In today’s investment world there are various asset class i.e. debt securities, Equities, Bonds, Exchange Traded Funds etc. An individual can invest in these asset classes in accordance with his risk appetite and time horizon. Those who are looking for smaller but steady returns over time without taking risk other than fixed deposits in Bank or post office, Non-convertible Debentures is a dark horse to yield better returns. In this column, we will discuss about 5 Points to Consider while Investing in Non-convertible Debentures.

What is Debentures?

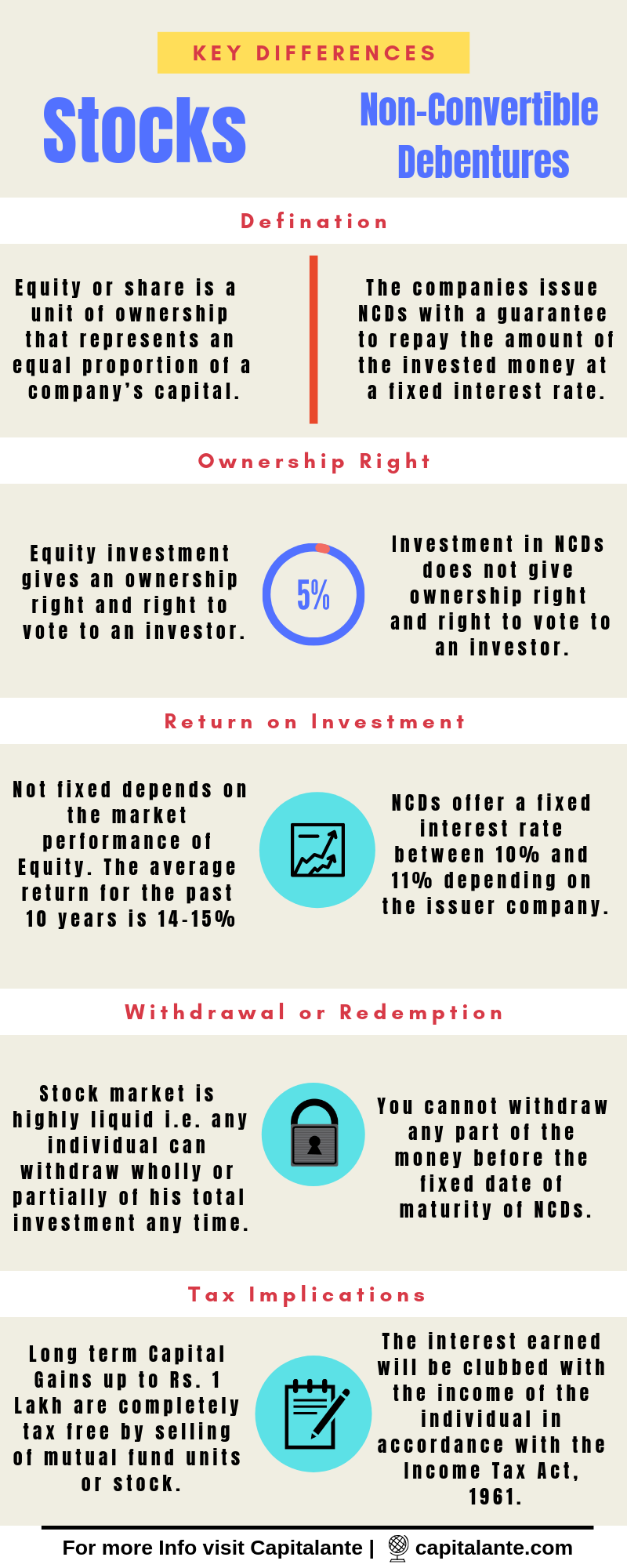

Owing to the higher interest rate of 16%-17% in business loans the companies collect their capital to either run their business or expand the business by issuing securities i.e. non-convertible debenture with a guarantee to repay the amount of the invested money when the security is matured. In other words, whenever capital is required the companies for expansion of business or any other purpose issue a debt paper for a specific period of time. Then the company pays out the interest on the money invested at the fixed maturity date.

