Financial freedom is the ultimate goal for every individual. First of all, you should prepare a perfect investment strategy to get started. When it comes to investing in the stock market you need to learn how to invest in the stock market. In this detailed guide, we’ve compiled a list of some of the best stock market investing books for beginners who want to boost investing knowledge and skills to pick value stocks. Here are the top 25 best stock market books for beginners.

Book #1. Intelligent Investor by Benjamin Graham

Needless to say, The Intelligent Investor is among the ace investor Warren Buffet’s all-time favourite value investing books. This book helped him to build an investment portfolio of over 73 billion dollars. In this book, the author Benjamin Graham focuses on the following points,

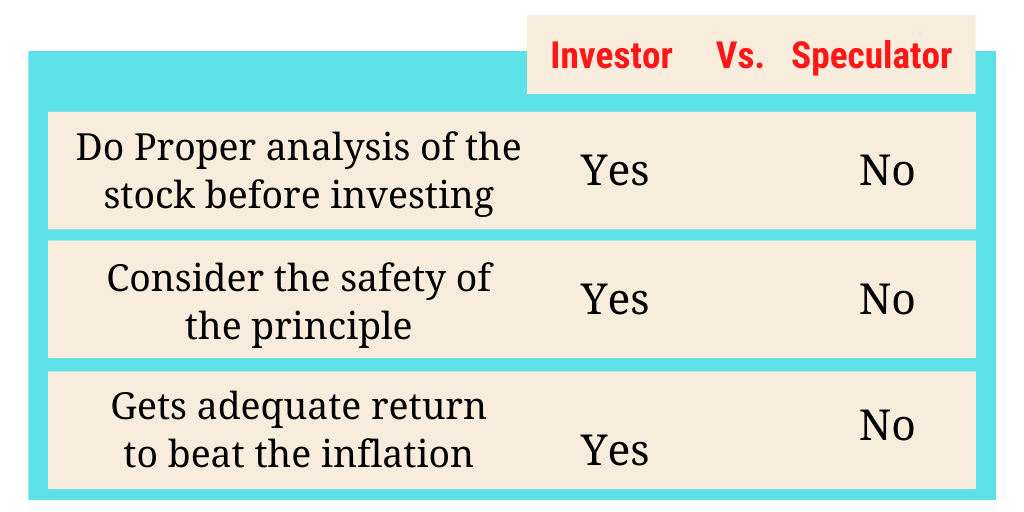

Investing vs. Speculating

Let’s make it clear with an example. Suppose you want to buy a tailoring shop. You are left with two choices. First, you should visit the tailoring shop headquarters, check the total income, free cash flow, assets, and liabilities, if any. Then come up with a final price of the tailoring shop. The second option is you approach to meet the owner to buy his tailoring shop. Then you make the payment whatever the owner asks for. It is clear from the above examples that an investor follows the first option and the speculator follows the second option.

Margin of Safety

Let’s make it clear with an example. After making an analysis of the stock you find that the intrinsic value of the stock is around $100. Fortunately, the stock is currently trading at $100. But you are waiting for the stock to come to the level of $90 or $80 or even $70. After a market correction when the stock trades at $80, you buy the stock. The difference between the intrinsic value of any stock and the price you buy the share is your margin of safety.

Mr. Market

The author describes Mr. market as a person who plays with the emotions of the investor. Here the author described Mr. market as the business partner of an investor who is a sentimental person. One day Mr. market knocks at your door enthusiastically and offer you to sell your stake in any company/stock at a very higher price. And then Mr. Market demands a similarly higher price if you want to increase your stake by buying his stake. Contrary to that, one day Mr. market knocks your door depressed and willing to sell his stake for a very low price and additionally gives you the choice to sell your stake at a very low price.

As an intelligent investor, you need to execute a profitable deal when Mr. market offers you buy low and sell high. You need to invest wisely in a company where the fundamentals are intact and buy stocks when you get stocks at an attractive valuation and below intrinsic value.

- Get the book from Amazon India

Book #2. Security Analysis by Benjamin Graham and David Dodd

Even though the book was published in 1934 some 86 years ago, this book is a must-have book for any serious investor. The author Benjamin Graham and David Dodd are considered as the fathers of value investing. In this book, the author emphasizes the following aspects,

- How to pick stocks after bargain such great crash of 1929.

- How to calculate the Margin of Safety.

- Interpretation of financial statements i.e. income statement balance sheet.

- The authors strive to reinforce the matrices around determining if a security is truely on sale or not.

- Pick a stock by calculating an appropriate margin of safety interest coverage.

- An overview of all kinds of investment i.e. bond, preferred issues not only stocks.

- Get the book from Amazon India

Book #3. One up on Wall Street by John Rothchild and Peter Lynch

In the introduction, the authors suggest buying ten-baggers that refer to stocks that increase 10 times to its initial price. If you have found a few ten-baggers before the professional analysts discover them then these ten-bagger stocks turn your stock portfolio into the best one. In this book, the authors emphasize on following points.

Should you own a house – If you have not owned a house yet now then buy a house first.

How much money you should invest – Don’t invest all the money which will make you sick if you lose it. Invest the extra money that can’t devastate your life.

How to invest like an ace investor

The main point of this book lies in this section is to avoid and ignore the analysts and experts.

Apart from hot picks delivered by the analysts in CNBC do your won research and find quality stocks to yield better returns. You should focus on sectors that you have deep knowledge or are familiar with and don’t try to time the market. Instead, buy when there is a sharp correction in the market.

In this section, Peter Lynch focuses on the following qualities of any investor namely patience, self-reliance, willingness to do independent research, ability to ignore market panic at the time of sharp correction, etc. The author advises an investor to buy when everyone else is selling and avoid short term fluctuations in the stock market.

The gist of the book lies in one word do your research before starting to invest in any company. You should invest in any company after asking yourself two questions, why you think this business is good and why you’re buying this stock though the stock price is moving upward. You should pick such a company which has,

- A lower price to earnings ratio compared to peer companies,

- A low percentage of institutional investors,

- Insiders buying the company’s stock,

- The company buying back its own stock,

- A low debt to equity ratio compared to peer companies.

- Get the book from Amazon India

Book #4. Common Stocks and Uncommon Profit by Philip A. Fisher

After starting an investment journey as an acolyte of Benjamin Graham, Warren Buffet was quite impressed by the methods of value investing of a San Francisco based money manager namely Philip A. Fisher. Philip A. Fisher was preferred to invest in high-quality growth stocks and then hold them for decades to gain a compounding effect.

In this book, the author discusses the step by step approach to pick the best growth stocks. Under the chapter ‘what to buy’ the author offers the ’15 point checklist’ before investing in any stocks. Here are the few points of ’15 point checklist’,

- What products or services the company offers to increase the sales in the upcoming years.

- Does the management of the company have the capacity or determination to develop new products to boost sales?

- Whether the company’s research and development efforts are up to the mark.

- The company’s cost analysis and accounting.

- Short-range or long-range profit outlook.

