Are you planning to purchase a car? But confused how much should you spend on a car? Now a day in India own a 4 wheeler car or a sport bike is a status of symbol. Owing to this increase in real disposable income people are very eager to own a car beside their own nest i.e. house. But one of the popular questions is should I buy a car or make use of UBER or OLA and invest the money. Here we will discuss if you should buy a car by taking a car loan or not. In addition, we will offer you some principles if you have created a fund for your dream car. After that, we will discuss how much should you spend on a car.

What ordinary people do?

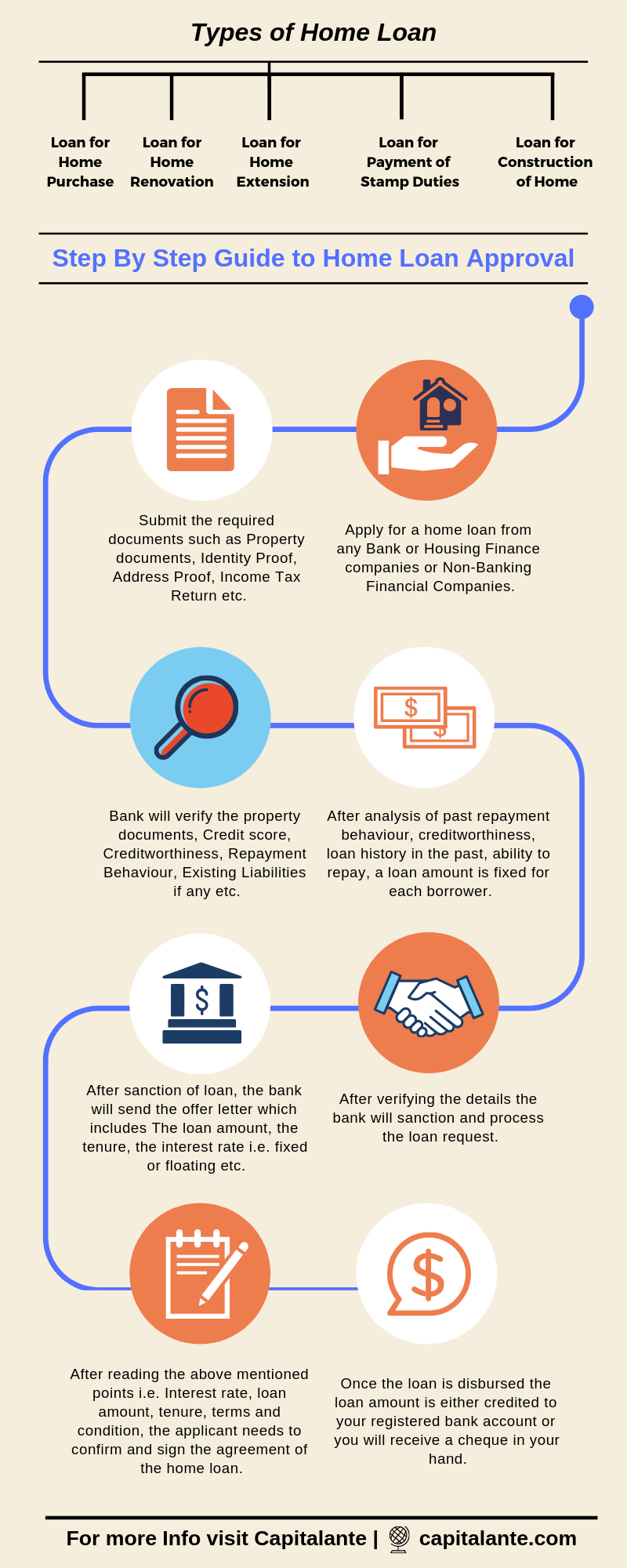

After getting a job or starting to earn at an age of 24-25, an average salaried employee first starts saving for a certain period of time i.e. for the first 5 to 10 years. After achieving the target of saving Rs. 10 lack, one individual goes to a bank and applies for a home loan on EMI basis. After reviewing the loan eligibility the bank gives the loan.

