The stock market is a lucrative sector. Everyone feels temptation to invest in this field. As an investor, you should move with a long term horizon. A beginner can start investing in stock market very easily. The stock market yields the best returns and surpasses all the asset classes when you stay invested for the long run. Apart from that, the sharp correction in the stock market can be an opportunity to buy more stocks, since the stocks are available at an attractive valuation.

How a beginner can start investing in Stock Market

Here’s a step by step guide on how to start investing in the stock market.

- Step #1. Create an Emergency Fund.

- Step #2. Buy term insurance plans and health insurance plans to tackle an emergency situation.

- Step #3. Read some books to gather knowledge about investing.

- Step #4. Open a Demat and trading account to trade stocks.

- Step #5. Pick quality stocks after running independent research.

- Step #6. Diversify your stock portfolio.

- Step #7. Stay invested for the long run to get fruitful returns.

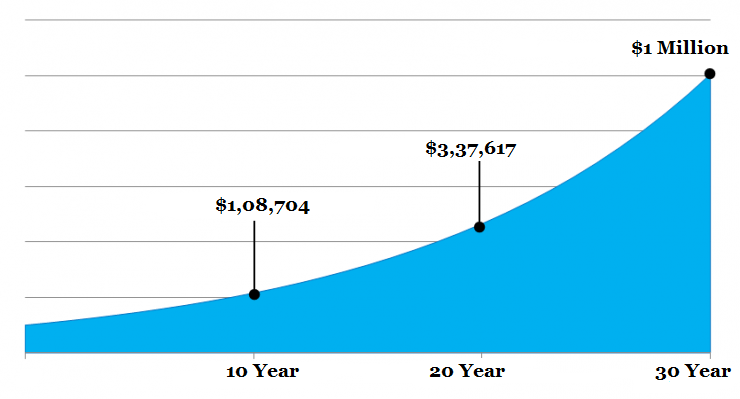

Step #1. Create an emergency fund

This is the first condition every investor should follow. Create an emergency fund that consists of all of your expenses even the Amazon Prime membership fee of 3 months to meet emergency expenses namely flight fee for travel, a trip to Shimla, etc.

The biggest advantage of the emergency fund is that you will not need to sell your stocks when your stocks witness a sharp correction to meet the expenses such as your Delhi trip or the renovation of your house.

Step #2. Buy a term insurance plan

You are not superhuman and prone to meet health emergencies. This is also a must step to take. You should buy term insurance before you start your investment journey.

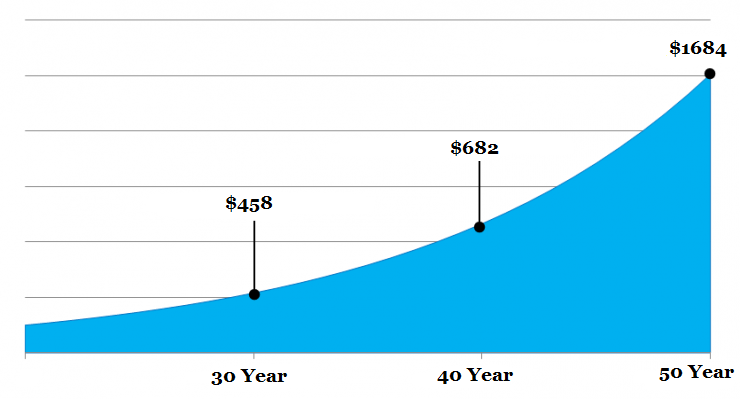

Apart from that when you buy a term insurance plan early you will pay a lesser premium. Let’s make it clear with the following example.

When you buy a term insurance premium of $1 million, you need to pay $458 a year when you buy a term insurance plan at the age of 30. But when you are late by 10 years the insurance premium will be $682. When you buy a term insurance plan at the age of 50 you are liable to pay $1684 a year for a $1 million sum insured.