- When to sell a stock, Five don’ts for investors, how to find growth stocks.

- Never sell the stock if all the above-mentioned points are satisfactory or deemed fit.

- Get the book from Amazon India

Book #5. The Little Book that Beats the Market by Joel Greenblatt

In this book, the founder and managing partner at Gotham Capital provides a magic formula which enabled the writer to end up with a 40% annualized return for over 20 years. The author describes the magic formula by making use of 6th-grade math and humour. The magic formula which enables better returns, in the long run, consists two financial ratios namely Return on Capital and Earnings Yield.

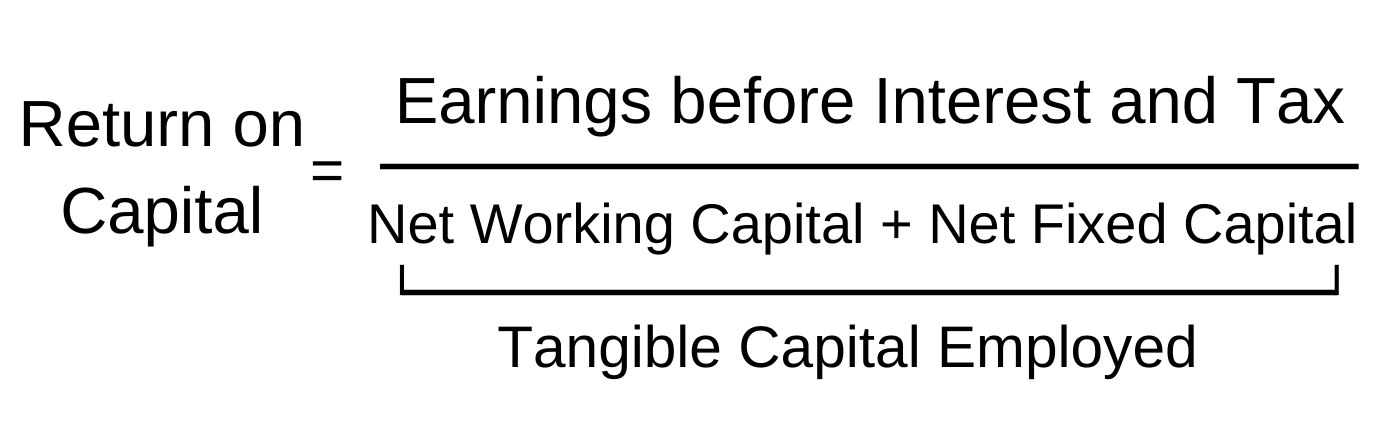

Return on Capital

Here the author makes use of ROC apart from ROE or ROA since EBIT does not include tax rates for different companies while making a comparison. [Net Working Capital + Net Fixed Capital] is used as a part of fixed assets since this actually reveals how much capital is required to run the business on a day to day or yearly basis as clear as a day.

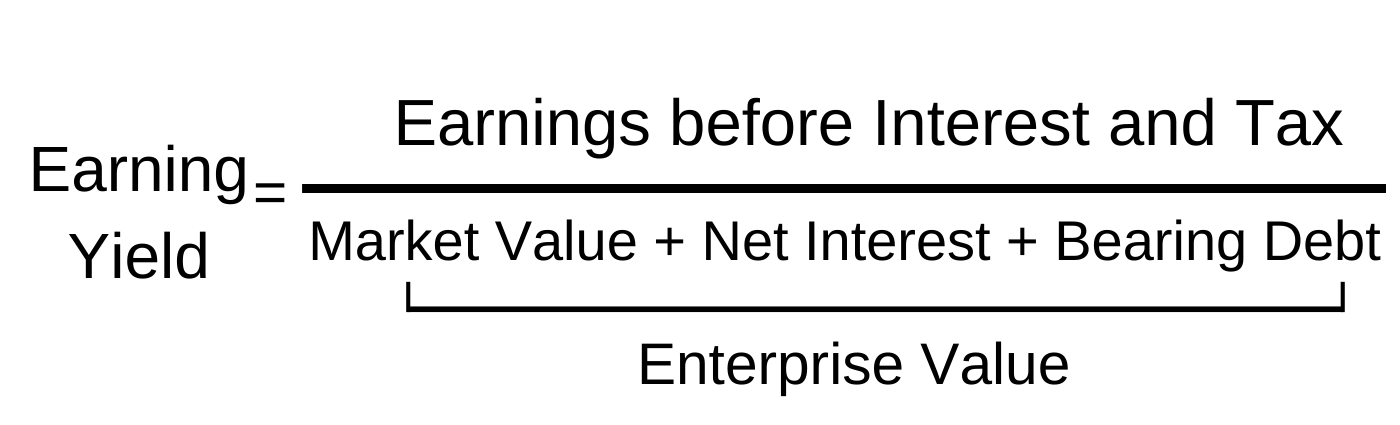

Earning Yield

Earning yield refers to how much money you can make on every dollar you invest in preferred stocks. Finally, you should consider the following points to pick the best stocks that yield better returns, in the long run,

- Calculate Return on Capital and Earnings Yield before investing in any company or stock.

- Rank the companies which are deemed fit.

- Keep patience to gain fruitful returns because the above-mentioned factors are unpopular but effective ones.

- Get the book from Amazon India

Book #6. The Little Book of Value Investing by Christopher H. Browne

The Term ‘Value investing’ was coined by Benjamin Graham the mentor of Warren Buffet. Value investing implies finding such undervalued stocks as compared to the strength of the company i.e. the intrinsic value of the company. In this book, the author has identified various types of investors.

Value Investors vs. Fancy Investors

Let’s make it clear with an example. Suppose the stock market is a supermarket that has various kinds of items i.e. stock.

Fancy investors are such types of buyers who buy sexy well packaged glamorous products. Apart from this kind of investors, value investors look for such stocks which are on sale and available at best prices i.e. at attractive valuations. The growth investors sit back and wait for an opportunity to buy stocks less than what they are worth and sell stocks at higher prices than their worth.

Diversify Stock Portfolio

You need to diversify your portfolio of at least 10 stocks across various sectors. You need to consider the margin of safety while buying a stock. Needless to say, the margin of safety refers to the difference between the intrinsic value of any stock and the price you have bought the share. In other words, the margin of safety is the difference between what the actual price of a stock should be, and how much below the intrinsic value you have bought the stock.

Buy stocks at low valuations

You should identify value stocks in respect of earnings ratio and compare them with the current trading price of any stock. Pick value stocks after making Analysis of balance sheet i.e. Debt, Current ratio, Liquidity, etc. and Income statement.

Invest in Global Market

The author advises you to buy not only domestic stocks but also global stocks. You can invest in those countries which have stable economics namely Western Europe, Japan, Canada, Australia, the United States, New Zealand but not in Pakistan or China.

Before investing in any stock you should ask sixteen researchable questions about the company. If the answers make you feel confident invest in it. If not, don’t invest in the company. Finally, you should stick to the company for the long term for better returns since investing is a marathon not a sprint of 1000 meters.

