Looking for pension plans which will enable you to meet the expenses after you have stopped working? Here we will discuss different types of pension plans, features, and benefits, and finally how to choose the right pension plan in India.

What are pension Plans?

Pension plans are also known as Retirement plans which enable an individual to allocate a part of savings in order to provide a steady income after his retirement. Usually pension plans i.e. retirement plans offer an individual to allocate a part of savings in order to ensure a steady flow of money after retirement. There are two stages of pension plans namely the Accumulation stage and Vesting stage. In the accumulation stage, one individual pays premiums annually or monthly or quarterly until retirement. After retirement, the vesting stage starts. During the vesting stage, the individual receives a regular stream of income and after the death of the individual, the nominee continues to receive pension till death.

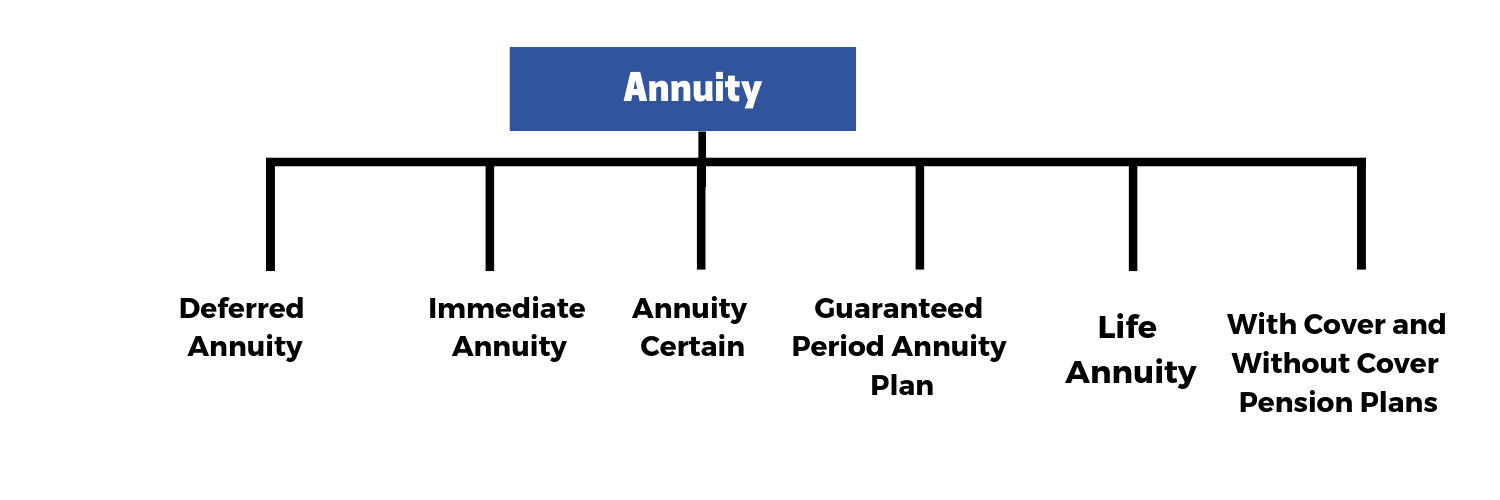

Types of Pension Plans in India

In accordance with the investment portfolio and characteristics, the pension plans are classified into the following categories.

- Deferred Annuity.

- Immediate Annuity.

- Annuity Certain.

- Guaranteed Period Annuity Plan.

- Life Annuity.

- With and Without Cover Pension Plans.

- National Pension Scheme.

- Pension Funds.

What is Annuity?

An annuity is a financial product offered by various insurance companies. An annuity is a contract between an individual and the insurance company itself after you make a lump sum payment or a series of payment to the insurance company. The main object of annuity is to secure the financial needs of an individual i.e. a steady payment after retirement.

You can opt for annuity plan either by paying a lump sum payment at once or continue contribution for a specific period of time by paying regular premiums. The duration of annuity may be for any specific period of time i.e. just to say for the upcoming 20 years or until the death. If you choose until death then you may get lower amounts. Let’s make it clear with the following example.

