Do you think $1 million might not be enough? Well, it will take about 12 days to count $1 million. Around 60% Americans think that $1 million is enough to lead a worry-free retirement life.

According to the latest estimates on average, a $1 million retirement fund will last 19 years. But everyone’s situation, lifestyle, spending habits is different. It’s possible to lead a happy retirement life, since many Americans manage their finances post-retirement with less than one million.

According to the latest estimates on average, a $1 million retirement fund will last 19 years. But everyone’s situation, lifestyle, spending habits is different. It’s possible to lead a happy retirement life, since many Americans manage their finances post-retirement with less than one million.

So, should I retire with $1 million? Is it enough to lead a worry-free retirement life?

The Short answer is that $1 million is enough retirement corpus for an average American retiring the next week to pay his/her utility bills. But the million-dollar question is whether you are going to retire the very next week or going to retire after 30 years.

When you are going to retire?

This is a million-dollar question. Do remember when your retirement is 3 decades away, the picture seems different. For example, when you are going to retire after 30 years you will need $3 Million, owing to inflation. You don’t have $3 million. Don’t worry if you are in your 30s, you have plenty of time to build a retirement corpus of $3 Million. Let me show you the 7 steps by following which you are going to lead a happy retirement life.

- Know your worth,

- Spend less than your income,

- Be safe, be insured,

- Create multiple sources of Income,

- Determine how you lead your lifestyle,

- Calculate a realistic Retirement Budget,

- Invest wisely across various asset classes and stay invested in the long run.

Step #1. Know your worth

It means calculating your portfolio value i.e. property, assets such as gold, bullion, etc., and their valuations. You should think about your earning and the possibility of an increase in your earning. You can calculate the current value of all the possessing from land, house, jewelry to any other valuable things. Then take into account the future liabilities that will come in the way. You cannot predict the future and any emergency situation that may arise in your life. But you can hold an assumption of your possible responsibilities. Whatever, your present wealth can give you a real snapshot of your financial situation. According to the real worth of your holdings, you can determine your position and then use your savings to build a better future.

Step #2. Spend less than your income

This is an age-old proverb, yet relevant at all times. You should use your hard-earned money wisely. Buy those things that you really need. You should not spend your money on simply pleasure or entertainment purposes. Always set a budget for your monthly expenditures. Try to save at least 20% of your income. In accordance with the 50/30/20 rule of money, one individual may spend 50% on needs, 30% on wants, and the rest 20% on saving.

Step #3. Be insured, Be safe

In order to get success in wealth management, an individual is supposed to take an insurance policy to secure his family in case of his uncertain demise. The most important thing is you should buy a term insurance plan at an early age. Whenever you start earning you should take a term plan. The earlier you take a term plan, the lesser the premium will be for the term plan.

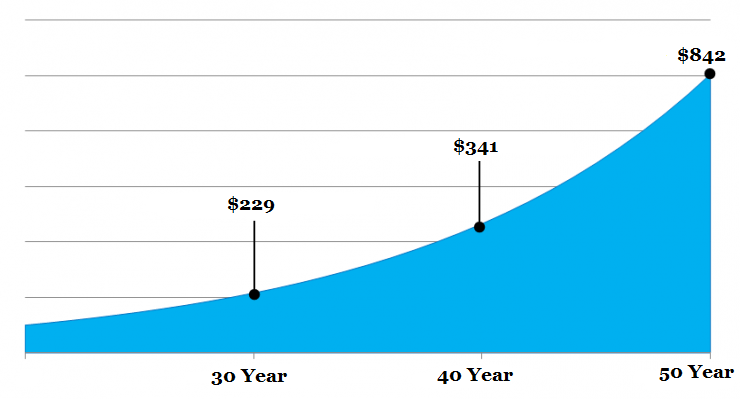

Suppose, you buy a term plan at the age of 30 and you want to continue this plan for the upcoming 20 years. can easily avail up to $500,000 as your life insurance for just $229 yearly. But if you delay for 10 years, you need to pay a yearly premium of $341. Again if you buy a term insurance plan at the age of 50 years then you need to pay $842 per year for an assured sum of $500,000 for the upcoming 20 years.

Buy a Health Insurance Policy

One individual should buy a health insurance policy. Health insurance or Mediclaim Policy is an insurance that covers any kind of health hazards or the risk of the health of a person wholly or partially. It bears the medical expenses of a person that is incurred. You can opt for health insurance for any kind of uncertain or accidental health problems. To get the health insurance you need to select a lump sum amount and on the basis of it you are to pay a premium either monthly or quarterly, or yearly basis.

The insurance covers the medical expenses when you suffer from any health hazards and it helps to carry out the investment without worry. In other words, the health insurance policy will ensure funds for the physical ailments of you as well as your family. This medical insurance policy diminishes the heavy medical bills.

Step #4. Determine how you lead your lifestyle

According to most of the millionaires, nearly 90% of people cannot become rich even after their retirement, because they are not visionary. You should differentiate between your needs and wish from the start. You have access to laptops, tablets, and smartphones,so you can use Excel sheets to track expenses. Prepare a detailed expense sheet with major pockets of spends like stationery, travel, food, entertainment, and shopping. You have to maintain records under these heads. You can fix an amount for each head. In this way, you can track the expenses easily.

