After making a proper analysis of 6 myths about the stock market, here we will discuss the 10 reasons to invest in the stock market. Many of us have an intention to create a passive source of income because everyone dreams to earn more and more to lead a better lifestyle. So, to create a passive income one option may be stock market. Let’s have a look various reasons to invest in stock or share market.

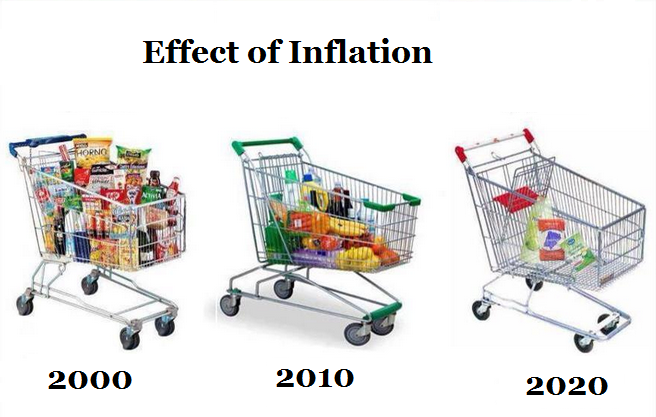

To beat the inflation

First of all, let’s understand what inflation is. Suppose you want to buy a bike costing Rs. 50000/-. Now, you have a fund of Rs. 40,000/-. So you decide to buy the bike the very next year. But when you knock at the bike showroom you find the price of the bike has increased to Rs. 55000/-. So, after one year the price of the bike has increased of Rs. 5000/- i.e., 10%. This increase is inevitable in every product or commodity and this is a continuous process. The price of commodities increases year on year basis.

If you save money to say Rs. 1 lakh and you put it aside in your home locker the value of that Rs. 1 lakh is going to decrease year on year. Then after some years, the value of this Rs. 1 lakh may be Rs. 70,000/- or less and this valuation of decline is an ever ending process. This is called inflation in economic terms. The gist is current inflation rate is almost 7% and you need to invest your money in such an asset class that can beat the inflation rate and gives you a steady return. If you invest in the stock market via direct equity or mutual fund, historically the equity asset class has given 15-16% CAGR which is more than the inflation rate of 7%.

- Read also: 6 reasons for investing in the stock market – Bankrate.com

- Read also: Reasons to invest in stocks – Fidelity – Fidelity Investments

Better Growth potential over a long-term horizon

It is a proven fact that equity asset class gives better returns over the all asset class for a period of 15-20 years. In the year November 1995, the benchmark index Nifty 50 was trading at Rs. 1000/-, now in November 2018 Nifty 50 is trading around Rs. 10000/-. Since inception, the benchmark has delivered a compounded annual growth of return of 12%. The investors who started investment back in 1995 have earned better yield than any other asset class. So, there is a sufficient reason to make an investment in the stock market for a long-term horizon to earn better returns in the future.

Passive income source

Ace investor Warren Buffet said that an average person should have at least 3 income sources to get rich. Many people dream about earning money. The stock Market investment enables an investor to create a passive income source. After making fundamental analysis, technical analysis, qualitative analysis, balance sheet, and profit and loss account, once you have selected the best companies to invest in, you need to carry out the investment for a long-term horizon. These companies will yield better returns after a long time. If you are not aware of such kind of analysis or study, you can make an investment in the stock market via mutual funds offered by several mutual fund companies.

Need not to be a genius to invest in the stock market

If you have the ability to solve 10th standard maths, you can easily understand how the stock market works. All you need to do is to find quality stocks which are able to give you better returns. You can pick potential stocks by making use of Fundamental analysis, Technical analysis, Qualitative analysis, Balance sheet, Profit and Loss account etc. You need to invest in such companies which are well known like Asian paints, Titan Company, Minda Industries, VIP Industries, Symphony etc. and sit tight. They are quite capable of giving you better returns in the future.

To create a second source of income

Common individuals have a common perception that they need to work hard after getting a 9 to 5 job and it is quite enough to secure their future. They get to stick to the job and continue to do so for the entire life. These types of people can create a second source of income by investing in dividend paying stocks which have a good dividend payment record. By investing in dividend paying stocks you can easily create a second source of income through value appreciation and regular dividend payout.

