The Goods and Service Tax (GST) is nothing but a single tax which combines all separate taxes in the central or state level. Before the advent of GST in the Indian economy, there were 17 different types of indirect taxes of central and state governments. Now all these taxes have been abolished and combined in a single form of tax that is GST. In this column, we will give you a beginners guide to how GST works, what is GSTIN number and how to get your GSTIN number, how to file GST Return and the points to consider while filing GST Return.

Pre GST era Taxation System

Before the implementation of GST, all dealers had to register themselves under the state VAT law. Then they were provided with a unique TIN number by the respective state tax authority. Now, the GST has turned the whole country into one market one tax policy. Earlier to this, all businessmen or service providers were provided with the service tax registration number by the central board of excise and custom. Stepping towards the new GST regime all registered taxpayers are now consolidated into one single platform for compliance and administration purposes.

- Read also: GST Return Filing – How to File GST Returns Online – ClearTax

- Read also: How to File GST Returns Online in India – Types of GST Returns

All businessmen and service providers are provided with a unique Goods and Services Tax Identification number i.e., GSTIN. Now, a single tax is charged on a product. The central and state governments have a particular share on that tax. Different kinds of taxes like excise, customs, state entry tax, commercial tax, and value-added tax have now been abolished and replaced with a single tax namely Goods and Services Tax. Now the ultimate users or the people pay one tax in the form of GST.

What is GSTIN Number?

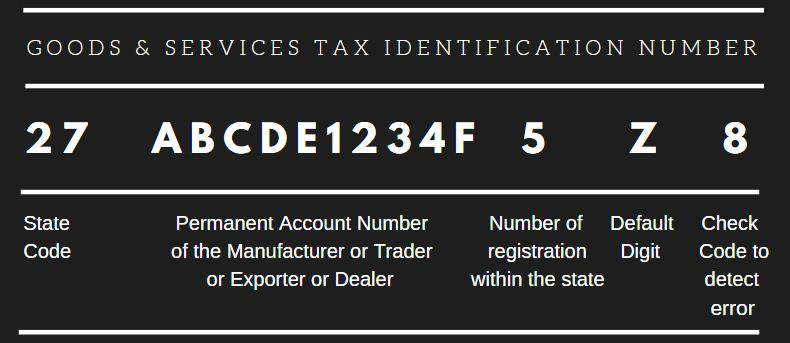

Just like PAN card, Goods and services Tax Identification Number i.e., GSTIN is a set of digits including English alphabets and numbers.

Let’s make it clear with an example, just look at the following GSTIN number

- The first two digits represent the state code. The state code is the same as they were in the Census list of 2011. Obviously, the state code will be different for

the different state. The state code for Karnataka is 29, the state code of Maharashtra is 27. - The Next ten digits are the PAN of the respective person who runs the shop or any firm or any business or provides any kind of services.

- The thirteenth digit is assigned on the basis of the number of registration within the state. Here, in the above-mentioned case, it is 5.

- The fourteenth digit is fixed for everyone and every case. It is denoted by Z as default.

- The last i.e., the fifteenth one is for check code to detect any error. It may be an English alphabet or a number.

How to get GSTIN Number?

First of

- Go to the Online GST portal

- Go to Register Now. Then fill in Part A of the application with your name, address, E-mail Id, and a registered mobile number.

- The portal will verify your details and send you one-time password (OTP) to your mail as well as mobile number as provided by you earlier.

Once you submit the OTP, your verification is now completed. The system will provide you with an Application Reference Number i.e., ARN via your registered mobile number and e-mail id.

Now, you need to fill Part B of the application using the ARN. The scanned copies of the following documents are to be uploaded in the GST portal.

- Passport size photograph,

- Taxpayer counterfoil,

- Proof of place of business. In case you are running your business in a rental property, you need to upload No objection Certificate from the owner of the property.

- Bank account details i.e., account number, the name of the account holder, IFSC code, Bank Branch etc.

- Authorization form.

Who will file the GST Return?

