Are you hunting high and low for what are the best penny stocks to buy right now? Since investing in penny stocks has a high level of risk, a broader question stumble in the investor’s head is that ‘Should I invest in penny stocks?’ The answer is both Yes and No.

When a stock is trading much lower than $5 then investors find it the best investment. It is because the small gains in the share price translate into a huge return, but the risk profile is high.

Before jumping into the best penny stocks to buy under $5, let’s look at a glance what penny stock is, why you should invest in it, what inherent risk is associated when you are investing in penny stock, which are the best penny stocks to buy, and finally what points you should consider before investing in penny stocks.

What is Penny Stock?

When the stock of a small company is trading below $5 a share, in the major exchanges namely New York Stock Exchange, American Stock Exchange, or Over the Counter Bulletin Board, then the stock is referred to as Penny Stock.

Long ago, penny stocks were used to be referred to those stocks that were trading for less than $1 per share. Later the United States Securities and Exchange Commission modified the definition of penny stocks. Now a penny stock can be referred to which stock that is trading below $5.

What are the Pros of Investing in Penny Stocks?

When you are investing in penny stocks after making proper analysis, penny stocks can generate higher returns than most of the blue-chip stocks. Here are the 3 pros of investing in penny stocks.

Huge Intraday Gains – Many a retail investor gets an average 15% return over a year by investing in large-cap stocks, but penny stock can deliver a 15% return in a single trading session. The investors who are investing in large-cap stocks will find it exciting when they trade in penny stock.

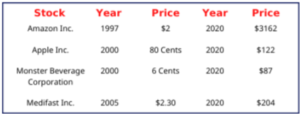

A Skyrocketing Return – There are full of success stories of penny stocks that have delivered an exceptional return of 100% not in years but in a few months. When you have picked an excellent company that has a proven management team, healthy financial health, and growing market share, you have just hit the jackpot. Sit tight and the stock will turn your investment multifold within a year.

Investing in penny stock requires only $5 – When you want to buy a blue-chip stock like Facebook and Amazon you must have $300 in your trading account. But when you are going to invest in penny stocks you can start investing as low as $5.

What are the Cons when a retail investor starts trading in Penny Stocks?

Even if the penny stocks are trading at exceptionally lower prices, there is room for moving upward. But investing in penny stocks is much riskier than most of the blue-chip stocks.

A penny stock can empty your bank account – Many retail investors find it attractive since they hear the success stories of penny stocks that have delivered a whopping return of 1000% within 3 years. But do remember 99% retail investors lose money while investing in penny stocks.

Only a few exceptions namely Timothy Sykes, Tim Grittani, have been able to make money by investing in penny stocks. So before investing in penny stocks stay cautious since this can lead you to bankruptcy.

Prone to Manipulation – In most of the cases, promoters and insiders of a shell company enlist their company in OTC platforms and Pink Sheets to deceive the investors. They make use of the ‘Pump and Dump’ strategy to make money by manipulating the price.

They buy the shares of the company in bulk deals that lead the share price to higher levels. When a retail investor like you and I find it an attractive investment opportunity since the price is up, they dump the shares and retail investors suffer a huge loss.

You won’t find accurate pieces of information – Before investing in any stocks an intelligent investor analyzes the earnings results, assets, and liabilities. But when you are investing in penny stocks you will hardly find these pieces of information, since major brokerage houses don’t cover these cheap companies.

The chances are higher that you will lose significantly your investment when investing in penny stocks without analyzing the earnings and valuations.

Low Trading Volume – Suppose a penny stock has delivered a return of 100% within a month. But to whom you are going to sell your shares when the trading volume of the penny stock is 10 and you have 10000 shares. Unlike blue-chip stocks that have over a million trading volumes a day, the majority of penny stocks have a trading volume of 100 a day.