Since a home is one of the necessities the ordinary people have to meet, you can buy a home on EMI basis. To do so you need to consider the matter of repaying your home loan quickly. After taking a home loan people head to take a car loan. This is the biggest blunder a common individual makes. After the approval of car loan, people get trapped into a vicious cycle.

Points to consider before taking a car loan

Earlier, I have mentioned on various occasions the benefits of remaining debt free. But you need to consider the various crucial aspects of money in the near future such as retirement corpus, future obligations such as education and marriage cost daughter apart from buying a car on loan. Here we don’t tell you that you should not take a home loan, but to consider the other crucial aspects such as retirement, future expenses before taken a car loan.

How much should you spend on a car

Now, if you are determined to buy a four-wheeler what amount you should spend is a matter of concern. You may follow some principles. In order to fix that problem, we will make use of famous The 50/30/20 Rule, The 28/36 debt Rule, The 20/10 Debt Rule, & 20/4/10 Rule to calculate the money which you are free to put to buy a car. Let’s illustrate these famous rules to calculate spending to buy a car.

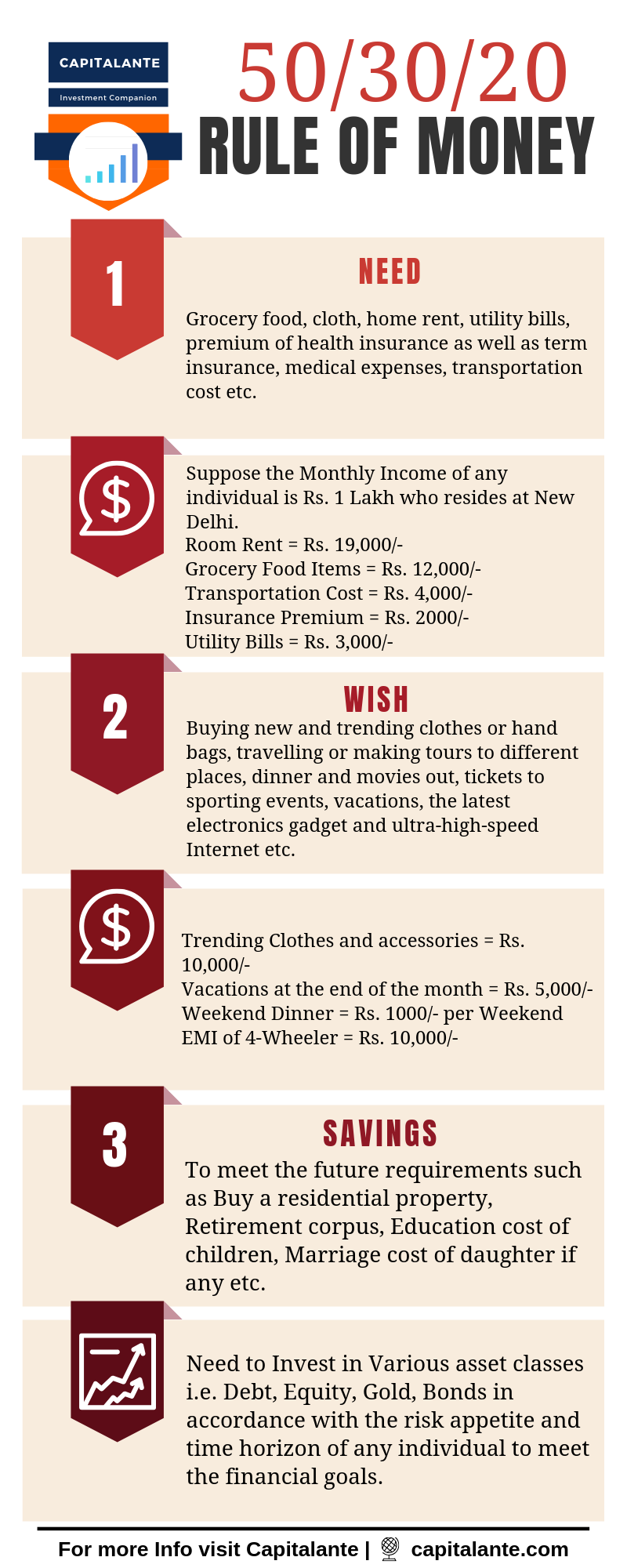

50/30/20 rule of Money

Senator Elizabeth Warren coined the term 50/30/20 rule in her book “All Your Worth: The Ultimate Lifetime Money Plan.” This calculation is very simple and very easy to apply. You should divide your post-tax income into three parts and allocate every part for every sector. Your income will be divided as 50% on needs [Grocery, Insurance Premium etc.], 30% on wants [Buy a car, travelling or making tours to different places, dinner and movies out, tickets to sporting events etc.] and the rest 20% for saving.

