Anil who has met with a medical emergency has applied for a loan, but the lender has refused to give him the loan owing to the bad or low CIBIL score. Are you scared about this kind of nightmare when a loan is the only option to tackle the above-mentioned circumstance? If you are going to improve your credit score stick with the post. In this post, we will discuss what CIBIL Score is, how CIBIL Score is calculated and how to improve CIBIL Score from 300 to 800.

What is CIBIL Score?

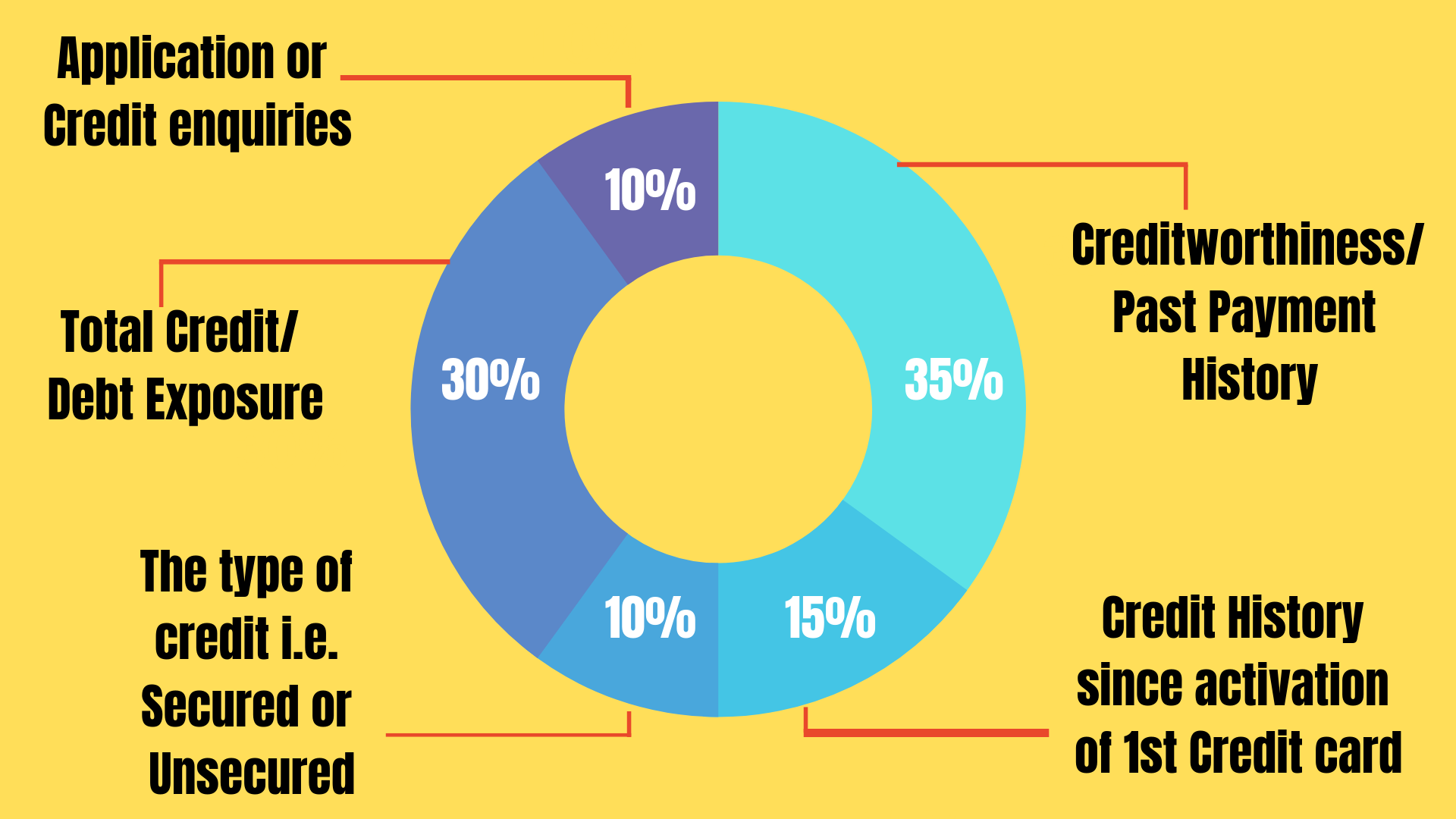

CIBIL Score is a 3 digit number varying between 300 and 900 which is calculated after analysis of following points.

- Credit history i.e. how many years an individual has made use of credit card since activation of one’s first credit card.

- Creditworthiness i.e. whether you have cleared the entire debt amount at a regular fixed interval in the recent past if any.