How Currency Fluctuations boost return on investment

Another important aspect to consider while investing in foreign stocks is the currency of the foreign nation. Let’s make it clear with an example. Suppose you want to buy ‘Apple’ from India. In this way, you not only buy any specific stock but also invest in the American dollar. So, if you bought ‘Apple’ in 2010 when a US Dollar was worth Rs. 50 and you sell that stock in 2020 when a US dollar is Rs. 75. Apart from the dividend, you make a significant profit from currency fluctuation.

Finally, value investing is boring. Stick to the numbers for the long run just say 10 or 20 or even 30 years for a fruitful return. In the case of value investing you won’t outshine during the bull run as compared to sexy or growth stocks. But in the bear market value stocks deliver a positive return as compared to sexy stocks were tanks.

- Get the book from Amazon India

Book #7. Learn to Earn by Peter Lynch

In this investment classic Peter Lynch reveals his investment techniques which enabled his fund to generate a whopping annualized return of 29% for the 13 years. If you had invested $37k in Fidelity’s Magellan Fund in 1977 when Peter Lynch took charge as a fund manager and sold in 1990, he would have left your investment worth over a million dollars. The author discussed the following points to consider while investing.

When to start investing

The author has mentioned that many people don’t start investing until they are in their thirties, or forties or even fifties. This act does not enable them to achieve financial freedom to lead a worry-free retirement life. You should start an investment as early as you start earning.

Why Start Early?

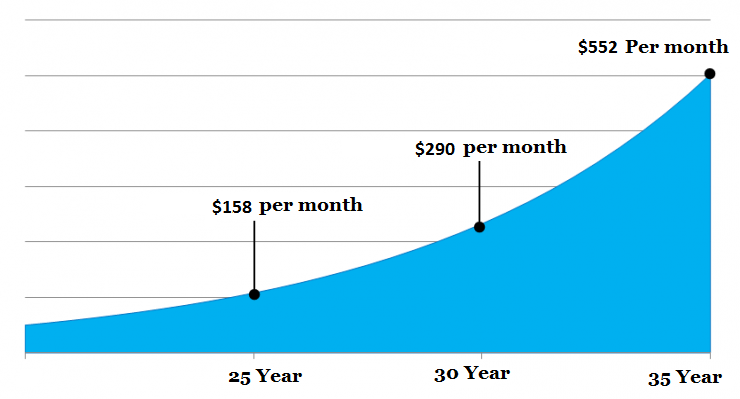

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just $158 per month then you will get One Million Dollar when you are 60, assuming 12% CAGR. If you are late by 5 years i.e., start investment at the age of 30, then you need to invest $290 per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 35 years then you need to invest $552 per month.

If you are thinking you will start investing after you generate a handsome income then you are lagging. The author advises an investor to focus on long term investment to yield better returns.

How to pick the best stocks

Our elementary education system irrespective of you are in school or graduating in college, teaches neither the stock market nor the fundamental of our economic system.

An average American is familiar with Nike, Reebok, McDonald, etc. Nearly every American drinks Coke or Pepsi but only a few own the shares of the companies mentioned above. The same scenario happens in our country i.e. India also. Every engineering techie wants to join TCS, Tech Mahindra or Infosys but only a few of them own the shares of the tech companies.

Those who want to start investment opportunities are everywhere for them. Let’s make it clear with an example.

Nearly every Indian are familiar with Fevicol or Fevistick. These are the brands of Pidilite industries. In the pigment sector, Asian Paints is another famous brand. But only few buy the stocks of Pidilite Industries or Asian Paints. I am not suggesting you to buy shares right now but you should start investment after proper analysis of stocks which will yield better returns in the long run.

How to analyze the company

In this section, the author discusses the different ways to invest in any company, the risk, and the reward of investing in any company.

The author Peter Lynch categorizes the lives of any company into various stages namely, birth stage, growing stage, value stage and old stage. Just make it clear with an example of ‘Apple’.

Birth stage – Back in 1976, ‘Apple’ was started by two guys in a garage. This is the birth stage of any company i.e. Apple.

Growing stage – After a huge IPO Subscription in December 1980, the company entered into a growing stage and delivered a huge return till the 1990s.

Value stage – This is a stable value stock in comparison to new companies that have just entered the rat race. In this stage, the company has reached a stable stage i.e. value stage.

Old stage – Right now after 50 years of existence or operation Apple has expanded every nook and corner of the world like Coca-Cola and IBM, etc.

- Get the book from Amazon India

Book #8. How to Make Money in Stocks by William O’Neil

In this book, the author has given a case study of stocks that have delivered constant robust returns by making use of 100 charts from 1880 through 2008. By reading this book you will find great stocks that in the long term uptrend with good fundamentals. The author discussed the following points,

CANSLIM Method

CAN SLIM strategy is used by the author as an investment strategy that involves the analysis to find out the best stocks. This strategy stands on the pillars of the Earning, New product or service, Supply and demand, Leader or laggard, Institutional sponsorship, and Market direction. This strategy enables investors to invest before they start a bull run or in other words, is overvalued. This is all seasoned investment formula to pick the best stocks. Here are the components of CANSLIM strategy,

- C = Current Quarterly Earnings

- A = Annual Earnings Growth

- N = New Product or Service

- S = Supply and Demand

- L = Market Leader or Laggard

- I = Institutional Sponsorship

- M = Market Direction

The Cup and Handle Pattern

This chart pattern is of bullish reversal which means the stocks that are about to move up big time. You will find this chart pattern not only daily chart or monthly chart but also on an hourly chart or even a 5-minute chart.

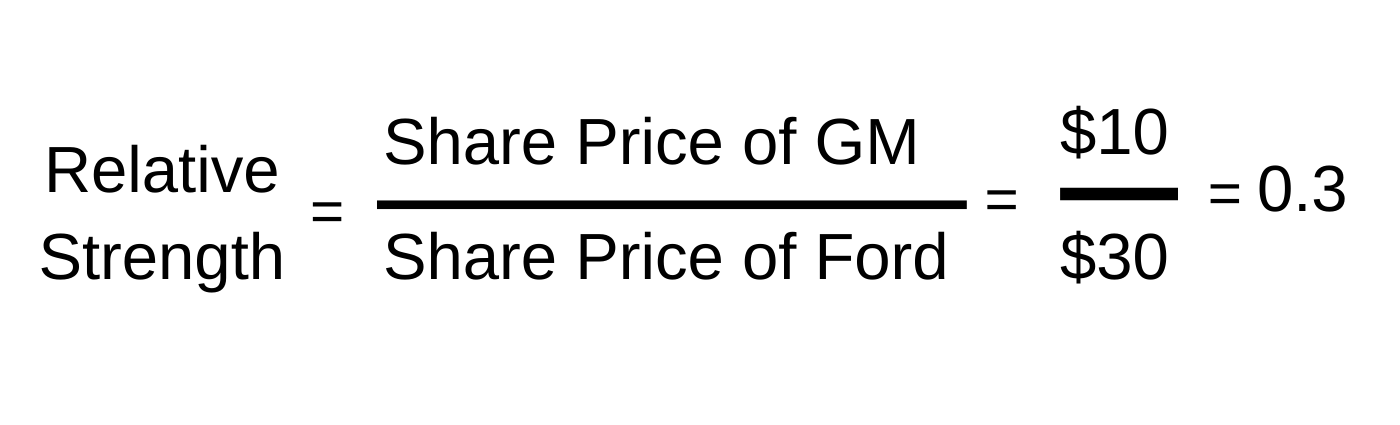

Relative Strength

This is the best aspect of this book I have learned. Relative Strength is the measure of the price trend of a stock compared to another stock. It is calculated by taking the price of any stock and dividing it to another stock.

