Mr. Murugan receives a monthly paycheck from his employer of $300 in a month. His monthly household expenses are $100 for grocery, $50 for rent of the house, $50 for EMI for the bike, $50 to buy branded clothing. The rest $50 dollar is incurred for weekend dinner, movie tickets, vacations, etc. This means Mr. Murugan is quite efficient to manage his finances in accordance with his income but is left with no savings to tackle future expenses or emergencies. From the above example, it can be concluded that Mr. Muguan is not financially literate. Not only Mr. Murugan, in India around 70% of people have no financial literacy. Here we will discuss what financial literacy is, components of financial literacy, the importance of financial education to manage your finances better.

What is Financial Literacy and why is it important?

Financial literacy is the education where an individual learns about the basic financial skills which enable an individual to create a budget, make a balance between spending and savings, profitable saving technique, manage debt efficiently, and planning for future obligations. Financial literacy enables an individual to make an appropriate and informed decision while investing in the stock market, buying a term insurance plan, retirement planning, and above all financial planning.

Lack of financial literacy may lead an individual to bankruptcy or left with no money after retirement. Owing to the lack of financial literacy individuals take a large amount of debt such as housing loans or car loan and after retirement, they are left with a penny to face financial crisis.

Are you financial literate?

Before deciding whether you are among the financially literate, think about the following question and give yourself an honest answer,

- Have you created your monthly budget i.e. household expenses, insurance premiums, utility bills, and savings?

- Are you debt-free or take active steps to become debt-free?

- Have you created an emergency fund to meet unforeseen expenditure or carry out monthly expenses for 3 months?

- Are you aware of how compound interest works?

- Have you any idea about the various kinds of insurance you need to take?

Components of Financial Literacy

Needless to say, the first step to achieve the financial freedom you need to be financially literate. This is because if you are financial literate then you can manage your finances better. So, let’s dig the components of financial literacy.

Make a budget and stick around to it

Earning and saving both are equally important. Saving is needed to secure future or to meet the future obligations such as after retirement life, education cost of children, and marriage cost of daughter if any, to own a house, treatment cost of self and family members, to finance the son for his business or any other occupation. So, from the rising of sun i.e. early days of employment, you should concentrate on savings and proper management of the savings to beat the inflation rate.