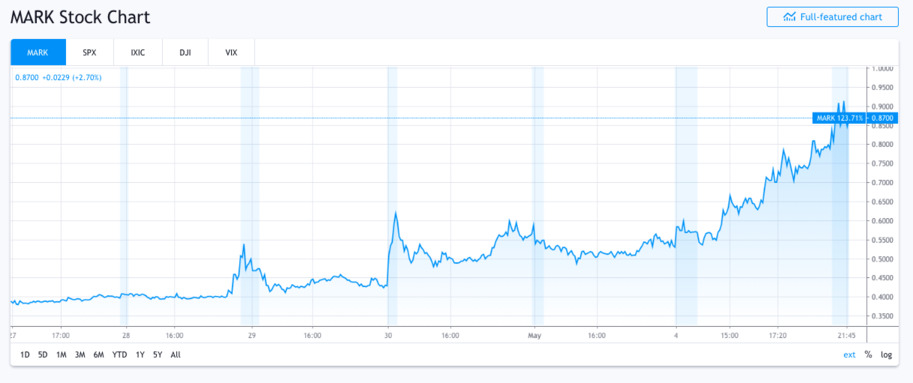

Highly Volatile – Unlike blue-chip stocks that are less volatile, penny stocks have high volatility. A penny stock can surge 20% a day, on the flip side, a penny stock can deep 30% a day.

Risky companies – Since the penny stocks trade in Over the Counter Bulletin Board and Pink Sheets, it can be assumed that they are the low-quality companies, that is why they are listed on pink sheets.

Low Market Capitalization – Since the trading price of penny stock is below $5, most of the penny stocks have low market capitalization. Additionally, they trade infrequently, which means you will find it difficult to sell when you want to offload the shares.

How to Find Quality Penny Stocks to Invest

When you are about to include penny stock in your portfolio, the biggest challenge is to stay clear of ‘Pumps and Dumps’ scam of penny stock by its promoters and insiders. Here are the key parameters you should watch before investing in penny stocks.

Conduct a deep study about the company – When you take an informed decision especially when you are investing in penny stocks the chances are higher that you will make money by trading in penny stocks. Don’t invest in penny stock solely because it is available at cheap prices below $5. You should run thorough research about its business model, peer competition, earnings, before investing in it.

Whether the company has a high debt – You are free to invest in debt-free stocks or stocks with marginal debt. Stay clear of stocks that have a huge debt to equity ratio.

Calculate the Liquidity Ratio – The Liquidity Ratio reveals what assets and liabilities a company has. When the liquidity ratio is greater than 2 then it is clear that the company has twice assets to repay its debt obligations. The higher the liquidity ratio is the better the investment opportunity is.

Check out whether the Stock is Volatile – After deep research look out whether the stock witnesses price volatility. Pick a stock that has price volatility to make money by trading in penny stocks.

Look out the Trading Volume – To whom you are going to sell your 1000 shares when the trading volume of a penny stock is 50 a day. Don’t invest in penny stocks with less than 1 million trading volume daily.

Whether the promoter has pledged the shares – It’s crucial to watch whether the promoters of a company have pledged the share of the company. Avoid the companies whose promoters have pledged the company’s shares.

Top 7 Best Penny Stocks to Buy Right Now

When you want to invest in blue-chip stocks you should have $100 in your trading account, but you can start investing in penny stocks when you have $5 in your trading account. Many an investor finds penny stock a lucrative investment option to gain 100% within a quarter, not in 5 years.

After you have conducted independent research you will find quality penny stocks that are trading below $5. Here are the 7 Best penny stocks to buy with strong fundamentals that are available at $5.

Genius Brands International (GNUS)

Genius Brands was incorporated in 2006 by Bababan Howard Alan. Genius Brands International operates in the Consumer Services Sector. This is a content and brand management company that is engaged in developing, and marketing children’s entertainment products. The company’s headquarter is located in Beverly Hills, California.

Let’s check out Genius Brands International’s fundamentals,

Market Capitalization – $300 Million,

Share Volume – 12,240,011

Beta – 2.27,

52-Week High/Low – $11.73/$0.05.

Waitr Holdings (WTRH)

Waitr Holdings was established in 2008 and is engaged in food ordering and delivery businesses. The company connects the local restaurants and consumers via mobile and desktop. Consumers can browse foods and choose the menu accordingly. Waitr Holding’s headquarter is located in Lafayette, Los Angeles, California.

Let’s check out Waitr Holdings fundamentals,

Market Capitalization – 394 Million,

Share Volume – 2604679

Beta – 0.41,

52-Week High/Low – 0.26/5.85.

OrganiGram Holdings (OGI)

This company is engaged in the production and sale of medical marijuana products namely Strains, Cannabis, Vaporizers, etc. The company was incorporated in 2010 and its headquarter is located in Moncton, Canada.

Let’s check out OrganiGram Holdings fundamentals,

Market Capitalization – 331 Million,

Share Volume – 19664069

Beta – 1.01,

52-Week High/Low – 1.01/3.64.

