Although there are various factors to pick a quality stock such as fundamental analysis, technical analysis etc. fruitful stock picking strategy is Growth at a Reasonable Price or GARP investing Method. The mechanism works on the principle of picking such stocks whose fundamentals are intact, but undervalued. In this column, we will discuss how to pick quality stocks by GARP investing method.

How to pick quality stocks by GARP investing method

In the share market, there are more than 1500 companies or stocks listed. So, to pick such stocks which are capable of giving the better return is quite a difficult task. GARP investing method emphasizes the price to earnings ratio as well as price to book price. Let’s make it clear with an example. You should analyze the compounded sales growth, compounded profit growth, debt ratio. You should find that all the numbers are satisfactory. Now, you need to analyze the P/E ratio as well as the P/B ratio. Generally, GARP investors are in search of such companies or stocks which are somewhat undervalued i.e., with a lower valuation. But these companies or stocks hold solid sustainable growth in terms of sales margin or profit growth etc.

- Read also: Stock-Picking Strategies: GARP Investing – Investopedia

- Read also: Stock Picking Strategies | Stockaholics

GARP investors normally pay attention to a company’s current valuation and use the profit and earnings ratio i.e., P/E ratio to analyze the stock. In general lower P/E indicates that a company is currently undervalued, but is capable to deliver better returns than the stocks trading in higher valuation within the same industry. In this strategy, investors aim at choosing those stocks which are a little bit of higher valuation than the minimum P/E ratio but have

| Factors | Berger Paints | Akzo Nobel India Ltd. |

| Market Cap | Rs. 29,558 Crore | Rs. 7,082 Crore |

| Compounded sales growth | 14.41% | 11.88% |

| Compounded profit growth | 17.07% | 19.23% |

| P/E ratio | 60.47 | 17.69 |

| Factors | Titan Company | Rajesh Exports Ltd. |

| Market Cap | Rs. 77321 Crore | Rs. 16,834 Crore |

| Compounded Sales Growth | 18.12% | 43.15% |

| Compounded Profit Growth | 22.11% | 22.84% |

| P/E | 64.62 | 37.95 |

Points to Consider,

Many investors make a mistake while choosing a stock with a lower P/E ratio. They pick stocks and compare them with the P/E ratios of different sectors.

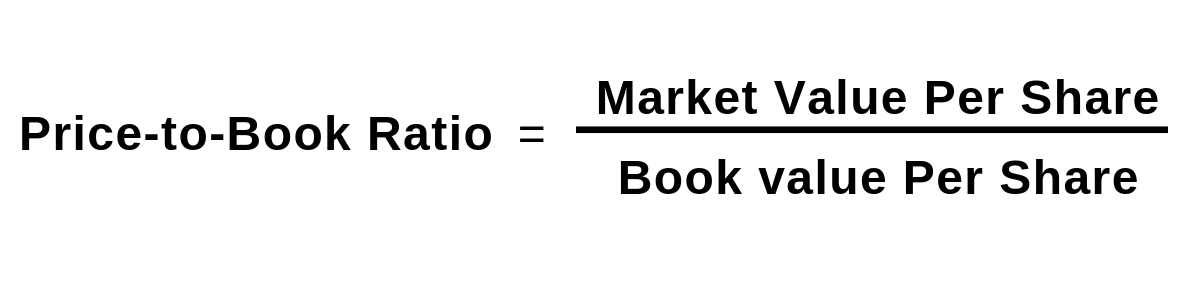

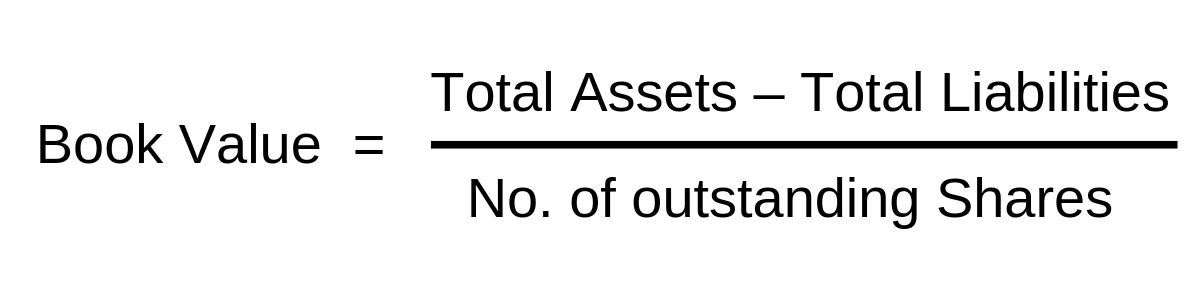

Apart from the P/E ratio, GARP investors also concentrate on Price-to-book ratio i.e., P/B ratio. The price to book ratio is calculated as follows,

While calculating the P/B ratio you should at first check the fundamental aspects of a stock which has a lower P/B ratio. Then you can invest in that undervalued stock accordingly. You should focus on those companies or stocks whose products, publicity, brand value etc. are good. A company with Lower P/B ratio does not generate robust return i.e., 100% within one year or 500% return within 3 years, but in future, it will boom and deliver 50% CAGR over a long-term horizon i.e., of 10 years. Most of the GARP investors focus on positive earning numbers over the past 3 years of reasonable stocks which are capable of giving 25%-30% earnings growth.

Finally,

This type of investment involves both the indicators of growth investment and value investment. GARP investment strategy is rewarded in a volatile market and this method ensures a steady return. In a bull market growth investment style is unbeatable, but in the bear market value investment style is unbeatable. To compare both the strategies, GARP investment style ensures more consistent and predictable returns.

- Read also: How to use Price to Earnings Ratio to Pick Stocks

- Read also: How to Pick Best Stocks Step by Step

If you have any question regarding picking multi-bagger stocks by GARP investing method feel free to comment. If you loved the post don’t forget to share.