Step #3. Read books to gather knowledge about the stock market

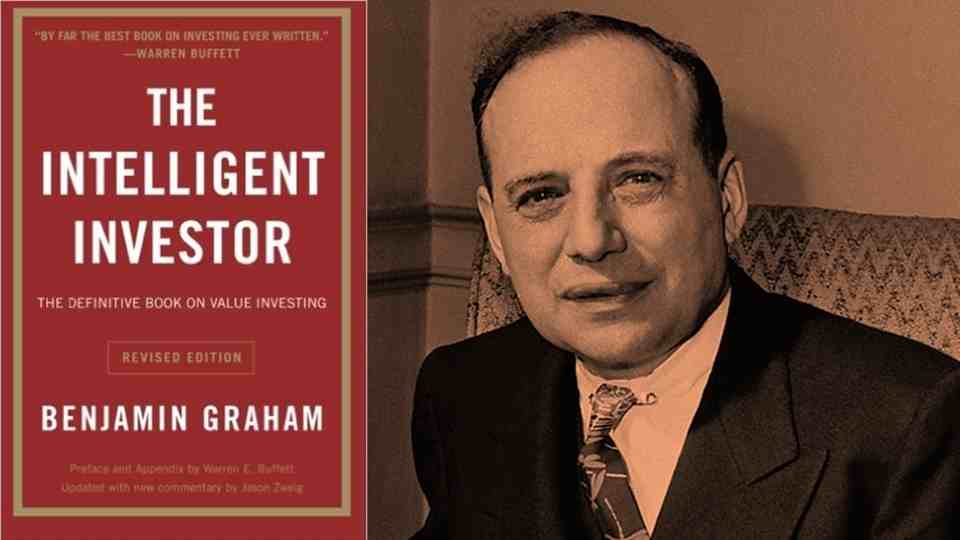

By reading the books namely the Intelligent Investor, How to Make Money in Stocks, The Money Rollover you will gather knowledge about stock market investing and able to pick the best stocks that will yield in the long run.

The intelligent investor – Written by Benjamin Graham, he is the father of value investing. By reading this book you will get a clear idea about who is Mr. Market and how Mr. Market plays with the emotion of the investor. Additionally, you will learn the difference between investment and speculation and how to calculate the margin of safety.

How to Make Money in Stocks – The author, William O’Neil describes how a retail investor can make money in the stock market by applying the CANSLIM strategy and The Cup and Handle Pattern.

The Little Book that Beats the Market – The author Joel Greenblatt has described how you will find the best undervalued stocks that will yield the best returns in the long run by making use of Return on Capital and Earnings Yield.

The Little Book of Value Investing – The author Christopher H. Browne has given a detailed snapshot of not only how an individual diversifies a stock portfolio but also how to pick the best stocks that are trading at low valuations.

Beating the Street – The mutual fund superstar Peter Lynch has given a detailed snapshot of 21 Investment Principles and 25 Golden Rules of Investment.

Step #4. Open a Demat and trading account to trade stocks

When it’s time to pick a Demat and trading account provider, do consider the fees and charges of the brokerage house. When you want to invest for the long run then it’s a good idea to open a brokerage account with TD Ameritrade, or Charles Schwab. They are the reliable stockbrokers that have delivered a satisfactory service. They help you to buy the desired stocks.

How to select a Stockbroker to start investing in the stock market?

To trade in the stock market you must have a trading and Demat account. Trading accounts not only give access to trade stocks on trading hours but also help to track a portfolio of stocks, mutual funds, and commodities. Here are the 7 parameters you should check before opening a Demat and trading account.

Background & Reliability

When it’s time to open a Demat cum trading account, you should run an independent analysis about the reliability and market reputation of a stockbroker. Read the reviews, complaints of the users, and check for how many years the stockbroker has been offering Demat Services. To avoid fraud, always install the trading app via Google Playstore on your smartphone.

Brokerages and other charges

Before opening a Demat cum trading account do check the account opening charges, delivery charges, intraday trading charges, yearly account maintenance charges of the Demat account, and trading account. When you find the charges are reasonable then you should move to the next point to pick the best one.

Trading Platform

This is the most crucial point you should consider because you are paying an opening fee or renewal charges for this service. When you find the trading platform user-friendly and fast then you can choose this stockbroker. Check the user experience by visiting the comment section of the stockbroker’s trading platform.

Look for the minimum balance to be kept in the trading account

Various trading platforms ask the investor to maintain the minimum balance in your trading account as your bank account. Check out the minimum amount you are asked by the stockbroker, before opening a Demat cum trading account.