Suppose you invest Rs. 10 Lakh at once and you opt for a period of 20 years in order to get a regular source of income for that fixed time. Then the insurer will start paying in accordance with the time horizon as opted for by the individual.

Deferred Annuity

This type of annuity offers regular payment at installments or at once to an individual after a prolonged saving period. Usually when any individual deposits money in any annuity then the insurer deposits the amount in the annuity owner’s name. Then the annuity company offers a fixed interest rate on the fund. When you opt for regular payment then the amount is credited according to the capital.

Immediate Annuity

Unlike Deferred Annuity which requires a specific period of time to payout, immediate annuity enables a regular guaranteed income almost immediately to the individual. In Immediate Annuity, one individual can opt for a period of any specific period or as long as an individual remains alive. The biggest drawback of the immediate annuity is that if the annuitant dies earlier than the term period, the payment stops and the insurer keeps the principal balance. In other words, once any individual purchases the immediate annuity, it can neither be cancelled nor he can get a refund of the principal amount from the insurer.

Annuity Certain

Annuity Certain assures an individual a fixed stream of payments for a specific period regardless of the lifespan of the individual. In the case of death of the individual i.e. annuitant before the term period, the annuity certain continues to make payments to the nominee as per the annuitant’s accord. Any individual will get the regular payment as per monthly, quarterly, half-yearly, or annually basis. Unlike the Immediate Annuity, the annuity certain assures annuitant to pay the residue in the case of annuitant’s death before the term of the annuity to the nominee. For example, any individual i.e. Annuitant buys an annuity for a certain option with a 10-year tenure. But in the case of the certain annuity, the nominee will receive the stream of payment until the completion of the 10-year term in the case of annuitant’s death.

Guaranteed Period Annuity Plan

Like the Annuity certain, you need to choose a fixed period of the term for 5 years, 10 years, 20 years and even 30 years. You can also opt for life with guaranteed term option which enables an annuitant an income stream for life. In this plan, a regular payment is credited to the nominee in case of death of the annuitant within the guaranteed period.

Life Annuity

The scheme ‘Life Annuity’ enables an individual i.e. annuitant to receive a regular payment until death. In addition to this if any individual has opted for the option ‘with spouse’ then after the death of the annuitant, the spouse will receive a regular payment till death. Usually, the annuitant needs to pay regular premiums or payments until retirement. Once the policyholder gets retired the insurer kicks start a regular payment to the annuitant until death. Here are the types of ‘Life Annuity’,

Fixed Annuity – In the case of the fixed annuity, the annuitant will receive a fixed percentage in respect of the annuity amount.

Variable Annuity – In the case of the variable annuity, the annuitant will receive an amount in accordance with the performance of the investment’s return received from annuities.

Joint Annuity – This enables an annuitant to get regular payments until both the spouses die. But if the primary annuitant dies then the amount is reduced in the case of the second person of the spouse.

With Cover and Without Cover Pension Plans

Apart from annuity incomes an additional lump sum payment will be forwarded or made in the case of death of the policyholder. On the other hand, Without Cover Pension plan the insurer does not make any lump sum payment on the death of the policyholder.

Suppose you have opted for a guaranteed period Annuity plan with cover for a period of 10 years. Now you will receive a regular payment in accordance with the sum and the time horizon. But then you die at the 10th year. In addition to this regular payment, your nominee will get a lump sum amount owing to the death of you. In the case of Pension Plan without cover, your nominee will get regular payments till the term period, but not any lump sum payment.

