You can enjoy a hassle-free investment option easily. SEBI follows the unified KYC regime which implies that once the individual is KYC verified, the individual need not submit the required documents again to open another mutual fund or buy any financial services or products. In this column, we will discuss what Central KYC Register or CKYCR is and its features, how Central KYC Registry works, Difference between KYC, eKYC, cKYC, how to check the cKYC status online and its benefits.

What is Central KYC Register or CKYCR?

The Central Know Your Customer Register or CKYCR was initiated to prevent identity theft, financial fraud, money laundering, and terrorist financing. The prime feature of CKYC is that once any individual/investor completes his/her KYC process, he/she does need to submit the documents again to fulfill KYC norms.

Central KYC Register is the centralized repository of KYC records of the individuals. The records of the individual are used by institutions such as Mutual fund houses, Stockbrokers, Insurance companies, and Banks, etc. The uniqueness of the cKYC registry is that whenever the individual complies with the KYC norms to buy or invest in financial products, the individual need not submit the details once again. Various institutions as mentioned above can access the information stored in the central KYC registry. Once verified the individual can invest in mutual funds or buy insurance policies etc.

Historical Background of Central KYC registry

Under section 73 of Prevention of Money Laundering Act, 2002, empowers the central government to make rules to prevent the generation of black money. To curb the black money the central government of India has created Central Registry of Securitisation Asset Reconstruction and Security interest of India to ensure Single KYC whenever any individual buys/invest any financial products. This is the apex body that manages the Central KYC registry for storing, safeguarding, and easily accessible the Know Your Customer records.

Difference between KYC, eKYC, cKYC

Needless to say KYC stands for Know Your Customer. With the purpose to curb black money Government has initiated the KYC. Whenever any individual invests in a mutual fund or buys an insurance policy or opening a bank account KYC is mandatory.

In order to open a bank account or mutual fund or buy an insurance policy the individual needs to furnish various details such as name, PAN number, Address, in a prescribed form along with required documents such as address proof, identity proof, etc. Then these institutions make use of In-person verification [IPV] which verifies the documents and identity of the person submitted along with KYC form. Once verified, the data of the respective individual and attached documents are entered/uploaded in the database i.e. KYC Registration Agency (KRA).

e-KYC

In order to invest in a mutual fund, NPS, or to buy an insurance policy an individual can make use of eKYC for KYC compliance. But in the case of eKYC any individual can invest up to Rs. 50,000/- per annum for the fund house. To invest more than that the respective individual will fill up a cKYC. Electronic KYC or eKYC can be done in two ways namely,

- One individual needs to furnish the Aadhar card and give consent to read Aadhar data. A one-time password will be forwarded to the registered mobile number. Once verified the details of the respective individual are uploaded into the records of the KRA.

- One individual can make use of biometric verification i.e. thumb or retina scan.

cKYC

In the case of KYC or eKYC you need to undergo the tedious process of submitting KYC documents various times, but in the case of Central Know Your Customer i.e. cKYC, you need to furnish once in your lifetime. Once you submit the KYC documents along with your KYC form, on successful verification all the details are uploaded in the central KYC registry. Whenever you want to buy any other financial product or service the respective institution or company will fetch your details from the central KYC registry.

