Many retail investors have a common perception that what penny stock is today will be the multi-bagger stock in the future. This is because once symphony was considered a penny stock and traded at Rs. 5/- in 2000. Now symphony trades at Rs. 1500/- in 2019 and is a large-cap company. There many more examples like this.

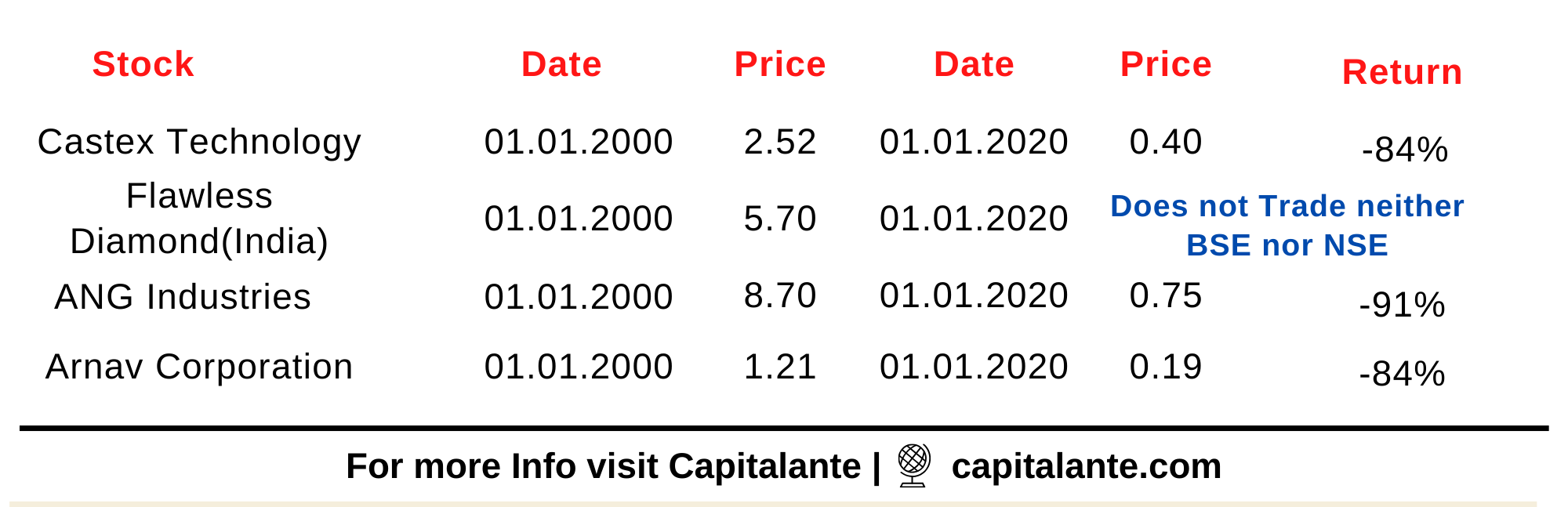

So, following the examples, people think that every penny stock will deliver the skyrocket return in the future. It is quite true but only three out of every 1000 penny stocks have delivered positive returns to investors. Many retail investors lose millions of money by trading or investing in penny stocks. In this column, we will discuss whether an investor should invest in penny stocks, the strategy to pick the best penny stocks & Top 10 penny stocks to buy in India.

What is penny stocks

First of all, let’s understand what penny stock is. Penny stocks are defined as those stocks which trade at a very low price i.e. Rs. 10 or Rs. 5 or less. These companies possess very low market capitalization. These penny stocks do not fit the stringent regulations by the major stock exchanges like NSE, BSE, Nasdaq, etc. Penny stocks have a very low trading volume with low liquidity or a lack of liquidity.

Risks associated with Penny stocks

Penny stocks carry some risk with them. The risk associated with the investment in penny stocks are as follows,

- The biggest risk is that when a penny stock company goes bankrupt, its shares typically are eventually cancelled and become worthless. Any remaining assets are sold to pay back the banks and other creditors. But after the bankruptcy announcement, stocks may continue to trade on the stock market for weeks or months, and traders can still buy and sell the shares, which can cause problems for uninformed investors.

- Penny stocks lack trustworthiness as they are not registered with major stock exchanges like NSE, BSE, Nasdaq or NYSE, etc.

- There are several instances when penny stocks have been delisted by SEBI from the stock exchanges i.e. BSE and NSE for non-compliance with the requirements of the stock exchange and SEBI.

- You will not get any coverage about the business model, revenue model, expansion of business, etc. of the company from the brokerages.

- Without reliable financial data as mentioned above investing in penny stocks is like gambling.

- Read also: Which penny stocks are worth investing in India?

- Read also: penny stocks: Latest News on penny stocks

In addition to

Penny stocks show extreme price volatility of 50% to even 100% in a single trading session of one day. You may find that many penny stocks jump to 500% within one year and many correct up to 500% within one year. Due to their check price they can easily be manipulated. But without any proper information and analysis i.e. business model, sales margin, profit margin, market cap, etc. you cannot predict the future of a penny stock. There are only two possibilities left. The first one is you may become a millionaire or go bankrupt.

Penny stocks have a low trading volume. Let’s make it clear with an example. Suppose, you possess 1000 shares of a particular penny stock with an average buying price of Rs. 2. Now, within one year the penny stock has delivered 400% return and is now trading at Rs. 8/-. So, you decide to book the profit by selling your 500 shares. Here you will face the problem. The yearly trading volume of the penny stock is only 100. So, to whom you will sell your shares if there is no one to buy that large quantity of shares.