- Credit exposure i.e. whether you have utilized the full credit limit which has been assigned to your credit card. It is advised that you should utilize only 30% of your available credit limit.

- If any individual can enquire too many times to avail credit, it is assumed that the person is a credit hungry which adversely affects his CIBIL Score.

- The type of credit i.e. whether you have applied for a secured loan or unsecured loan in the recent past. If you have taken a loan against any collateral then it is secured loan and if you have taken a loan against no collateral then it is an unsecured loan. If you have applied for a secured and unsecured loan and paid the both at a given time then it suggests that you have the capacity to handle both types of loan.

- Your profile’s debt to asset ratio i.e. the possibility of repayment of a loan by selling your asset whenever required.

- Read also: 7 quick steps to improve your CIBIL Score

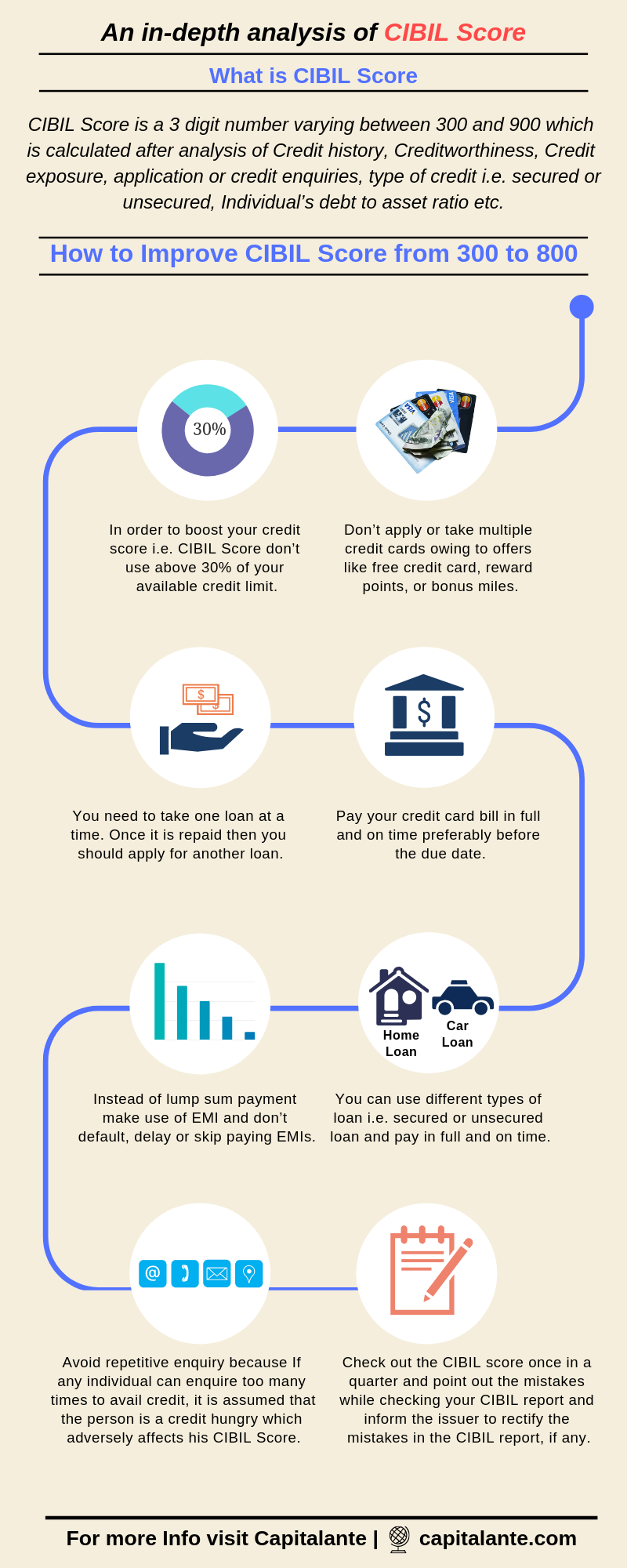

How to improve CIBIL Score from 300 to 800

In accordance with the mandate of The Reserve Bank of India, all banks or credit card issuers should check the CIBIL score of an individual and issue a particular loan amount on the basis of the CIBIL. Now in order to get easy loans and sometimes on an attractive interest rate you need to improve your CIBIL Score. A candidate with higher CIBIL score is preferred by credit issuing authorities. You can improve your CIBIL score easily from 300 to 800. In order to improve your CIBIL score, you should consider the following points.