Surround yourself with financially educated and conscious people from whom you can learn about financial planning. Also, make sure that your group of friends comprises people who share similar financial goals. It can be difficult to adhere to financial disciplines when you spend time with spendthrifts. A great way to learn about the art of finance is to find a family friend who can mentor you throughout the process – someone who has achieved his own financial success.

Many Americans have a dream to travel around the world and spend $3000 on average. If you are looking for a worry-free retirement life you should travel to Oxford, Ohio instead of Oxford, The UK. Do remember to boost your retirement savings, maintain a balanced budget or find a part-time job to fund your endeavors along with your full-time job.

Step #5. Create Multiple Sources of Income

According to Warren Buffet, apart from your salary income and investment, you should create various income streams.

But How? Well, this is a Million Dollar Question.

Many persons have a common perception that starting a business is quite a herculean task that requires a lot of money, an innovative idea, and of course getting a license to start the business. But with small smart work, you can start a business from scratching with a small amount of $100 right now.

Idea #1. Make a YouTube Channel

YouTube is full of videos that cover investment, personal finance, coding, blogging, cooking, etc. You can run a YouTube channel on investment, personal finance to make money. The content delivered by the journalists in the newspapers or news channels does not fit all. If you can deliver high-quality unbiased content on finance via YouTube videos that are able to feed a larger portion of people in order to achieve financial freedom, then you will make money.

Idea #2. Run a Finance Blog

Just like this blog you can write various investment-related articles that will help your audience to achieve financial freedom. If you have established authority and get search engine traffic then you will make a handsome amount of money by displaying banner ads and paid sponsorships. Many successful Bloggers like Amit Kumar of Apna Plan, Sreekanth Reddy of ReLakhs make a decent income in this way. The blog you are reading now also makes money via Google Adsense and Affiliate marketing.

Idea #3. Dropshipping

Unlike selling the products physically, Dropshipping business is a kind of e-commerce business without owning a single product. In this kind of e-commerce business, you neither produce any product nor warehouse to store the product. Once someone buys an item from your website you make an order with the third party and the third party handles everything else.

Idea #4. Ghost Writing

There are full of marketers who are busy with marketing, search engine optimization, etc. They don’t have much time to write blog posts. As a Ghostwriter, it is your job to write quality content. In a nutshell, you i.e. the Ghostwriter get paid to write articles/blog posts for someone else.

Idea #5. Virtual Assistant

A small business owner has many important yet time-consuming tasks. If you have organizational skills, communication skills, etc. then as a virtual assistant you need to do the following works,

- Updating the company’s Facebook Page, Twitter Profile, etc.

- Prepare balance sheet and Profit & Loss account, Ledger Account, etc.

- Sending and reply to e-mails.

- Blog Posting.

And so on…….

As a Virtual Assistant, you can make between $10 and $50 per hour online.

Idea #6. SEO Consultant

The current blog you are reading gets traffic that still comes from search engines i.e. Google. As an SEO consultant, you can offer techniques on Search Engine Optimization and make money.

Idea #7. Website Flipping

Real estate, Stocks are not the few investment businesses that involve purchase low and selling high. We have Website Flipping ‘online real estate/Stock’. As a business owner you can buy an existing website, and after making necessary modifications flip [sell] the website at a higher price. There are various marketplaces i.e. Flippa & GoDaddy auction where you can buy and sell domains.

Step #6. Create a realistic Retirement Planning

One of the common misconceptions among the masses is that after getting a job most people think that they are too young to plan for retirement. Early retirement planning will secure financial needs with ease for the life after their retirement. Let’s make it clear with the following example.

Suppose you are of 30 years and your yearly expenditure is $60,000 now.

So, your annual expenditure after 30 years [at the age of 60 years] will be $125,854 assuming a 2.5% inflation rate.

So, in order to lead a happy retirement life after 60 years of age and if you live at least 80 years, then you will need to manage a corpus of [$125,854 × 20 years = $2.5 Million].

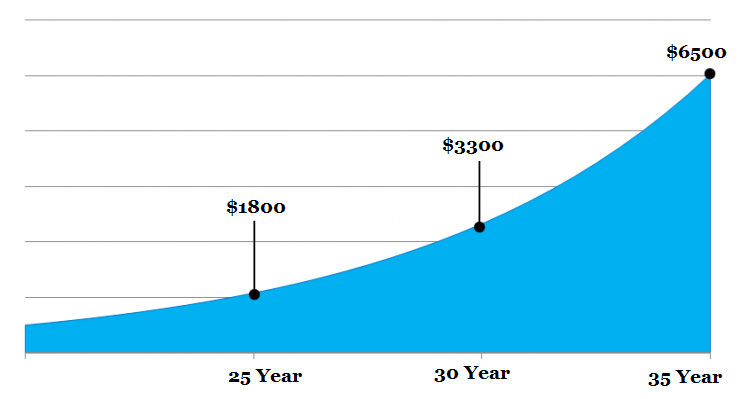

If you start investing at the age of 30 years with just $ 1800 per month then you will get $5.5 million when you are 60, assuming 12% CAGR. If you are late by 5 years i.e., you start investing at the age of 35, then you need to invest $3300 per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 40 years then you need to invest $6500 per month.