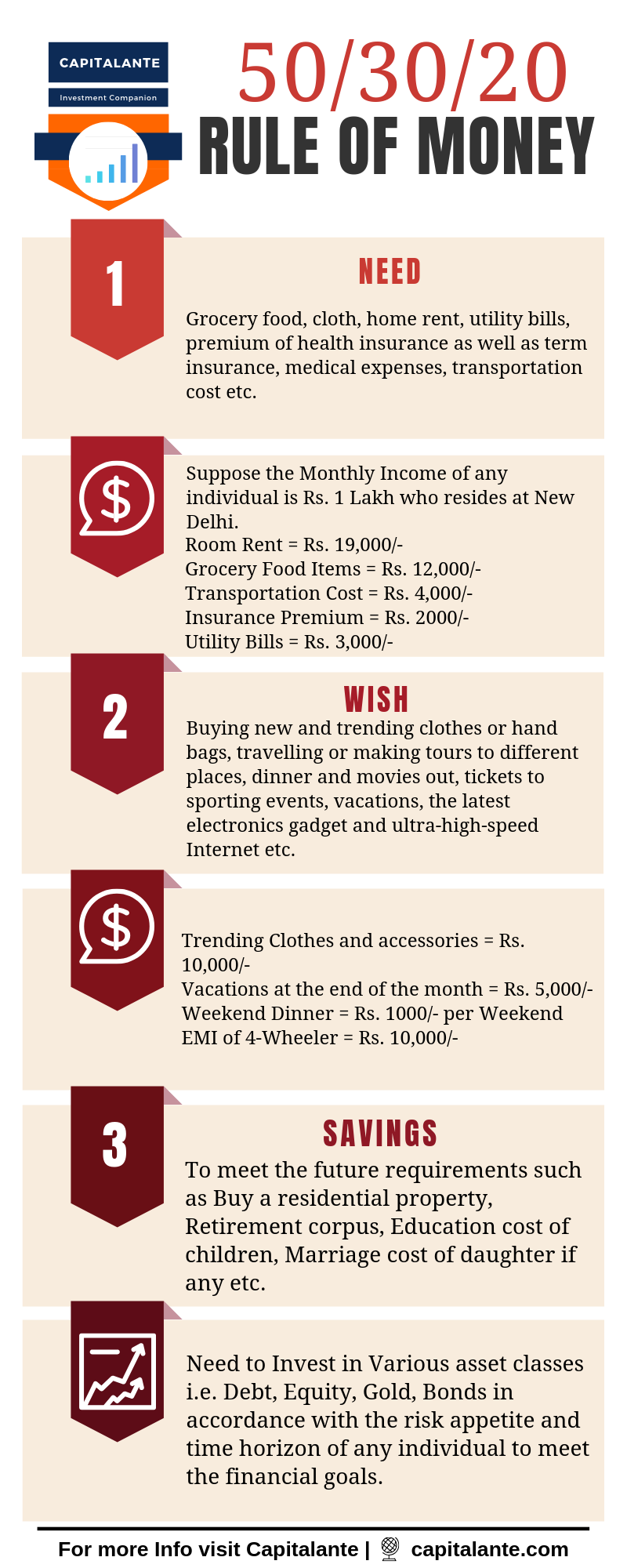

Now the question arises how much you should or can save. You should divide your post-tax income into three parts and allocate every part for every sector. Your income will be divided as 50% on needs, 30% on wants and the rest 20% for saving. Surround yourself with financially educated and conscious people from whom you can learn about financial planning. Also, make sure that your group of friends comprise people who share similar financial goals.

- Read also: Financial literacy – Wikipedia

Pay the debts if you have any

If you have taken any kind of loan irrespective of types of loan you need to try to pay off the debts as early as possible. Here are the benefits to pay off the debt,

- If you pay off the debts then you will enhance your credit score which enables you to get loans at the cheaper rate.

- You can invest the surplus money which you pay as the interest in accordance with the loan amount.

- If you remain debt-free then you can invest money in order to make retirement corpus and for future obligations.

- Since you are debt-free, you will not experience stress which will increase your self-esteem, performance, and fewer illnesses. This will increase your productivity which increases your paycheck.

One of the common questions is whether any individual should pay off the debt or start investment. The straight forward answer is that if you are not like Warren Buffet then it is a wise decision to pay the debt then start investment.

