Apart from fundamental analysis or technical analysis or qualitative analysis of stocks one of the important matrices is Free cash flow while determining the health of a company. A company or an organization runs its operation and by this it earns money. To understand a company’s true economic condition one should check the free cash flow of the concerned company. Free cash flow actually reveals the profit the company makes. It implies a broader range in the company’s functioning in the overall business.

What is Free Cash Flow?

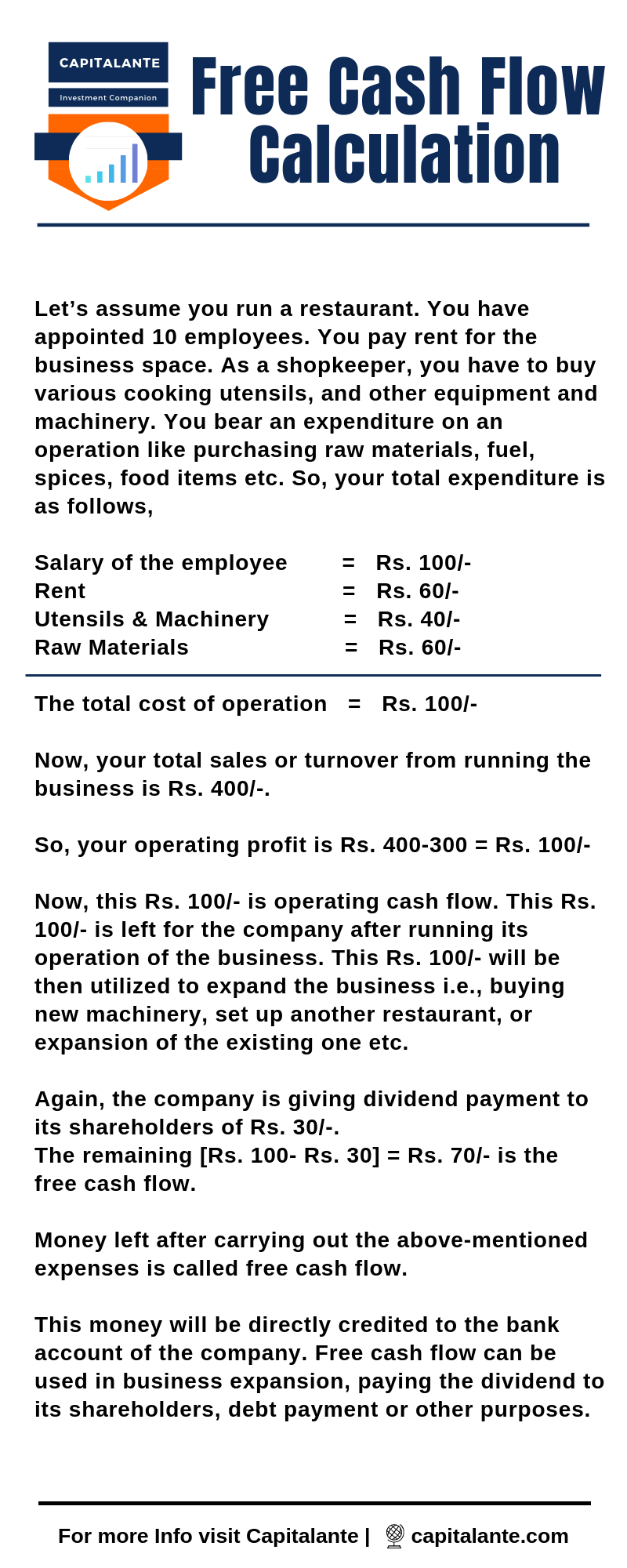

Free cash flow is the cash a company earns from its business. It is calculated after the deduction of all expenses from the earning. An efficient company can produce profit for its shareholders, so free cash flow can be an effective scale to measure the company’s condition. Common investors utilize free cash flow to understand a company’s net earnings after subtracting all required expenditures. Then the remaining amount left with the company is distributed among the investors as dividends or share buybacks.

- Read also: What’s the formula for calculating free cash flow? | Investopedia

- Read also: Free Cash Flow (FCF) – Investopedia

How to calculate free cash flow?

Why free cash flow is important?

It is very difficult to manipulate free cash flow because it includes all the basic things to consider. The free cash flow can be used to pay off debts a company withdraws or can be taken home by the company. This free cash flow is a statement that describes the capital expenditure carried out by a company. The capital expenditure includes purchasing new machinery, expansion of business by possessing another plant or land or building, etc. The free cash flow expresses the real earning which is transferred or deposited in the bank after deducting all expenses. It is important to watch out the free cash flow because from here we can know how much dividend a company will give its investors or how much money will be re-invested for the expansion of the business.

As we have known earlier that a debt-free company is the best to invest. It is because a debt-free company possesses the potential to deliver

Interpretation of free cash flow

Whenever you check the free cash flow of a company, you should analyze from which source the company is gaining its capital for its day-to-day business. Usually, there are two sources, the first one is earning from running operation i.e., business and the second one is receiving debt from the market i.e., debt financing. If the company runs its operation from the profit earned by running operation you should stay invested with the company. But if the company runs its business by debt financing, naturally the debt will increase the time to time. So, stay clear of these types of companies or stocks.

Conclusion

Free Cash flow is one of the most reliable and widely used metrics among value investors, as it provides an accurate position of the company’s financial condition. In simple words, free cash flow is an account of how much cash a company is left with after paying for all expenses.

Companies that manage to generate consistently large cash flows without incurring much capital expenditure are always valued higher by investors. Negative free cash flows are a sign of the

- Read also: How to use Price to Earnings Ratio to Pick Stocks

- Read also:

Stock Picking Strategies: Qualitative Analysis of Stocks

If you found this post helpful share with your loved ones and if you have any question make a comment so that we have a discussion.