Many beginners who start investing in the stock market get confused about Nifty and Sensex. They also cannot understand the relationship between an individual stock like Titan Company or HPCL, and Nifty and Sensex. Here we will discuss what Sensex and Nifty are, the difference between any individual stock and Sensex or Nifty, how to calculate free-float market capitalization and the difference between Large-cap, Midcap and Smallcap.

Do you hear the term Dalal Street?

Dalal Street is an official address of the Bombay Stock Exchange and several related financial firms and institutions. It is located at Mumbai, Maharastra, India.

What is Nifty and Sensex?

In order to understand all about Nifty and Sensex, at first, you need to understand the stock exchanges. So, let’s dive into this.

What is stock exchange?

The stock exchange is a facility where securities such as bonds, notes, shares or stocks are bought and sold by stock brokers and traders at prices governed by the forces of demand and supply. A stock exchange operates as a controlling authority which imposes stringent rules, listing requirements, and statutory requirements which are followed by all listed and trading parties. In India, there are a total of 28 stock exchanges, with the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) being the largest.

Bombay Stock Exchange

- Bombay stock exchange was established in 1875 by Premchand Roychand. It is the oldest stock exchange in Asia.

- It is the 10th largest stock exchange in the world in respect of overall market capitalization.

- More than 5500 companies are publicly listed on the BSE.

- SENSEX is a benchmark index of Bombay stock exchange.

National Stock Exchange

- The National stock exchange was established in 1992. It is the first demutualized electronic exchange in the country.

- It is the 11th largest stock exchange in respect of overall market capitalization.

- More than 1900 companies are publicly listed on the NSE.

- NIFTY is a benchmark index of National stock exchange.

What is Index?

There more than 5500 companies are listed on Bombay Stock Exchange and more than 1900 companies listed on National Stock Exchange. Now it is a very difficult task to track each stock or company to evaluate its performance. So, some major stocks or companies are selected to check or evaluate the market. If these stocks perform well it is assumed that the market is doing well. These companies or stocks constitute a smaller part of the whole assembly. This small part is taken as the representative of the whole market. This small part is called index. The index is computed from the prices of those selected stocks. Nifty 50 represent almost 44% of the value of the stocks trade at the National Stock Exchange.

Let’s make it clear with the following example.

BSE Auto

This index consists of those companies’ shares that operate in automobile or auto ancillary industry or sector. BSE Auto Index consists of companies like Maruti Suzuki, TVS Motors, Tata Motors, Bajaj Auto, Motherson Sumi, Minda Industries.

BSE Bank

This index consists of those companies share that operate in the Banking sector. BSE Banking Index consists of companies like HDFC Bank, ICICI Bank, SBI, Kotak Mahindra Bank etc.

- Read also: Sensex Today | Live Updates

What is SENSEX 30?

Bombay Stock Exchange Sensitive Index or BSE SENSEX comprises 30 well-established companies listed on Bombay stock exchange. The stocks in SENSEX are included in accordance with the financial soundness, performance, and Free Float Market Capitalization of stock across various sectors. SENSEX comprises 30 companies across different sectors and these companies are selected on the basis of the free float market capitalization.

The SENSEX consists of the following 30 stocks as on 01.01.2019

| Sector | Company or Stock |

| FMCG | ITC Limited Hindustan Unilever Limited |

| Oil & Gas | Oil and Natural Gas Corporation Limited Reliance Industries |

| Banking | Axis bank HDFC Bank ICICI Bank IndusInd Bank Kotak Mahindra Bank State Bank of India Yes Bank |

| Auto | Bajaj Auto Hero MotoCorp Limited Mahindra & Mahindra Limited Maruti Suzuki India Limited Tata Motors – DVR Ordinary Tata Motors Limited |

| Finance | Housing Development Finance Corporation Limited[HDFC] Bajaj Finance Limited |

| Power | Power Grid Corporation of India Limited NTPC Limited |

| Mining & Minerals | Coal India Limited Vedanta Limited |

| Information Technology | Infosys Limited Tata Consultancy Services Limited HCL Technologies Limited |

| Paints & Pigments | Asian Paints Limited |

| Steel | Tata Steel |

| Telecom | Bharti Airtel Limited |

| Engineering | Larsen & Toubro Limited |

| Pharmaceuticals | Sun Pharmaceuticals Industries Limited |

What is Nifty 50?