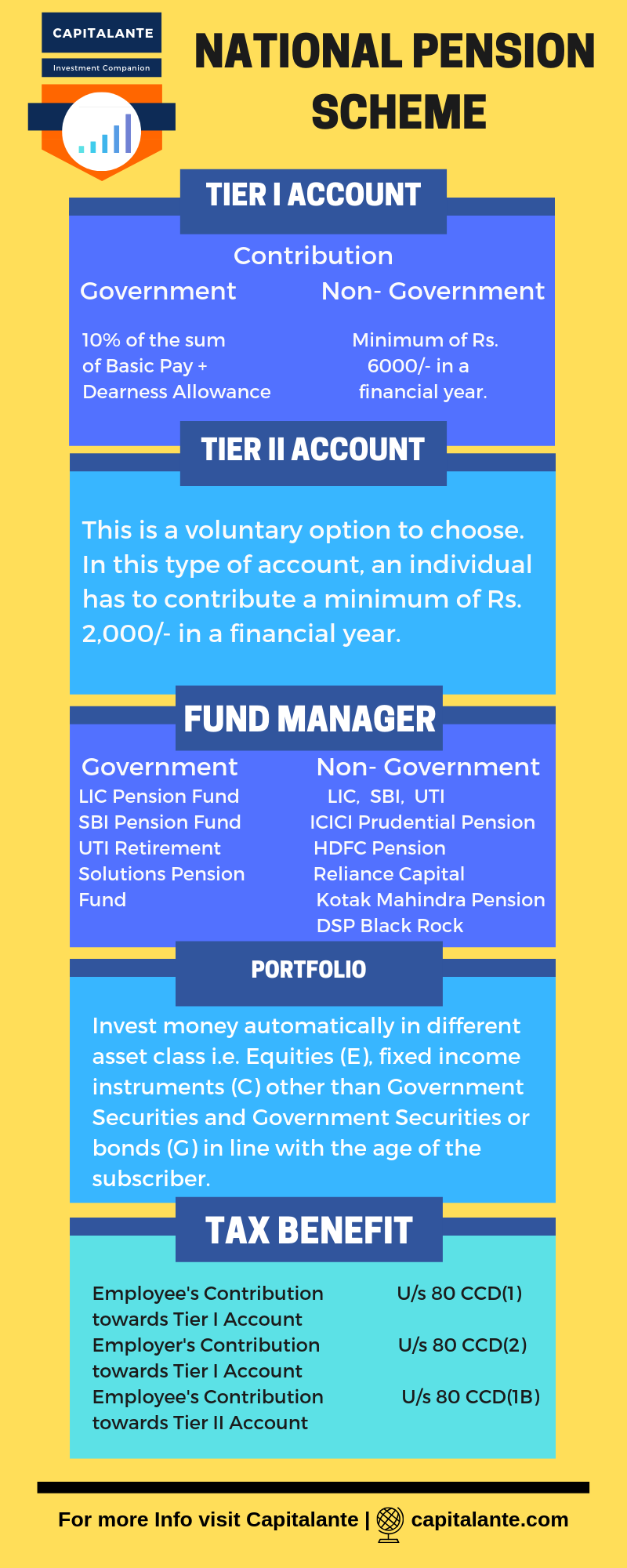

National Pension Scheme

In 2004, Central Government launched a pension scheme Named National Pension scheme for its employees. The scheme offers a large variety of investment options to employees designed and regulated by Pension Fund Regulatory and Development Authority (PFRDA). From the year 2009, the scheme was made open to any individual Indian Citizen whether Government Employee or Private Employee, resident in India or Non-Resident Indian (NRI) unless the NRI changes its citizenship status, provided the condition that the individual has to be between the ages of 18 &65.

National Pension Scheme primarily offers two types of account namely Tier I Account and Tier II account. Tier I account is mandatory while Tier II account is optional. National Pension scheme provides two ways to invest the money namely Auto Choice or Lifecycle Fund & Active Choice.

Active Choice

An Active choice is the option to invest in Equities (E), Investments in fixed income instruments (C) other than Government Securities, Investments in alternative investment schemes such as real estate investment trusts, infrastructure investment trusts or alternative investment funds (A) and investment in government securities or bonds (G).

Auto Choice

In contrary to Active choice, An Auto choice provides the option to invest in Equities (E), fixed income instruments (C) other than Government Securities and Government Securities or bonds (G) as per the life cycle fund matrix designed by experts. There are three lifecycle-based funds to choose between An Aggressive Fund, the Conservative Fund, and the Moderate Life Cycle Fund.