Step #7. Invest wisely across various asset classes

Now, you need to consider the perfect asset allocation strategy and investment route to meet the above-mentioned purposes such as retirement corpus, education cost of son & daughter, Marriage cost of the daughter, buying a home etc.

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class that has some moderate risk than the other asset class like the bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Asset allocation strategy

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or the stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities. If your risk appetite is high, for better returns over a long period of time you can invest your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young you can afford to wait and see for a long time. Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

By which route can a common individual start investment in the stock market?

In order to make an investment in the stock market, beginners have two options. The first option is to invest via direct equity by opening a de-mat account and the second one is via a mutual fund. In order to make a profit in the stock market via direct equity, you need to analyze the fundamentals, business analysis, balance sheet, profit and loss account, free cash flow while choosing the stock in which you are going to invest.

In the case of Mutual Funds

But in the case of mutual fund investment, you need not analyze the above-mentioned points. Mutual funds are managed by fund managers who are active in this field for a long time and possess vast knowledge and experience. The fund managers pick stocks or shares in which your money is to be invested. The fund manager of the respective mutual fund invests your money in different sectors like Banking, Finance, FMCG, Infrastructure, Automobiles, Information Technology, and Manufacturing, etc. You may invest a lump sum amount at once or you may opt for a monthly, quarterly, or yearly basis via SIP.

If you are confused which route you should follow to start investing in the stock market, i.e. direct equity or mutual fund, you may read the article How you can invest, directly in equity or via mutual funds.

Monitor your investment

Besides having patience you need to monitor or check your investment portfolio at least once in a year. You cannot just close your eyes and remain to relax after making an investment. You should check the status of your investment once in a month. Let’s assume after 3 long years you notice that one of your mutual funds does not cope with the market and can’t deliver a better return than the benchmark index then you should invest anywhere else.

Stay invested with a long term view

After making your first investment you need to stay invested in the long term if you are investing in the equity asset class. This is because to earn compound interest. Needless to say, the power of compounding enables an investor to earn interest on interest.

Now, to enable the compounding of your money you need to do the following 3 things.

Long-term Horizon

Just look at the following graph.

If you make a lump sum investment of $16,000 at once and allow the money to compound at the rate of 15%, then you will get-

- $64,728 after 10 years,

- $2,61,861 lakh after 20 years,

- $10,59,370 after 30 years.

Start Early

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 30 years with just $ 1800 per month then you will get $5.5 million when you are 60, assuming 12% CAGR. If you are late by 5 years i.e., you start investing at the age of 35, then you need to invest $3300 per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 40 years then you need to invest $6500 per month.

Start with a little amount and don’t forget to increase whenever possible

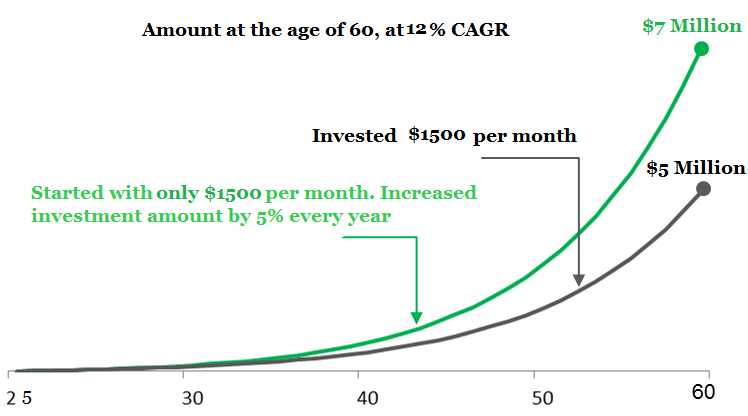

To get the benefit of compound interest you may start with a little amount of $1500 a month. You may then increase the amount of SIP every year with a little extension of 5%. Let’s understand it with the following graph.

As shown in the graph if you have made a SIP of $1500 per month for the upcoming 30 years, then you will get $5 million. If you increase the SIP amount by 5% every year then you will get $7 million after 30 years. So, step up your SIP amount as possible.

To conclude this, you need to gain the compounding interest.

- Long-term investment horizon.

- Start as early as you can.

- Invest consistently and step up i.e., increase your contribution.

Finally, decide where you will live after retirement

When you will retire next week it’s important to decide where you will stay to enjoy your retirement life. When it’s time to pick the best place to retire, do consider the cost of living, wellness, healthcare facilities, and quality of life. The best states for retirees are Iowa, Nebraska, Missouri, Florida, South Dakota, Nevada, Texas, Oklahoma, and Wyoming.

Hope this article will help you to create a roadmap to create a retirement fund that will lead you to worry-free retirement planning. If you have any questions regarding is $1 Million Enough to Retire at 60 feels free to comment so that we can have a discussion.