You can start an investment with a small amount of Rs. 500/-

Nowadays, there has been a tradition that people go to restaurants or hotels once a week. They spend at least Rs. 1000/- for four members of the family. This extra luxury can be skipped once in a month. If you manage to skip once and start an investment with this Rs. 1000/- for the rest 30 years you will get Rs. 46 lakh after 30 years assuming 15% CAGR.

No lock-in period

Like the public provident fund which has a 15 year lock-in period or a national savings certificate which has 5 year lock-in period, the stock market does not have any lock-in period. It means you do not have a time frame for buying or selling stocks. You can hold any stocks for as long as you wish to or sell the stocks right after buying within the gap of one minute only.

Power of compounding

Power of compounding enables an investor to earn interest on interest. Let’s make it clear with an example. Suppose, you invested Rs. 1, 20,000/- at once in the stock market 5 years ago and the market has given 15% CAGR during this 5 years.

| Year | Opening balance | Amount invested | Interest earned | Closing balance |

| 1 | 0 | 120000 | 18000 | 138000 |

| 2 | 138000 | 0 | 20700 | 158700 |

| 3 | 158700 | 0 | 23805 | 182505 |

| 4 | 182505 | 0 | 27375 | 209880 |

| 5 | 209880 | 0 | 31482 | 241362 |

If you invest an amount of Rs. 120000 at once and you do not invest a penny the amount will grow to Rs. 241362/- at the end of 5 years assuming 15% CAGR.

Now, to enable compounding of your money you need to do the following 3 things.

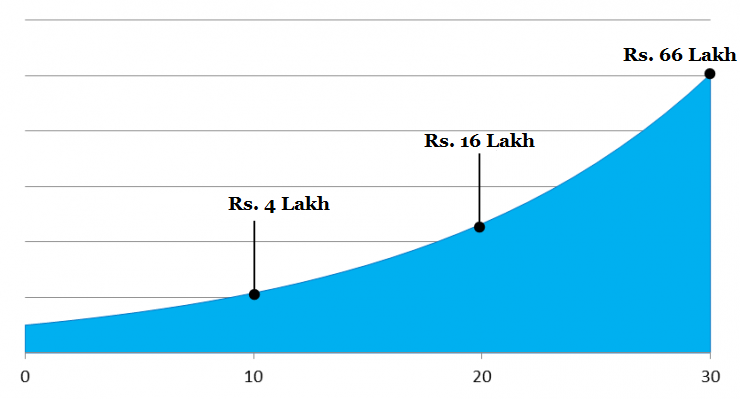

Long-term Horizon

Just look at the following graph.

If you make a lump sum investment of Rs. 1 lakh at once and allow the money to compound at the rate of 15%, then you will get-

- 4 lakh after 10 years,

- 16 lakh after 20 years,

- 66 lakh after 30 years.

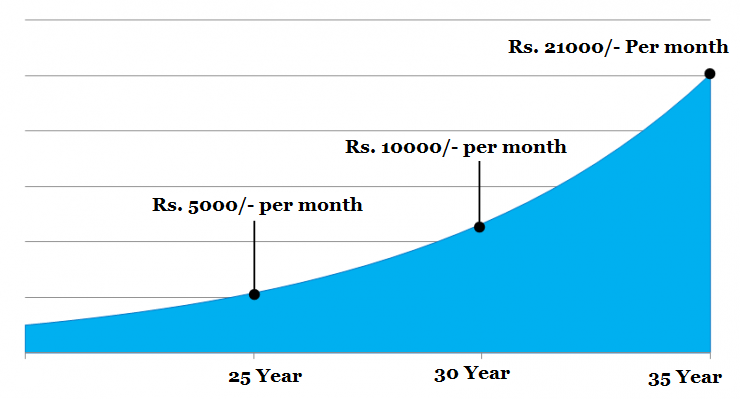

Start Early

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just Rs. 5000/- per month then you will get Rs. 5.7 Crore when you are 60 assuming 15% CAGR. If you are late by 5 years i.e., start investment at the age of 30, then you need to invest Rs. 10000/- per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 35 years then you need to invest Rs. 21000/- per month.