| Tier I account | Tier II account | |

| Option | Mandatory Account | Optional Account |

| Minimum Contribution Per year | Rs. 6000/- | Once Rs. 1000/- at the time of account opening. |

| Minimum amount per contribution | Rs. 500/- | Rs. 250/-. |

| Contribution | For the salaried employee, it is 10% of the [Basic + DA]. For self-employed Professional it is a maximum of 20%. | No Limit. |

| Withdrawal Options before retirement | Permitted but on certain Conditions. | Permitted without any circumstances. |

| Fund transfer | Can’t transfer to the Tier II account. | You can transfer any amount of money from Tier II account to Tier I account anytime. |

| Tax Exemption | 10% of the [Basic + DA] or Rs. 1,50,000/- which is lower under section 80CCD(1) | Rs. 50,000/- under section 80CCD (1B). |

Pension Funds

Usually, the pension funds are offered by PFRDA authorized fund managers namely LIC Pension Fund, SBI Pension Fund, UTI Retirement Solutions Pension Fund, ICICI Prudential Pension Fund, HDFC Pension Management Company, Kotak Mahindra Pension Fund, Reliance Capital Pension Fund, and DSP Black Rock Pension Fund Managers. Like the national pension scheme, they also invest in various asset classes to enable better returns on the basis of the choice opted by any individual.

Benefits of investing in Pension Plans

Anybody who wants to maintain the regular cash flow to meet the expenditures after retirement needs to invest in pension plans. Pension fund not only allows an individual a tax deduction under section 80C but also offers investment options in accordance with the risk appetite of an individual. Here are the key features and benefits of pension plans.

Long term savings

Since an individual pays 10% of the salary [Basic Pay + Dearness Allowance] in the National pension scheme it will enable long term savings. Irrespective of annuities or pension funds, these options enable an investor to generate steady cash flow after his retirement by investing in various asset classes.

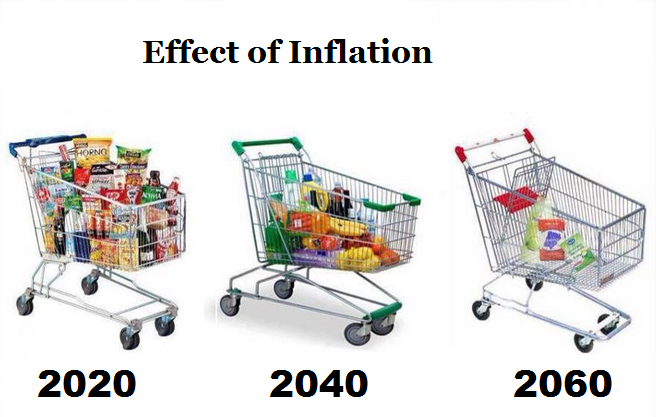

Beat the inflation

The current inflation rate is almost 7% and you need to invest your money in such an asset class that can beat the inflation rate and gives you a steady return. Since the pension funds and NPS invest the money in equities it will help your capital to protect against inflation. Historically the equity asset class has given 15-16% CAGR which is more than the inflation rate of 7%.

Insurance can be combined with annuities

Annuity assures an individual a fixed stream of payments for a specific period regardless of the lifespan of any individual. In the case of Annuity certain, on the death of the individual i.e. annuitant before the term period the annuity continues to make payment to the nominee as per the annuitant’s accord. With Cover Annuities pay a lump sum payment on the policyholder’s death to the nominee. In the case of Joint Annuity, an annuitant will get regular payment until both the spouse died.

Tax Deductions

You can avail the benefits of section 80CCC by depositing money in Notified Pension Scheme i.e., Annuity Plan of LIC. Under this section, an individual can avail tax deduction equal to the amount paid or deposited in any annuity plan of LIC or any other insurer. Usually, contribution towards annuity is tax-free, but the amount in the hands of the individual is subject to tax.

Under section 80CCD (1) allows a tax rebate for individuals for contribution to their pension accounts. Contribution up to 10% of the sum of [Basic Pay + Dearness Allowance] or 20% of gross total income (in case the taxpayer being self-employed) or Rs. 1, 50,000/- in a year whichever is less is allowed under section 80CCD (1).

On retirement, an individual becomes eligible to withdraw maximum 60% of the lump sum amount accumulated by his own contribution and employer’s contribution. On the 60% of the lump sum amount withdrawn by an individual 40% is exempt from tax and the rest 20% is liable to tax.