Ease of fund transfer

A large portion of stockbrokers offers a 3-in1 account. The 3-in-1 account enables an investor to manage the capital that is available at the savings bank account, trading account, and Demat account. A 3-in-1 account is helpful in the sense that you can transfer the capital from your savings account to your trading account to buy stocks and vice versa.

Availability

For intraday trading make sure that your stockbroker is available in market timing. It allows you to trade frequently and execute the trades with ease. Timely execution plays a vital role in intraday trading, so make sure that your stockbroker is available round the market clock.

Advisory and research facilities

As a newbie in the stock market, it’s worth considering whether the respective stock broker offers such services or not. When you want to buy the advisory services from your stockbroker, do check the reliability and past performance of the stockbroker in advisory and research categories.

Step #5. Pick quality stocks after running an independent research

Now is the toughest part.

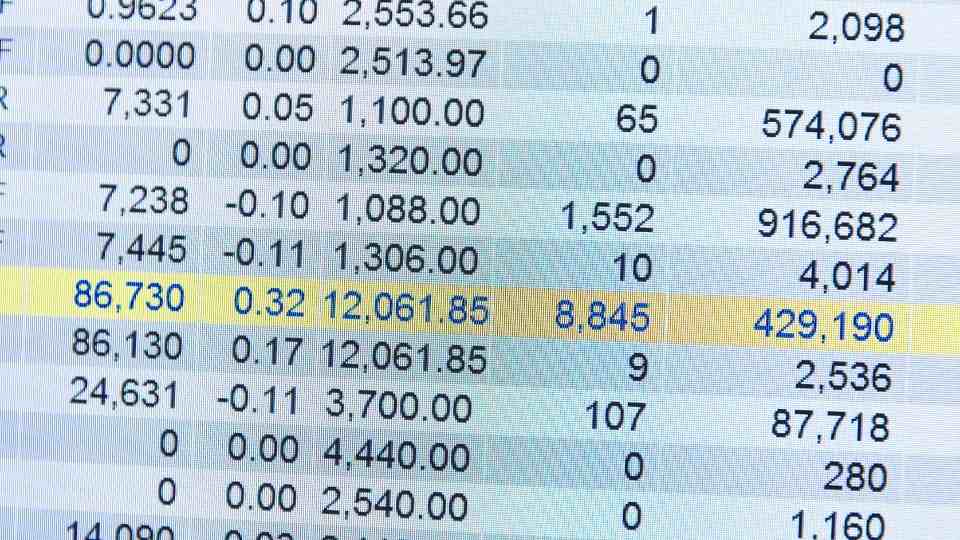

The stock market has over 10000+ stocks. It’s a tuff call to pick the quality stocks that will deliver robust returns in the long run.

When it’s time to pick a stock, do check stock on the basis of the following parameters.

Parameter #1. Debt to Equity Ratio

When the total liability of a company is divided with the assets of the company, you will get the debt to equity ratio. Pick a stock with a debt to equity ratio is below 0.25 or has a marginal debt.

Different sectors have different debt to equity ratios. Take an example of banking and financials, energy, or utility sector that has higher debt levels. The best stock to start investing in is either debt-free or has a marginal debt of 0.10.

Parameter #2. Compounded Sales Growth

When a company delivers steady growth in its sales or revenue, the company may possibly declare a dividend to cheer the shareholders and witness a bull run in the long run.

Don’t start investing in those companies where the sales margin is deepened for the last 3 years. When you have found a company that has delivered robust double-digit growth in sales, you are free to invest in that company.

Parameter #3. Compounded Profit Growth

When a company delivers a double-digit profit growth year on year, you can invest in that company. The company may increase the dividend and the share prices may move upwards on the wings of sales growth and profit growth.

