Black money is one of the biggest obstacles in the way to achieve financial strength and security. Unfortunately, this black money is generated by the people themselves. It is a fact that everyone wants to earn money as much as he can but wants to pay fewer taxes to the government. To do so, many people hide their income or show a lesser amount of income than what they earn, so that they have to pay lesser tax to the government. In this way that hidden money gets converted to the black money. According to government laws, generating or accumulating black money by any means is a criminal

Actually in our country India most of the people are ignorant. They do not have proper knowledge about Income tax and tax planning or management of tax. With the appropriate tax planning anyone can save a good amount of tax and with this, his/her money will not turn into black money. The money will be white and of course legal. Tax planning is not overnight planning at all. You need to know the deductions allowed by the income tax act under the chapter VI-A, and then you can make good use of the deductions available.

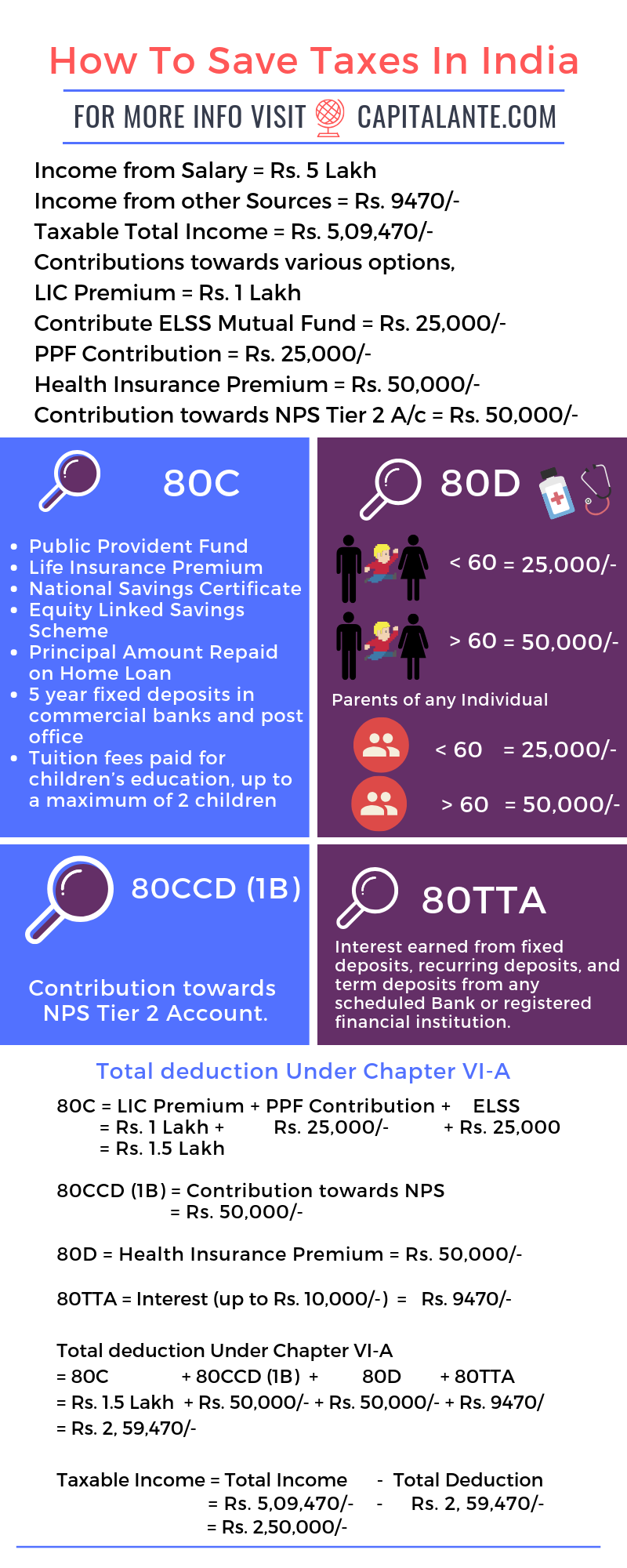

Tax Saving Options under section 80C of the income tax act, 1961

You can avail the benefits of section 80C of Income Tax Act up to a maximum limit of Rs. 1, 50,000/- for the Assessment Year 2019-20 by depositing money in the following schemes.