If the relative strength of Ford to GM ranges between 0.5 and 1 historically then the current level suggests that Ford is undervalued and GM is overvalued. Where value investing stands for buying low and selling high, relative strength investing is to buy high and sell even higher.

Relative Strength investing is quite helpful when the stock market is crashing but truely sound companies will not fall as much as lousy stocks. It is because this kind of stocks are actually the top 10% of stocks in the market.

The Sherlock Holmes of stock picking has offered a big set of ‘hints and clues’ which is quite helpful for picking next big winners. By reading this book you will learn

- How to cut losses,

- When to book profit and sell the stock,

- How to manage money and allocate to build a stock portfolio,

- How to pick and buy stocks across various sectors.

- Get the book from Amazon India

Book #9. Beating the Street by Peter Lynch

If you had invested $37k in Fidelity’s Magellan Fund in 1977 when Peter Lynch took charge as a fund manager and sold in 1990, he would have left your investment worth over a million dollars. The fund has delivered a whopping 29% CAGR for the 13 years as clear as a day. And behind that, there is no magic.

In this book, Peter Lynch will help both small investors as well as big investors to develop a winning investment strategy. You need to understand that stocks are not lottery tickets and there is always a reason behind why the stock of any company performs the way they do. In this book, you will learn,

- How to find good undervalued business.

- Behind every stock, there is a company and find what they are doing.

- After analyzing, you should buy any stock. The best stock to buy is the stock which you have already invested in.

- Stop hunting for ‘Best Stock’. Maybe you have owned already. Instead of searching, quality businesses stick to the ones you already own and invest more.

- Instead of searching for good stocks in good industries, you should focus on good business in bad industries since good business attracts competition. [higher margin lower costs]

21 Investment Principles

Peter Lynch has delivered 21 investment principles. By following them any novice investor can gain fruitful returns in the long run. Here are the few,

- Avoid the ‘Weekend Warriors’ who deliver thousands of predictions about the economy. Instead of following these analysts you should find quality undervalued business and invest regardless of the state of the world.

- Finding quality stocks is a never-ending process. You should stop hunting for undervalued stocks when you have already quality stocks in your portfolio.

- Invest in that business where insiders are increasing their stake in the business.

25 Golden Rules of Investment

Peter Lynch has delivered 25 Golden Rules of Investment in this book. Here are the few,

- Any Investor can outperform the ‘Weekend Warriors’ if he has invested in such companies or industries of which he has a complete understanding.

- If you have not found any company that seems attractive, put your money in the bank until you discover undervalued business.

- Don’t invest in such companies which are with a poor balance sheet.

- Sell a stock when the company’s fundamentals deteriorate.

- You need to study companies since the chances of success are like a poker when you bet without looking at your cards.

- A portfolio of stocks or equity mutual funds [ with proper analysis] outperforms a portfolio of bonds and money market funds in the long run.

- Get the book from Amazon India

Book #10. You can be a Stock Market Genius by Joel Greenblatt

The author is among one of the best investors of all time since he delivered an annualized return of 50% by running a hedge fund from 1985 to 1995. This huge return was achieved by neither passive strategy nor a systematic quantitative approach. You can achieve this stellar performance by a lot of work and also luck. By hunting down the grounds the author outlines the strategy by which he generates amazing returns.

- How to use situations like Spin-off, Restructuring or merger of securities, right offerings, recapitalizations, risk arbitrage, bankruptcies, etc. to make a profit from the stock market.

- In this book, the author makes use of various case studies that explain the details of each situation.

- In order to diversify owning 8 stocks and 500 stocks, you can really pick your spots to book profit.

- Employ a margin of safety while investing.

Just like Warren Buffet emphasizes the competitive moat, Intrinsic value by Benjamin Graham, the author uses a quantitative statistical approach to make money in the stock market. According to the Author, every investor can not possibly participate in even a fraction of the opportunity. But by reading this book you can be successful to identify or spot various investment opportunities.

- Get the book from Amazon India

Book #11. Bogleheads’ Guide to Investing by Mel Lindauer, Michael LeBoeuf, and Taylor Larimore

Irrespective of your age or net worth or goal ‘Bogleheads’ Guide to Investing’ will give a straightforward sound practical advice on investing. This book enables an individual to prepare a strategy for long term wealth creation without any worry of day traders.

How to prepare a healthy financial lifestyle

To lead a healthy financial lifestyle you need three points to consider before investing. The three important points are

- Pay off all your credit card bills and debts,

- Create an emergency fund,

- Calculate your net worth.

Apart from the three points, the author emphasizes to insure yourself by buying life insurance, health insurance, and long-term disability insurance.

Start early to gain the Power of Compounding

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 25 years with just $158 per month then you will get One Million Dollar when you are 60, assuming 12% CAGR. If you are late by 5 years i.e., start investment at the age of 30, then you need to invest $290 per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 35 years then you need to invest $552 per month.

Investment Portfolio

You should invest in such asset classes that you have a complete understanding. Then invest across various asset classes namely, Bonds, Mutual Funds, ETFs, Commodities, etc.

How much should you save?

This book offers a detailed guide on how much you need to save. By offering an interesting calculation the author shows what will be your target amount for worry-free retirement life.

Asset Allocation Strategy

In this book, the author has given a snapshot on how to allocate your assets following your age, goals, risk appetite and time horizon.

Finally don’t try to time the market and stick with your long term strategy. You should rebalance your portfolio only if necessary and keep a cautious eye on earnings and ignore short term market volatility or market correction.

- Get the book from Amazon India

Book #12. A Beginner’s Guide to the Stock Market: Everything You Need to Start Making Money Today by Matthew Kratter

According to the author, the stock market is the greatest opportunity machine that is ever created. The author believes that every person should start investment not only the rich and the privileged. Since there are various types of investors in the market such as traders who want to make a lot of money instantly by trading and also such investors who want to get rich slowly. By reading this book you will be able to prepare a strategy to make money from the stock market. Here are the key points of the book,

- Any investor must know how the stock market really works to prepare a strategy of own.