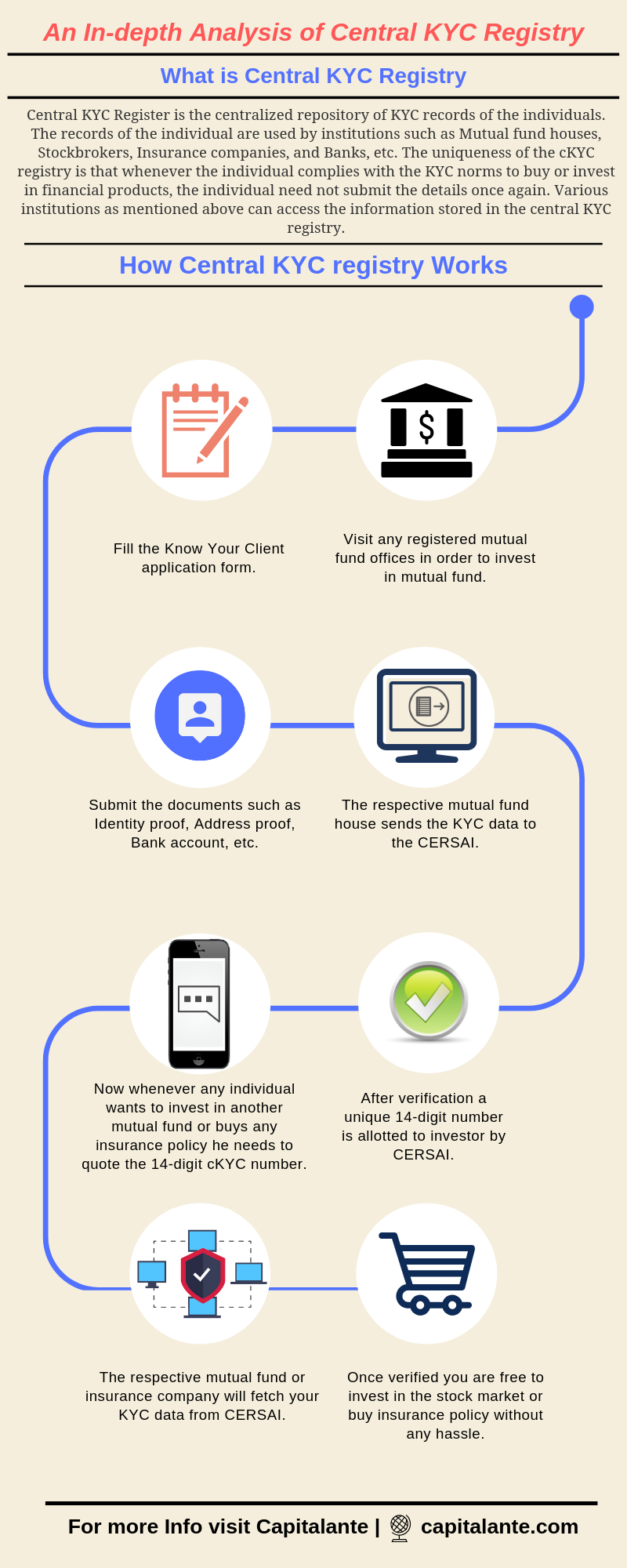

How Central KYC registry Works

Suppose you start investing in the stock market via a mutual fund. So, in order to invest, you may go to any of the registered mutual fund offices like SBI Mutual Fund, ICICI Mutual Fund, HDFC Mutual Fund, Franklin Templeton Mutual Fund, UTI Mutual Fund, Reliance Mutual Fund, etc. Then you need to fill the Know Your Client application form and submit documents such as Identity proof, Address proof, bank account details, two passport size photographs, etc. As soon as you have provided the above-mentioned details, the KYC data will be sent to the CERSAI and after successful verification, you will be allotted a unique number.

Now if you want to invest in another mutual fund or buy an insurance policy from any insurance company then you need not submit KYC documents again. The respective mutual fund or insurance company will fetch your KYC data from CERSAI. So, you need to submit your KYC documents once in a lifetime which makes all of your investment under one shed hassle free.

Types of cKYC Accounts

In order to invest or buy any financial product or services, there are three types of accounts in the KYC form namely,

Normal KYC account – If you submit any of the following 6 documents then your account will be treated as normal KYC account,

- PAN card,

- Aadhaar Card,

- Driving License,

- Voter ID Card,

- Passport,

- NREGA job card.

Simplified KYC account

If you do not submit any of the above mentioned 6 documents then your account will be treated as simplified KYC account. These types of customers can comply with cKYC by submitting any of the following documents,

- An Identity proof including Passport size photograph issued by the state or central department.

- Copy of Bank account or post office savings bank account statements.

- Copy of Utility bills such as water, electricity, piped gas, etc. not more than two months old.

- Duly attested passport size photograph by a gazetted officer.

Small KYC account

If you do not submit any kind of valid documents then your account will be treated as small KYC account. These types of customers can comply with cKYC by submitting a self-attested application along with passport size photograph. This type of account is valid for a time of 12 months. After a span of 12 months, the respective person needs to submit a document which shows that the individual has applied for any one of the 6 documents as mentioned above. In this type of account, there are some restrictions namely,

- Aggregate credits do not exceed Rs. 1 Lakh in a year,

- Total withdrawal does not exceed Rs. 10k in a month,

- Account balance does not exceed Rs. 50k at any time.

How to check the cKYC status online

You can check the status of your KYC by submitting your PAN,

- https://kra.ndml.in/

- https://camskra.com/

- https://www.karvykra.com/

- https://www.cvlkra.com/

- https://www.nsekra.com/

You may also download the KYC application from the links mentioned above.

How this will help retail investors

Let’s have an example. Arindam has just received a lump sum of Rs. 1 Lakh as Diwali bonus. So, he decides to invest the sum. Now, Arindam has decided to invest a part of the bonus into mutual funds and into direct equity by opening a Demat account. In order to invest in mutual funds, Arindam needs to comply with the KYC by submitting documents such as Identity proof, Address proof, bank account details, two passport size photographs, etc. After a few months when he contacts a broker for opening a Demat account the broker asks him to submit the KYC documents. Arindam gets confused why he needs to submit the documents once again when he had submitted when he opened the mutual fund account.

In order to make a hassle-free investment option for the retail investors, SEBI follows the unified KYC regime which implies that once the individual is KYC verified, the individual needs not submit the required documents again to open another mutual fund. Central KYC Registry will store all the information about each investor at once. The central server allows access to all financial institutions such as insurance companies, pension funds, mutual funds, etc. Once you are verified you are allotted a unique 14-digit cKYC number. Whenever you want to open a mutual fund or open a Demat account or buy an insurance policy you need to furnish the cKYC number. You need not submit the KYC documents once again.

- Read also: Top 36 Types of Mutual Funds after Categorization and Rationalization of Mutual fund schemes by SEBI

How this will help financial institutions/companies

All the details such as name, date of birth, documents such as identity proof i.e. PAN Card, Passport, etc. Address proof i.e. Voter ID card, Aadhar card, etc. are stored digitally. It helps the financial institutions to verify data so that the customers need not do KYC multiple times. The institutions can find out if the individual is KYC compliant or not with ease by making use of Central KYC Registry. If the KYC details are updated then institutions can get a real-time update.

Benefits of Central KYC Registry

Here are the benefits of the Central KYC Registry,

- Since Central KYC Registry stores all the information along with the valid documents it eases the financial companies to verify the details by unique 14-digit cKYC number quoted by the individual.

- The individual gets rid of the tedious process of KYC forms and provides countless self-attested documents many times whenever buy any financial product or services.

- An individual gets access to Central KYC Registry and can make updates to their existing records if necessary.

- Central KYC Registry diminishes the barrier among various products such as insurance policy, investing in the mutual fund or opening of Demat account irrespective of the type of financial product or services.

How Capitalante can help you

Are you confused about how to prepare an effective financial plan to achieve financial freedom? If yes, learn how to prepare effective financial planning.

Hope this article will help you to understand the Central KYC Registry better. Let me know if I have missed any information regarding Central KYC Registry. If you have any questions feel free to comment so that we can have a discussion. If you have found this post helpful feel free to share with your loved ones.