Looking for the Best stocks to invest in India for long-term Investment that may give a steady return with minimum risk? Picking the best stocks to buy in India for long-term investment is a difficult jargon to solve. In order to pick the best sectors to invest, you need to analyze the sectors by making use of SWOT analysis. In this column, we will discuss the cyclical stocks which will yield better returns in the near future. We will also make a comparison between cyclical stocks and defensive stocks.

What are Cyclical Stocks?

Cyclical stocks can be typically defined as such stocks which are affected by macroeconomic, systematic changes, the real disposable income of the people. These companies sell such products or offer services which boom in the case of expanding economy. Let’s make it clear with the following example.

When the real disposable income increases owing to the economic progression then people tend to buy luxurious products to upgrade their lifestyle such as bikes, Refrigerator, electronic goods etc. In this way, various sectors such as Automobile, Housing, entertainment, retails, paints and pigments, consumer durables, services will benefit. This will increase these companies’ sales and their share prices too.

In contrary, when the economy is in the depression or recession phase people are less likely to buy luxurious products and this impacts on the sales negatively. Since the sales margin decreases, the profits of the cyclical company tends to drop and the share price also drops.

- Read also: Definition of ‘Cyclical Stock’

What are Defensive stocks i.e. non-Cyclical Stocks?

Defensive stocks are usually called non-cyclical stocks since these stocks deliver constant dividend and stable earnings irrespective of the state of the economy. Let’s make it clear with the following example. Whatever the economic scenario it becomes you will still use toothpaste in the morning, make use of water, gas, and electricity etc. During the economic recession, one individual is not supposed to significantly reduce the spending incurred to buy soap or toothpaste or razor blade. From the above examples, it is clear that utilities i.e. Non-Cyclical or defensive stocks will deliver satisfactory returns irrespective of economic downturns since demand for these products and services will remain relatively stable.

