without any collateral.

No repayment period: Unlike debt financing, you need not pay any fixed monthly or yearly payments to make. This enables a company to manage funds efficiently for expansion of business or purchase of machinery to boost production.

More cash on hand: Since you have more cash on hand since there is no loan repayment amount. So, the company can declare a dividend to the shareholders in accordance with the profitability of the company.

Long term planning: Since the investors do not expect the immediate return on their investment, you can manage the funds efficiently which will yield better returns in the near future.

Disadvantages of Equity Financing

Here are the disadvantages of equity financing,

Share of Profit of the company: Since equity gives an ownership right and voting right to the shareholders, the dividend paid to the shareholders are more than the interest payable in the case of debt financing.

Loss of control: Since the shareholders are the owners of the company, you need to consent or consult with the shareholders in the case of differences of opinions among the shareholders.

Should you opt for Equity Financing?

If you have started a start-up with no operating profits and history, still you can raise fund from angel investors and venture capitalists. The venture capitalists focus on such companies which are in the cyclical sectors with a potential to generate huge returns in the near future i.e. 5-6 years. The venture capitalists or angel investors focus on the business model, competition in the industry, profitability, etc.

Which one should you opt

Suppose, you are running a small business and you require $100 for expansion and modernization of machines to boost the production. Now you have two options. First, you can either take out a business loan of $100 from any bank or NBFCs or you can sell a stake in your business to investors for paying $1000. Secondly, you can make use of equity financing by giving the investors a stake of 40% in exchange for capital.

Now, in the case of Debt financing if you have taken a loan from the bank at the interest rate of 9% for the tenure of 2 years then you need to pay $570 per year. Let’s make it clear with the following example,

- Suppose your company makes a profit of $2000. In the case of debt financing, you will need to pay $570 per year. So, you will make a profit of $2000- $570 = $1430.

- But In the case of equity financing since you have given a 40% stake in exchange of capital, you will need to pay [40% of $2000 = $800]. So, you will make a profit of $2000- $800 = $1200.

Suppose in the second year your company makes a profit of $4000 by running out operations in a year.

- Irrespective of your company’s profit you need to pay $570 per year. So, you will make a profit of $4000- $570 = $3430.

- But In the case of equity financing since you have given a 40% stake in exchange of capital, you will need to pay [40% of $4000 = $1600]. So, you will make a profit of $4000- $1600 = $2400.

Finally,

From the above examples, it is clear that debt financing is far better than equity financing in the case of robust profit earnings since debt financing is less expensive. But the fixed interest rate is a disadvantage in the case of reducing profit since you need to pay fixed interest in a year. Let’s make it clear with the following example,

Suppose your company makes a profit of $1000 by running out operations in a year.

- Irrespective of your company’s profit you need to pay $570 per year. So, you will make a profit of $1000- $570 = $430.

- But In the case of equity financing since you have given 40% stake in exchange of capital, you will need to pay [40% of $1000 = $400]. So, you will make a profit of $1000- $400 = $600.

Debt Financing Vs. Equity Financing

| Points | Debt Financing | Equity Financing |

| How companies raise funds | In the case of debt financing companies raise funds by issuing debentures, bonds, etc. | In the case of equity financing companies raise funds by issuing shares or stocks. |

| Ownership | Since the lenders give a loan at a fixed rate which is to be repaid within a fixed tenure, they are the creditors of the company not the owners of the company. | Since the company raises funds from the retail investors by selling a percentage of the business or the company to the investors, in exchange for capital, they are the owner of the company. |

| Voting Right | Do not have any voting right. | Have voting rights. |

| Share profit | You need to only pay interest. | You need to share profit whenever the company declares a dividend. |

| Collateral Required | Lenders require collateral or a personal guarantee or assets such as property, factory, etc. | Need not to give any collateral. |

| Time of payment | You need to repay the loan along with interest instantly irrespective of profit or loss. | Shareholders will get a dividend from the profit earned by the company. |

| Tax implications | Interest payable is subject to deduction of tax. | Any company mandatorily pays dividend distribution tax irrespective of dividend amount. |

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare an effective financial planning.

- Read also: Top 25 Types of Loan in India

- Read also: Venture Capital Financing – Methods, Funding Process, Features

Hope this article will help you to understand the difference between debt financing and equity financing. If you have any question regarding Debt Financing Vs. Equity Financing, feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.