Cover your risks

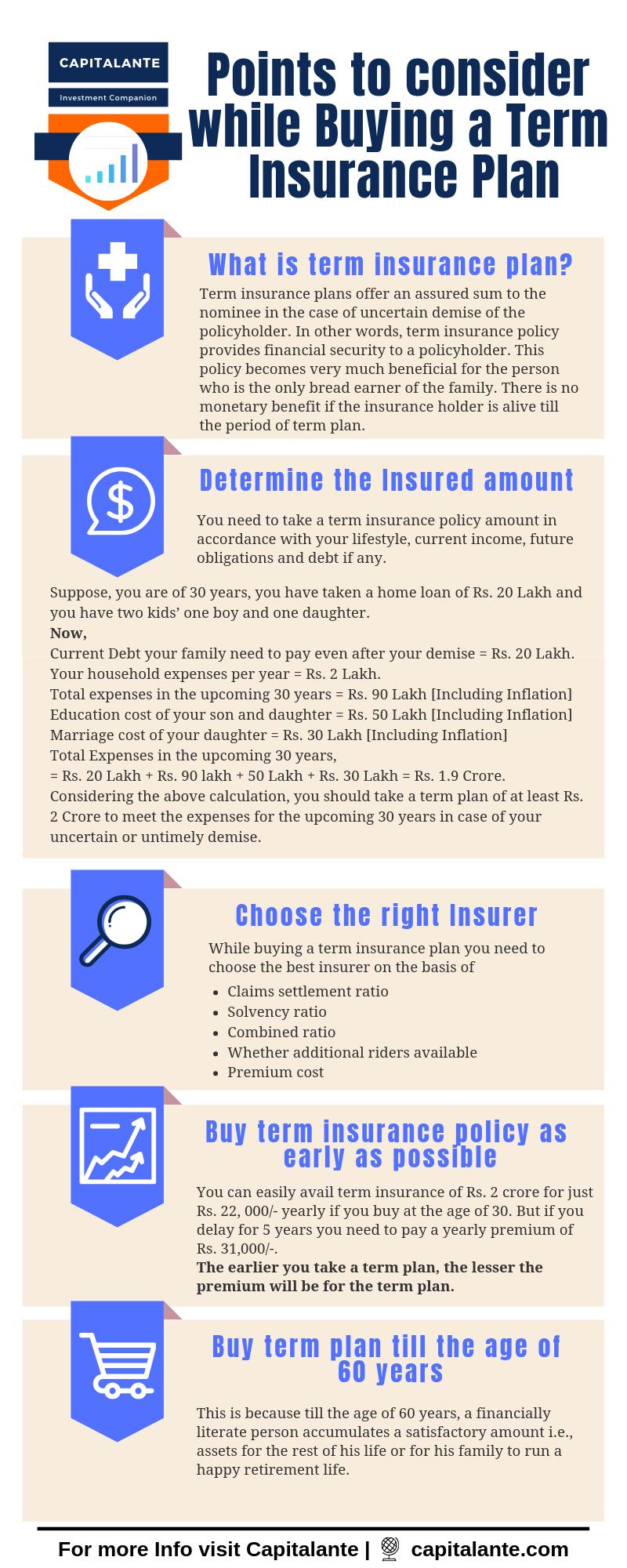

What will your family have to face on your sudden demise if you have taken a home loan or car loan or education loan? It is a big question. Here comes the role of term insurance plans. Term plans can ensure the future of your family. In the case of health insurance policy even if you are young 10-20 day hospitalization costs sway all of your savings. So, take insurance policy at a younger age. You need to pay a lesser premium if you take a term plan or health insurance plan earlier.