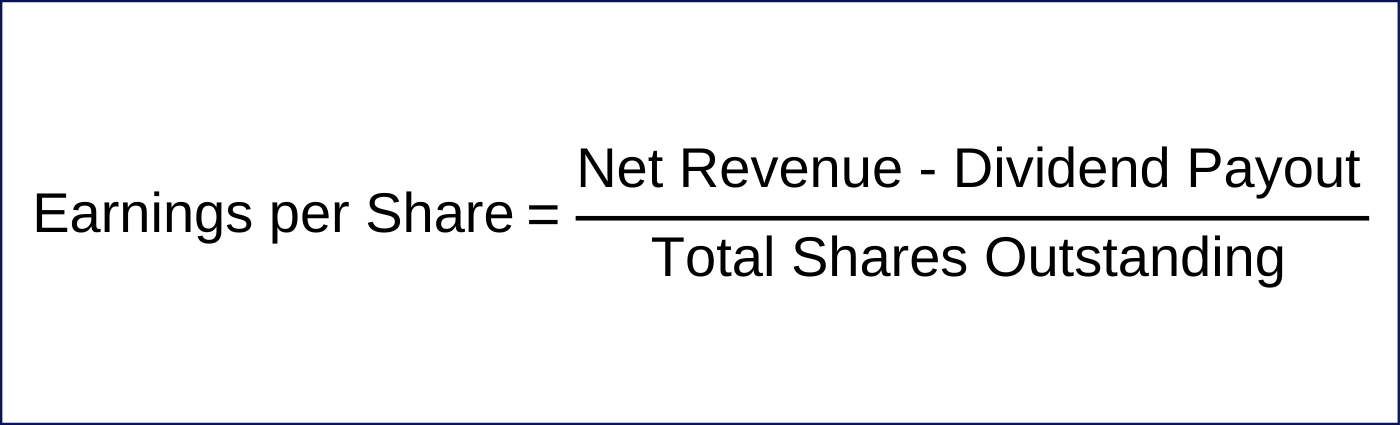

Parameter #4. Earnings per share

When the end result of net revenue a firm generates minus the total dividend declared in a financial year is divided by the total shares outstanding you will get earnings per share.

Before investing in any stocks do check whether the profit margin is in line with the earnings per share or not. The higher the earnings per share is the higher the profitable business is.

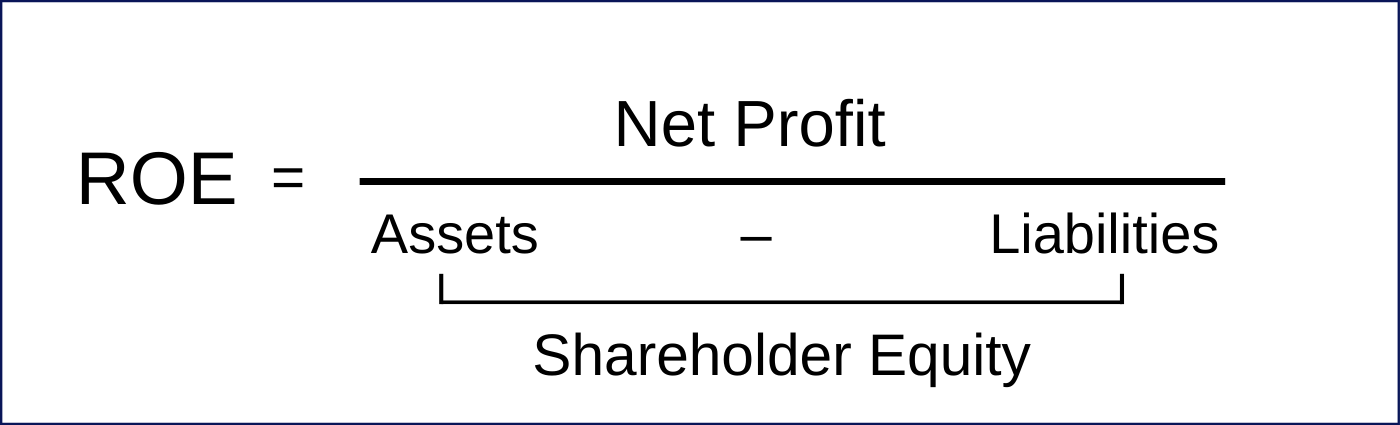

Parameter #5. Return on Equity

To gauge the profitability of a corporation, the return on equity is one of the key metrics used by the analysts. When the net income of a firm is divided with the shareholder’s equity, you will get the return on equity.

The return on equity tells an investor about how much profitable a business i.e. company is by running business operations. When a company delivers a higher return on equity, it’s worth finding whether the company is pumping external capital to deliver a robust return on equity.

