Looking for the Best fund other than a mutual fund to invest in India for long-term Investment that may give better returns in comparison to mutual funds with minimum risk? If you are a High Net Worth Individual/investor who wants to invest above 1 Crore at once then hedge funds is one of the investment opportunities which are capable of delivering better returns in the long term.

What is Hedge Fund?

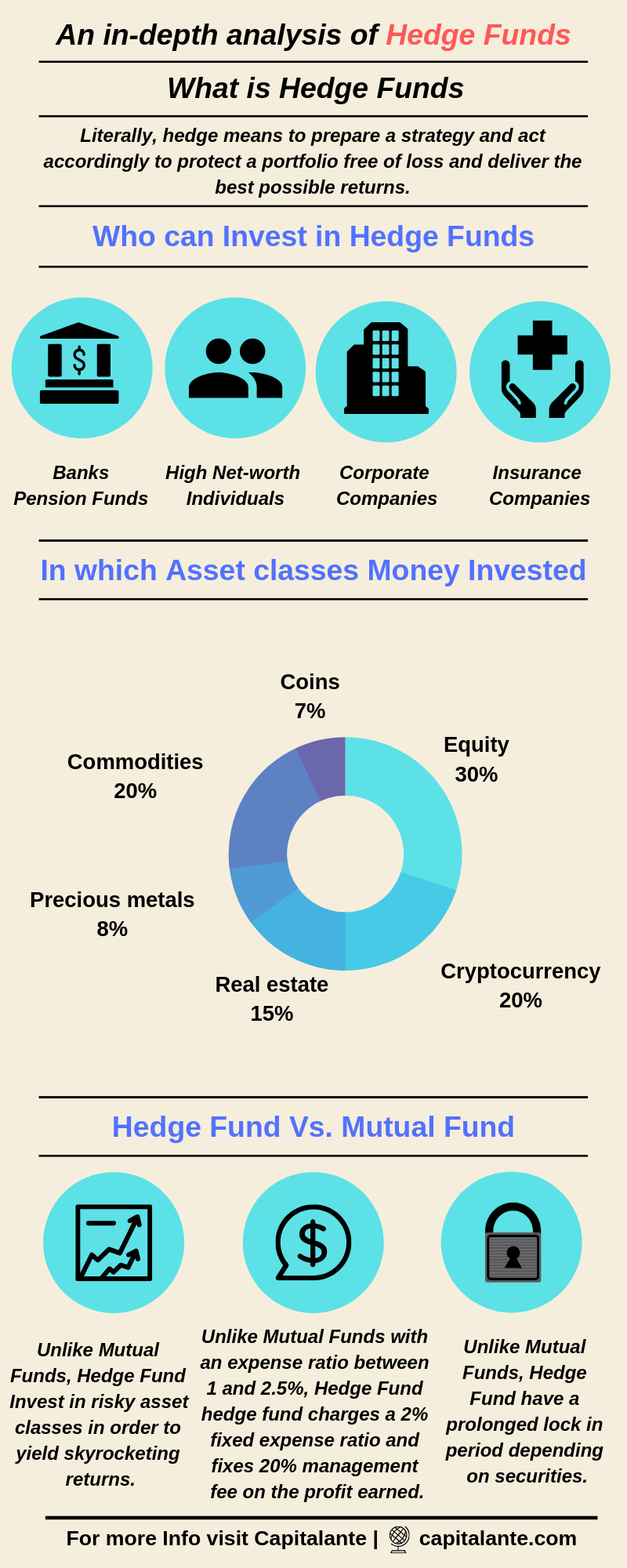

Literally, hedge means to prepare a strategy and act accordingly to protect a portfolio free of loss and deliver the best possible returns. Usually, Hedge fund collects money from high net worth individuals (HNI), banks, insurance companies, corporate companies, pension funds etc. The money collected from the above-mentioned sources is used by fund manager of hedge fund to invest in various asset classes namely equity, rare stamps, real state, antiques, commodities, precious metals, coins, cryptocurrencies [such as Bitcoin, Ethereum], private shares in start-ups etc. to generate better returns for the investors. In order to enable greater returns, the fund managers make use of scalp trading i.e. buying and selling shares which takes place in minutes to seconds.

To deliver better returns fund managers make use of several investment strategies namely-

Short Selling

Generally, a majority of investors takes a long position on any stocks after making a proper fundamental and technical analysis of stocks. Unlike retail investors fund managers of hedge funds take a long position in stocks which are undervalued and in contrary take a short position in such stocks which are overvalued. In other words, when stocks witness a sharp correction then the fund manager buys those stocks in an attractive valuation.

Make use of different trading strategy

The fund managers of hedge funds make use of technical analysis to find out and exploit intraday price fluctuations by making use of charts, daily moving average, stop loss, resistance, support etc.

Make use of an upcoming event

Under this strategy fund manager utilizes an upcoming event such as quarterly or annual results, Merger or acquisitions, restructuring, share buyback, etc.