National Stock Exchange Fifty or simply Nifty comprises 50 well-established companies listed on National stock exchange. The stocks in Nifty are included in accordance with the financial soundness, performance, and Free Float Market Capitalization of stock across various sectors. Nifty comprises 50 companies across different sectors and these companies are selected on the basis of the free float market capitalization.

| Sector | Company or Stocks |

| FMCG | ITC Limited Hindustan Unilever Limited |

| Oil & Gas | Bharat Petroleum Corporation Limited Hindustan Petroleum Corporation Limited GAIL (India) Limited Indian Oil Corporation Limited Oil & Natural Gas Corporation Limited Reliance Industries Limited |

| Banking | Axis bank HDFC Bank ICICI Bank IndusInd Bank Kotak Mahindra Bank State Bank of India Yes Bank |

| Auto | Bajaj Auto Eicher Motors Hero MotoCorp Limited Mahindra & Mahindra Limited Maruti Suzuki India Limited Tata Motors – DVR Ordinary Tata Motors Limited |

| Finance | Bajaj Finance Limited Bajaj Finserv Limited Housing Development Finance Corporation Limited[HDFC] Indiabulls Housing Finance Limited |

| Information Technology | Infosys Limited Tata Consultancy Services Limited HCL Technologies Limited Tech Mahindra Limited Wipro Limited |

| Infra & Engineering | Adani Ports & Special Economic Zone Limited Larsen & Toubro Limited |

| Pharmaceuticals | Dr. Reddy’s Laboratories Limited Cipla Limited Sun Pharmaceuticals Industries Limited |