- How to pick the best stock broker to open a brokerage account,

- How to place your first order to buy stock,

- The reasons why stock prices tend to move upwards and how to spot before it starts a bull run.

- What horrible mistakes common retail investors make while investing,

- You should buy dividend stocks that pay you quarterly. The dividend you receive from companies, buy more dividend stocks to make money from the stock market.

- How to pick value stocks like ace investor Warren Buffet,

- How to prepare a strategy or plan to secure the financial future of your family.

- Get the book from Amazon India

Book #13. Irrational Exuberance by Robert J. Shiller

Since the world has not experienced any economic crisis after the great depression since 1930 the author has offered the shrewd insights sober warnings some hard facts in this book. In this book the author suggests,

- The stocks tend to move upwards right back after experiencing a correction.

- The stocks will deliver better returns when an investor sticks to the long term.

- You should start investing in stocks via mutual funds.

- Don’t expect stocks will deliver better returns in case the stock has delivered better returns during the past few years.

- A comprehensive guide of value investing and contrarian investing.

- Pitfalls of investing in stocks when the stock has a high price to earnings ratio.

- How to invest wisely at the time of market economic upheaval.

- How to pick value stocks like Warren Buffet to get consistent earnings and dividend.

- Get the book from Amazon India

Book #14. The Most Important Thing: Uncommon Sense for the Thoughtful Investor by Howard S. Marks

This is one of the best portfolio management books that are ever written. The author Howard Marks offers a detailed case study on why you cant outperform the market return by following the herd. Let’s dig it.

First Level Thinker vs. Second Level Thinker

You can’t succeed by following the exact strategy that others are doing. You must acquire a second-level thinking beyond the obvious. It is a proven fact that the circumstances are rarely repeated exactly. First-level thinkers look for favorable circumstances to buy or unfavourable circumstances to sell. But second-level thinkers check whether the investment is over-hyped or expensive to provide a margin of safety. They also check whether the stock price is at an attractive level or not before buying it.

Growth Vs. Value

The author has given a detailed snapshot of Growth and Value. Growth refers to you are betting on the future i.e. an uncertain future. Contrary to Growth, Value refers to you are paying less than what is worth today.

The right time to buy any stock

The most dangerous time to buy is when any company is at the peak of its popularity on the wings of positive data and the prices are skyrocketing.

The best time to buy any stock is when no one wants to buy the stock of the company owing to all the negative data and consequently share price is downward. You can make a profit when the price of any company is below the real worth of the company.

How to minimize risk and maximize returns

Risk neither comes from weak fundamentals nor volatility in the stock market. It depends on you i.e. how you can react during a volatile market. You can minimize risk either by making an accurate estimate of the intrinsic value of any company or by comparing the price to the value of the company.

You should be steer clear of greed, fear, and tendency to diminish logic. You should stick to the intrinsic value of the business and margin of safety to maximize the returns in the long run.

- Get the book from Amazon India

Book #15. Buffett: The Making of an American Capitalist By Roger Lowenstein

The author of the book summarizes all the important life events of ‘Oracle of Ohama’ Warren Buffet. The book will give you a snapshot of value investor Warren Buffet’s hardships when he was a kid to become one of the greatest value investors across the world. In this classic, the author has given an account of all the life struggle and investment journey in a storytelling mode.

Early Days of hardships

When Warren Buffet was born on August 30, 1930, the United States was going through the Great Depression. The author describes how Warren Buffet’s family struggling for a livelihood when his father lost his job and what sacrifices his mother did.

When Warren Buffet Started Investing in the Stock Market

At the age of 10, Warren Buffet visited the New York Stock Exchange with his father. After one year he is successful to book a profit by buying and selling stocks with his sister Doris.

To start investment in the stock market he worked as the collector of lost golf balls in the local golf course. When he was a 14-year old boy he delivered newspapers to earn money.

How Columbia Business School changed his Life

When he was graduated from Columbia Business School Buffet was the only student ever to earn an A+ in one of Graham’s classes. Later Buffet realized that he found a mentor who changed his life. From his mentor, Buffet learned,

- How to calculate the intrinsic value of any company, to determine whether the stock is risky.

- If the intrinsic value is higher than the market value, then the stocks are not risky.

- If the intrinsic value is higher than the market value then buy these undervalued stock prices before they meet the market value.

After completion of Graduation, Buffet was hired by Benjamin Graham to work for his investment firm on Wall Street — Graham-Newman Corp.

At the age of 26 Buffet returned to his hometown, Nebraska

The author has given a snapshot of the investment journey of Warren Buffet after he returned to his hometown.

After returning to his hometown, Buffet started his own investment firm namely Buffet Associates with a capital of $5,00,000. The author has given a detailed overview of how Buffet managed to double his portfolio value at the end of the third year.

The exact strategy behind buying Berkshire Hathaway the textile company was the deteriorating numbers.

How Buffet lead his life

Even though Buffet was one of the richest people, he lived with modesty in a house that he bought for $31,500 when he was 27 in Nebraska. Warren Buffet neither had an expensive lifestyle nor wanted the tax cuts for the rich. He has donated most of his wealth to charities.

- Get the book from Amazon India

Book #16. A Random Walk Down Wall Street by Burton Malkiel

If you are looking for a time-tested and throughly-researched investment strategy then you should read this book which offers an investment strategy that works in the long run.

Valuation Models

The author of the book coins the two stock valuation models namely ‘Firm Foundations’ and ‘Castles in the air’.

‘Firm Foundations’ model emphasizes the company’s core fundamentals namely business, profitability, growth, etc. while calculating stock’s valuation.

According to the ‘Castles in the air’ model you should invest in such stock when the next investor is willing to pay.

The Biggest Bubbles of all time

According to the author, any investor should calculate the actual value of any company before investing. In this section, the author has offered the three case studies to reveal that the price of securities returned to the same value as they were before the bull run. The case studies are as follows,

- The Tulip Mania in Netherlands, 1637,

- The South China Sea Bubble in England, 1720,

- The ‘dot com’ Bubble boom in the late 1990s and the burst in the early 2000s.

How to build an all-seasoned Portfolio

To maximize returns while minimizing the risk Malkiel has given a description on,

- How to diversify your investment portfolio across various asset classes,

- Picking the best stocks by making use of fundamental analysis and technical analysis.

- How human emotional biases can affect investment choices that impact the overall market. In this section, the author suggests investors don’t invest in what’s hot right now for the long term. You should buy those stocks that have reasonable numbers and sell stocks whose numbers deteriorate.

The author advises if your goal is long term, invest in equities and for the short term you should invest in bonds. Before you start your investment journey via index funds build an emergency fund and get insured. Apart from that, you need to invest not only tax-saving schemes but also in a retirement fund to lead a worry-free retirement life.

- Get the book from Amazon India

Book #17. Stock for the Long run by Jeremy Siegel

Through detailed historical data, the author highlights that the stocks are not only the least risky asset but also the best-performing asset class in every 30 year time horizon. You can outperform professional investors who look for returns from year to year since the stock market is very volatile in the short run.