The 28/36 Debt Rule

According to The 28/36 Debt Rule, Debt-to-income Ratio, an individual should not spend more than 28% of gross income on housing expenses and more than 36% of all debt including car loan or housing loan etc. In accordance with The 28/36 Debt Rule, 28% represents the monthly principal, interest payable, property taxes i.e. estate tax and insurance payable on the property. The rest 36% represents all recurring monthly debt compared to one’s gross household income including credit card debt, personal loans, EMI on Housing loan, EMI on car loan etc.

The 20/10 Debt Rule

According to the 20/10 Debt Rule, the first component 20 implies that any individual should not spend more than 20% of the annual income towards debt repayment. The second component 10 implies that any individual should not spend more than 10% of the monthly income towards debt repayment.

Suppose, you receive a monthly salary of Rs. 1 Lakh. You have taken a home loan of Rs. 5 lakh for a term of 4 years at an interest rate of 9% per annum. In this case, you will be subject to pay around Rs. 6 lakh including the amount and interest. So, your monthly installment or EMI will be approximately Rs. 12, 443/-. It means you are paying 12% of your salary to repay your car loan.

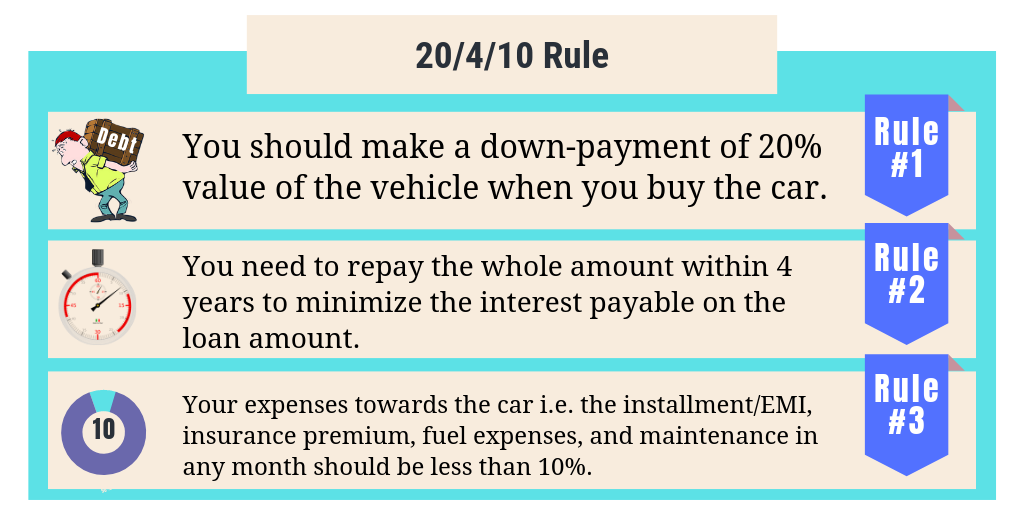

The 20/4/10 Debt Rule

According to the 20/4/10 rule,

The first component, 20 implies you should make a downpayment of 20% value of the vehicle when you buy it. If a 4 wheeler costs Rs. 5 Lakh, you may make the initial downpayment of 20% of Rs. 6 Lakh = Rs. 1, 20, 000/-.

