Now I am blessed with a daughter, and that’s why I decided to secure my financials, so I went to my father for his suggestions before making all the things pleasant.

After hearing my plans, my father was frightened and said ‘poor management will destroy your financial life, and there are higher chances that you will have to sell your assets for livelihood after retirement’. Then, I decided to share with you the common retirement planning mistakes to avoid to live a worry-free retirement life.

12 Worst Retirement Planning Mistakes to Avoid

Retirement planning not only leads a person to live a retirement life without woes but also helps to achieve financial freedom even at the age of 50, if done properly.

When you don’t have any retirement plan to secure the financial future, you will live a retirement life full of stress and worry. To escape this you need to avoid these mistakes mentioned below.

Mistake #1. Avoid early retirement planning

After getting a job most of the people think that they are too young to plan for retirement. They believe that they have much time to plan for retirement. They ignore this vital thing that early planning will secure financial needs after their retirement. Like this, they spend years after years and when the age of 60 comes close they find themselves with very little savings for the post-retirement life. So a sincere person will keep this thing in mind and try to do planning for his or her post-retirement life.

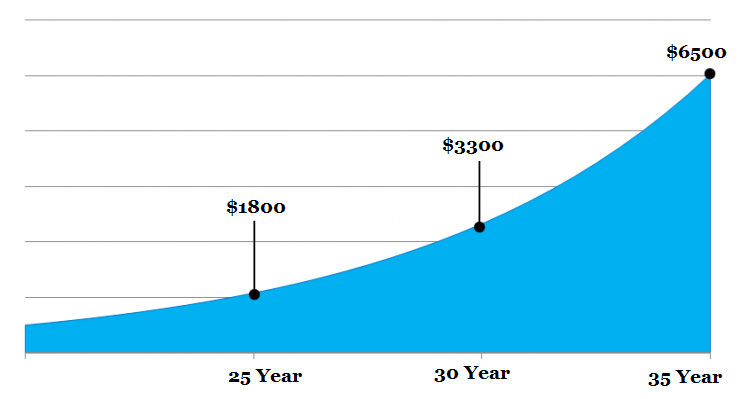

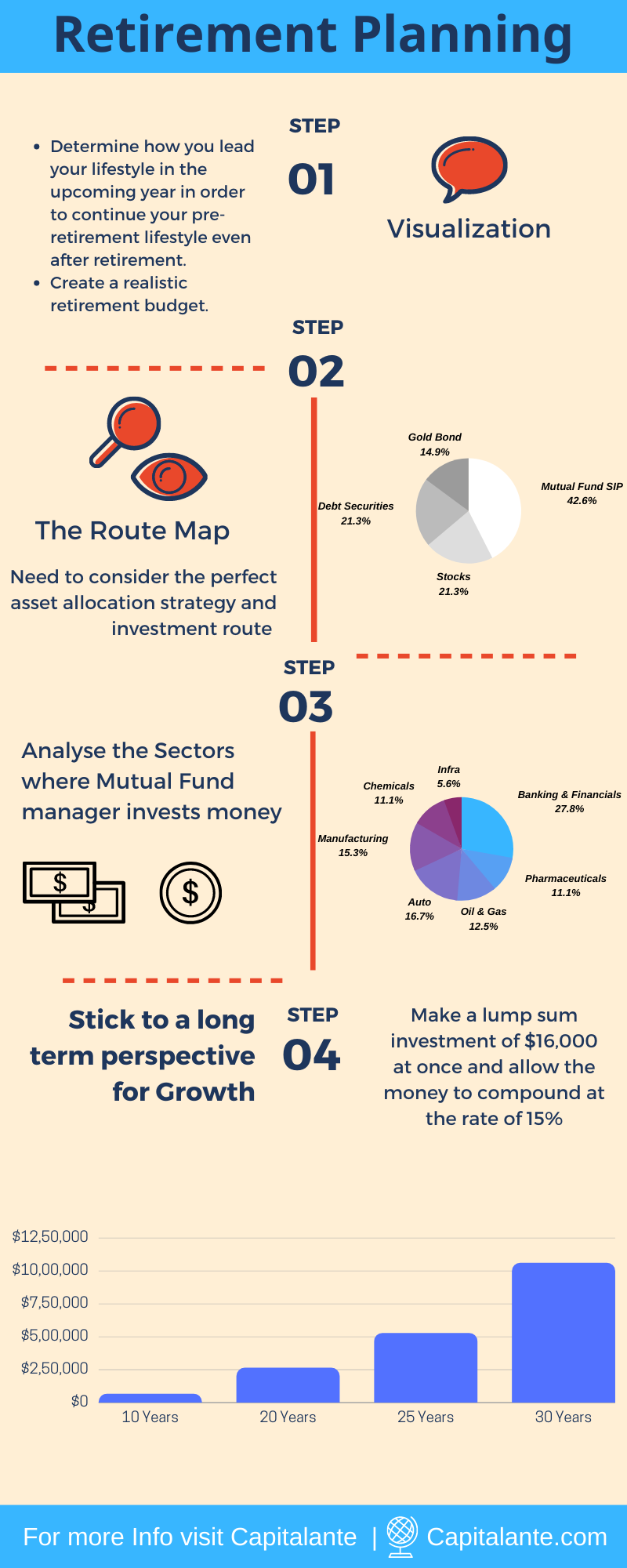

To make how early retirement planning will help you to get it right, concentrate on the graph.

If you start investing at the age of 25 years with just $ 1800 per month then you will get $3 million when you are 50, assuming 12% CAGR. If you are late by 5 years i.e., you start investing at the age of 30, then you need to invest $3300 per month to get the same corpus at the age of 50 years. Again, if you start investing at the age of 35 years then you need to invest $6500 per month.