| Telecom | Bharti Infratel Limited Bharti Airtel Limited |

| Metals | Hindalco Limited Vedanta Limited |

| Power | Power Grid Corporation of India Limited NTPC Limited |

| Diversified | Titan Company Limited Grasim Industries Limited |

| Power | JSW Steel Limited Tata Steel Limited |

| Mining | Coal India Limited |

| Paints & Pigments | Asian Paints Limited |

| Cement & Construction | Ultratech Cement |

| Media | Zee Entertainment Enterprises Limited |

| Chemicals | UPL Limited |

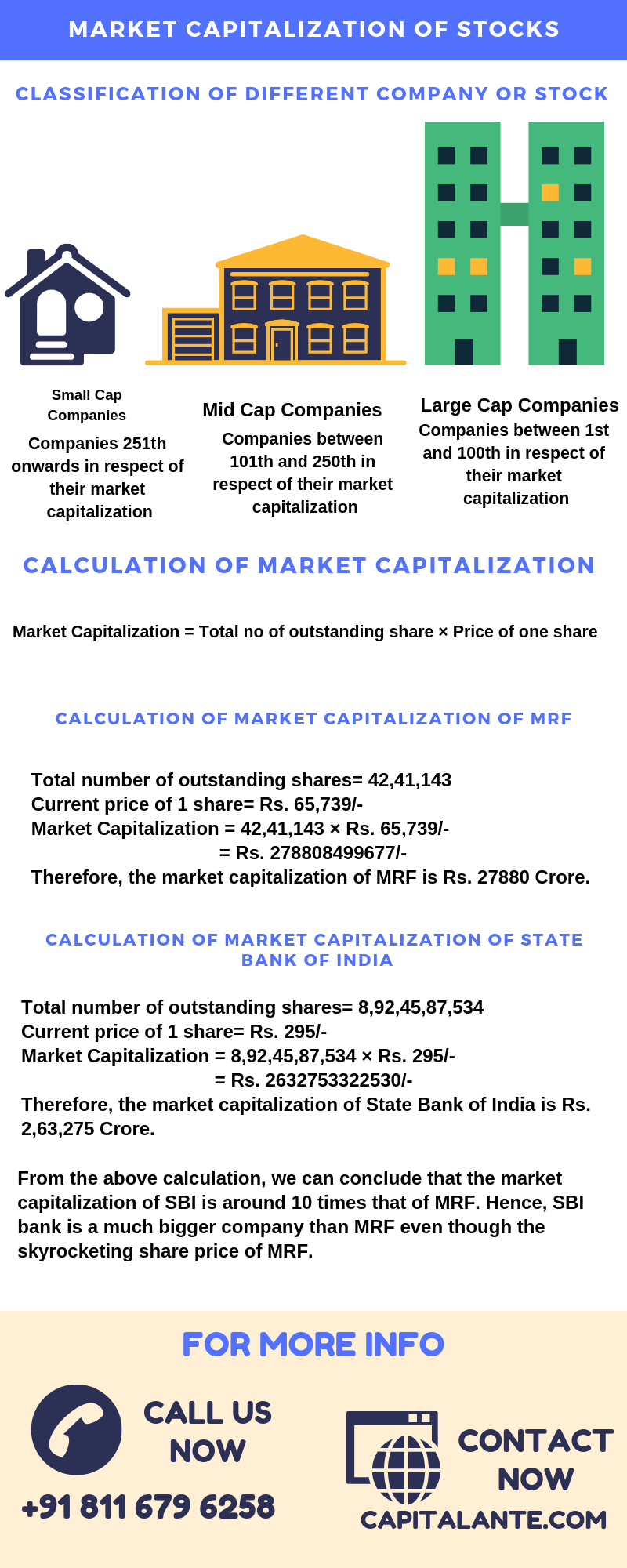

In the Indian stock market, the companies are divided into the following categories on the basis of their market capitalization namely,

| Market Capitalization | Classification |

| Less than Rs. 500 Crore | Small Cap |

| Between Rs. 500 Crore and Rs. 10,000 Crore | Mid Cap |

| More than Rs. 10,000 Crore | Large Cap |

What is Free Float Market Capitalization?

Free float refers to the shares that can be traded i.e. bought and sold by traders or buyers or sellers.

Market capitalization refers to the share value of any individual stock i.e. current market price of one share and number of outstanding shares issued by any specific company. Outstanding Shares can be defined as the shares currently owned by stockholders, company officials, and investors in the public domain which are available for trading.

Now let’s dive into the calculation of Free Float Market Capitalization,

Market Capitalization = (Total no of outstanding share) × (Price of one share)

For example, let us assume for a company like Capitalante.

Total number of outstanding shares= 100

Current price of 1 share= Rs 100/-

Market capitalization = 100 × 100 = Rs. 10,000/-

Therefore, the market capitalization of the company Capitalante is Rs. 10000/-.

Now let’s discuss what are large-cap stocks, mid-cap stocks, and small-cap stocks.

Large Cap Stocks

Large-cap companies are well established. They have maintained a good relationship with the investors during the course of time. Due to their business model, revenue earning it can be expected that these companies will not face problems to generate revenue. Large-cap companies enjoy an advantage to put much lower capital, because they can gather finances from different sources easily. If the large-cap company is a debt-free company, the concerned company can collect loan easily. On an economic crisis, large companies have the potential to perform their operations. Large-cap stocks are safer to invest because they are less volatile in respect of mid-cap or small-cap stocks. They have records to give a constant and dependable performance.

Mid Cap Stocks

Usually, midcap stocks are capable of giving you better returns than the large-cap stocks. But they are more volatile than the large-cap stocks. But one thing you keep in mind is that all the large companies today we see were not like this since their existence. They took time. Similarly, Mid-cap or small-cap companies will grow gradually and become large-cap stocks generating a multi-bagger return for their investors on the wings of robust earnings growth in the near future if they survive harsh economic conditions.

Small Cap Stocks

Small Cap Stocks are with small capital and of course small business. These companies are actually the start-ups or the companies which are in their early stage. Small cap stocks have an untapped market for business. So these companies have the potential to perform in future though a higher level of risk is involved in investing in small-cap companies.

If you have any question regarding Nifty and Sensex, feel free to comment so that we have a discussion. If you have found this post helpful don’t forget to share this post.