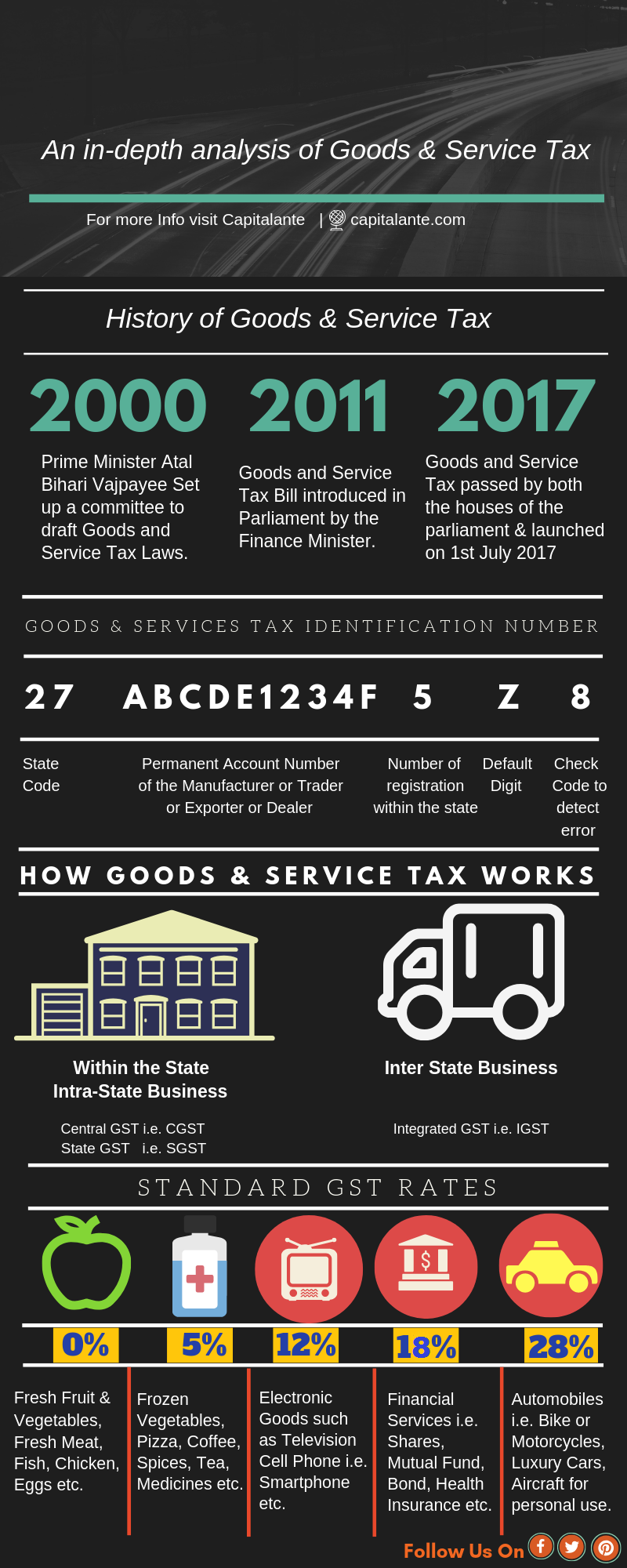

As a business owner, you must declare the income that you make by carrying out any business transaction or providing any service. GST return is just a legal document which contains all the details of your sales, purchases, tax collection on sales i.e., output cost, tax paid on purchases i.e., input taxes. You need to pay taxes in accordance with business turnover and taxes applicable i.e., 5%, 12%, 18% & 28%.

- Anyone who sells physical products or digital products such as online courses, video tutorials, e-books etc.

- Regular businessmen.

- Import/Export service providers.

- Persons who conduct affiliate marketing i.e., get commissions from Amazon, Flip kart or any other company by promoting their products or services.

How GST works and how to calculate it

Goods and services tax is a destination based tax i.e. the goods or services will be taxed at the place where they are finally consumed/used. GST is not levied in the place where the product is produced or processed. It may be possible that a product is being produced in the state and then transported to any other state. Finally, in the destination state, the product is bought or consumed. Here the GST is imposed @ 18%. Central and the concerned state where the product is sold to the customer receive tax @ 9% each. The state government has the right to collect GST where any particular product is consumed. Let’s make it clear with the following examples.

Suppose, I have a factory where shirts are produced and the factory is located in the state of West Bengal. Now, a shirt made here is transported to Gujarat. Then the state of Gujarat has the right to impose and collect GST on that shirt. The state of West Bengal cannot collect GST or impose any kind of tax. GST cannot be charged at the place of production of a product. Again, I have a website which is operated from Maharashtra. The website offers online services such as video tutorials on blogging, website programming, or sells e-books on blogging or affiliate marketing etc.

-

If the seller and the buyer are from the same state

If any person purchases our services or e-books from Nagpur, then the calculation should be as follows,

The place of supply is Nagpur which is in Maharashtra i.e., the location of the buyer. Since it is being sent from Maharashtra and consumed in Maharashtra, Maharashtra State have the right to charge or collect GST. In this case, the tax rate of selling financial services or e-book is 18%. So,

-

If the seller and the buyer are from different states

If any person purchases our services or e-books from Bangalore, then the calculation will be as follows.

The place of supply is Bangalore in Karnataka i.e., the location of the buyer. Since it is being sent from Maharashtra to a different state i.e., Karnataka, Integrated Goods

While filing GST you need to furnish the following details,

- Name, address, GSTIN number of the businessman or the service provider

- Tax invoice number

- Date of issue

- The buyer’s name, address & GSTIN number if any. If the buyer or recipient is not registered i.e., does not have any GSTIN number & the value of the product or service is more than Rs. 50000/- then the sales invoice should have the following details i.e., Name and address of the buyer or consumer & State name and state code.