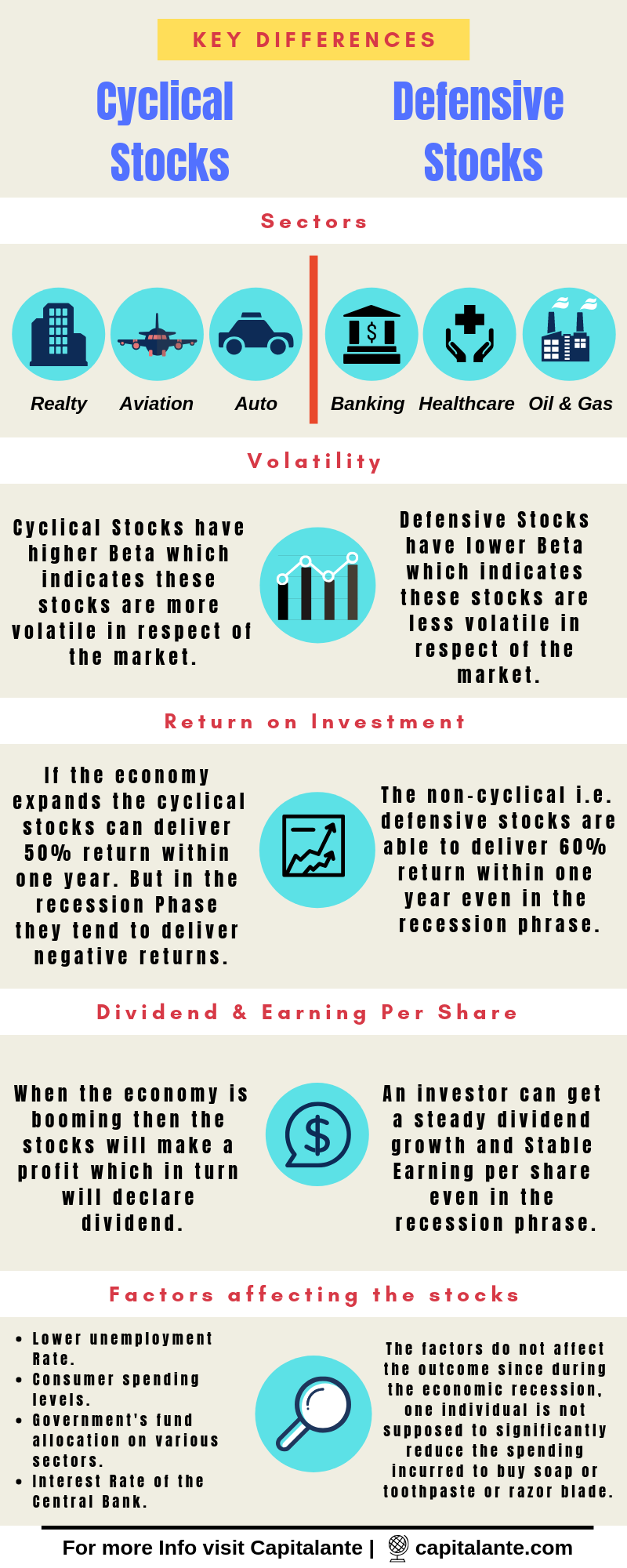

The Difference between cyclical stocks and defensive stocks i.e. non-cyclical stocks

Many a person has a common dilemma what the perfect strategy is while investing in the stock market i.e. between Cyclical stocks and Defensive stocks. Let’s compare the two.

Cyclical stocks tend to change in accordance with the economic scenario of a country. If the economy expands then cyclical stocks tend to deliver better returns than the defensive stocks. On the other hand, in the recession phase, they deliver negative returns. Let’s make it clear by making use of the following examples.

Usually, during the expansion of the economy and the increase in disposable income people get tempted to buy new cars, a new house or renovate their houses, and travel to different places. So, the beneficiary sectors are automobiles, housing, finance companies, and travel-related companies.

On the contrary, when the economy goes into recession phase people tend to spend less and cut their expenses to save. In that phase due to reduced demand companies reduce their manufacturing capacity which decreases their sales as well as profit margin.

But defensive stocks deliver stable earnings irrespective of the condition of the economy.

Usually, cyclical stocks have higher beta i.e. the volatility of a share in respect of market than the defensive stocks. Let’s make it clear with the help of the following example.

During the economic progress, they deliver better returns than defensive stocks. Usually, cyclical stocks have a beta greater than one and defensive stocks have a beta less than one. Non-cyclical stocks neither outperform the market when the economy is booming nor underperform the market when the economy is in a downturn. On the other hand, cyclical stocks outperform the market when the economy is booming and underperform the market when the economy is in recession phase.

How to pick best Cyclical Stocks

In order to pick the best cyclical stocks, you need to consider the following points.