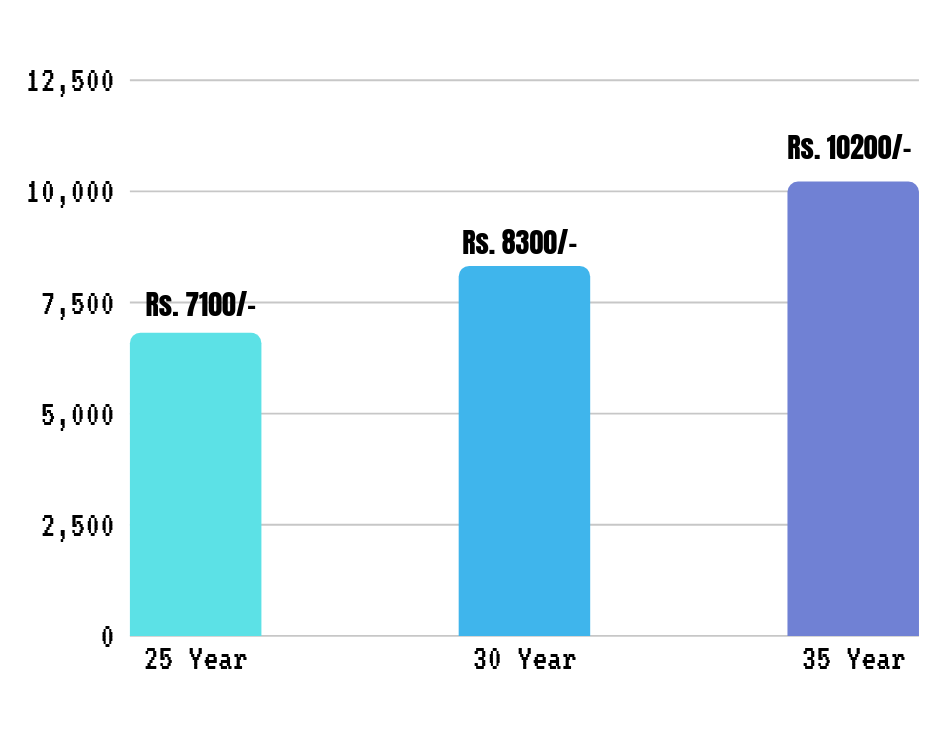

In the case of Term Insurance Plan

Suppose, you buy a term plan at the age of 25 and you want to continue this plan till the age of 60 years and a sum assured is Rs. 1 Crore. So, the duration of the term plan is 35 years. If you choose a Term Plan at the age of 25 then you have to pay Rs. 6800/- per year. If you choose a Term Plan at the age of 30 then you have to pay Rs. 8300/- per year instead of choosing a term plan at the age of 35 that costs Rs. 10,200/-. So, you have to pay a lesser premium at the age of 25 instead of at the age of 35.

In the case of Health Insurance Plan

If you take a family floater plan at the age of 30 years of Rs. 5 lakh and the plan consists of self, your spouse and 2 dependent children, you have to pay Rs. 11,000/- on a yearly basis. But if you take the same plan at the age of 40, you have to pay Rs. 16,000/- on a yearly basis. So opt for a family floater plan as early as possible. It is better to take a family floater plan just after marriage and later you can include your children.