Mistake #2. Unable to visualize the situation after retirement

First of all, let’s assume that a person gets a job at the age of 25 years. If you want to retire at 55, then you are 30 years apart from your dream retirement. This service period may vary from person to person and may be of 27 or 30 or 33 years or more. Generally, we can assume that a person has a service period of 30 years. You must have a clear view and a good understanding of the expenses that will be required to live after retirement.

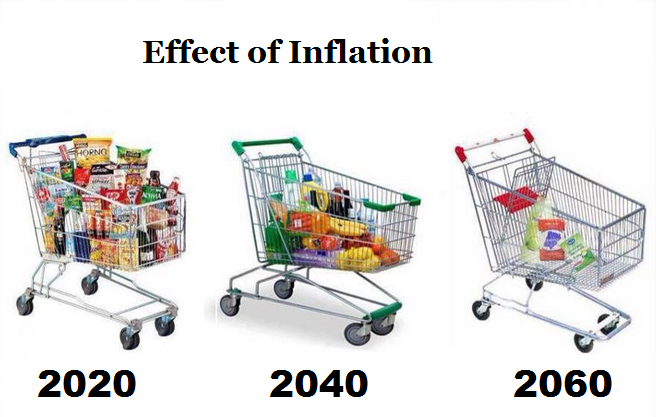

The current inflation rate is 2.5% per year. It means next year you will need $102.50 to buy the same product you can buy now at $ 100. So if you can fulfill your requirements with $5000 per month now, you will need $10,488 approximately per month after 30 years assuming a 2.5% inflation rate. Consider the case of inflation and do the needful.

Mistake #3. Unable to save money

After making money many people spend lavishly. They think this current flow of income will remain forever. They do not focus to save money. Before spending they do not think whether it is necessary to invest the money on useless things. So make savings from the very fast day of your earning. At first, apply the 50/30/20 rule of budgeting and start investing at least 20% of your income. Then increase savings in accordance with your salary hike. In this way, your investment corpus will increase year by year. By doing this you are not supposed to become a billionaire, but definitely will be able to fulfill your financial requirements easily after your retirement.

Mistake #4. Don’t have any planning about the retirement age

Do you believe one in every six American is engaged in jobs when he is at 65? U.S. Department of Labor statistics has released a data that made this claim accurate. But the hard fact is that you are not supposed to carry out your job till the last day in this earth. Instead, when you have earned your first dollar start to prepare an effective retirement plan.