Types of Debentures

There are two types of debentures the companies offer namely Convertible Debenture and Non-convertible debentures. The convertible debentures can be converted the debt to the equity shares. This means the convertible debentures can be traded in the stock exchanges. In addition to this, the convertible debentures can be sold before the maturity date. In this way if you buy a convertible debenture you have the ownership right.

While in the case of Non-convertible debentures the company does not convert the debt into the equity shares. Any investor who buys Non-convertible debentures will receive the interest payout in the registered bank account when the NCD is matured.

Types of Non-convertible Debentures

Usually, Non-convertible debentures can be classified as secured and unsecured. Secured NCDs offer investors a steady rate of return backed by assets of the company such as land, building, factory etc. This type of NCDs are much safer, because if the company fails to pay the interest along with the principle amount these properties i.e. assets can be liquefied and paid the amount to the debenture holder i.e. investor.

In contrary to this, non-secured NCDs are not backed by any kind of assets or securities if the company i.e. issuer fails to pay the principle amount along with the interest on maturity.

Interest Payout

Usually, NCDs offer a higher interest rate than the Fixed Deposits in Bank or Post offices. The interest rate is between 11 and 12%. Since the Bond issuer gives security of the capitals backed by assets of the company, but in the case of NCDs they are not backed by assets of the companies. For this reason the bond issuer offers interest rate less than 8% in comparison to NCDs which offer a rate of 11-12%.

Non-convertible Debentures issuer gives an investor dual earning options namely growth option and interest payout option. In the case of growth option the interest accrued in one year will be reinvested. In that case on maturity you will receive the principle amount as well as the interest accrued all at once. On the other hand in the interest payout option you will receive the interest payment in monthly or quarterly or yearly basis.

How a common individual can buy NCDs?

Public Issue – Different companies open NCDs for common individuals. People can buy these NCDs by submitting a physical form of purchase. You need to submit all of your details including bank details. You can buy NCDs online also from your Demat account.

Secondary Market – Since NCDs are listed on stock exchanges i.e. NSE or BSE or both, any individual is free to invest in NCDs through trading account just like buying any individual stock.

5 Points to Consider while Investing in Non-convertible Debentures

Creditworthiness

You need to consider the risk of default in payment by the NCDs issuing authority. The default could be in the form of untimely payment of coupons/interest rate or non-payment of the principal at the time of maturity. The chances of a default can be assessed with the rating of NCDs or security gains from various agencies. The higher rating indicates that the NCDs or security authority is able to pay the money invested by lowering the chances of default.

Rating

You need to check out the rating of the NCDs if it is unsecured NCDs by rating agencies like CRISIL, CARE etc. If the NCDs have AAA rating then it is considered the safest bet. Since Unsecured NCDs are not backed by any kind of assets or securities, the company i.e. issuer may fail to pay the principal amount along with interest on maturity.

Capital Adequacy Ratio (CAR)

It is the ratio of the company’s Capital which can be available without shut down its operation and the current liabilities. Suppose any company makes a loss in any financial year, the company needs to make use of reserved capital to run its daily operation. Before you invest in NCDs check whether the company’s CAR ratio is less than 12% which is maintained historically.

The Interest Coverage Ratio

The interest coverage ratio is a ratio between the debt a company has and the Profits the company earns at any given time. The ratio is quite helpful to determine how easily a company can pay interest on its outstanding debt with the help of its current earnings. You need to analyse how many times of interest payment the company is able to cover with the current earning. Invest in such NCDs whose interest coverage ratio is 2 at least. The analysts prefer such NCDs whose interest coverage ratio is more than 3.

Tax Efficiency

If you invest and sell the convertible debentures which are listed on stock exchanges in less than one year, then you need to pay short term capital gains tax on profit. But if you stay invested for more than one year, the interest earned will be clubbed with the income of the individual in accordance with the Income Tax Act, 1961.

So, before buying NCDs you must check the post-tax returns in comparison to tax-free bonds. If the risk-adjusted returns are not so lucrative then you should invest in Tax-free bonds instead of NCDs.

- Read also: Top 23 Best Investment Options in India

- Read also: 29 Tax free income sources in India

Hope, this article will be helpful for you to choose the best NCDs while investing. If you have any questions feel free to comment so that we can have a discussion. If you have found this post helpful share it with your loved ones.