How to pick the best Pension Plans

In order to pick the best pension plan, you should consider the following points apart from the returns delivered and tax deductions & exemptions.

Understand your need

In order to make perfect financial planning, you must have a clear view and a good understanding of the expenses that will be required to live even after retirement. The current inflation rate is 7% per year. It means next year you will need Rs. 107/- to buy the same product you can buy now with Rs. 100/-. So if you can fulfill your requirements with Rs. 25000/- per month now, you will need Rs. 2, 00,000/- approximately per month after 30 years. Consider the case of inflation and do the needful. You need to calculate the desired corpus at the retirement age to lead a happy retirement life without any financial woes.

Suppose you are 30 years old and your annual expenses right now is Rs. 2.5 Lakh.

Then, the expenses at the age of 60 years assuming a current inflation rate of 7% will be = Rs. 19 lakh. [Excluded term insurance premium and health insurance premium since they are fixed at the time of buying].

So, you will have to accumulate a corpus of [Rs. 19 Lakh × 20 years = Rs. 3.8 Crore] at the age of 60 years assuming you will live at least 80 years.

So, in order to achieve the target of a corpus of 4 crores you need to invest Rs. 13,000/- month till the 60 years assuming 12% CAGR.

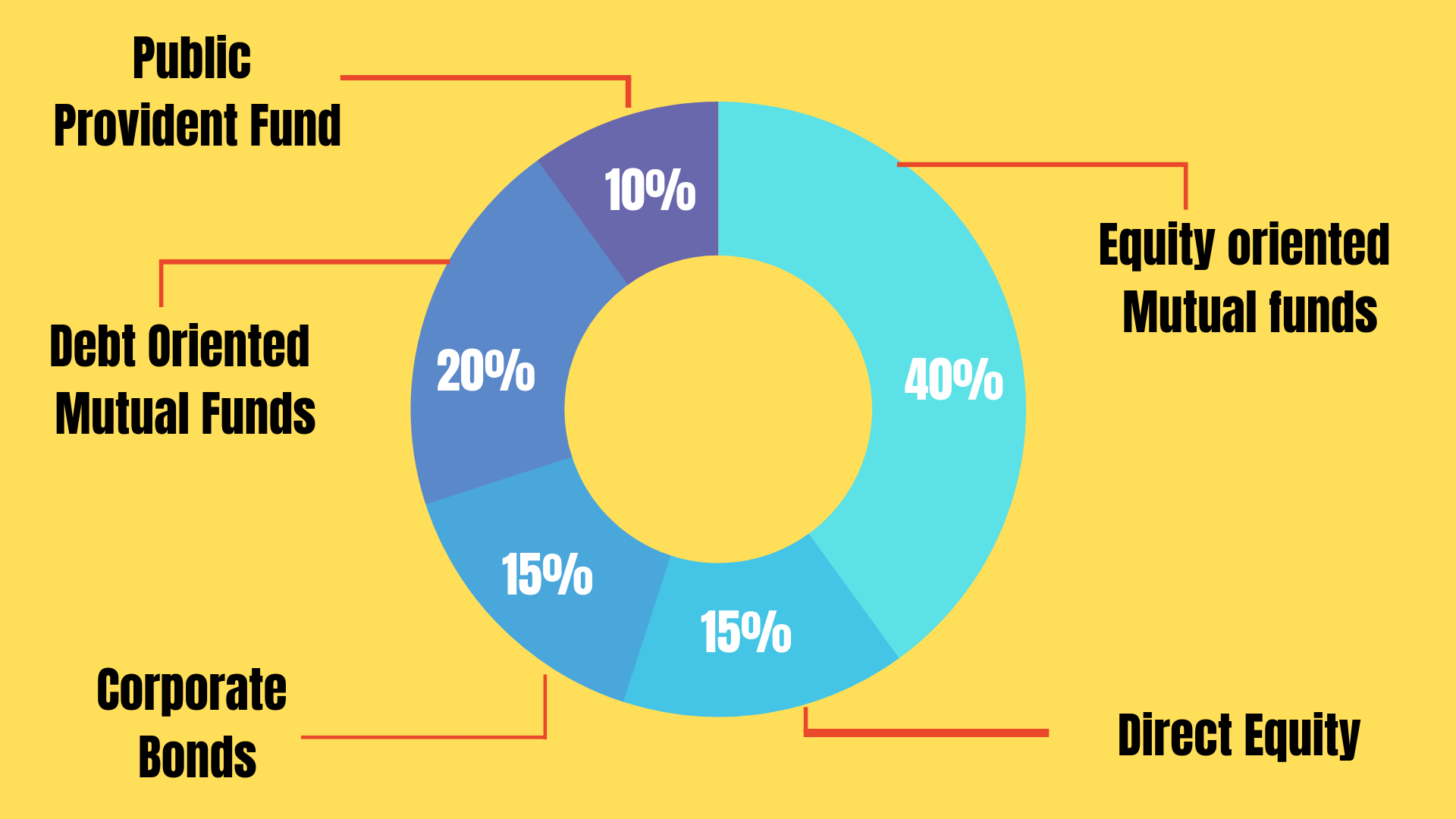

Do some research

Now, you need to consider the perfect asset allocation strategy and investment route to reach the desired corpus. Usually, risk and returns are directly proportionate. The higher is the return the higher will be the risk involvement. Before making an investment you should consider your goals and then invest accordingly.

The asset allocation in different buckets enables you to manage or diversify the risk. Equity is such an asset class which has some moderate risk than the other asset class like the bond, debt securities. But historically, equity yields more returns over a long period of time. So, what will be your asset allocation irrespective of your age? A generally accepted trick is that you have to subtract your age from 100 to determine the percentage of your investment to the equity asset class.