Stocks Vs. Bonds

This book gives a detailed comparison between stocks and bonds by analyzing the 200+ year’s data since 1800. If you had invested $1 in US Stocks in 1800 your investment would have been worth $260000 in comparison to bonds of $563 in 1994.

By making use of historical data he shows that a diversified stock portfolio has given an average return of 6.6% yearly [post adjusted inflation]. It means your purchasing power gets doubled in every decade. From the above fact to boost your purchasing power and wealth creation you should invest in the stock market not only on bonds since bonds offer ‘nominal’ return.

Myths about Sectors and Returns

By investing in high growth sectors or countries you won’t get the highest returns. Since high growth sectors tend to have very high valuations which lower the future returns. The author makes a detailed analysis of the tobacco company ‘Philip Morris’ to illustrate the same.

Invest in Global Equities

Since US market constitutes less than half of the world’s total equity, you should invest in all over the world to best companies namely Unilever, Nestle, Sanofi, etc.

How to outperform the market?

If any company doesn’t pay a regular dividend it does not indicate it should have not be valued. Apart from dividend payment, you should concentrate on where the company will deliver returns in the long run. You should investigate the ability of any company to pay a dividend. To prove his theory he makes use of Berkshire Hathway which has not paid any dividend since 1968. But since its ability to pay a dividend has gone up enormously resulting in stock price inches higher.

Psychology of Investment

Irrespective of large corrections and bubble burst on the account of wars, political shifts, and economic data releases, your job is to measure the risk and avoid taking instant action.

Finally, this book will help you to achieve financial freedom by making an informed decision on how to invest your money.

- Get the book from Amazon India

Book #18. The Winning Investment Habits of Warren Buffet & George Soros by Mark Tier

The author gives a detailed overview of how Warren Buffet, Carl Icahn, George Soros have made billion-dollar fortunes by investment. They neither diversify their portfolio nor focus on big profits which involve big risks. Even Warren Buffet admitted that he did not read the research reports. The only instance Warren Buffet read analyst reports when he needed a laugh. You should read not only the annual reports of the companies you plan to buy but also their competitors. Here are the investment strategies they all practice rigorously.

What to buy?

After analysis of the true value of the business, you should determine whether the business is available at an attractive valuation. Invest in such business which meets your investment criteria. If you do not find any business, put your money in T-bonds.

When and How much you should buy?

You need to prepare an investment system with a detailed analysis of what to buy, when to buy, and at what price to buy and how much you should buy. As a master investor, you need to act instantly after you make a decision instead of what others think about your investment decision.

You should make use of Mr. Market to serve you not to guide you. You should conduct independent research to determine whether the market value of any stock is lower than the intrinsic value.

Instead of diversification of the portfolio, you should concentrate on building a portfolio of a few stocks with a competitive moat. When Buffett found the quality business that met his criteria he was reluctant about how the market was valuing them.

When to Sell?

You can sell a stock under 3 conditions,

- You have made a mistake,

- When your pick no longer meets the criteria,

- You have got a lucrative opportunity and the only way to buy that stock is to sell your existing stocks in your portfolio.

Finally, Monitor your investment since monitoring is as important as buying a stock after proper analysis.

- Get the book from Amazon India

Book #19. When Genius Failed: The rise and fall of Long-term Capital Management by Roger Lowenstein

In this business classic, the author draws parallels between ‘Long-term Capital Management’ and ‘Lehman Brothers’ or ‘AIG’. Here the author shows how the hedge fund like the ‘Long-term Capital Management’ made money and lost its money. Needless to say, Long-term Capital Management was founded in 1993 by some smartest Wallstreet traders and academics including two Noble laureates in Economics. By taking interviews with dozen of key players Lowenstein has analyzed how this $100 billion venture has suffered catastrophic losses endangering not only the biggest banks but also the stability of the financial system itself.

This is not the only instance. This is a template since the same situation occurred again in the case of ‘Lehman Brothers’ or ‘AIG’ after a decade i.e. in 2009, a decade later. The firm i.e. hedge fund delivered a 40% annualized return during the period between April 1994, and April 1998.

If you what to learn what happened in the case of Bear Stearns and Carlyle Capital you must read this book to cut losses in the near future since history repeats itself.

- Get the book from Amazon India

Book #20. Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any Market by Mark Minervini

Mark Minervini won the US Investing Championship in 1997 for delivering a return of 155% within a year. Mark Minervini started his trading career at the New York Stock Exchange in 1983 and delivered a net loss in stocks for 6 years. But after constant efforts and tons of hard work, he managed to achieve success from 1989. He delivered an average return of 220% year-on-year i.e. whopping 33,500% compounded total return for the period between 1994 and 2000.

What does an Investor expect from this book?

Mark Minervini reveals his trademarked stock market method “Specific Entry Point Analysis” i.e. “SEPA” in this classic ‘Trade Like a Stock Market Wizard’. Apart from that, you will learn,

- Trading in stocks and running a business doesn’t differ. As a trader, buy those stocks that have strong demand and book profit by selling them at a higher price.

- How to pick the best stocks before they start their bull run. By making use of ‘Netflix’ the author shows that the stock usually outperforms the market during the first 10 years since IPO.

- What forces initiates the bull run of any stock. It is a proven fact that 90% of stocks start their bull run after a sharp market correction or when the market comes out of a bear market.

- A step by step guide for the analysis of trends i.e. Four Stages of Stock Price Action.

- Get the book from Amazon India

Book #21. Encyclopedia of Chart Patterns by Thomas N. Bukowski

If you are a technical investor and trader who is wondering what was happening after looking at a chart pattern, then this is a must-read book. In this detailed guide, the author has given a complete analysis of 63 generic chart patterns and their variations. By reading this book you will learn,

- How to trade like a master in the events of quarterly earnings, stock upgrades and downgrades by brokerage rating agencies/houses.

- What are the key features to analyze the chart patterns?

- Statistical analysis of the failure of chart patterns.

- How to identify the correct pattern which will enable success in trading.

- When and why various chart patterns have failed.

- Get the book from Amazon India

Book #22. Japanese Candlestick Charting Techniques by Steve Nison

If you are a novice investor who does not know the technical knowhow then you should read this book to learn the logic of technical analysis. In this detailed guide, the author describes different types of chart patterns in a very interactive and smooth flowing manner. This 20 chapter classic illustrates

- The study of indicators like moving averages, MACD, Fibonacci retracements, oscillators, Open interest, etc.

- Various types of trading techniques namely short term trading, directional trading, algorithmic trading, etc.

- Coding strategies timing the market.

- Get the book from Amazon India

Top 3 Best Stock Market Books by Indian authors

Book #23. How to Avoid Loss and Earn Consistently in the Stock Market by Prosenjit Paul

Even though there are hundreds of books about ‘how to make money from the stock market?’ then why 80% of retail investors make a loss in the stock market. In this detailed guide, the author Prosenjit Paul has given a detailed snapshot of

- Why stock market investment is not risky at all.