- Description of goods and services i.e., cost, what the product or service is all about

- Total value or cost of the product or services,

- The applicable rate of GST i.e., CGST, IGST, SGST,

UTGST , - Amount of tax paid or collected

- Place of supply and the state code where the product or service is being delivered

- Signature of the supplier or the seller or the service provider

- HSV code for business, but whose turnover is less than Rs. 1.5 crore this HSN code is not required to be mentioned.

How to File GST Returns Online

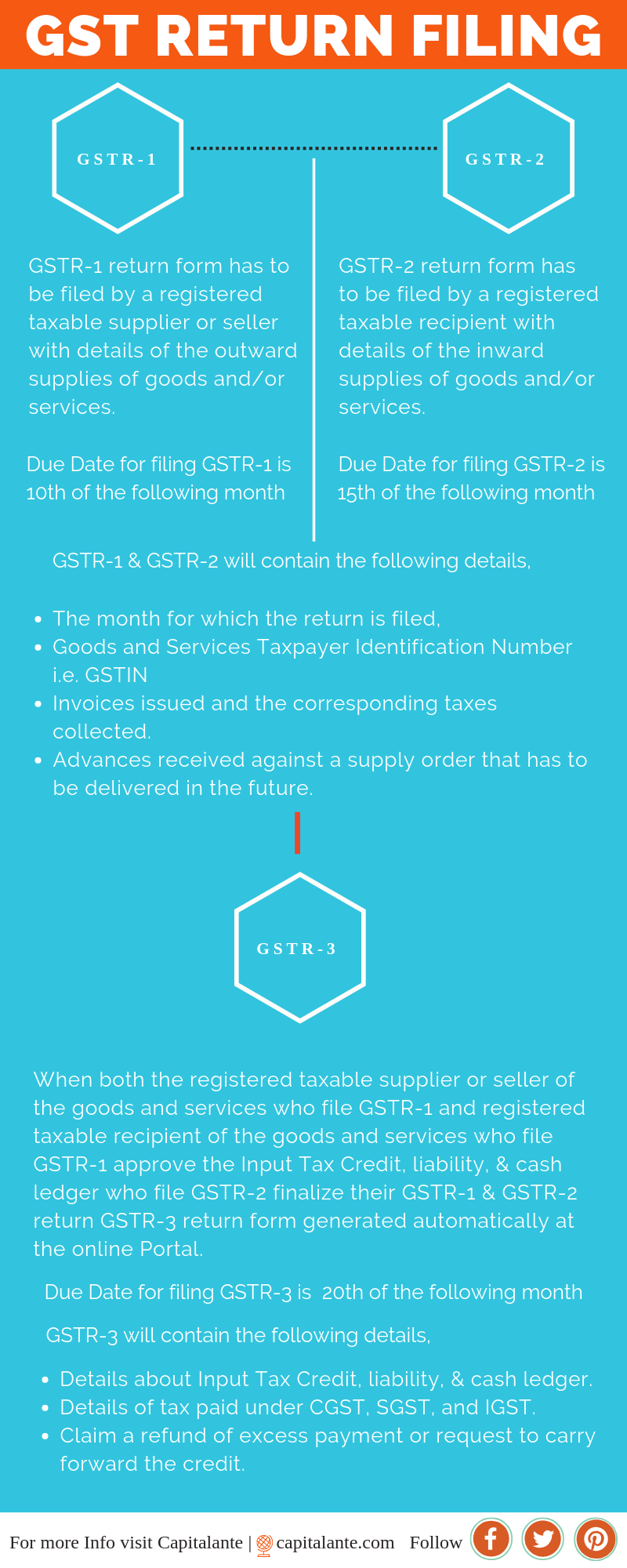

Every business person or service provider needs to submit GST return. One can file GST return via online only. Here is the detailed step one may follow to submit GST returns.

- Go to the GST portal

- A 15-digit Goods and services Tax Identification Number i.e., GSTIN will be forwarded to you via mobile and e-mail Id based on your state code and

PAN number. - Upload invoices such as sales, profits etc. on the GST portal. An invoice reference number will be issued against each invoice you submit.

- After uploading invoices, outward return, inward return, and cumulative monthly return need to be submitted online. If there happens to be

any error, you still have the option to correct them and re-file the returns. - You need to file the outward supply returns in GSTR-1 form through the portal on or before 10th of the following month. Suppose you want to submit the documents for September, then you need to submit the return on or before 10th October.

Read also: A Beginner’s Guide To Goods and Service Tax Step by Step

If you have any question regarding how to file nil GST return feel free to make a comment so that we have a discussion and if you found this post helpful please share with your loved ones.