The strategy to pick the best penny stocks

Many retail investors remain in search of penny stocks that will give multi-bagger returns in the future like Symphony or Minda Industries etc. In order to pick the best penny stocks to buy retail investors should consider the following points.

- The intrinsic value of the stock, because the price depends on the market cap, business size, turnover, etc.

- The business model of the company i.e. how the company generates revenue.

- The performance of the company i.e. whether the company’s revenue, profit margin increase year-on-year.

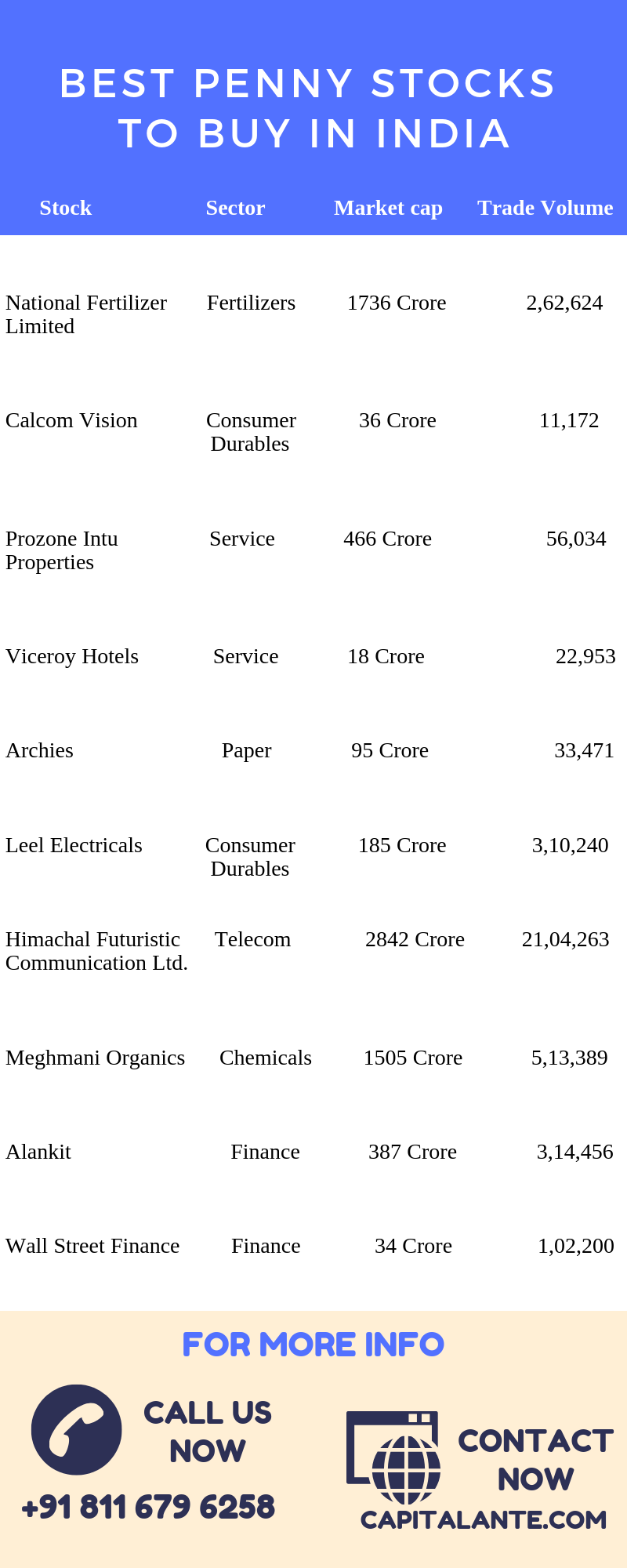

- In which sector the company is operating.

- The trading volume of the company.

- The trustworthiness of that company since penny stocks do not meet the stringent regulations by the major market exchanges.

Top 10 Penny Stocks to buy in India

Points to Consider while buying Penny stocks

In order to make the investment in penny stocks here are some suggestions.

Don’t invest a large amount

If you want to invest Rs. 1 lakh in the stock market, you can invest a maximum of 5% i.e. Rs. 5000/- in penny stocks.

Invest only in 10 penny stocks with a large volume

You can buy those penny stocks which have a large trading volume. If you invest penny stocks with large trading volume then you can sell your share i.e. offload them at once.

Don’t try to average your purchases

The making of an average concept cannot apply in the case of penny stocks. Suppose you buy 1000 shares of a penny stock at the price of Rs. 5. Then after a one-year price goes down to Rs. 2. In that situation do not put more money to buy more shares in order to bring an average. The best strategy is that you should sell that share whenever the price of the penny stock shows a spike.

Sell quickly

Once you have gained 50% or more from a penny stock, do not wait for more. Just sell your shares. A penny stock takes no time to decline from its 52 weeks high to 52 week low.

Note: This is the few lessons from the book which I discovered from Timothy Sykes’s brilliant book ‘Penny Stock Conspiracy‘.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: Why People Lose Money in the Stock Market

- Read also: How to Pick Best Stocks for Consistent Returns

If you have any questions regarding the top 10 penny stocks to buy in India feel free to comment so that we have a discussion. If you found this post helpful don’t forget to share this post.

Respected sir, Kindly suggest some names of penny stocks.