- Public Provident Fund

- Life Insurance Premium

- National Savings Certificate

- Equity Linked Savings Scheme

- Principal Amount Repaid on Home Loan

- 5 year fixed deposits in commercial banks and post office

- Tuition fees paid for children’s education, up to a maximum of 2 children

Tax Saving Options under section 80D of the income tax act, 1961

Indian Government allows tax benefits on health insurance/Mediclaim Policy. If you take a health insurance/Mediclaim policy you can avail tax benefits up to Rs. 1, 00,000/- per annum U/s 80D of the income tax act, 1961, for Assessment Year 2018-19.

- Case 1: You can avail tax benefits up to Rs. 50,000/- per annum. For Self, spouse, dependent children (Rs. 25,000/-) and for your parents (Rs. 25,000/-) who have not attained 60 years of age.

- Case 2: You can avail tax benefits up to Rs. 75,000/- per annum. For Self, spouse, dependent children (Rs. 25,000/-) and your parents (Rs. 50,000/-) who have attained 60 years of age.

- Case 3: You can avail tax benefits up to Rs. 1, 00,000/- per annum. For the eldest member of your family i.e., Self, spouse, dependent children who have attained 60 years of age (Rs. 50,000/-) and your parents either Mother or father (Rs. 50,000/-) who have attained 60 years of age.

Tax Saving Options under section 80CCD (1), 80CCD (1B) of the income tax act, 1961

This rebate is available for Government employees or other employees who receive salary and avail the facility of any kind of pension. An employee’s own contribution to Tier- 1 account of NPS is eligible for tax deduction, i.e., up to 10% of the Basic pay + Dearness allowance. Contribution up to Rs. 1, 50,000 is exempted under the section 80CCCD (1) of Income Tax Act, 1961.

Contributions up to Rs. 50,000/- in the Tier- 2

- Read also: Income Tax Saving Investments – Save your Taxes

- Read also: Tax Saving Investments: How to Save Income Tax?

Tax Saving Options under section 80GG of the income tax act, 1961

The Income tax act allows an individual this facility if he is staying on rent and he is not the owner or co-owner of a house where he is staying on rent. The amount you can save U/s. 80GG is as follows.

- Suppose the individual/the assessee is engaged in an unorganized sector. The person does not get any house rent from his/her employer separately and pays a house rent to his/her parents then he/she is eligible for the maximum deduction of Rs. 60000/-.

- But in the case where the individual/the assessee receives house rent separately apart from the salary the following calculation is applicable.

Let’s assume a person receives a net salary of Rs. 3,00,000/- and separately receives Rs. 1,00,000/- as house rent from his/her employer, then he/she can get the maximum amount of deduction of Rs. 90,000/- [@30% Standard Deduction] as per section 80GG.

Deductions in respect of interest income i.e., 80TTA

Maximum of Rs. 10,000/- earned as interest Income from any scheduled Bank or registered financial institution is exempted from income tax for a financial year. Interest earned more than this is taxable. If anyone gets Rs.20,000/-as interest he is liable to pay tax on (Rs.20,000-Rs.10,000=Rs.10,000/-).This is the current amount for the financial year 2018-19.

Now, let’s see the calculation of tax planning. Suppose you have an annual income of Rs. 5 Lakh. You pay Rs. 1 Lakh as LIC Premium, Transfer Rs. 25,000 at PPF Account, Invest Rs. 25,000/- at ELSS of SBI Mutual Fund, Pay Rs. 5o, 000 for Health Insurance Premium for your family, Contribute Rs. 50, 000/- in NPS Tier 2 Account and Earn Rs. 9470/- as Interest from Savings bank account. You reside at your parental home.

The government does not impose any tax liability on income up to Rs. 2.5 lakh in a financial year and after availing all the benefits of tax management your taxable income comes down to Rs. 2.5 lakh. So you are not eligible to pay a single penny towards tax.

- Read also: Top 5 best ELSS funds to invest in India

- Read also: How to file

Income tax return in India

If you have any question regarding how to save tax in India, feel free to comment so that we have a discussion. If you have found this post helpful don’t forget to share this post.