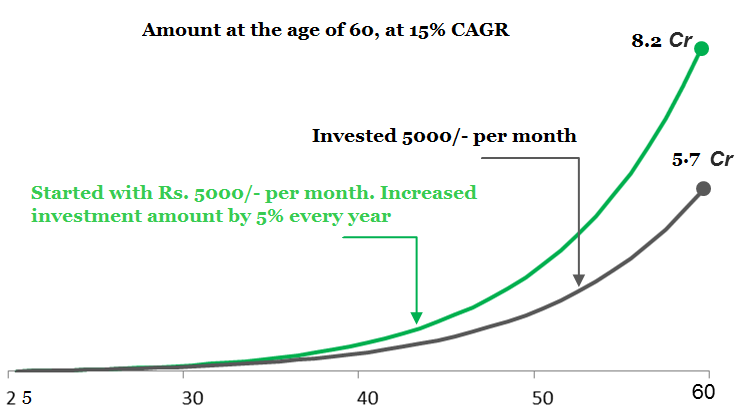

Start with a little amount and don’t forget to increase whenever possible

To get the benefit of compound interest you may start with a little amount of Rs. 1000/-. You may then increase the amount of SIP every year with a little extension of 5%. Let’s understand it with the following graph.

As shown in the graph if you have made a SIP of Rs. 5000/- per month for the upcoming 35 years, then you will get Rs. 5.7 crore. If you increase the SIP amount by 5% every year then you will get Rs. 8.2 crore after 35 years. So, step up your SIP amount as possible.

To conclude this, you need to gain the compounding interest.

- Long-term investment horizon.

- Start as early as you can.

- Invest consistently and step up i.e., increase your contribution.

Reduce Taxable Income

Suppose you want to invest a lump sum of Rs. 5 lakh or want to start with Rs. 5000/- per month for the upcoming 20 years. You are left with two options either by investing in debt instruments such as PPF, FDs in bank or post offices or making an investment in the stock market either via direct equity or mutual fund. If you invest in ELSS mutual fund then like the PPF you can avail tax deduction under section 80C of the income tax act, 1961.

Let’s understand this with an example.

Usually, Bank FDs offer 7-8% interest rate. In this case, let’s assume that the interest rate is 8%.

Investment corpus = Rs. 5 lakh.

Time horizon = 5 years.

Rate of interest = 8%

Interest earned = Rs. 2 Lakh.

So, you need to pay tax on the Rs. 2 lakh on the basis of your income which is between 10%-30%. In this case, you need to pay 10% taxes which means you need to pay = 20% of Rs. 2 lakh = Rs. 20000/-

So, your absolute return after taxes = Rs. 5 lakh + Rs. 1.8 lakh= Rs. 6.8 Lakh.

In the case of Equity,

On the other hand, equity asset class gives 15-16% return year-on-year.

Investment corpus = Rs. 5 lakh.

Time horizon = 5 years.

Rate of interest = 15%

Market return = Rs. 5 Lakh.

According to Government rule, you need to pay 10% taxes as a long-term capital gains tax if your return is more than Rs. 1 lakh. So, you need to pay taxes on the rest Rs. 4 lakh at the rate of 10% as long-term capital gains taxes. In this case, you need to pay 10% taxes which means you need to pay = 10% of Rs. 4 lakh = Rs. 40000/-

So, your absolute return after taxes = Rs. 5 lakh + Rs. 4.6 lakh= Rs. 9.6 Lakh.

Stock Market investment is now a lot easier

Due to the advent of modern technology, an interested individual can invest in the stock market sitting from his or her home. To do that you need to have an e-mail id, a PAN Card, a document as an address proof, a passport size photograph, and an internet connection. Many brokers and mutual fund houses offer one hour account activation. All you need to do is to visit the official website of stock broker or the mutual fund house and upload the documents there. Then within 24 hours, your account will be activated. Now, you are free to invest either to direct equity or in the mutual fund as much amount as you wish to invest.

- Read also: Why People Lose Money in Stock Market

- Read also: How to Pick Best Stocks for Consistent Returns

If you have any questions regarding this topic feel free to comment and share the post with the loved ones.