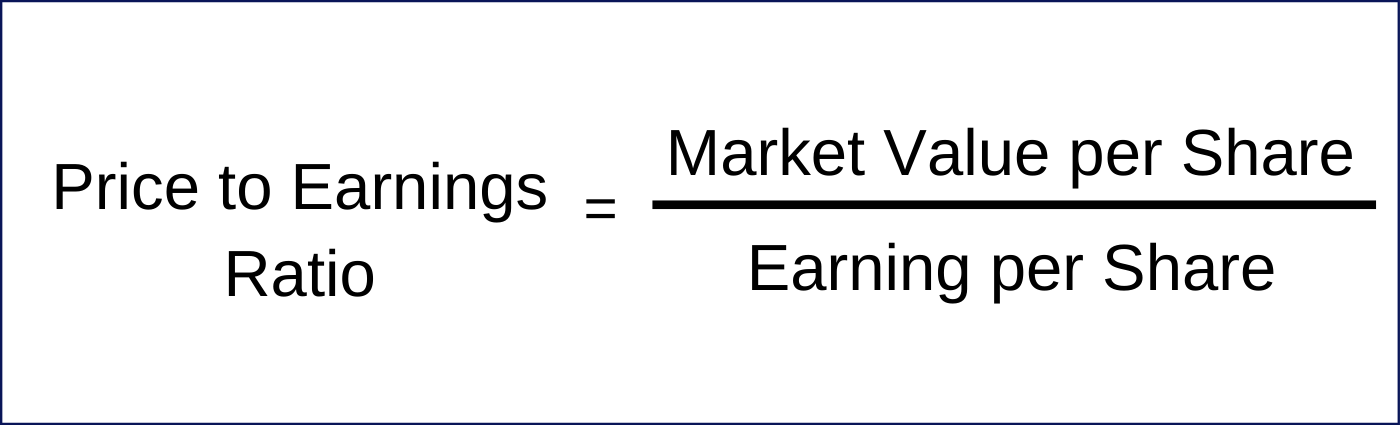

Parameter #6. Price to Earnings Ratio

The Price to earnings ratio is one of the key matrices that help an investor to gauge the valuation. One can calculate the price to earnings ratio by dividing the market price of a share with its earnings per share.

The price to earnings ratio may vary from sector to sector. Needless to say, the banking and financial stocks have a higher price-to-earnings ratio in comparison to the mining sector. When the price to earnings ratio is higher, then it can be assumed that the investors are optimistic enough that the company will continue to deliver robust earnings and probably increase its dividend payout to the shareholders in the long run.

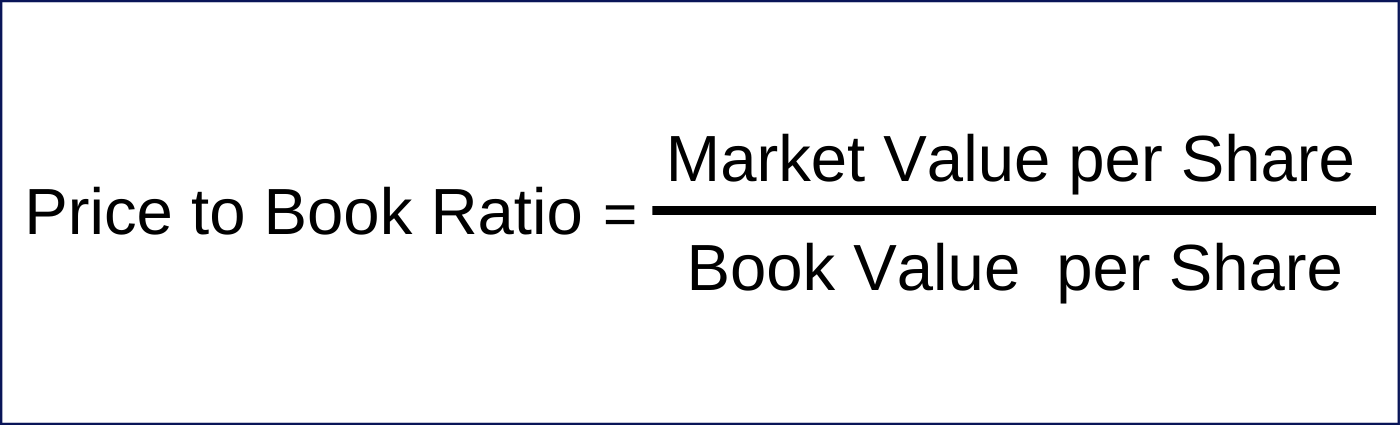

Parameter #7. Price to Book Ratio

The Price to book ratio helps an investor to gauge the valuation of a company and to determine whether the stock is overvalued or undervalued.