Asset Allocation Strategy

Let’s illustrate,

Total value = 100

Your age = 30.

So, you may invest [100-30] = 70% of your fund or capital in equities or stock market. The remaining 30% of your fund can be divided between corporate bonds and debt securities. If your risk appetite is high, for better returns over a long period of time you can invest your 90% investment into equity or stock market before or on attaining the age of 30. Since you are young you can afford to wait and see for a long time. Therefore, any correction in the stock market may be a buying opportunity. Basically, the equity asset class has a record to yield more returns than any other asset class i.e., debt instruments over a long period of time.

Start Early

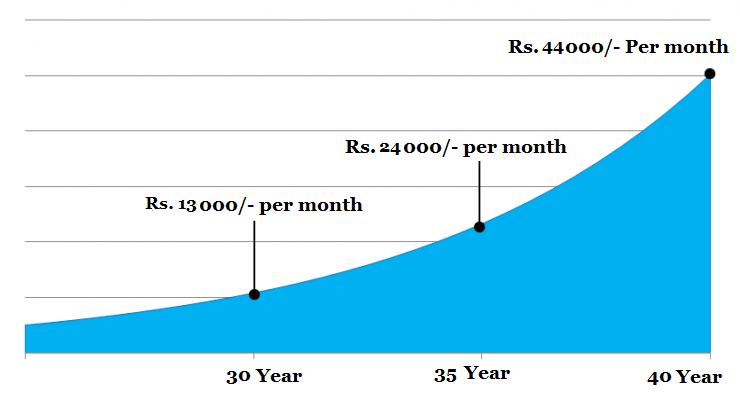

To make perfect use of a compounding effect, you need to start investing as early as possible. Ace investor Warren Buffet started investment when he was 11 years of age. To make it clear concentrate on the graph.

If you start investing at the age of 30 years with just Rs. 13,000/- per month then you will get Rs. 4 Crore when you are 60 assuming 12% CAGR. If you are late by 5 years i.e., start investment at the age of 35, then you need to invest Rs. 24,000/- per month to get the same corpus at the age of 60 years. Again, if you start investing at the age of 40 years then you need to invest Rs. 44,000/- per month.

Finally, while picking the best retirement plan you need to consider the following points before opting the best pension plans i.e. retirement plans,

- The current Age and at what age you wish to retire.

- The risk appetite and time horizon.

- Retirement corpus.

Read also: Financial Planning in Easy Steps

Read also: How to Make a Successful Retirement Plan

Hope this article will help you to plan for your retirement. If you have found any question feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share it with your loved ones.