Mistake #5. Consider kids as retirement corpus

There is a conception that children will take care of their parents. So some parents do not value savings for the future and lead a life of luxury and false show-off. But it is needless to say the reality. We may witness that children after being grown up do not show interest to bear the expenses of their parents. Now let’s understand what to do. You should start investing at an early age in your career. Try to save at least 20% of your income and invest it among different asset class i.e., Debt, Equity, Gold, etc. You should continue this till your retirement.

Mistake #6. Underestimate the insurance and cost of healthcare

Young people have a common perception that they are superhumans. Nothing can do any harm to them. It is because they are full of energy, enthusiasm, and can overcome any situation. As most of the term insurance policies have no monetary benefit on the survival of the policyholder, people consider term plan policies worthless. But here the most vital question arises what will happen if you die untimely or to say suddenly. In addition to this while taking a mediclaim policy, they ignore the fact that they will go old too. Most insurance companies do not offer insurance policies after 45 years if they allow, they will check the medical check-up. After the check-up, they allow or reject the application.

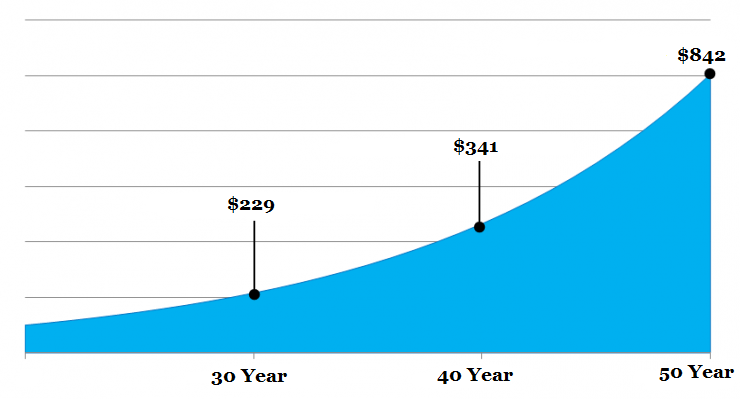

Suppose, you buy a term plan at the age of 30 and you want to continue this plan for the upcoming 20 years. can easily avail up to $500,000 as your life insurance for just $229 yearly. But if you delay for 10 years, you need to pay a yearly premium of $341. Again if you buy a term insurance plan at the age of 50 years then you need to pay $842 per year for an assured sum of $500,000 for the upcoming 20 years.

Mistake #7. Carry out the lavish life by withdrawing money from 401(k) accounts

Be careful not to touch this money for any ordinary financial needs like a tour, buying a Four Wheeler, or any luxury items. Do not show off luxury and stop spending on unnecessary things. Make expenses according to your income. You may use your surplus money to pay your must needs like health insurance premium, life insurance premium, etc. For any kind of adverse situation, you may create an emergency fund to tackle emergency conditions like health hazards. This fund will be your oxygen for post-retirement life. Last of all hurry up! You do not have much time left. Your retirement is knocking on the door. You will not even realize when these 30 years have crossed.

Mistake #8. Don’t maintain debt judiciously

Usually, an individual takes a loan to build his/her own nest on an easy EMI option either a monthly or quarterly basis repayment from banks or any other financial institutions. In addition to this, the individual applies for a car loan. After the withdrawal of home loans and car loans, people get trapped in a vicious cycle.

