With the economic progression of India and on the wings of home loans at an easy and affordable interest rate and various initiatives by Government of India’s project ‘housing for all’, people are more eager to take home loans and build their nests. But one of the popular questions is should I buy a home or rent one and invest the money. Here we will discuss if you should buy a home by taking a home loan or not. In addition, we will offer you some principles if you have created a fund for your dream home and have enough amount to buy a home or a flat. After that, we will discuss what amount you should put to buy a house.

What ordinary people do?

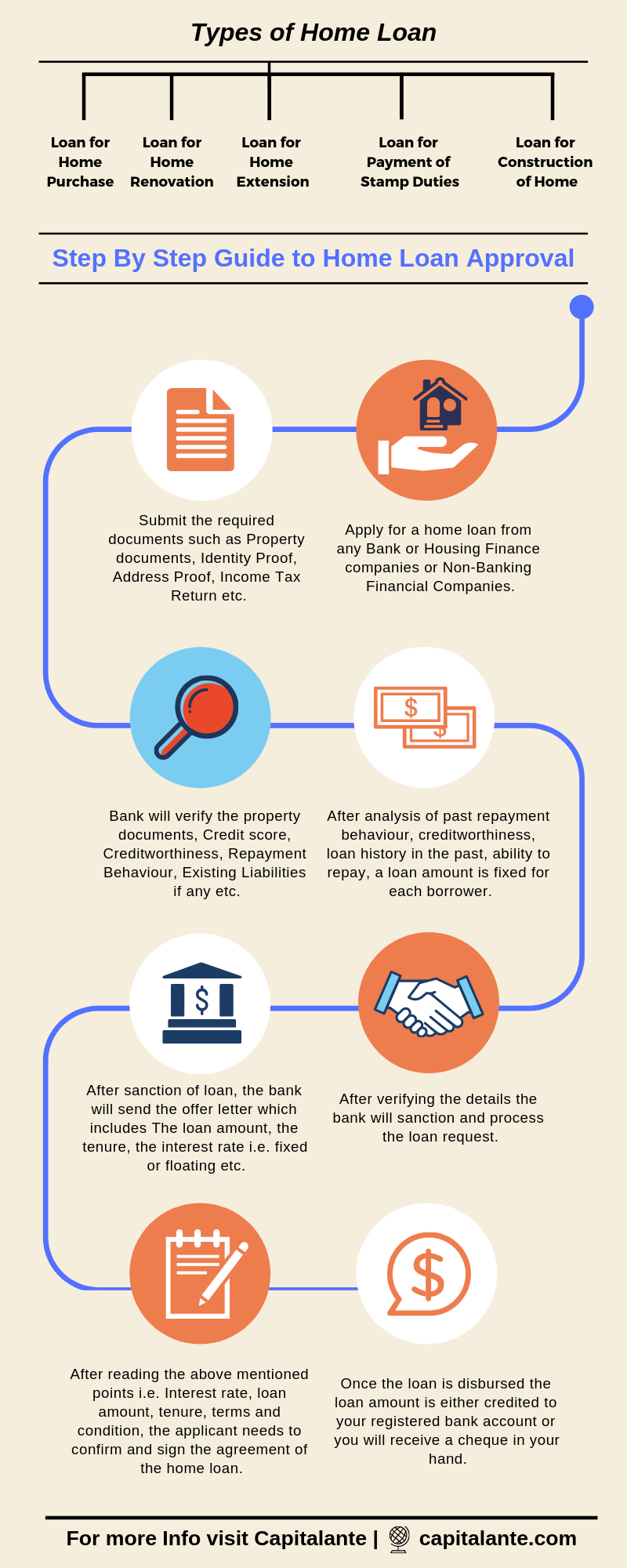

After getting a job or starting to earn at an age of 24-25. An average salaried employee first starts saving for a certain period of time i.e. for the first 5 to 10 years. After achieving the target of saving Rs. 10 lack, one individual goes to a bank and applies for a home loan on EMI basis. After reviewing the loan eligibility the bank gives the loan.

Usually, an individual takes a loan to build his/her own nest on easy EMI option either a monthly or quarterly basis repayment from banks or any other financial institutions. After the withdrawal of home loan, people get trapped into a vicious cycle. Earlier, I have mentioned on various occasions the benefits of remaining debt free. It is advised that you should pay off your home loan as early as possible.

Demerits of owning a house in case you are in transferable jobs

The biggest problem to own a house is if you are in the transferable job then it is quite difficult to stay at your own house. Many people work in Government offices like income tax office, central excise, audit department or are in the private sectors transferred at a span of 5 years or less. If any individual owns a residential flat at Durgapur and transferred to Kolkata or New Jalpaiguri then it is quite difficult to stay at Durgapur. You have to move out from Durgapur to your posting place. So, you need to repay your home loan via EMI option and in Kolkata or your posting place you have to rent a room. So, your expense becomes double.

Many persons suggest we can offer the flat on rent. But at these tier-II cities, you will not get a rent of Rs. 19,000/-. An individual may get maximum rent of Rs. 10,000/-. So, your monthly loss is Rs. 9,000/- and yearly approximately it is 1 lack apart from extra charges mentioned above.

The maximum amount of Money you can put to buy a house

Now, if you have created a fund for your dream house and have enough amount to buy a house or a flat what amount should you put to buy a house. In order to fix that problem, we will make use of famous The 20 Percent Rule, The Income Rule, & The 28/36 debt Rule to calculate the money which you are free to put to buy a home or a flat. Let’s illustrate these famous rules to calculate spending to buy a home.