Nokia Corporation (NOK)

Nokia Corporation was founded by Fredrik Idestam in 1865 and operates in the Technology sector. This company is engaged to build network infrastructure, and provide technology and software solutions. The company’s headquarter is located in Espoo, Finland.

Let’s check out Nokia Corporation’s fundamentals,

Market Capitalization – 22 Billion,

Share Volume – 19,423,505

Beta – 0.57,

52-Week High/Low – 2.34/5.14.

Charlotte’s Web Holdings (CWBHF)

The company started its journey in 2013 and operates in the Healthcare sector. This company deals in the production and distribution of wellness products namely beverages, food, and powdered supplements. The company’s headquarter is located in Boulder, Colorado.

Let’s check out Charlotte’s Web holding’s fundamentals,

Market Capitalization – 724 Million,

Share Volume – 479,607

Beta – 2.26,

52-Week High/Low – 2.10/ 9.33.

Aphria (APHA)

Apharia was established by Cole Cacciavillani and John Cervini in 2013. The company operates in the Healthcare sector. This company works in the production and supply of cannabis for medical purposes. The company’s headquarter is situated in Leamington, Canada.

Let’s check out Aphria’s fundamentals,

Market Capitalization – 2 Billion,

Share Volume – 16,163,717

Beta – 2.66,

52-Week High/Low – 1.95 – 8.88.

VOC Energy Trust (VOC)

VOC Energy Trust was established in 2010 and the company has been operating in Energy Sector. What makes it the best investment is that recently the company has announced a dividend that is to be distributed to its shareholders. The company’s headquarter is located in Houston, Texas.

Let’s check out VOC Energy Trust’s fundamentals,

Market Capitalization – $39 Million,

Share Volume – 63,469

Beta – 1.90,

52-Week High/Low – 1.26/5.11.

7 Rules of Investing in Penny Stock

For many retail investors it’s been a lucrative investment opportunity to multifold their investment corpus by investing in penny stock. The biggest reason why investors want to invest in penny stock is that since investing in penny stocks doesn’t require huge investment capital.

They find it perfect investment in hope of skyrocketing return when picking suitable penny stocks. If you want to invest in penny stock do consider the following points.

Don’t Invest a Lion’s Share in penny stocks

Invest 10% in penny stocks of your stock portfolio. When you have a stock portfolio of $1000 then don’t invest more than $100 on penny stocks. You should invest in penny stocks what you can afford to lose.

Don’t diversify your penny stock portfolio to 10

When you are investing in penny stocks don’t diversify your stock portfolio that consists of 10 stocks. Instead, invest in 3 stocks after proper analysis. This will help you to track the performance of the penny stocks and it is easier to monitor when you have 3 penny stocks instead of a portfolio of 10 penny stocks.

Stay invested in NASDAQ and NYSE

Avoid the penny stocks that are trading on the Over the Counter and listed on Pink Sheets, since these markets have fewer regulations to comply with. On contrary, the penny stocks that are trading in NASDAQ and NYSE have to fulfill stringent regulations. When you want to invest in penny stocks, start investing in those penny stocks that are trading in NASDAQ and NYSE.

Avoid Averaging

Don’t try to average when the penny stock is trading much lower than your buying price. Instead, you should sell your stocks when the price is moving upwards and come to your buying price.

Buy penny stocks with high volume

When you have bought 1000 shares of a penny stock, it is easier to sell the stocks that have a trading volume of 50000. You will find it difficult when you have 500 shares but have a trading volume of 5000 even if the stock has delivered a return of 100% within a quarter.

Don’t believe in email or a message

You will get lots of mails about multibagger penny stock to pick where they have claimed that a penny stock is going to be the next ‘Apple’. Don’t believe in claims. Just imagine when a company has the potential to become apple then why they are listed on Over the Counter and Pink Sheets.

Don’t invest blindly in penny stocks on the basis of email or messages. Instead, do independent research to find a quality business that will yield better returns.

Don’t invest in penny stock in the long run

If you are going to hold shares for a decade then you will probably lose your investment capital. It is a good decision to sell a penny stock when the penny stock has delivered a 25% return within a week.

Hope this article will help you to find what are the best penny stocks to buy now. If you have any question feel free to comment so that we can make a discussion. If you have enjoyed the post feel free to share this post with your loved ones.