Clear idea about future obligations

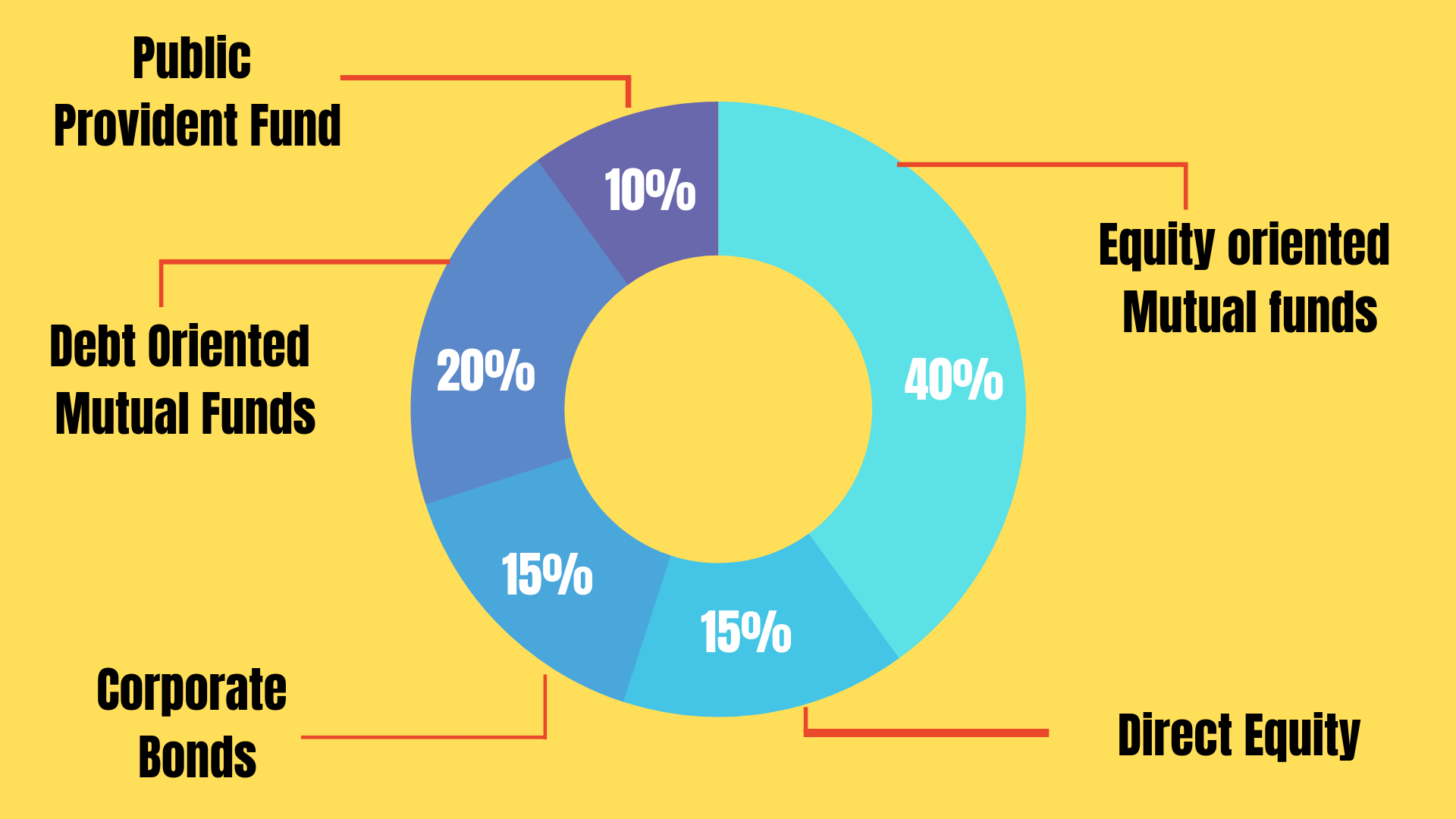

You need to specify your goals either it is short term or long term because you have to decide your investment portfolio in accordance with your goals. If you are planning for the purchase of four-wheeler car within the next few years then you need to invest your corpus in debt instruments, because in the short run the stock market is quite volatile.

But in the case of retirement planning which is a long term goal you should invest in the equity asset class since the equity asset class outperformed all the asset class over the long term.

Suppose at the age of 30, you stay with your family in any rented house and you have got one son and one daughter. So, in order to meet the future obligations like to own a house, the education cost of son and daughter, the marriage cost of daughter you need early planning. Let’s understand it.

Total cost for the higher education of your daughter and son, let’s say after 15 years after they passed 10th standard, = Rs. 50 Lakh.

Marriage cost of your daughter including inflation = Rs. 30 Lakh.

Amount needed to buy a house after 20 years including inflation = Rs. 1 Crore.

Since they are long term goals, in order to meet future obligations, you need early planning. Let’s discuss,

To meet the education cost

If you start investing in any equity-oriented mutual fund for the period of the next 15 years with just Rs. 4000/- per month then you will get Rs. 50 lakh after 15 years assuming 15% CAGR.

To meet the Marriage cost

If you start investing in any equity-oriented mutual fund schemes for the period of the next 20 years with just Rs. 2000/- per month then you will get Rs. 30 Lakh after 20 years assuming 15% CAGR.

Fund to buy a house

If you start investing in any equity-oriented mutual fund schemes with just Rs. 7000/- per month then you will get Rs. 1 Crore after a span of 20 years assuming 15% CAGR.

Why should you invest in mutual funds?

You can invest little amount per month via Systematic Investment Plan (SIP) in mutual funds because,

- To beat the inflation

- Better Growth potential over a long-term horizon

- Passive income source

- To create a second source of income

- You can start an investment with a small amount of Rs. 500/-

- No lock-in period

- Power of compounding.

Now, to enable compounding of your money you need to do the following 3 things.