The second component, 4 implies that you need to repay the whole amount within 4 years to minimize the interest payable on the loan amount. In other words, if you carry out the loan for longer tenure you will have to pay more interest. In order to clear out the due amount, you should try to increase your EMI amount in accordance with your increasing income. If you choose a longer tenure then you pay a lesser EMI, but you are liable to pay more interest in the longer tenure. The last digit 10 implies the monthly expenditure for your four-wheeler.

The last component, 10 includes your expenses towards the car i.e. the installment/EMI, insurance premium, fuel expenses, and maintenance in any month should be less than 10%. You need to check whether your monthly expenditure does not cross 10% of your salary or income. If you earn Rs. 1 Lakh in a month, then you can afford 10% of Rs. 1 Lakh = Rs. 10k per month for your vehicle.

Now after the discussion of what amount you should take for a car loan remains the biggest dilemma. Again there is another problem whether you should buy a brand new car or buy a second-hand car?

Buy a brand new car or a used one

People are eager to buy a used car owing to the following reasons,

- The cost to buy a used car is much lesser than a brand new car.

- Lesser insurance premium in case of a used car than a new one.

- A brand new car depreciates faster in the first three years and after three year depreciates to a lower extend.

The above reasons are correct but you should buy a new car owing to the following reasons,

- You can choose the brand new car in accordance with your budget and features of the car you need.

- You will get an easy loan for buying a new car from any bank or NBFCs in comparison to buy a used car.

- Latest technology and features such as rear-view camera, electrical vehicle, blind spot monitoring etc.

- Lesser repair and maintenance cost.

Finally, you should drive the car for at least 10 years. This is because it is not a pair of shoes which you can afford to buy once a year since buying a car required lots of money. Here I offer you the famous quote delivered by ace investor Warren buffet,

“If you buy things you do not need, soon you will have to sell things you need.”

Rent or own a Car: Financial Impact

In accordance with the 20/4/10 rule, if you invest your initial down payment Rs. 1,20,000/- in any equity oriented mutual fund or stock market at one-time lump sum investment then you will get Rs. 19,63,962/- after 20 years assuming 15% CAGR.

After that

Suppose you have taken a car loan of Rs. 4 lakh for a term of 4 years at an interest rate of 9.15% per annum. So, In accordance with the 20/4/10 rule,

| Loan Amount | Rs. 4 Lakh |

| Interest Paid | Rs. 79161/- |

| Total Repayment Paid | Rs. 4,79,11/- |

| Loan Term | 4 Years |

| Monthly Repayment EMI | Rs. 9,982/- |

If you invest this Rs. 9982/- per month in any equity oriented mutual fund you will get around Rs. 6.6 Lakh after 4 years assuming 15% CAGR.

How to get rich by using a bike or public transport instead of 4 wheeler car

Suppose, the distance between your house and your workplace is 10 km approximately. So, every day you have to make a two and fro journey of total 20 km. If you go alone to your office then you can use a bike or public transport instead of a four-wheeler car. Let’s make it clear with an example.

The to and fro journey between your home and workplace is 20 km.

An average 4 wheeler car gives a mileage of 10 km per litre petrol.

So you need to buy a petrol of = 20 km / 10 = around 2 litres.

Your approximate consumption of petrol or diesel for a month is = 2 litres × 30 days = 60 litres.

So, your total cost for a month= 60 litre × Rs. 80 = Rs. 4800/-.

Now in the case of a bike,

An average bike gives a mileage of 30 km per litre petrol.

Total distance covered by a bike = 20 km × 30 days = 600 km.

Your approximate consumption of petrol or diesel for a month is = 600 km / 30 km = 20 litre.

So, your total cost will be = 10 litre × Rs. 80 = Rs. 1600/-.

Your total savings is = 4800-1600 = Rs. 3200/-.

Now,

If you invest this Rs. 3200/- per month in any equity oriented mutual fund you will get around Rs. 1 Crore after 25 years assuming 15% CAGR.

- Read also: Should I buy a home or rent and invest the money?

- Read also: How to get Rich by Small Sacrifices

Hope this article will help you to calculate how much should you spend on a car. If you have got any question feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.