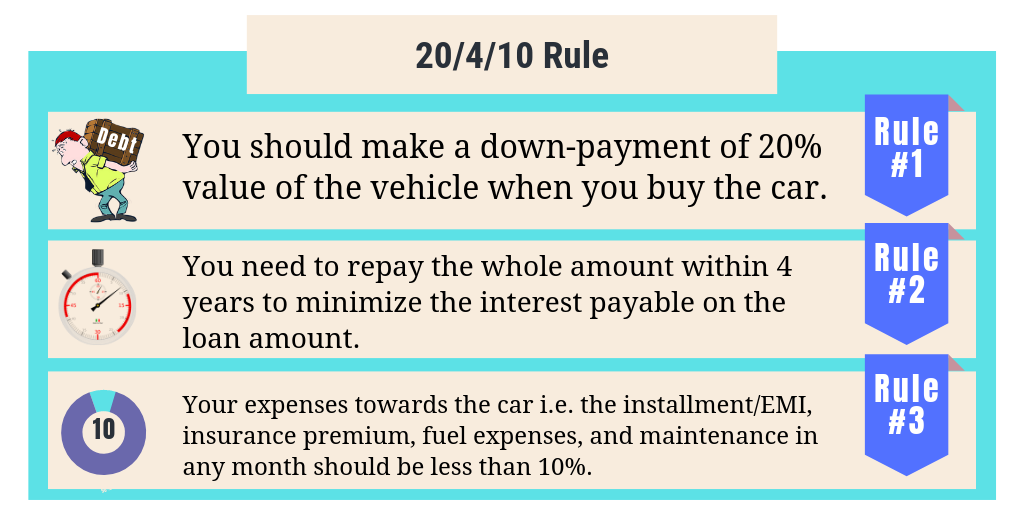

In order to fix that problem, we will make use of the famous The 20 Percent Rule, The Income Rule, The 28/36 debt Rule, & The 20/4/10 Debt Rule to calculate the money which you are free to put to buy a home or a flat.

Mistake #9. Does not create an emergency fund

Owing to the temptation to get a credit card, people borrow money from parents, relatives, or friends thinking that they will start repayment when they get a salary increase. So, people do not build their emergency fund. This is the biggest financial planning mistakes to avoid. But when the emergency breaks through and an unexpected money requirement in lieu of health hazard or any unexpected situation arises, people take a personal loan or redeem their portfolio to meet the requirement.

Every person should make ensure to create an emergency fund for any kind of emergency or unforeseen situation. This saving amount may vary from person to person according to his status or requirements. Try to accumulate enough money in this fund so that you can bear your all expenses i.e., food, clothes, insurance bills, even your sip installments for at least 6 months in an emergency.

Mistake #10. Don’t invest in accordance with time horizon and risk appetite

Novice investors invest their money in the equity asset class with a hope for a very short period of time just to say 1 year or 3 years and expect their money to be doubled. But they forget that the share market is volatile in the short run and a wealth builder in the long term. So, after their investment the market corrects and consequently, they suffer a loss. In this way, they exit the market with a huge loss.

You need to specify your goals either it is short term or long term, because you have to decide your investment portfolio in accordance with your goals. If you are planning for the purchase of a four-wheeler car within the next few years then you need to invest your corpus in debt instruments, because in the short run the stock market is quite volatile. But in the case of retirement planning which is a long-term goal you should invest in the equity asset class since the equity asset class outperform all the asset classes over the long term.

Mistake #11. Invests without diversification

Many a person invests the money without diversification i.e. invests in one asset class irrespective of time horizon or risk appetite. This is one of the worst mistakes a retail investor makes especially when he is planning for retirement.