- Step by step guide to picking winning stocks.

- How to evaluate the management of the company.

- How to check out valuations.

- When to buy a stock and when to sell a stock.

- How to avoid loss and make a profit in the stock market.

- How to build your model portfolio.

- Whether you should consult with an investment advisor.

Why stock market investment is not risky at all

When we purchase Cars, Smartphones, or any expensive stuff we undergo rigorous research but many novice investors invest without any research before investment. The stock market is risky only if

- You follow the stock tips which are delivered by several analysts blindly.

- Instead of focusing long term capital appreciation interested in intraday trading. It’s hard to find an investor who makes million or billion solely due to intraday trading.

- Without any proper knowledge, kick start in F&O Trading. One thing you must know that only Brokers, stock exchange and Government are making money when you trade, not you.

- Invest with the borrowed money to earn quick bucks.

The First Step to pick quality stocks

You should check the following points before investing in any company i.e. stock,

- Invest in such quality companies whose debt to equity ratio is less than 1. The best company to invest in is either debt-free or has marginal debt.

- The best stock to buy that has delivered a Return on Equity of 15% and discard any stock which has delivered ROE less than 12% during the past 5 years. Consistent ROE is a clear signal that the management is efficient enough to manage the capital efficiently.

How to evaluate the management of the company

Management is the backbone of any company. You should analyze the following points before investing in any company,

- It is a good sign that promoters or institutional investors purchase the company’s stock via block deal or bulk deal from the open market. Since Promoters increase their stake it is a clear signal that they have high confidence and expect best returns.

- If any company has high Foreign Institutional Investors then it can be interpreted that it is a quality business. But when FIIs sell their stake it does not mean that the company has weak fundamentals.

- To raise funds promoters pledge their equity shares in the banks or NBFCs. You should not invest in such a company that has pledged more than 30% of equity shares.

- Invest in such companies that are consistently paying a dividend over the last 10 years.

How to Check out Valuations

Valuation is the core factor in the world of investment. Will you find a buyer who will buy a quality product that you have bought at an excessively higher price? The clear cut answer is no. Instead of buying quality stocks at higher valuation check out the following factors,

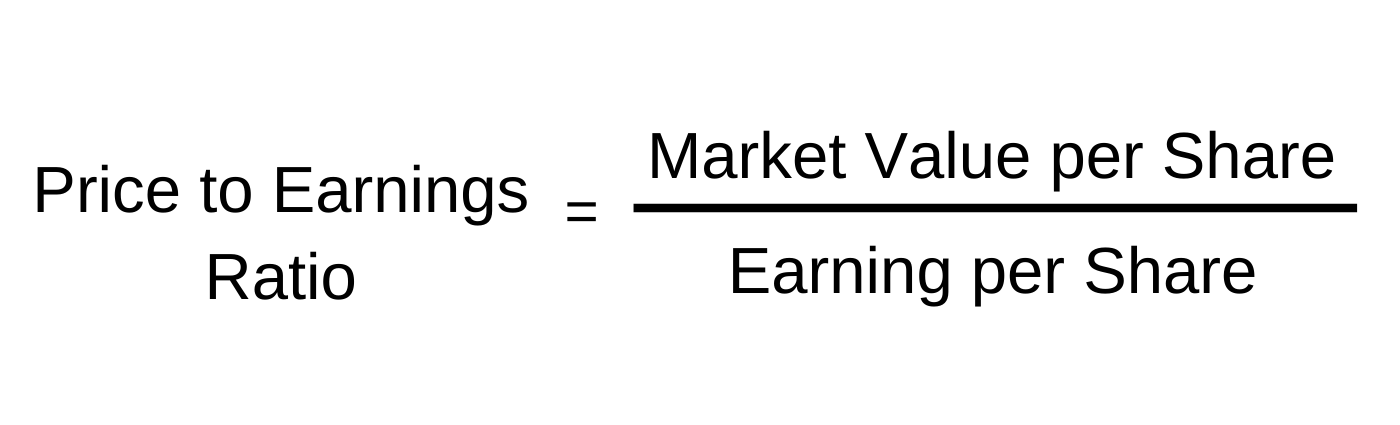

Analyze Price to Earnings [P/E Ratio]

You should pick stocks that not only have strong fundamentals but also are trading lower than their historical average. You should invest in those stocks that have a lower P/E Ratio compared to peer companies.

But don’t rely solely on the P/E ratio since

- A One-time income can easily alter earnings or profit lowering P/E ratio.

- A one time expense can elevate the P/E ratio.

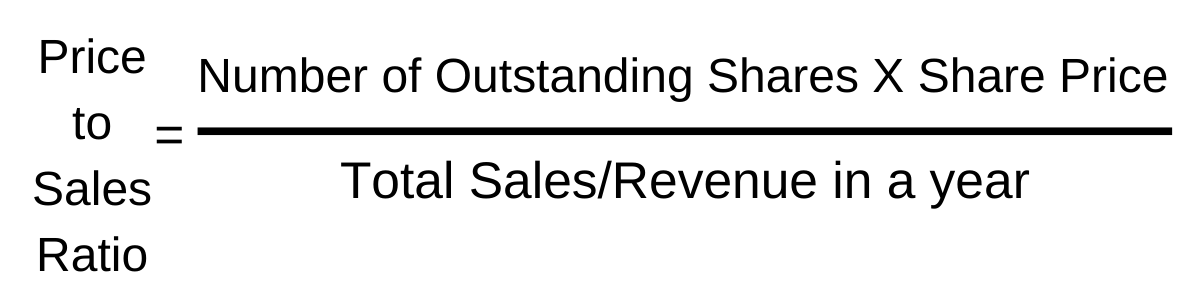

Analyze Price to Sales Ratio [P/S Ratio]

The Price to Sales Ratio reveals how much the market values every dollar for the sales of any company. You should invest in such companies that have a lower P/S Ratio. While picking the best stocks you should check the industry where the company is operating since there is a possibility to report loss apart from an increase in revenue/sales.

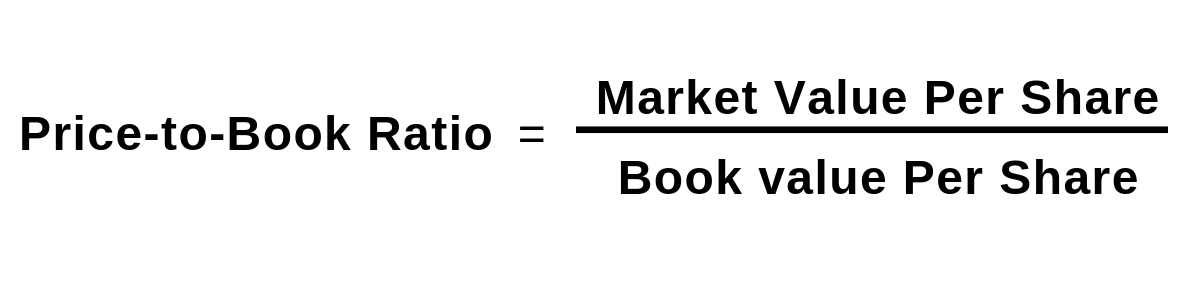

Analyze Price to Book Ratio [P/B ratio]

Invest in quality business which has a P/B ratio of less than one. The lower the ratio is, the more the attractive valuation will be.