Keep the oldest credit card account

There are many persons who close the credit card account because they feel that the credit card is no more in use and when he needs he will apply for another credit card. This is the biggest blunder an individual makes. Since you have made a timely payment of your dues in the near past your CIBIL score has improved. The timely payment of dues has given the much-needed longevity which is adjusted with your CIBIL score. Now even if you don’t need credit card anymore, please don’t deactivate your credit card account. In future whenever you apply for any loan either it is housing loan or car loan the lenders will consider the tenure while evaluation the loan application.

Suppose you have borrowed money to buy a motorcycle in the recent past. You have chosen the EMI option to pay off the due. You have consistently paid off the due within a specific time. And within one year you have paid off the whole due. You may foreclose your loan amount by paying earlier than the EMI time period. This will signal that you are reliable enough to let you borrow a large sum and manage your funds judiciously since you foreclose your loan amount. Once you have closed your credit card, your credit card history will be lost.

Try to pay on time

You receive a credit card from your credit card issuer and the card issuing authority gives you a stipulated time to repay the amount. Now it is your responsibility to pay off the amount timely. This will not only increase your creditworthiness but also affect your CIBIL Score. If you fail to pay off the credit then the company usually charges between 2-3% interests on a monthly basis. If calculated on a yearly basis then you need to pay an interest of around 40% yearly. In the event of you fail repeatedly to pay off the dues then it will affect your creditworthiness and CIBIL score. The direct impact of this will be that you won’t be able to get Credit Card in the near future by any credit card issuer. In addition to this, your loan application may be rejected due to failing to pay on time.

Suppose you have borrowed Rs. 20K from any bank or NBFCs in order to purchase a smartphone. Now, if you are able to pay the entire amount just within 6 months then you may opt for EMI for six months. You should be cautious about the timely repayment of EMIs because failing to pay on time adversely affects your CIBIL score. Once you have cleared all the due by EMI option it will enhance your CIBIL Score.

Utilizing full limit

Since your credit card issuer sets a limit of Rs. 1 Lakh, it does not mean that you should avail full credit utilization. It has a significant impact on your credit score. The less you utilize your full credit limit the more you will improve your credit score. Suppose your credit card issuer allows you to spend Rs. 100/- per month. So, in order to boost your credit score don’t use above 30% of your available credit limit. Here it is Rs. 30/-. It is advised that you may use only 15-20% credit allowed to your card. If for any reason you have to use more than 80% or the full 100%, try to pay off the amount within the stipulated time.

Withdrawing cash

You can withdraw cash with your credit card from ATMs. But it attracts a high rate of interest. Any withdrawal from ATMs attracts as much as 2-4% per month and the interest is calculated from the first day of the withdrawal. So, it is advised not to withdraw from ATMs with your credit card except on emergency situations. Again, small withdrawals attract higher charges.

Avoid applying too much loan amount at once

Although you hold good credit score and you are confident about getting a huge amount of loan, it is advised that your loan amount should be minimized in a fixed period of time. You need to take one loan at a time. Once it is repaid then you should apply for another loan. Since your credit card issuer checks whether you have any outstanding loan at the time of applying for one loan, it has a higher possibility that the company will reject your loan application. This rejection will affect negatively to your credit score. So after repayment of the existing loan amount in full you should apply for another loan. This will enhance your chances of getting a loan easily.

Take different types of Credit

If you are the first time borrower then it is clear that your CIBIL score will be low. You can use different types of loan which is available from the bank to enhance your CIBIL score. There are various types of loan in India you can withdraw. Suppose, you are working as a person then you can apply for a personal loan which is an unsecured loan to buy a TV or Washing Machine, smartphone, refrigerator etc. Then you can repay the loan within a stipulated time period via EMI option.

Suppose you have a PPF account. Then you are free to apply for a loan against your PPF account to meet any expenditure. This loan is a secured loan. On successful repayment of whole debt, your credit score will improve.

Since you have paid off the dues within a stipulated time, this will signal that you are reliable enough. This also implies that you can handle any type of loan irrespective of loan type i.e. secured or unsecured. This will enhance the possibility of getting an instant loan approval even of a large sum.

Rectify the mistakes in the CIBIL report

The credit history is improved or upgraded once in a year or half yearly. Please check out whether the CIBIL score is upgraded or not after repayment of a loan within the stipulated time. Point out the mistakes while checking your CIBIL report and inform the issuer about the incorrect information or delay in recording credit history. After successful repayment do check your CIBIL score from time to time.

- Read also: Top 10 Worst Credit Card Mistakes to Avoid

- Read also: Top 17 Types of Credit Cards in India

Hope by following above-mentioned points you can improve your CIBIL Score. If you have found any question regarding how to improve CIBIL Score feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.