Searching for stocks which are available at a discounted prices

Various stocks witness a sharp correction owing to weak earning number, increase in debt burden, increase in non-performing assets etc. When the company experiences a financial stress, the company sells its securities at a discounted price of even 50% for financing. Then fund manager makes investment in those stocks after making proper analysis about advantages and disadvantages.

- Read also: What are hedge funds? – Investopedia

Key features of Hedge Funds

Here are the key features of Hedge funds you need to know before starting investment in any Hedge fund.

This fund is for High Net-Worth Individuals

Hedge funds is ideal for investors like high net worth individuals (HNI), banks, insurance companies, corporate companies, pension funds etc. In order to make an investment in any hedge fund you need to invest a minimum amount of at least 1 crore.

Invest in risky asset classes in order to yield skyrocketing returns

In order to yield better returns, the hedge fund manager invests the money in various asset classes namely equity, rare stamps, real estate, antiques, commodities, precious metals, coins, cryptocurrencies [such as Bitcoin, Ethereum], private shares in start-ups etc. to deliver skyrocketing returns for the investors.

Lock-in-period

Unlike the liquid stocks with a high volume, it does not have any lock in period. Hedge funds have a lock in period depending on securities. The hedge fund manager invests a huge money in thinly traded securities like loans or other debt which have a prolonged lock in period.

Taxation

Although SEBI has given a status to the hedge funds as the Category III Alternate Investment Funds, the hedge funds have not received any pass-through tax status. Any individual or non-individual is not eligible for any kind of tax deduction i.e. like ELSS or capital gains up to 1 lakh in the case of Hedge funds.

High Expense Ratio

Unlike the direct mutual fund schemes the hedge funds do not enjoy a rate of more than 1%. Usually hedge funds charge both expense ratio and management fee which is famously known as ‘Two and Twenty’. The term means that hedge fund charges a 2% fixed expense ratio and fixes 20% management fee on the profit earned from the respective hedge fund.

Regulations

Although in India SEBI has given a status to the hedge funds as the Category III Alternate Investment Funds but it is not mandatory for hedge funds to get registered with the securities market regulator. Unlike the mutual funds the hedge funds are not required to disclose or update the NAV regularly.

Mutual Funds vs. Hedge Funds

Since in India Hedge funds are not so popular that is why many people think that Hedge funds are one of the types of mutual funds. Both the mutual funds and the hedge funds are managed by the fund managers. But in the case of hedge funds, the fund manager takes an aggressive and diverse strategy i.e. trades in derivatives and options to deliver huge returns for the investors. Here is the comparison table of Mutual funds and Hedge funds.

| Points | Mutual Fund | Hedge Fund |

| Regulations | Must comply with the stringent regulations by the stock market regulator i.e. SEBI. | Does not require to meet stringent regulations or get registered with the securities markets regulator. |

| Who can invest | Retail investors can start investment with a little amount. | Hedge fund is ideal for High net worth individuals (HNI), banks, insurance companies, corporate companies, pension funds etc. |

| Portfolio | Mutual funds Invest in limited asset classes namely equity, debt, bonds, money market instruments etc. | Hedge funds invest in various asset classes namely equity, rare stamps, real estate, antiques, commodities, precious metals, coins, crypto currencies [such as Bitcoin, Ethereum], private shares in start-ups etc. |

| Transparency | Mutual funds publish reports on returns delivered, portfolio etc. publicly. | Portfolio, financial reports are delivered only to investors not disclosed publicly. |

| Lock-in-period | Does not have any Lock-in-Period except ELSS of 3 years. | Have longer lock-in-period depending on securities where the money is invested. |

Switch of Funds |

Mutual funds offer various schemes and combinations among which you can choose. It is easy to switch of funds according to your risk appetite from equity to debt or vice versa. | Does not have any options yet. It depends on the fund manager who invests the money into different asset classes. |

| Initial investment amount | You can start investing with as low as Rs. 500/- at once or via Systematic Investment Plan. | Minimum investment amount is Rs. 1 crore. |

| Fees | Lower expense ratio between 1% and 2.5%. | A fixed 2% fixed expense ratio and fixed 20% management fee on the profit earned from hedge fund. |

| Withdrawal options | An individual can withdraw wholly or partially of his total investment any time except ELSS which has a 3 years lock-in-period from the date of the first contribution. | The hedge fund manager has invested a huge money in thinly traded securities like loans or other debt which have a prolonged lock in period. |

| Tax benefit | Offers tax-free income in long term up to Rs. 1 lakh in any financial year and ELSS offers tax deductions up to Rs. 1.5 Lakh under Section 80C. | Neither the tax deductions nor the tax free income is available for hedge funds. |

Finally, if you are a high net worth investor and have a proper understanding of the various sectors where the hedge fund manager invests the money then you are free to invest in hedge funds.

- Read also: Top 10 best sectors to invest in India for long term

- Read also: How to Invest in the Stock Market

If you have any questions regarding hedge funds in India feel free to comment so that we can have a discussion. If you have found this post helpful and relevant feel free to share the post with your loved ones.