Apart from the above key matrices here is the easiest way to check valuation.

By making use of PEG ratio you can find four categories of stock namely,

- Undervalued – The PEG ratio is less than 0.5.

- Either Undervalued or Reasonably valued – The PEG ratio is between 0.5 and 1.

- Reasonably valued – The PEG ratio is between 1 and 2.

- The overvalued – The PEG ratio is greater than 2.

When to buy a stock and when to sell a stock

You should invest more when the fundamentals are intact even when the stock offers a 200% return. It is quite a hard call to sell a stock than buying a stock. You should sell a stock when the earnings are deteriorating rather than the stock price movement. You should exit from any stock when its valuation is too expensive compared to its earnings numbers.

How to avoid loss and make a profit in the stock market,

To minimize loss and maximize the profit you should consider the following points,

- Don’t sell a stock solely because the stock price has corrected to 30%. Check the fundamentals. If they are intact then sharp corrections is not the reason to sell a stock.

- Despite earning numbers are deteriorating the investors either hold the stock hoping for a sharp rise or buy more to average out the buying price.

- According to the ace investor, Benjamin Graham in the short run share market is a voting machine but in the long run, it is a weighing machine. You need not worry about short term market volatility. Focus on the long term capital appreciation.

Finally, invest in the long run. If you fail to hold a stock for 10 years then you should not buy the stock for the next 10 minutes.

How to build your Model Portfolio

You should properly diversify your portfolio across various sectors but don’t over diversify since this will erode your hard-earned money. Your portfolio must include a fewer number of stocks with strong fundamentals across various sectors.

Whether you should consult with an investment advisor

If you have not found the quality business right now then stick to mutual funds only. Be aware of people or companies which offer ‘Jackpot Share tips’ or ‘100% sure shot call on futures or options’ etc.

Finally invest in such companies that have

- Debt to Equity Ratio is less than 1.

- The sales growth rate is greater than 10% or the last 3 years.

- The profit growth rate is greater than 12% or the last 3 years.

- The Return on Equity and Return on Capital Employed [ROCE] is greater than 20% for the last 3 years.

- Get the book from Amazon India

Book #24. Stocks to Riches by Parag Parikh

Even though there are full of value investing books a few books are available on behavioral and psychological investing. The author of this book is trader, value investor and founder of ‘Parag Parikh Long Term Equity Fund’ [PPFAS]. He elaborate the behavioral part while investing quite efficiently.

How to avoid the loss in the stock market

No one in this world wants to be on the losing side not in the investment world. With proper example, the author describes how retail investors are in a hurry when the stock price is moving upward or hold a losing position for a long time to minimize the loss. Buy when others are buying and sell when others are selling doesn’t generate a fruitful return. To make money in the stock market you should buy when others are selling.

Get Tempted to Prices of a stock rather than fundamentals

Without the calculation of the fair value of any company, we make investment solely on the price of the company. Let’s make it clear with an example.

Suppose you hold 100 shares of any company at the price of Rs. 200. But owing to the drop in revenue or financial fraud the stock witnesses a sharp correction and now trades now at Rs. 130. Now after one month the share price of the stock elevates to Rs. 170 and within a few trading sessions the share price drops to Rs. 100. But you do not sell your stocks at the price of Rs. 170 in the hope of the stock will go upward and you will sell your shares at the price of Rs. 200.

What is Decision Paralysis and how to deal with it

If you are a serious investor then you need to make a decision deciding how much you will make money in the market. According to the author, any investor experiences with decision paralysis owing to,

- The fear of making a huge loss,

- Unwillingness to take the risk when you have got a fantastic opportunity to buy a stock at an attractive valuation.

To escape from decision paralysis you can make use of Dale Carnegie formula. According to Dale Carnegie at the time of taking decisions make the worst assumption when you feel the decision will not go in your favour.

Don’t invest in any company since the company has declared a bonus share or stock split. The company offers a bonus share or goes for a stock split to achieve the company’s purpose.

Finally, you should diversify your portfolio across various sectors. You should allocate a maximum of 20% of your portfolio allocation in any sector and don’t allocate more than 10% in any stock. You have not got married to any stock. When the purpose of buying a stock is achieved sell the stock and book profit. If you are emotionally strong and buy a stock with intact fundamentals in a panic situation when others are selling you will make a great return.

- Get the book from Amazon India

Book #25. The Dhandho Investor by Mohnish Pabrai

There is a common perception that risk and returns are equivalent i.e. the bigger the risk is the better the returns are. But value investors like Benjamin Graham, Warren Buffet, Joel Greenblatt have given a brief description that any investor can make a great profit with minimum risk. The Indian-American author, Mohnish Pabrai offers 9 principles by making use of any investor can maximize the returns while minimizing the risk.

Principle #1. Focus on buying an existing business

If you start investing in a few publicly traded business you can find real opportunity to buy at attractive valuations. Apart from that, you don’t need a huge capital to start investing.

Principle #2. Invest in simple businesses

By investing in a simple business you not only earn a decent profit but also unlikely to lose a huge capital.

Principle #3. Invest in distressed business

According to the author, human psychology affects the share prices to a large extent than the buying and selling of the entire business. You should invest in simple businesses that are under distress enabling you to get the shares at an attractive valuation.

Principle #4. Invest in business with a competitive moat

You should invest in such businesses that have sustainable competitive advantage i.e. moat.

Principle #5. Few bets, big bets, and infrequent bets

According to the ace investor Warren Buffet, diversification can be seen as a protection against ignorance. Pabrai offers your portfolio should not include 100 companies when you want to earn above-average returns.

Principle #6. Fixate on arbitrage

You should look for arbitrage opportunities since this will help you to earn a high return with minimum risk.

Principle #7. The Margin of Safety

When you find the stock trade much lower than its intrinsic value you should buy to earn a decent return. You should look for such stocks that have a margin of safety.

Principle #8. Invest in low-risk, high-uncertainty businesses

When you have a range of possible future scenarios that do not have permanent loss of investment, you can invest to make a profit.

Principle #9. Invest in copycats compare to the innovators

If you have found good clone businesses that are able to constantly lift and scale the work of the innovators then you should invest in those businesses.

- Get the book from Amazon India

How Capitalante can help you

Are you confused about how to prepare a stock portfolio to achieve financial freedom? If yes, learn how to pick the best stocks to buy for the long run.

- Read also: Top 21 Best Personal Finance Books You Must Read in India

- Read also: Top 10 Books Every Investor Should Read

These are some best stock market investment books for beginners. Feel free to suggest any other book which I have missed in this column. If you have found this post helpful feel free to share it with your loved ones.