When the market price of a stock is divided with its book value per share the end result is the price to book ratio.

By calculating the book value of a stock you will find what you will get if the company goes bankrupt and after all if its assets are liquidated and paid to the lenders of the company.

Any company with a price to book ratio of less than one is considered undervalued and any stock with a book value greater than 3 is considered overvalued.

Step #6. Diversify your stock portfolio

First, learn how to pick the best stocks. Now it’s time to know how to diversify your stock portfolio. Ace investor Warren Buffet’s investment philosophy is that don’t put all of your eggs in one basket. To minimize the risk you should diversify your stock portfolio across various sectors namely Airline, Insurance, Banking, and Financials, etc.

-

Read also: How to Invest in the Stock Market

Step #7. Stay invested for the long run to get fruitful returns

Now after you have properly diversified your stock portfolio, it’s time to start investing and stick to the investment for the long run.

Why Long run?

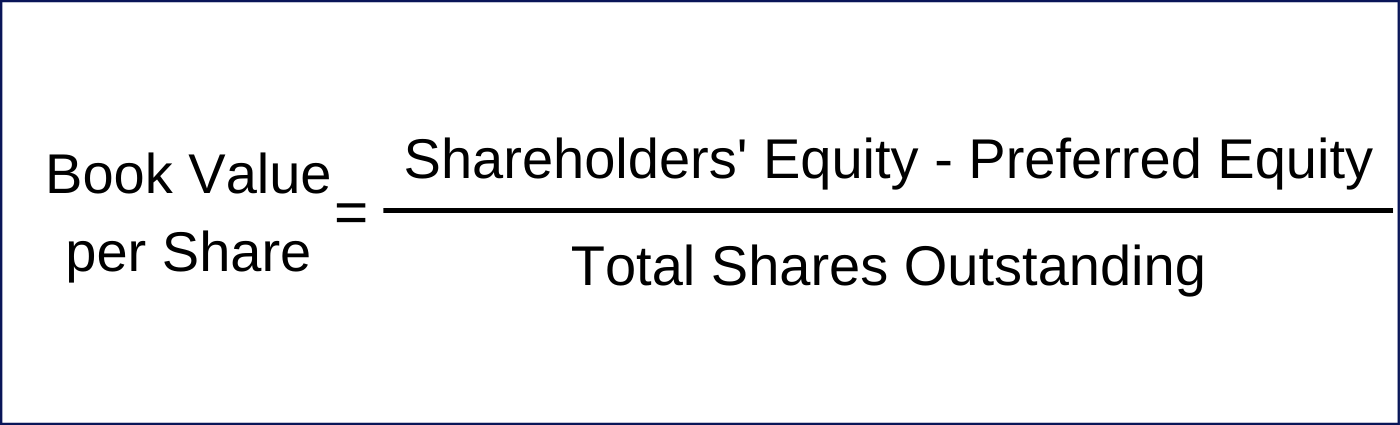

Just take a look at a graph.

When you invest $35000 at once then you will get the following corpus assuming 12% CAGR,

- $1,08,704 after 10 years,

- $3,37,617 after 20 years,

- $1 million after 30 years.

Final Thoughts

Here is the step by step process of how a beginner should start investing in the stock market,

- Gather investing knowledge by reading investing books

- Open a Demat and Trading account

- Transfer capital from savings account to a trading account

- Pick a bunch of stocks with strong fundamentals across various sectors

- Enter the price and hit the ‘Buy’ button

- Sit tight for the long term and let the stock reap the fruitful returns

Hope this article will help you or any other beginners to start investing in the stock market. If you have any questions regarding How to invest in stocks for beginners with little money, feel free to comment so that we can have a discussion.