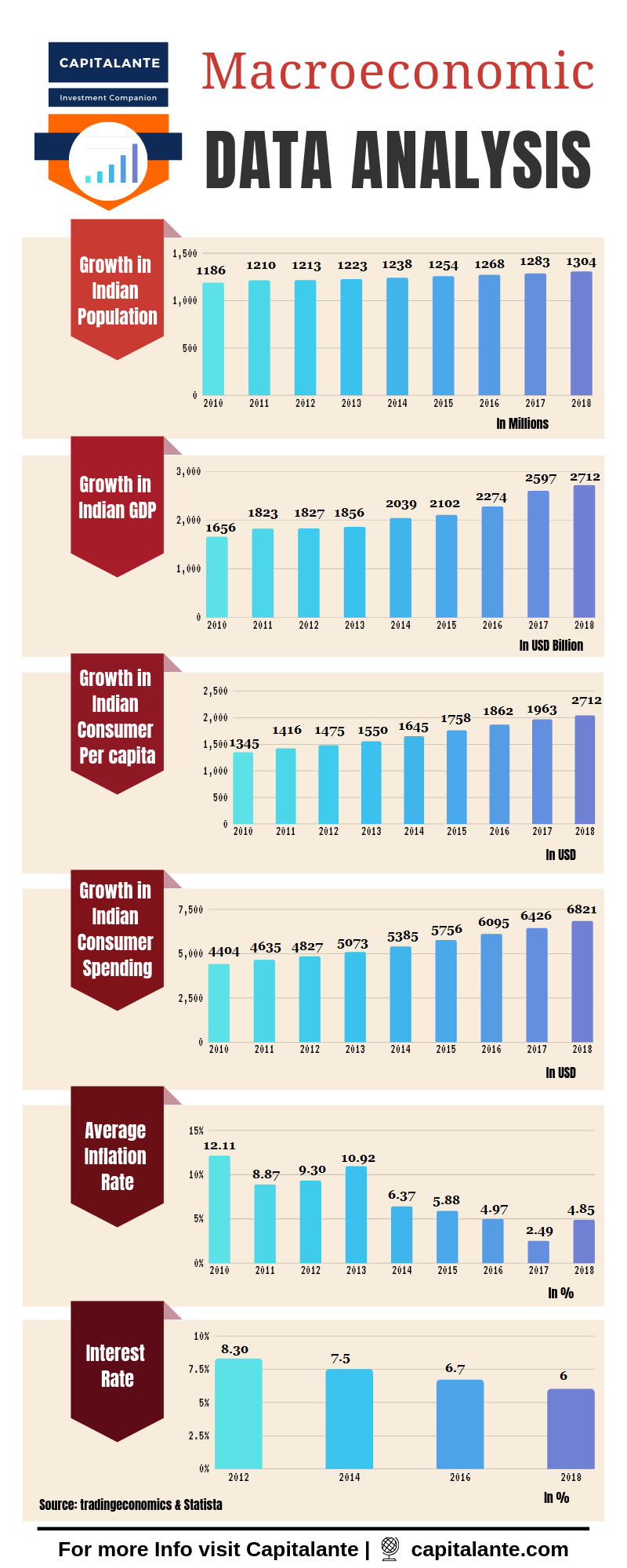

- Analysis of several macroeconomic data such as the growth of population, Gross Domestic Product, Inflation rate, Real Disposable Income, the Interest rate of loan etc.

- Make use of SWOT analysis of stocks and analyze the sectors which are likely to boom with the help of the above mentioned macroeconomic data as mentioned above.

- While choosing industry pick such industry that will not disappear any time for at least 10 years such as NBFCs or Entertainment companies such as Netflix, Walt Disney, or Sports shoes brands like Nike, Adidas etc.

In order to pick best cylindrical stocks which will enable better returns in the near future, let’s make an analysis of the leading NBFC namely Bajaj Finance in respect of macroeconomic data such as the growth of population, Growth of Gross Domestic Product, Inflation rate, real disposable Income, the Interest rate of loan etc.

Note: This is the few lessons from the book which I discovered from Alex Frey’s brilliant book ‘A Beginner’s Guide to Investing: How to Grow Your Money the Smart and Easy Way’.

From the above infographics, it is clear that our economy is rapidly increasing in respect of Growth in GDP, Real disposable income, per capita income, inflation rate and interest rate. By these robust numbers, the stocks have given an immense return of 40,000% return since 2008. So, from this perspective, this type of stock are still capable to deliver better returns in the near future since the Indian economy has the potential for expansion in comparison to world economics.

Which type of stocks should be included in your portfolio?

You need to create a portfolio in accordance with the economic scenario and most importantly a proper understanding of the cyclical sectors and defensive sectors. Let’s make it clear with the following example. Automobile, aerospace, apparel, accessories were previously treated as cyclical sectors, but now these are not cyclical sectors anymore. They are now treated as defensive sectors. You may emphasize defensive stocks because they tend to deliver stable returns irrespective of economic scenario, but cyclical stocks give better returns if selected carefully.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Top 10 best stocks to buy in India for long-term

- Read also: Top 10 best sectors to invest in India for long term

Hope this will help you to make a better portfolio. If you have any questions regarding this topic feel free to comment so that we can have a discussion. If you have found this post helpful please share it with your loved ones.

Excellent article.