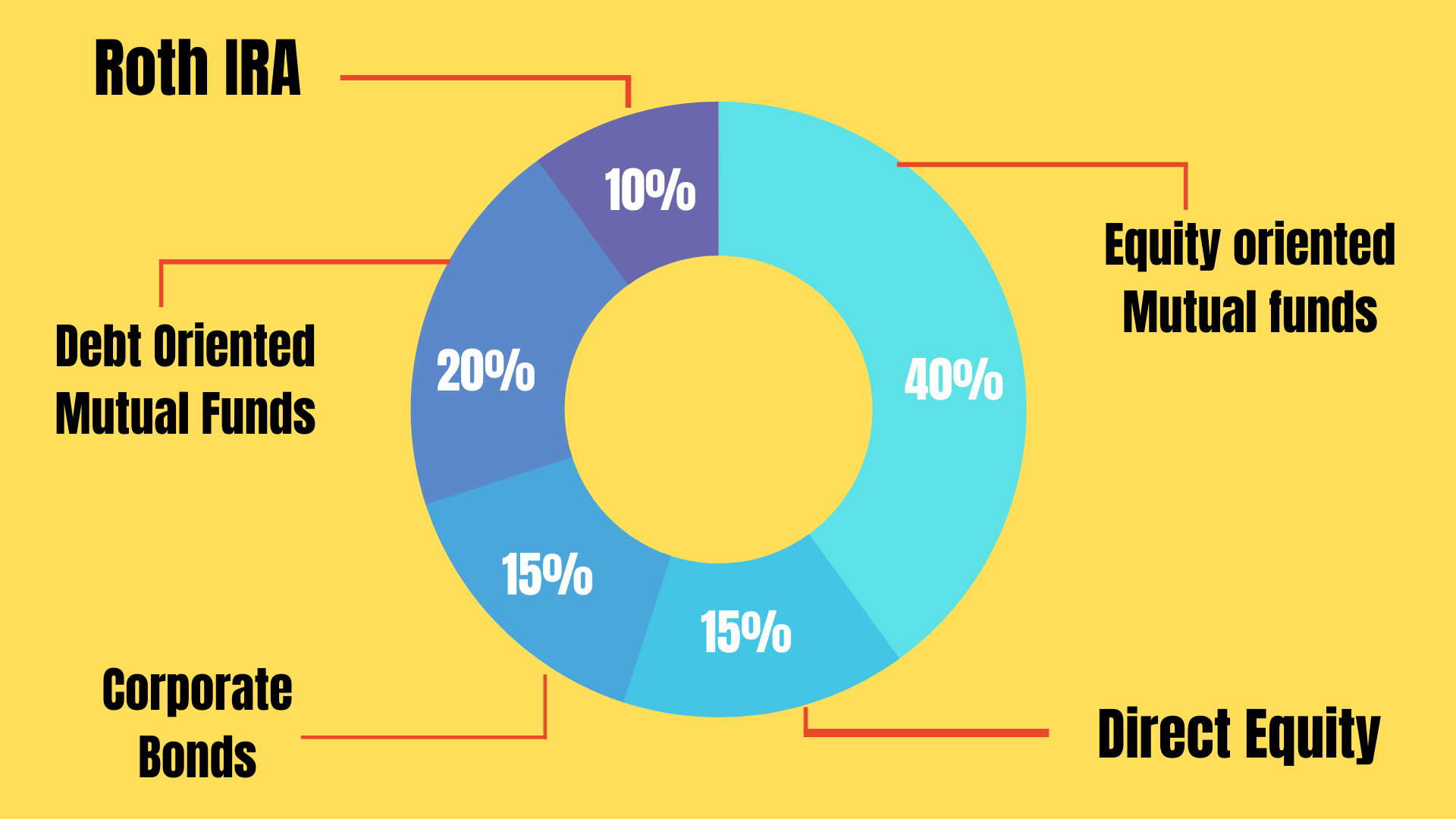

You need to prepare an asset allocation strategy to diversify your investment portfolio among the different asset classes like gold, equity, bonds, and debt instruments. Asset allocation strategy enables an individual investor to diversify or mitigate the risk by making an investment in different asset classes. A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Mistake #12. Submitting Social Security Application too early

Though you are entitled for retirement benefits at 62, this does not mean that you should take it too. When you claim social security at full retirement age of 67, you will avail more benefits than when you claim in 62. Financial advisors recommen you should not file for retirement benefits until 70, since you will get an 8% boost in benefits each year when you are between 67 and 70 owing to delayed retirement benefits.

Final Thoughts,

No matter how much you are earning. Do prepare your retirement planning now. If you haven’t started saving yet, try to save more from right now. If your salary doesn’t make you happy, dedicate your time to acquire skills and make money online just from your computer or laptop.

Hope this article will help you to avoid biggest retirement planning mistakes. If you have any question regarding the worst retirement planning mistakes to avoid, feel free to comment so that we can have a discussion. If you find this post helpful feel free to share with your loved ones.