Long-term Horizon

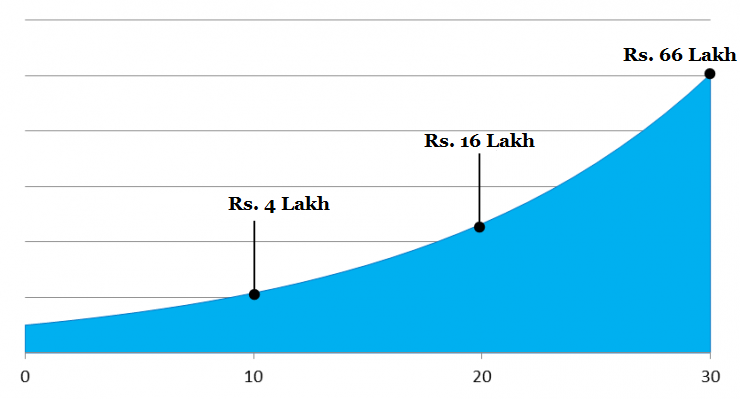

Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

Start Early

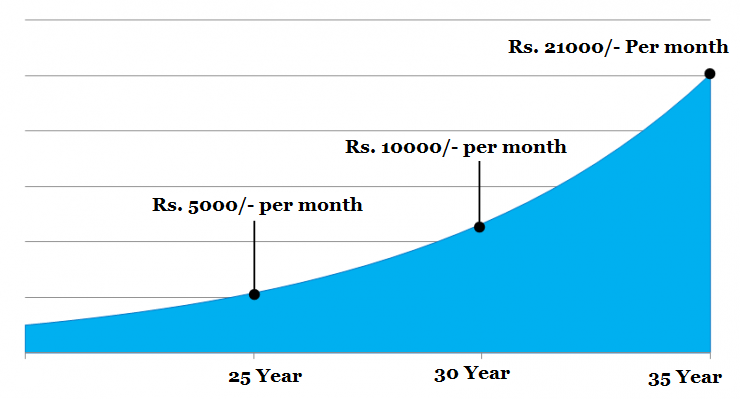

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just Rs. 5000/- per month then you will get Rs. 5.7 Crore when you are 60 assuming 15% CAGR. If you are late by 5 years i.e., start investment at the age of 30, then you need to invest Rs. 10000/- per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 35 years then you need to invest Rs. 21000/- per month.

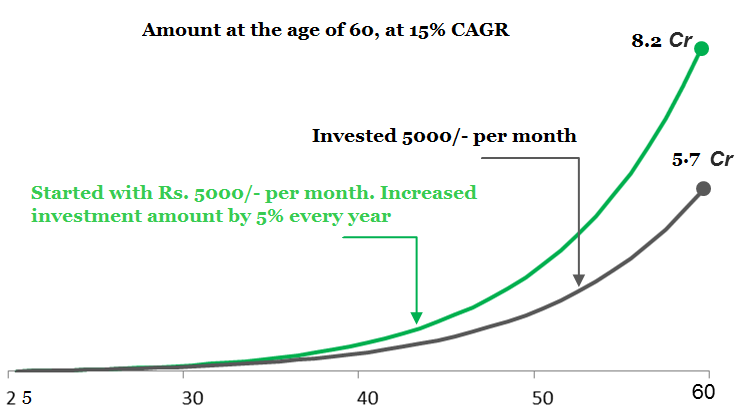

Start with a little amount and don’t forget to increase whenever possible

To get the benefit of compound interest you may start with a little amount of Rs. 1000/-. You may then increase the amount of SIP every year with a little extension of 5%. Let’s understand it with the following graph.

As shown in the graph if you have made a SIP of Rs. 5000/- per month for the upcoming 35 years, then you will get Rs. 5.7 crore. If you increase the SIP amount by 5% every year then you will get Rs. 8.2 crore after 35 years. So, step up your SIP amount as possible.

To conclude this, you need to gain the compounding interest.

- Long-term investment horizon.

- Start as early as you can.

- Invest consistently and step up i.e., increase your contribution.

Build an emergency fund

Every person should make ensure to create an emergency fund for any kind of emergency or unforeseen situation. This saving amount may vary from person to person according to his status or requirements. Try to accumulate enough money in this fund so that you can bear your all expenses i.e., foods, clothes, insurance bills, even your sip installments for at least 6 months in an emergency.

- Read also: How to manage Emergency Fund Step by Step

Benefits of Financial Literacy

Like food and water, money is another tool that enables you to buy the things you need in order to live the life you want. In order to achieve financial freedom, you need to consider money as a tool to achieve your dreams and lead a stress-free life without any financial woes. Here are the key benefits of financial literacy,

- Manage your finances better.

- Take an international vacation without compromising your budget.

- Without any financial woes about the marriage cost or education cost of children.

- Freedom to retire early i.e. at an age of 50, a decade early than the usual retirement age of 60.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

- Read also: 8 Points to Consider While Buying a Term Insurance Plan

- Read also:10-Step Process to Achieve Financial Freedom

Hope this article will help to become a financially literate person who is able to take a more informed decision. If you have any questions regarding financial literacy feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.

Amazing content