- According to The 20 Percent Rule, an individual should put at least 20 percent down when buying a home. This rule ensures that any individual does not spend more amount while buying a home than what the individual can afford.

- According to The Income Rule, an individual should buy a house cost of which does not exceed his three years’ worth of the gross annual income when buying a house. This rule ensures that any individual doesn’t spend more amount while buying a house than what the individual can afford.

- According to The 28/36 Debt Rule, Debt-to-income Ratio, an individual should not spend more than 28% of gross income on housing expenses and more than 36% of all debt including car loan or housing loan etc. In accordance with The 28/36 Debt Rule, 28% represents the monthly principal, interest payable, property taxes i.e. estate tax and insurance payable on the property. The rest 36% represents all recurring monthly debt compared to one’s gross household income including credit card debt, personal loans, EMI on Housing loan, EMI on car loan etc.

Should you buy a house or flat by taking a home loan on EMI basis

After getting a job or starting earning at an age of 24-25. An average salaried employee first starts saving for a certain period of time i.e. for the first 5 to 10 years. After achieving the target of saving Rs. 10 lack, one individual goes to a bank and applies for a home loan on EMI basis. After reviewing the loan eligibility the bank gives the loan.

In urban areas one 2 BHK flat or a house costs around Rs. 30-32 Lakh. The individual’s saving is Rs. 10 lack. So, he has to take a home loan of Rs. 20 lack to own a flat or a house.

Let us assume one individual takes a loan of Rs. 20 lakh @ 8% interest rate which is to repay in the next 20 years. After calculation, the individual will have to pay Rs. 17,000/- a month for the upcoming 20 years. Calculating this he has to pay a total amount of Rs. 40 Lakh.

Should you buy a home or rent

You have to repay Rs. 17000/- monthly for the 20 years as a home loan EMI. Apart from EMI, you have to pay monthly charges like Property taxes, Security Services, Trash pickup, Water, and Sewer service, Repairs, and maintenance, Pest control, Pool cleaning (if you have one). In Tier II cities like Asansol, Durgapur, Nagpur, Ranchi, Tata etc. the total cost of these items are around Rs. 2000/-. So your total cost is Rs. 17000+ 2000 = Rs. 19000/-.

If you want to rent a 2 BHK flat or home you will easily get that @ a rate of around Rs. 7000-8000/- per month. By renting a house you are free of these hidden costs, neither you paid Property tax nor repair nor Maintenance cost.

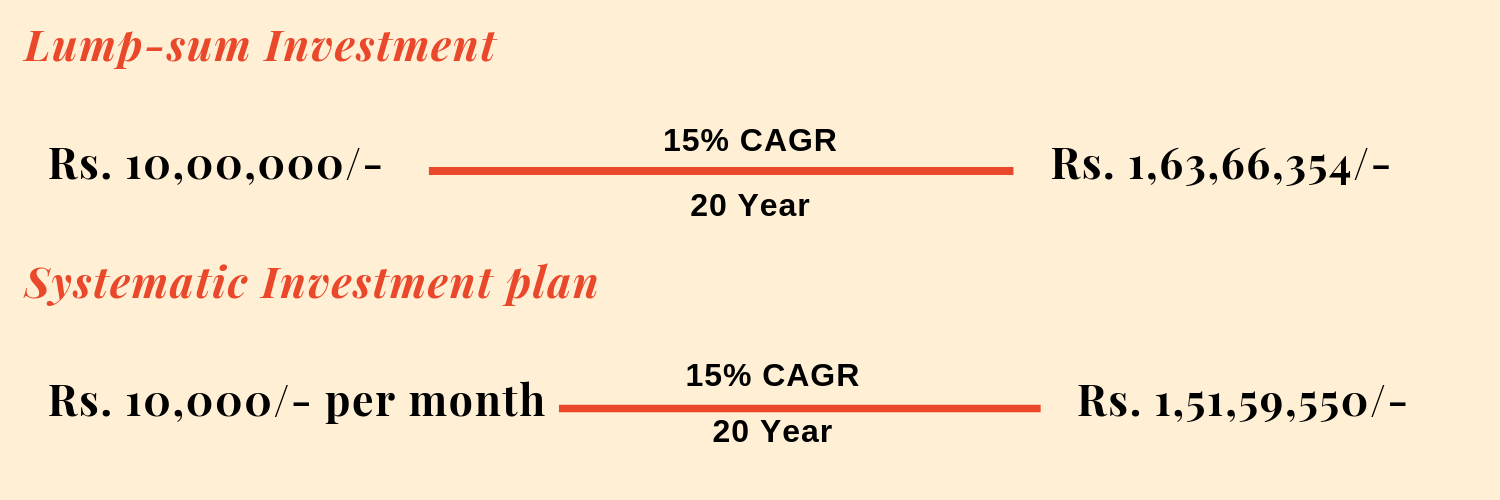

You need not pay any down payment just like owning a house. If you rent a room you will save around Rs. 10,000/- per month. If you invest the money in mutual funds via Systematic Investment plan for the next 20 years you will get Rs. 1,51,59,550/- assuming 15% CAGR.

If you invest your initial down payment Rs. 10,00,000/- in any equity oriented mutual fund or stock market at one-time lump sum investment then you will get Rs. 1,63,66,354/- after 20 years assuming 15% CAGR.

So, instead of paying EMIs you can invest that money in direct equity or equity oriented mutual fund schemes. And then after 20 years, you can easily buy a house of your own.

- Read also: How to Repay Your Home Loan Faster

- Read also: Top 23 Best Investment Options in India